Author:

Laura McKinney

Date Of Creation:

3 August 2021

Update Date:

1 July 2024

Content

Trust me - when you have to live on a budget, then you have a stable job.More and more people are looking to expand their financial resources than before. And that's also possible - There are times when you'll even realize those ways. Not only are you existing, you are living and enjoying this life. Let's see that we are overcoming the challenge!

Steps

Part 1 of 3: Determining the Budget

Estimate yourself income. This is the first step in any budgeting. To know how much you can spend, you need to know yourself make how much is. And by the way this income should be after tax. This is easiest to do on a monthly basis, so look at last month's pay stub - how much did you bring home in the last four weeks?

- If you are a freelance or freelance contractor, make sure you know how much you will be paid until April. This will limit your impact on the amount when you make an estimate for the whole year.

- If you're a regular employee, don't charge extra tax refunds. Only when it appears do we tell more. Now is not the time to calculate it.

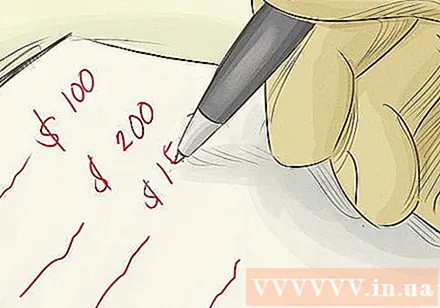

Make a list of your expenses. These are standard expenses that are easy to calculate (rent, student loans, travel expenses ...) and non-standard amounts: food, entertainment, snacks ... Be realistic. - but can be estimated too a little bit is fine. Try to think of anything else you've forgotten - are you supporting the International Children's Society? What other days do you drink a $ 4 Latte? Do you have auto-payments for yoga classes you have never taken? Make sure you cover all of your expenses!- Carefully consider your extra expenses. The main benefit of a flexible society is that you can log onto a website to see where you've spent your money. But that doesn't mean you have to forget your money!

Consider where you can cut back. When looking at the list (expenses), find places where you can reduce the unwanted items a bit. Can we get rid of the intended phone line? Is it possible to switch from cable TV to Netflix? Skip the other daily Latte? The easiest places to get rid of will be in the "spontaneous" section - things you won't even notice until you spend money on it.- When it comes to technology, don't worry if there can be controversy. Friend have the right to Call your phone / Internet / TV service provider to say you are unable to pay current charges. You will be amazed with the amount of that one customers often complain can be saved. So even look at the list and you say: Can't cut any more! I need them!Actually, you are just assuming that.

Set goals. Now that you know how much extra money you can save if you are aware of it, take that number and set a goal for saving. There are 2 numbers: 1) how much you should spend each month, and 2) how much you want to keep. The rest is at your disposal!- You can set daily, weekly, and monthly goals - it all depends on how you want to do it. You can spend $ 10 a day on food, $ 50 a week on groceries, or a full month's salary on something you feel you need. Just make sure you know exactly what will save you money.

Get out during times of need. There will always be such emergency situations. Maybe the faucet leaks or for some reason you have diarrhea can't work, they are urgent situations. You have to spend money on these - and if all this doesn't happen then great! It's easier for you to breathe.- Think about it: How often do you not spend on things that you don't plan for? If you are like 99% of people like us, the answer is always correct anytime. So even when the urgent situation is the birthday of a friend that you barely remember, you have already planned it out.

Prioritize extra expenses. You have a few coins in your pocket and are excited like walking on the cloud with the thought of whatever you want to spend. But unfortunately, the money is not falling from the sky and the amount is very limited, so it's important to prioritize it. Want a house full of dogs or get a manicure done every two weeks? Answer me, what makes you happier?- I don't intend to comment in the middle of a house full of dogs or every two pants manicuring at once, whichever is worse. Some people may not be that important, but to you have. They are all related. So for anything that is important to you, give it a place. Just the real thing like that. If it doesn't give it a place, sooner or later it must be discarded.

Part 2 of 3: Lifestyle Changes

Save money from now on. For most of us, this will certainly change the way we live. We used to party right after we got our paychecks until the money was over. Can't do anything more, it's sad. When Friday comes, stock up with a magic number you promise you can save. By the time you have spent all your money, you won't be tempted to spend it.

- If possible, put it in a savings account - or at least go somewhere other than the ones you normally use. Just put the money in the sock compartment (if you can't help it) or, worst of all, ask your mom to keep it. This way you force yourself to try to live up to the money you have laid out.

Self-sufficient. In today's technology age, this is quite demanding. Our culture is frozen food, wage employment and regular entertainment. To live on a budget, you cannot live differently. You have to learn how to do almost anything yourself. A few suggestions for you are:

- Start cooking. Not only is it more nutritious, but it's also cheaper. And if you can cook a big meal at a time, you can freeze it and keep those rainy days.

- Grow your own food. This will improve your cooking skills. Growing your own fruits and vegetables is as cheap as buying them. Not only do you reduce your grocery purchases, but you also have the satisfaction of growing your own food. How many people can say that ?!

- Suture. How many of us have a hole in our shirt and then throw it away? Come on, now raise your hand. You know you can do it. Instead of wasting, why don't we make, fix, and sew our own clothes by ourselves? Not only does it keep money in your account, but you are also super trendy. One look nobody have been? Great, excellent, wonderfull.

Create a second source of income. Okay, life is not like a dream, right? If you want to have a lot of money, there must be another job. But don't think of it like you're wearing an apron while doing a desk job - even picking up your baby every week can boost your lifestyle so you can feel a little better about it (this is main battle). The main thing is you have to be happy, not get rich.

- Ad. This is very serious. There are lots of little things that can make you a little bit money, even helping a divorced pregnant mother move into a new apartment. And thanks to your friends! Those who will probably know one-time chores for $ 50. If you don't ask, you will never know!

Find a roommate. That's another obvious way. Whether you live in a city or a small town with just one traffic light, 6 bars and 9 churches, find someone to share your room with. And don't forget to divide the small things too! That's half of the toilet paper money, half the food bill, half the alcohol money for Party Wednesday. If a roommate is a pleasant type, at least that's it.

- You can find friends to divide the rent or moving to a larger location and paying the same - both of which are beneficial (although the latter doesn't save much money). And if you have to use curtains to block your bed, then so be it. Life goes on. By the way, you can sleep on the floor in the corner of the room!

Cut down on bad habits. Because it will cost money.Obviously bad habits of smoking, alcohol, and drug use, there are many more. If it's not essential to survival, then you don't really need it. And if the effect is bad for you, then you are really don't need it. Sometimes we have to live true to ourselves and these are the times.

- Even if you are addicted to watching movies, you still have to follow that. Take an honest look at yourself: what habits cause you to lose unnecessary funds? We all have. And if you can't quit, are there other cheaper alternatives you can think of? Can Redbox be an alternative?

Use cash. Holding something in your hand makes everything different. Our head cannot pay full attention when scanning that little plastic card (ATM / credit card) while the money disappears from the account. Imagine if you used the card all the time, there will come a time when a little devil pops up saying the money is no longer yours. Then you know how to hesitate. So, just use cash. Only when you use cash do you really consider your spending.

- It's a good idea to allow yourself to spend comfortably this week. When I run out of money, I'm sorry, that's what life is like. This is a bit harsh - but it will teach you how to share your spending quickly!

Adjust your look. When it comes to changing frugality, one of the most important things is what you think. If you don't eat at a 5-star restaurant that makes you feel completely deprived, it is quite troublesome. But if one can adjust the look and feel less deprived, this whole budgeting effort will take almost no effort at all. You have less risk fighting the "Trying to be frugal" thought thought and going crazy with it. If so, budgeting isn't worth it if it drives you crazy!

- You don't need to follow Joneses. No need to maintain any pattern, believe it or not, it's up to you. You can be happy with what you have. Simple Living is not for the wealth you have. It's just the thought you make yourself like. If you are satisfied with your situation, then you are happy - and so should you.

Part 3 of 3: Tips for using Money

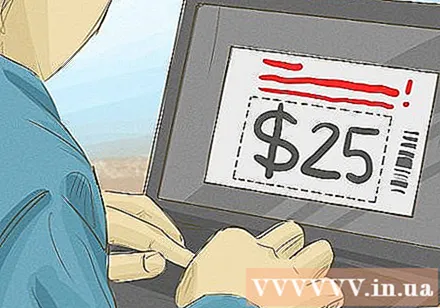

Buy with coupons. There is nothing to be ashamed of - this is the trend! There's even a long TV show for the genre! This is a real step forward! So grab the scissors and start cutting them all off. There are weekly advertisements in favorite stores with manufacturer's offers. Don't forget any of those 2!

- Think about each season. If the item does not sell this week, it may be next week, so try to delay. And sometimes midweek sales also offer the best prices.

Get used to discount shopping community. In addition to cutting paper and checking out the manufacturer's site, go to community discount sites like LivingSocial, Groupon, Hukkster, or TravelZoo. Good prices don't just stop at groceries - you can find it at restaurants that sell for half what you would normally pay. With a little ingenuity, your "partying" lifestyle will not be changed much!

- This is also a great way to enrich yourself. Can't afford to go to the gym? Join an 80% discount kickboxing class through Groupon. Need a Christmas gift? Well, what else do you use your coupons for now? With things that can be stored indoors, there's no need to hesitate!

Thrift shopping. This is also becoming a trend. If it's possible to buy used stuff, it's the same, right? Old stuff will knock consumerism away. And besides legal used stores, go to second hand shops, classifieds listings, auctions, and other community events (like church book stores ...). Immediately you will be a treasure hunter.

- Transactions with family. We are becoming a culture with too much furniture, and in fact we have a storehouse of it too. Think of a pretty interesting question: How many people do you know? So trade with them! They may (and rather: surely) have some belongings to be disposed of.

Using the Internet as an advantage. You know the classifieds, but have you ever heard of the Freecycle.org site? Go to the community page and find people let alone. And of course, there are also many people who want to buy from there. And remember this is just one of these sites!

- You really don't have to pay the full price for everything. In addition to the aforementioned community discount shopping sites, there are also sites like eBay and Etsy, where you can buy things from other people and usually for much cheaper.

Treat credit cards as rewards. This way is a bit dangerous. If you're the type of person who likes to shop, then credit card is the worst thing you can do for yourself. But if you know how to handle your debt (and have a good credit score), consider opening a credit card with a bonus program. Every time you use a card, you accumulate points for it. Then convert points into items - or cash. And the second source of income is here!- Always be sure to read your credit receipts. The last thing you want is to open up a credit card with a terrible rate of interest, start using it and then put yourself in a bad, bad debt situation. And that's of course not what you want to happen.

Towards experiences, not possessions. It may not be surprising to learn that it is experiences that make people happier than owning a bunch of possessions. Live experiences last longer and don't clog your closet when not in use. So if you find something lacking in your life, look towards the experience. Owning property doesn't really cheer you up. And if anything, that joy would not be long.- Is Christmas coming? Please request the class or gym membership fee. Travel request paid by credit card. Ask for things you can use really. Sure, a 50 in (inch) TV is fine, but next year you'll want to replace it anyway. Make your life richer with experiences, not anything else.

Advice

- Drink water instead of other beverages. Water is a healthy alternative to many drinks on sale, not to mention even cheaper.

- Try cutting down on food bills by going shopping once or twice a week and using the rest of the days to fix up on food in the kitchen.

- Try paying off any unpaid debts or bills. If you have not yet paid off your due credit debts, do so as soon as possible because interest will make those payments much more expensive.

- Reduce your electricity bills by following these steps. Turn off all lights in the room, unplug appliances if not in use. Don't just turn off appliances as they may still use a small amount of electricity but increase your electricity bill.

Warning

- Be careful when using credit cards. Many people are in debt because they keep spending it too much and it takes months, even years to pay off the debt. It can also lead to bankruptcy, making you homeless.

- Be careful when choosing a roommate as it may not be the right person to live with. Possible reasons are that she or he may have a criminal history or habit that annoys you, making it take longer for you to work through something else.