Author:

Florence Bailey

Date Of Creation:

20 March 2021

Update Date:

1 July 2024

Content

Maintaining financial stability is very important in any economy. However, household expenses, food, clothing, medicine, and other daily expenses will make it harder to achieve financial stability if you don't create a budget and stick to it. To create such a plan, you need to know the basics of budgeting. And here are some tips on how to find financial stability within 6 months.

Steps

1 Keep track of your running expenses. Write down all of your purchases that you make with credit and debit cards, as well as cash. Break down your purchases into different categories: food, housing, utilities, entertainment, transportation and travel, insurance, health, clothing. If you have children, budget for them as well. Also include a column for “miscellaneous” expenses.

1 Keep track of your running expenses. Write down all of your purchases that you make with credit and debit cards, as well as cash. Break down your purchases into different categories: food, housing, utilities, entertainment, transportation and travel, insurance, health, clothing. If you have children, budget for them as well. Also include a column for “miscellaneous” expenses.  2 Analyze all of your income, including your regular salary, interest income from bank accounts, and rental income.

2 Analyze all of your income, including your regular salary, interest income from bank accounts, and rental income. 3 Determine your progress, or lack thereof, by comparing your income with your expenses. If your expenses exceed your income, then you should immediately change this trend.

3 Determine your progress, or lack thereof, by comparing your income with your expenses. If your expenses exceed your income, then you should immediately change this trend.  4 Create a budget based on your recurring expenses. Try to reduce the cost of daily pleasures, such as making and drinking coffee at home rather than going to cafes, stop going to the cinema or other entertainment facilities, and save electricity and gas. Take food with you to work instead of buying ready-made meals at the convenience store around the corner. Don't buy anything from vending machines.

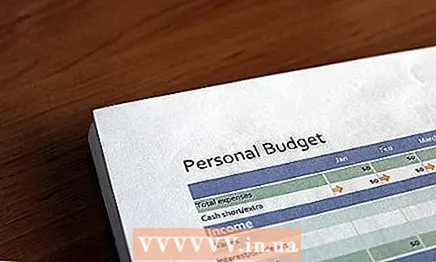

4 Create a budget based on your recurring expenses. Try to reduce the cost of daily pleasures, such as making and drinking coffee at home rather than going to cafes, stop going to the cinema or other entertainment facilities, and save electricity and gas. Take food with you to work instead of buying ready-made meals at the convenience store around the corner. Don't buy anything from vending machines.  5 Do not use credit cards, especially those that require high interest rates. Interest quickly accumulates and you have to pay for something much more than it actually costs.

5 Do not use credit cards, especially those that require high interest rates. Interest quickly accumulates and you have to pay for something much more than it actually costs.  6 Pay off all debts. Start with those debts that are closest to repayment. Develop a plan for paying off absolutely all debts, allocating a special budget for this.

6 Pay off all debts. Start with those debts that are closest to repayment. Develop a plan for paying off absolutely all debts, allocating a special budget for this.  7 If you have money to spare, spend it on paying off debts or put it in a savings account. Don't waste them. Use funds to achieve financial independence.

7 If you have money to spare, spend it on paying off debts or put it in a savings account. Don't waste them. Use funds to achieve financial independence.  8 Take another job to acquire an additional source of income if your budget plan is not paying off. Even if you need to get a job for a short period of time in order to pay off debts, then take this opportunity.

8 Take another job to acquire an additional source of income if your budget plan is not paying off. Even if you need to get a job for a short period of time in order to pay off debts, then take this opportunity.  9 Start enjoying free or cheaper entertainment. For example, rent a movie or watch TV instead of going to the cinema. Go to the park instead of a bar or restaurant.

9 Start enjoying free or cheaper entertainment. For example, rent a movie or watch TV instead of going to the cinema. Go to the park instead of a bar or restaurant.  10 Create a budget for a rainy day, which should be enough for you for 3-6 months of life. These funds can be used to solve urgent financial issues.

10 Create a budget for a rainy day, which should be enough for you for 3-6 months of life. These funds can be used to solve urgent financial issues.