Author:

Virginia Floyd

Date Of Creation:

7 August 2021

Update Date:

1 July 2024

Content

- Steps

- Part 1 of 3: Establishing the Foundations for Investing

- Part 2 of 3: Choosing Investment Instruments

- Part 3 of 3: Buying Your First Stocks

- Tips

- Warnings

When you buy shares, you buy a small part of the company. Some time ago, shares were bought on the advice of a broker and by means of voice orders. Today, anyone with a computer or even just a smartphone can buy and sell stocks at the touch of a button. If you are new to this business, then you may be stopped by some of the seeming complexities of this process. However, if you study some of the points, you can learn how to buy stocks on your own and make money on investments.

Steps

Part 1 of 3: Establishing the Foundations for Investing

1 Set goals for yourself. Take some time and decide for yourself why you need to invest in stocks. Do you want to invest in order to build up some reserve for the future or a safety cushion to buy a house or to save up for schooling for children? Or maybe you want to save money for retirement?

1 Set goals for yourself. Take some time and decide for yourself why you need to invest in stocks. Do you want to invest in order to build up some reserve for the future or a safety cushion to buy a house or to save up for schooling for children? Or maybe you want to save money for retirement? - It's not a bad idea to write down your motives. Try to write down your goals in monetary terms, estimating how much money you may need in the future for your goals.

- For example, buying a home may require an initial payment of 300 thousand rubles or more, but in general, real estate can cost 2 million rubles or more. For retirement, your goal may be to save 5 million rubles or more.

- Most people have more than one investment goal. These goals often vary in priority and timing. For example, you might set yourself the goal of buying a home within three years, saving for a child's education for 15 years, and saving for retirement for 35 years. Writing down your investment goals will help you clearly understand what to do and will also help you better focus on the goal.

2 Determine the investment timing. Your investment goals will determine how long the investment will remain in the account. The longer you invest, the higher the likelihood of a positive return.

2 Determine the investment timing. Your investment goals will determine how long the investment will remain in the account. The longer you invest, the higher the likelihood of a positive return. - If your goal is to save money to buy a home in three years, then your investment period, or "investment horizon", is relatively short. If you are investing in funds with the goal of saving for retirement after 30 years, then this is a long-term investment horizon.

- The S&P 500 stock index is a "portfolio" of the 500 most traded stocks. Between 1926 and 2011, there were only four 10-year periods when this index fell. This index has had no losses over 15-year periods. If you buy and hold this index for a long time, you will most likely make a profit.

- At the same time, the S&P 500 index fell 24 times in one year in its history, from 1926 to 2014. In the short term, stocks are extremely volatile, that is, their price can change dramatically and quickly. Consequently, investing in the short term is associated with higher risks compared to investing in the long term. If you invested successfully, then you can get more profit, and if not, you can lose everything.

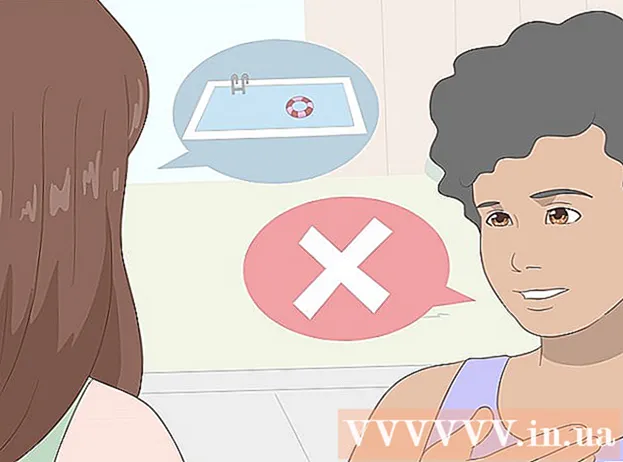

3 Define your risk profile. All investments involve risk. In all cases, there is a risk that you will lose some of the money, or even all of it. No one can guarantee a return on investment, nor can they even guarantee a return on the original amount you invested. How much you are willing to take the risk by investing is called "risk tolerance."

3 Define your risk profile. All investments involve risk. In all cases, there is a risk that you will lose some of the money, or even all of it. No one can guarantee a return on investment, nor can they even guarantee a return on the original amount you invested. How much you are willing to take the risk by investing is called "risk tolerance." - Before investing money, ask yourself: "How much money am I willing to lose if something goes wrong?"

- In most cases, the higher the risk of losing money, the higher the potential income.

- For example, investments that can double in a month are much more risky than those that can double in ten years.

- There is no investment worth losing sleep. If reaching your investment goals is overwhelming, then you should reconsider your goals: the time frame or the goals themselves.

- For example, imagine that your goal is to save money for a down payment of 400,000 rubles to buy a home worth 2,500,000 rubles over 3 years. If you need to reconsider your goal, then you can reconsider the amount, that is, you will need to consider housing options worth 2,000,000 rubles with an initial payment of 300,000 rubles, but at the same time keep the accumulation period of 3 years. Alternatively, you can revise the investment timeframe by increasing it to 5 years to make the goal more achievable. You can also consider combining these parameters with decreasing the target and extending the horizon.

- One of the first rules of investing is to avoid loss as much as possible. Do not take risks when it is not necessary to achieve your goals.

4 Calculate how much investment is required to achieve your goals. To calculate, you can use any of the many calculators available on the Internet. Calculate the percentage you plan to receive on your investment and the amount of that investment to meet your goals.

4 Calculate how much investment is required to achieve your goals. To calculate, you can use any of the many calculators available on the Internet. Calculate the percentage you plan to receive on your investment and the amount of that investment to meet your goals. - For example, suppose you need to save 300,000 rubles over three years, but you can only invest 5,000 rubles per month. In this case, you need to find a way to get a whopping 38.2% per annum all three years to achieve your goals, and this is fraught with high risks. Most investors will consider such an investment a bad decision.

- A more reasonable option would be to increase the time horizons to four and a half years. In this case, the investment goal will be safer and more achievable - 4.8% per annum.

- Another option is to increase the amount you invest monthly from 5,000 rubles to 7,750 rubles. So, you will reach your goal of 300,000 rubles with a more realistic 5.037% per annum.

- You can also reduce your financial goal of 300,000 in three years to 19,621 in three years, while maintaining the amount of RUB 5,000 invested monthly. To achieve this goal, your return on investment should only be 6% per year.

Part 2 of 3: Choosing Investment Instruments

1 Find out what types of investments are. The next task will be to choose which types of investments are best for you and which options are available to you.

1 Find out what types of investments are. The next task will be to choose which types of investments are best for you and which options are available to you. - You can buy stocks of specific companies. Buying shares in companies means partial ownership of those companies. As a result, your income will be the same as that of the owner of any other business. If a company's sales and profits rise, then the company's market share is likely to rise. This is especially true in the long run.

- In the short term, the market value of a company depends on investor sentiment and expectations. Emotions, rumors and perceptions of the company as a whole change the market value of companies. The prices at which you buy and sell stocks determine your profit.

- You can also invest in mutual funds (mutual funds). These funds allow many people to invest in many different stocks together. The result is an instrument with a lower level of risk, especially in the short term.

- Recently, ETFs (Exchange Traded Funds or Exchange Traded Funds) have been gaining popularity, many people refer to these funds as index funds. They are portfolios of stocks that are usually not managed by a manager. Most are created to copy the movement of an index, such as the S&P 500 Index, the Moscow Stock Exchange Index or the iShares Russell 2000.

- Like individual stocks, ETFs are traded on the market. ETF value can change during the day.

- Some ETFs track specific industries, commodities, bonds, or currencies.

- The advantage of index funds is investment diversification. Some index funds trade with little or no commission. This makes them available for investment.

2 Learn key terms. Many people rely on financial news to understand stock performance or market conditions in general. To make better use of these sources of information, it is important to know and understand some key terms.

2 Learn key terms. Many people rely on financial news to understand stock performance or market conditions in general. To make better use of these sources of information, it is important to know and understand some key terms. - Earnings per share: The portion of a company's earnings that is paid to shareholders. If you are hoping to earn dividends from your investment, then this is an essential element!

- Market capitalization: The total value of all shares in a company. This amount represents the total value of the company.

- Return on Equity: The income that the company generates in relation to the amount invested by shareholders. This metric is useful for comparing companies in the same industry as it helps determine which company is most profitable.

- Beta: A measure of the volatility of a stock in relation to the market as a whole. It is a useful metric for assessing risks. Typically, if the beta is below 1, then the stock has fairly low volatility. Stocks with a beta above 1 are highly volatile.

- Moving Average: The average price per share of a company over a specified period of time. This metric can be helpful in determining if the current price is good to buy or sell.

3 Follow analysts. Analyzing stocks can be time consuming and generally not easy, especially for beginners. This is why you can use analyst reports. Typically, analysts closely monitor certain companies and evaluate their performance.

3 Follow analysts. Analyzing stocks can be time consuming and generally not easy, especially for beginners. This is why you can use analyst reports. Typically, analysts closely monitor certain companies and evaluate their performance. - There are many reputable free sites that post analyst opinions about companies.

- Analysts often provide advice — short recommendations for specific stocks that often sound like “buy,” “sell,” or “hold.” However, other recommendations such as “stocks are overbought” may be less obvious.

- Different analysts use different terms in their recommendations. Financial sites often contain guides that explain specific terms used by different companies.

4 Decide on an investment strategy. When you have gathered all the information, it is time to think about your investment strategy. Different investors take different approaches. Here are some factors to consider.

4 Decide on an investment strategy. When you have gathered all the information, it is time to think about your investment strategy. Different investors take different approaches. Here are some factors to consider. - Diversification of investments. Diversification refers to the degree to which you distribute your money across different investment vehicles. Investing all of your funds in a small number of companies can lead to large profits if these companies perform well. But at the same time, this approach has higher risks. The more diversified your investments, the lower the risks. The better your investments are diversified, the lower the risks.

- Growth in profits thanks to compound interest. This build-up is the result of consistent reinvestment of the income generated. If you reinvest what you earn on investments, then you generate even more income in this way. Some companies have programs to do this automatically.

- Investing versus trading. Investing is understood as a long-term strategy aimed at making money with long-term growth. Stock prices rise and fall, and the investor invests in the hope that they will rise in the long run. Trading is becoming more involved in a process that involves buying stocks for a shorter period and then selling them. The buy-low, sell-high approach can be very profitable, but it requires constant monitoring of quotes and is associated with higher risk.

- Traders seek to assess the emotions of investors regarding a particular company by interpreting the history of price changes.Their goal is to buy stocks when their price rises and sell them before they start to fall. Short-term trading carries high risks and is not suitable for novice investors.

Part 3 of 3: Buying Your First Stocks

1 Consider trust management options. There are many ways to buy stocks. Each option has its own advantages and disadvantages. If you have little or no experience in buying stocks, then you may want to consider trust investing options. It is worth remembering that trust management costs money, but in such cases, professionals will take care of your investments.

1 Consider trust management options. There are many ways to buy stocks. Each option has its own advantages and disadvantages. If you have little or no experience in buying stocks, then you may want to consider trust investing options. It is worth remembering that trust management costs money, but in such cases, professionals will take care of your investments. - For example, a broker can guide you through the buying and selling process of stocks and answer any questions you may have. You may ask the broker, "What stocks do you recommend buying for my risk profile?" - and: "Do you have analytical reports on the stocks that I want to buy?"

- To find the right broker, ask someone you know or look for reviews on the Internet. Please note that the broker must have all the required certificates and licenses. Give preference to large brokers with a positive reputation.

- Remember, fiduciary management costs money. Often brokers charge a fixed amount and / or commissions for it when buying and selling shares. Also, often with trust, there is a certain entry threshold, that is, the minimum amount that you must deposit into your account.

- For example, if you decide to buy shares of Gazprom for 50,000 rubles, the broker can take a commission of 1,500 rubles to execute the transaction.

2 Consider self-management options. If you are not willing to pay high management fees to brokers and want to invest on your own, consider brokers offering low service fees.

2 Consider self-management options. If you are not willing to pay high management fees to brokers and want to invest on your own, consider brokers offering low service fees. - The downside to doing this on your own is that you won't get professional advice, but the big advantage is that you can save a lot on commissions.

- Here are some of the most popular brokers in Russia: Tinkoff Investments, VTB My Investments, Sberbank Broker, BCS Broker, Otkritie and so on.

3 Consider the option of opening an IIS. Since 2015, individual investment accounts (IIS) have been used in Russia - a brokerage account or an individual's trust account, which provides for 2 types of tax incentives to choose from.

3 Consider the option of opening an IIS. Since 2015, individual investment accounts (IIS) have been used in Russia - a brokerage account or an individual's trust account, which provides for 2 types of tax incentives to choose from. - IIS has a number of restrictions, such as, for example, only rubles can be credited to the IIS, and the maximum amount for crediting is limited to 1 million rubles per year.

- At the same time, IIS allows you to receive tax benefits if certain requirements are met. Deductions can be of the following types: a 13% deduction on deposited funds from personal income tax paid by an individual for the current year at the main place of work or exemption from tax on income received on the IIS (upon closing an account).

- For example, if you replenish the IIS for 400,000 rubles per calendar year, already next year you will be able to apply for a refund of 52,000 rubles, if, of course, you paid personal income tax for this amount for this year.

- The disadvantage of the IIS is only that it is impossible to withdraw funds from it without closing the account itself, but in order to receive tax benefits (which gives the IIS advantages in comparison with a regular brokerage account), the IIS must be opened for at least 3 years. In other words, any funds deposited on the IIA will be blocked for this period, as well as dividends (in some cases).

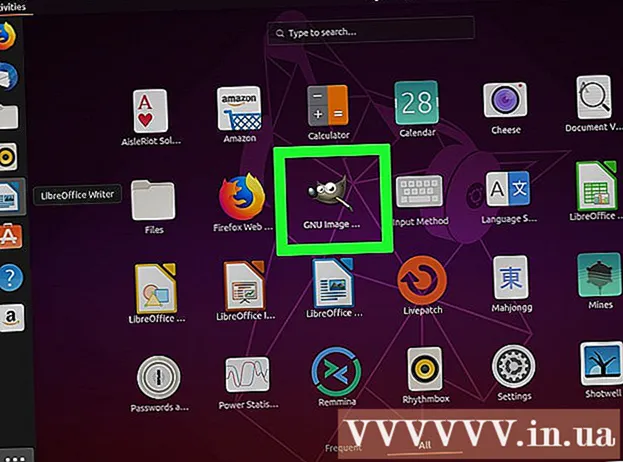

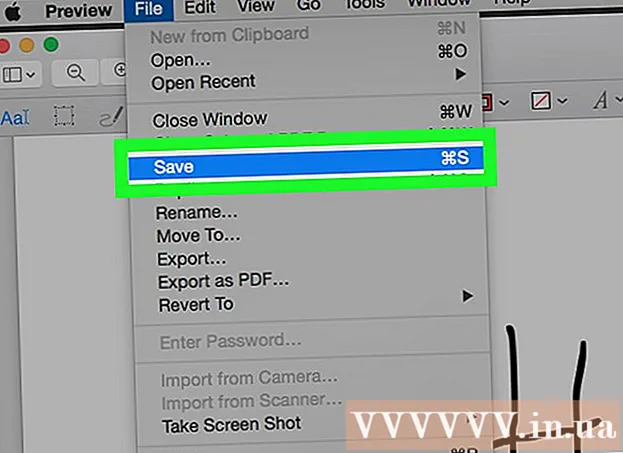

4 Open a brokerage account. Regardless of which option you choose, your next step is to open a brokerage account. You may also consider opening an Individual Investment Account (IIS). Most brokers can open an account online or even through a mobile application. However, you may need to provide certain documents or fill out some forms.The list of documents and other nuances may vary.

4 Open a brokerage account. Regardless of which option you choose, your next step is to open a brokerage account. You may also consider opening an Individual Investment Account (IIS). Most brokers can open an account online or even through a mobile application. However, you may need to provide certain documents or fill out some forms.The list of documents and other nuances may vary. - If you plan to use trust management, choose a broker that you think is reliable and with whom you will be willing to share your personal financial information. The more information the asset manager has, the more successfully he will be able to solve the tasks assigned to him in accordance with your needs.

- If you are going to choose a self-managed broker, then you will probably need to fill out several forms, send your documents, and in some cases visit the office. You may also need to deposit a certain amount into your account to start trading.

- The procedure for opening an IIS is no different from the procedure for opening a brokerage account. When opening an account, pay attention to the service tariff that you choose. In most cases, it is best to choose a plan without a monthly account maintenance fee.

5 Submit a request for the purchase of securities. When you open and set up your account, you can make your first purchase - it should be quick and easy. The way you buy shares may vary.

5 Submit a request for the purchase of securities. When you open and set up your account, you can make your first purchase - it should be quick and easy. The way you buy shares may vary. - If you decide to use trust management services, you can simply call your broker. The broker will do everything necessary for you. Your account will already be opened, and the broker will ask you to voice your account number before making a purchase. The broker will also confirm your order, which he will place in the system. Listen to the broker carefully, because we are all human and we can make mistakes.

- If you use a stand-alone brokerage plan, you will be able to place orders to buy stocks online. This can be done through the online platform, through the QUIK terminal or a mobile application, if your broker offers one. When placing an order, you will need to decide how much you are willing to invest and how many lots you can purchase for this amount.

- Buying securities on IIS is no different from buying securities on a brokerage account. However, you should remember about certain restrictions on the amount of investments and the investment instruments themselves, which were mentioned above.

6 Keep track of your investments. It is very important to understand that stocks and stock markets are volatile. Stock prices can rise and fall, especially over a short period of time. If you see that some of your investments are not performing well, then perhaps you should rebalance your portfolio.

6 Keep track of your investments. It is very important to understand that stocks and stock markets are volatile. Stock prices can rise and fall, especially over a short period of time. If you see that some of your investments are not performing well, then perhaps you should rebalance your portfolio. - Stock prices reflect investor sentiment. Investors very often react to rumors, false information, they are often subject to expectations and doubts. Don't waste time tracking the price of your stock over the course of a day or a week if you are investing for a year or longer.

- By tracking stock prices very closely, you run the risk of spontaneous decisions and losses. Try to track the performance of your investments over the long term.

- Along with this, do not forget to analyze and recognize when not everything is as good with the company's shares as it should be. For example, if a company loses a major lawsuit, if it entered a new market with high competition, then the company's stock may fall dramatically. In such cases, it is worth considering selling the stock.

Tips

- Many useful books, magazines and websites about stocks and stock markets can be found in stores and on the Internet. Do your own research, study the issue in detail before buying any stock instruments.

- Before buying stocks for real money, try working on a demo account for a while. Track stock prices and keep records of why you decide to buy or sell certain instruments. Evaluate if your investment decisions have paid off. Once you learn to understand how financial markets work and feel morally ready to trade on it, you can start buying real securities for real money.

- Invest in companies you know and like if they seem promising to you.

Warnings

- Any investment involves risk. Don't invest if you are not prepared to lose money.