Author:

Robert Simon

Date Of Creation:

20 June 2021

Update Date:

1 July 2024

Content

Sometimes, to calculate the interest earned on a savings account, you simply multiply the interest rate by the principal amount. In most cases, however, it's not that easy. For example, many savings accounts are listed with one-year term rates but compounded monthly. Each month, part of the interest will be calculated and added to the principal, affecting the interest of the following months. Adding and adding to your principal continuously is called compounding and the easiest way to calculate your future earnings is by using a compound interest formula. Read on to learn more about the pros and cons of this interest calculation.

Steps

Method 1 of 3: Compute compound interest

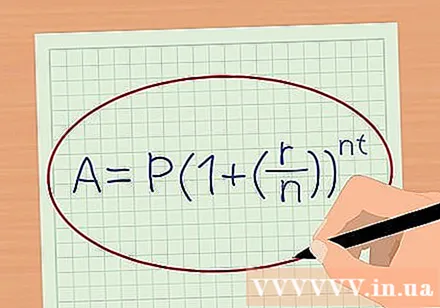

Identify the formula for calculating the effect of compound interest. That is: .

- (P) is the principal, (r) is the one-year term interest rate and (n) is the number of times the interest is compounded during the year. (A) is the account balance calculated under the effect of compound interest.

- (t) is the period during which interest is accrued. This should match the interest rate used (for example, if the interest is calculated annually then (t) should be the number or part of the year). If it's less than a year, divide the total number of months by 12 or the total number of days divided by 365.

Determine the variables used in the formula. Review your personal savings account terms or contact your bank representative to enter values into the equation.- Principal (P) is an initial deposit or existing money that is used to calculate interest.

- The interest rate (r) should be left in decimal. 3% should be filled in the formula as 0.03. To get this number, simply divide 3 by 100.

- Value (n) is the number of times interest is calculated and included in the principal (interest compound) in a year. The most common are monthly (n = 12), quarterly (n = 4) and yearly (n = 1) compounding. However, several other options may exist, depending on the specific terms of your savings account.

Plug the values into the formula. Once you have determined the value of each variable, fill in the compound interest formula to find the interest earned over a specific time frame. For example, for P = 20,000,000 VND, r = 0.05 (5%), n = 4 (compounded quarterly), and t = 1 year, we have the following equation: dong.- Daily gross profit is calculated in the same way, except that in this case the variable (n) is 365 instead of 4 as above.

Perform calculations. Now that the values are in place, let's solve the equation. Start by shortening the simple parts first. It involves dividing the annual interest rate by the number of periods to get periodic interest (in this case,) and finding, here simply:. From there, we obtain the equation: copper.- This equation can be further reduced by performing the calculation enclosed in parentheses:. Now, we get: copper.

Solve the equation. Next, calculate power by taking the result obtained in the last step to the power of the four (ie). We can. The equation is as simple as: copper. Multiply these two numbers together to get: copper. This is the value of your savings account after one year at 5% interest (compounded quarterly).

- Note that this is slightly higher than what you would expect to receive when the annual interest rate is quoted - dong. It shows the importance of understanding how and when profits are added up!

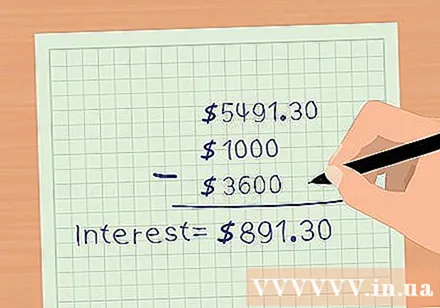

- The interest earned is the difference between A and B. So the total interest earned is dong.

Method 2 of 3: Calculate interest with regular capital contribution

Let's use the cumulative savings formula first. You can also calculate the interest earned on the monthly equity account. It is useful if the amount of money you save is stable and transferred to a savings account every month. The full equation is:

- Another simple method is to separate the compound interest of the principal from the interest earned on the equity (or payment / PMT). To get started, calculate your principal interest with the accumulated savings formula.

- As can be seen, with this formula, you can calculate the interest earned on a savings account added monthly and compound interest by day, month or quarter.

Use the second element in the formula to calculate the interest on your equity. (PMT) represents monthly capital contribution.

Determine the variables. Check your savings or investment agreement for the following variables: principal "P", annual rate "r", and number of periods in year "n". If it is not available, contact your bank. The variable "t" represents the number of years or parts of the year used to calculate interest and "PMT" is the value of the contribution / payment each month. "A" is the total value of the account earned with a given time and stake.

- Principal "P" may also represent the account value at the time selected starting interest calculation.

- The interest rate "r" indicates the interest paid to the account each year. It should be expressed in decimal form in the formula. That is, the 3% interest rate should be represented as 0.03. To get this decimal, simply divide the interest rate by 100 as a percentage.

- "n" is simply the number of compounding times per year. That would be 365 for daily, 12 for monthly and 4 for quarterly.

- Likewise, "t" represents the number of years used to calculate interest. It can be the number of years or parts of the year if the interest period is less than one year (for example 0.0833 (1/12) for a 1 month period).

Plug the values into the formula. With P = 20,000,000 VND, r = 0.05 (5%), n = 12 (compounding monthly interest), t = 3 years and PMT = 2,000,000 VND, we get: VND.

Simplify the equation. Start with reduction, possibly by dividing the interest rate by 0.05 by 12. We get:. You can also shorten it by adding one to the interest in the brackets. The resulting equation will be: copper

Exponentiation. First, find the exponent:. We can. Next, the power to reduce the equation to copper. Simplify by subtracting 1, we get copper.

Proceed to perform the final calculations. Multiplying the first cluster of the equation, we get 32,320,000 VND. Calculate the remaining cluster by dividing the denominator by the numerator:. Next, multiply the result by the value of the contributed capital (in this case, 2,000,000 VND). The resulting equation is: copper. The savings account's value under these terms will be VND.

Calculate the total interest earned. In this equation, the interest earned is the difference between the total account (A) and the sum of the principal (P) and the product between the number of contributions and the value of the capital contribution (PMT * n * t). In the above example, the interest rate earned is equal to or dong. advertisement

Method 3 of 3: Use spreadsheet to calculate compound interest

- Open a new workbook. Excel or similar spreadsheet programs (such as Google Sheets) help save you computation time and even offer pre-designed financial functions shortcuts to help with compound interest.

- Name the variable. When using a spreadsheet, it can always be helpful to be as neat and clear as possible. Start by naming the column of cells containing the important information used in your calculation (eg interest rate, principal, time, n, equity).

- Put the variables in the spreadsheet. Now fill in your account's data in the next column. As a result, the spreadsheet is not only easy to see and interpret later, but also allows changing one or more variables so that many different savings options can be studied.

- Equation. The next step is to type in your own version of the accrued interest formula () or a more complex version, taking into account monthly equity (). Use any blank cells, begin with "=" and use regular math symbols (including parentheses if needed) to type the appropriate equation. Instead of entering variables like (P) and (n), type the names of the cells that store the corresponding data or simply click on those cells while composing the equation.

- Use a financial function. Excel also provides financial functions that can assist with your calculations. In particular, "future value" (FV) can be used because it calculates the value of an account at some point in the future with variables like the ones you are familiar with. To use this function, go to any blank cell and type "= FV (". Excel will have a wizard window as soon as you open the first function formula brackets to assist in entering the correct parameters.

- Instead of accruing interest, the future value function is designed to calculate the amount payable to balance an existing account when it is continuously accumulating interest. Therefore, the function will automatically output negative results. To resolve this issue, type

- Similar data parameters, separated by commas, are used in the FV function, but they are not exactly identical to the ones we used above. For example, the "interest rate" here is (the annual rate divided by "n"). It will be calculated automatically in the parentheses of the FV function.

- The parameter "nper" here is a variable - the total number of interest periods is added up and total capital contribution. In other words, if the PMT is nonzero, the FV function will assume that you contribute the amount of PMT capital over each and every period specified by "nper".

- Note that this equation is most common for (such calculations) schedule mortgage repayments over time with recurring payments. For example, if you are planning to have a monthly installment for 5 years, "nper" would be 60 (5 years * 12 months).

- PMT is the amount of capital contribution periodically over the entire time (a stake in "n").

- "" (or Present Value) is your principal account - your account's initial balance.

- The last variable, "" (type), can be left blank in this calculation formula (the function then returns itself to 0).

- The FV function allows you to perform simple calculations within the parentheses of a function formula, such as a complete FV function will likely take the form. It shows a 5% annual interest rate compounded monthly for a 12-month term and during that time, you contribute 2,000,000 VND / month. At the same time, your initial balance (principal) is VND 100,000,000. The results show how much your account is after 1 year (129,674,000 VND).

Advice

- Besides, compound interest calculation can be more complicated with variable capital contribution. At this point, you need to calculate your equity / payment interest separately (with the same formula introduced above) and it's best to use a spreadsheet to simplify the calculation.

- You can also use an online annual published interest calculator to determine your interest earned on a savings account. Search the internet for "annual published interest calculators" for this multitude of sites offering free services.