Author:

Ellen Moore

Date Of Creation:

15 January 2021

Update Date:

1 July 2024

Content

Annual interest income is the interest rate earned on a deposit, savings account, or other form of investment. Typically, annual interest income is calculated for compound or cumulative interest, rather than simple interest, of the nominal rate. One of the purposes of using the Annualized Rate of Return as a percentage is to compare potential return with other investment opportunities. To calculate this rate, you need to know how often interest is credited to your savings account.

Steps

1 Divide the annual interest rate (nominal or simple) by the frequency of crediting interest payments in months. For example, if you have $ 10 in your account, with an annual interest rate of 10%, interest crediting once every six months, or twice a year, divide 0.10 by 2. The result is 0.05.

1 Divide the annual interest rate (nominal or simple) by the frequency of crediting interest payments in months. For example, if you have $ 10 in your account, with an annual interest rate of 10%, interest crediting once every six months, or twice a year, divide 0.10 by 2. The result is 0.05.  2 Add 1 to the resulting figure. For our example, the result would be 1.05.

2 Add 1 to the resulting figure. For our example, the result would be 1.05.  3 Multiply the result by a factor equal to the percentage frequency. In our example, this is 1.05 x 1.05 = 1.1025.

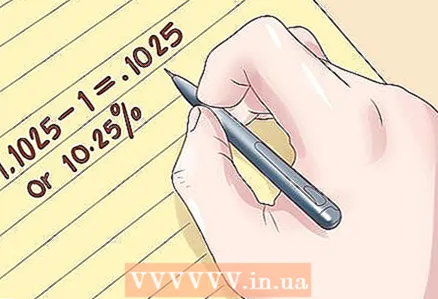

3 Multiply the result by a factor equal to the percentage frequency. In our example, this is 1.05 x 1.05 = 1.1025.  4 Subtract 1 from your result. In the example you are considering, this would be 1.1025 - 1 = 0.1025. Multiply by 100 to convert to percentage. In our case, the annual percentage return is 10.25%.

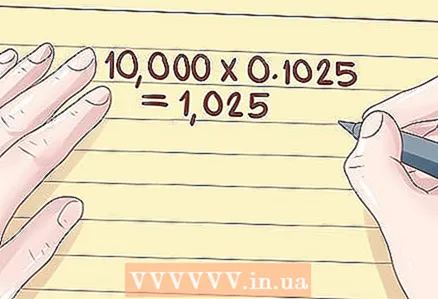

4 Subtract 1 from your result. In the example you are considering, this would be 1.1025 - 1 = 0.1025. Multiply by 100 to convert to percentage. In our case, the annual percentage return is 10.25%.  5 Multiply the resulting value by the amount on the account: 10 x 0.1025 = 1.025 to determine the percentage to be credited to the account during the year. For example, you would earn $ 1,025 and your account balance becomes $ 11,025.

5 Multiply the resulting value by the amount on the account: 10 x 0.1025 = 1.025 to determine the percentage to be credited to the account during the year. For example, you would earn $ 1,025 and your account balance becomes $ 11,025.

Tips

- To compare your annual interest income to the simple interest rate, multiply your balance by the annual rate and the remaining period in years. For example, an investment of $ 2000 at 5% for two years gives you: 2000x 0.05 x 2 = 200. If your interest is not credited to the account, you will earn $ 200 in that time. Compare this to the same investment and nominal interest rate when you deposit interest every six months into the account, you will receive $ 207.63.

What do you need

- Account statement

- Calculator