Author:

Frank Hunt

Date Of Creation:

12 March 2021

Update Date:

1 July 2024

Content

- To step

- Part 1 of 3: Apply for a standard joint account

- Part 2 of 3: Choosing a type of joint account

- Part 3 of 3: Make agreements about the use of your joint bank account

Opening a joint bank account is a relatively easy procedure. However, it can be more complicated to agree on the type of bank account that is right for both you and your co-owner. Make sure you agree on how to use your joint account before opening the account. Set a monthly budget and determine what happens to the bill if your relationship changes or one of you dies.

To step

Part 1 of 3: Apply for a standard joint account

Choose a bank or lender together that meets both of your wishes. If you open a bank account with someone you live with, think of a bank close by. If you are opening an account with someone who lives further away, such as a son or daughter who lives on her own, you are better off choosing a bank that has branches in both places.

Choose a bank or lender together that meets both of your wishes. If you open a bank account with someone you live with, think of a bank close by. If you are opening an account with someone who lives further away, such as a son or daughter who lives on her own, you are better off choosing a bank that has branches in both places. - If you are already at the same bank, it can be useful to open your joint account there as well, so that you can easily transfer money.

- If you want to both keep your old accounts but also invest in your community, consider opening a joint account with a local credit union.

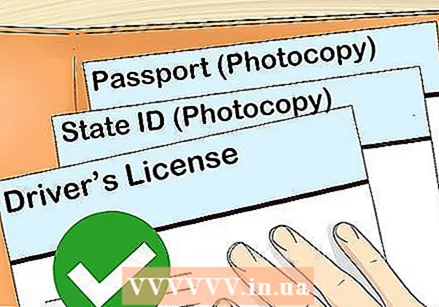

Collect your documents. To open a joint bank account you must bring proof of identity with your name, date of birth and address. Documents likely to comply include:

Collect your documents. To open a joint bank account you must bring proof of identity with your name, date of birth and address. Documents likely to comply include: - A passport

- An ID card

- An alien's document

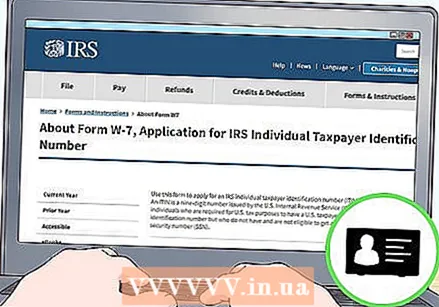

Both have your ID to hand. You probably also both need a number that is used by social services and the tax authorities. Make sure you have that on hand too. In the Netherlands this is the Citizen Service Number.

Both have your ID to hand. You probably also both need a number that is used by social services and the tax authorities. Make sure you have that on hand too. In the Netherlands this is the Citizen Service Number. - If you do not have a Citizen Service Number, read how to apply for one on the central government website.

Fill in the forms together at the bank of your choice. Check the bank's website to see if you need to visit in person, make a call, or simply fill out online forms to open your account.

Fill in the forms together at the bank of your choice. Check the bank's website to see if you need to visit in person, make a call, or simply fill out online forms to open your account. - Go to the bank together to sign the paperwork for opening a joint bank account.

- If you apply online, you should have the paperwork ready for both of you.

- If you open an account with a minor for whom you are the guardian, you may be asked to sign a consent form that will allow them to open the account.

Make your first deposit together. Determine the minimum amount you need to open an account with the bank of your choice. Decide how much each of you will deposit. Call, go online, or go to your bank to make a personal deposit.

Make your first deposit together. Determine the minimum amount you need to open an account with the bank of your choice. Decide how much each of you will deposit. Call, go online, or go to your bank to make a personal deposit. - For example, if your bank requires a minimum of $ 300 and you open the account with a partner, you will both deposit $ 150.

Part 2 of 3: Choosing a type of joint account

Consider a standard joint account. These accounts are the most common type of joint account. They are available to everyone, but especially popular with couples. With the standard joint account, owners have equal access and accountability.

Consider a standard joint account. These accounts are the most common type of joint account. They are available to everyone, but especially popular with couples. With the standard joint account, owners have equal access and accountability. - When a partner dies, all money goes to the surviving owner.

- This account is not subject to inheritance after an owner has passed away.

- Creditors can collect into this account regardless of who deposited the balance.

Choose to request a second bank card for an existing account. In this way, the other cannot transfer money without the consent of the other.

Choose to request a second bank card for an existing account. In this way, the other cannot transfer money without the consent of the other. - Creditors cannot simply collect from the total balance of the account, but only with the permission of the main owner of the account.

- This account is not subject to inheritance law. The entire balance is owned by the main owner.

Get bank power of attorney to manage money for another person. If you have an elderly or incapacitated family member who needs to manage their money, you can apply for power of attorney to act as their administrator. The money in the account belongs to the owner. As an administrator, you use the money to pay the owner's bills and manage their transactions.

Get bank power of attorney to manage money for another person. If you have an elderly or incapacitated family member who needs to manage their money, you can apply for power of attorney to act as their administrator. The money in the account belongs to the owner. As an administrator, you use the money to pay the owner's bills and manage their transactions. - After the death of the owner, the funds are divided according to their will.

- Creditors may be able to collect from the account. If you have power of attorney, your creditors can ask you to prove that you have no ownership of the bank account.

Open a group account if you want to open a bank account with more than two people. These are popular with groups of friends and business associates, but anyone can open one. You can divide your ownership evenly, or give someone more responsibility and access. You are all entitled to a fixed percentage of the bill.

Open a group account if you want to open a bank account with more than two people. These are popular with groups of friends and business associates, but anyone can open one. You can divide your ownership evenly, or give someone more responsibility and access. You are all entitled to a fixed percentage of the bill. - If one of the owners dies, an estate will divide its share of the balance according to its will.

- This type of account is subject to inheritance law. If there is no will, the deceased's funds are distributed among their close relatives.

- However, creditors can still collect on the entire account, even if one partner deposits more money.

You can also put your money separately in a joint investment account. If one of the partners comes to transfer, the balance is in the other owner's account.

You can also put your money separately in a joint investment account. If one of the partners comes to transfer, the balance is in the other owner's account. - This account is not subject to inheritance law upon the death of an owner.

- Creditors can collect from the account regardless of which of you deposited the balance.

Part 3 of 3: Make agreements about the use of your joint bank account

Agree on how much you will transfer each month. Whether you are depositing an equal amount or unequal amounts, you need to know how much money you deposit each month. It is important that you can be confident that the balance will remain at a certain level, as you are both liable for any costs if you go into the red.

Agree on how much you will transfer each month. Whether you are depositing an equal amount or unequal amounts, you need to know how much money you deposit each month. It is important that you can be confident that the balance will remain at a certain level, as you are both liable for any costs if you go into the red. - Consider depositing the same amount every month.

- Another fair way your incomes differ is by depositing a certain amount of money that you have earned each month. This only works as long as the balance remains above the required minimum.

- If this is your only bank account, just put all your money into it.

Determine which costs you pay from your joint bank account. Communicate openly, clearly and regularly about which costs can be paid from your bank account. Consider writing it down so you don't forget.

Determine which costs you pay from your joint bank account. Communicate openly, clearly and regularly about which costs can be paid from your bank account. Consider writing it down so you don't forget. - If one of you pays the bills, they may pay them all from this bill.

- Cancel the joint account if one owner uses it for purchases that you have not agreed upon.

Protect your balance in case the relationship changes. If your relationship with the person who co-owns the account changes, check with the bank to make sure neither of you can withdraw the money without consulting the other. Explain that you want to cancel the joint account.

Protect your balance in case the relationship changes. If your relationship with the person who co-owns the account changes, check with the bank to make sure neither of you can withdraw the money without consulting the other. Explain that you want to cancel the joint account. - If you've applied for a second debit card for an existing account, don't worry, as the co-owner of your account cannot withdraw money without your permission.