Author:

John Pratt

Date Of Creation:

11 April 2021

Update Date:

26 June 2024

Content

- To step

- Method 1 of 4: Opening a PayPal account

- Method 4 of 4: By E-mail (As Self-Employed)

- Tips

- Warnings

PayPal is an online payment system that organizes payments between individuals and companies. PayPal allows users to pay for goods and services by sending money to someone's email account. PayPal has existed since 2000, operates in more than 150 countries and offers customer service in 24 of those countries. By following the steps below, anyone can easily use the system.

To step

Method 1 of 4: Opening a PayPal account

Follow the app's instructions to set up a payment schedule. The easiest option is to enter each sale individually, but you can also enter a list of standard prices.

Follow the app's instructions to set up a payment schedule. The easiest option is to enter each sale individually, but you can also enter a list of standard prices.  If a customer wants to pay, plug the PayPal Card Reader into the audio input of your smartphone or tablet. You should be able to see exactly when a connection has been made with the device.

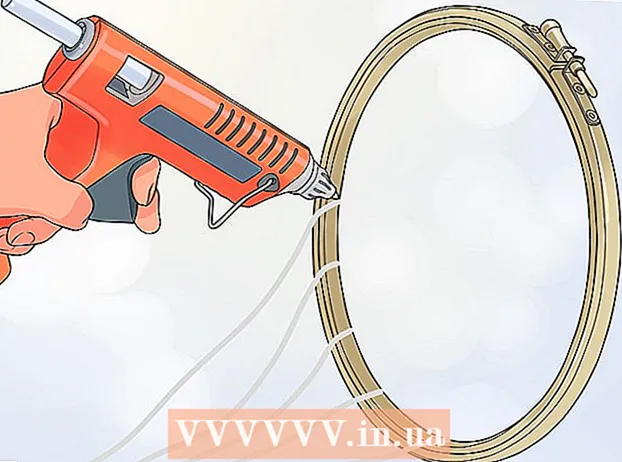

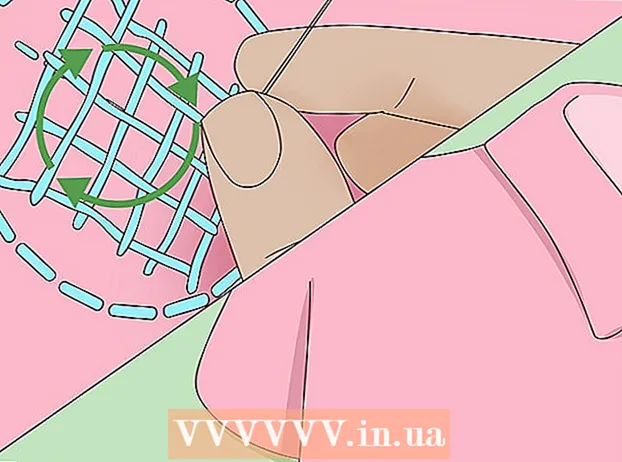

If a customer wants to pay, plug the PayPal Card Reader into the audio input of your smartphone or tablet. You should be able to see exactly when a connection has been made with the device.  Enter the amount that the customer must pay. On the next page, click on "Loyalty Card". Then swipe the card through the card reader. Make sure you swipe the card correctly.

Enter the amount that the customer must pay. On the next page, click on "Loyalty Card". Then swipe the card through the card reader. Make sure you swipe the card correctly. - When swiping, make a quick movement and make sure that the magnetic strip is passed through the reader in its entirety.

- If you don't have a card reader yet, you can still accept payments. You will now only have to enter the customer's details manually or scan the card with your phone.

Have your customer sign for the payment. Click on "Complete purchase" to complete the payment process and receive payment.

Have your customer sign for the payment. Click on "Complete purchase" to complete the payment process and receive payment.

Method 4 of 4: By E-mail (As Self-Employed)

Create a PayPal account with a valid email address. That is all you need to be able to receive online payments as a self-employed person. This is especially useful if you work freelance for various companies, for example. Many companies prefer PayPal payments over other payments because they are processed faster than, for example, international money transfers.

Create a PayPal account with a valid email address. That is all you need to be able to receive online payments as a self-employed person. This is especially useful if you work freelance for various companies, for example. Many companies prefer PayPal payments over other payments because they are processed faster than, for example, international money transfers. - Your employer will also need a PayPal account for this method. Ask if this is the case and if he accepts this form of payment.

When you want to be paid, you give your employer the email address associated with your PayPal account. You don't have to do more - the employer can then transfer money to you.

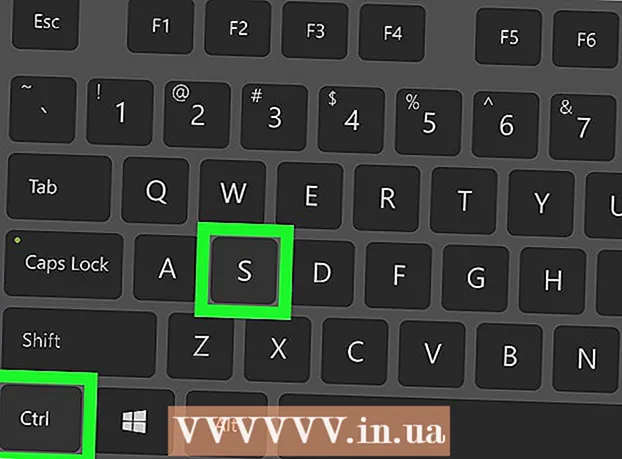

When you want to be paid, you give your employer the email address associated with your PayPal account. You don't have to do more - the employer can then transfer money to you.  Log in to your personal PayPal account as soon as your employer has paid you. Click on "Withdraw" and choose the way you want to transfer the money to yourself. For example, choose:

Log in to your personal PayPal account as soon as your employer has paid you. Click on "Withdraw" and choose the way you want to transfer the money to yourself. For example, choose: - A transfer to your bank account (free).

- Payment by check (for a fee).

- Applying for a PayPal debit card (free).

- Note: When you receive a payment, you will be notified by PayPal by email. In this e-mail you can read how you can receive your money.

If you have not done this yet, you can now enter your payment details on the next page.

If you have not done this yet, you can now enter your payment details on the next page.- When you transfer money from PayPal to your bank account, it can take 1 to 2 days for the payment to be processed. Payment by check can take anywhere from 5 to 10 days.

Tips

- In addition to a card reader, there is also the possibility to accept payments in a different way via the PayPal app. Consider, for example, checks and invoices.

- PayPal also offers the possibility to receive international payments in other currencies.

- If you do not connect a bank account or credit card to your PayPal account, you can request a PayPal payment card. You can also use this card to verify your account.

Warnings

- PayPal Seller Protection is only available to people with a verified account. The protection is practical when, for example, a payment from a customer is reversed. In these cases you can often get your money back from PayPal.

- Only paid PayPal accounts are insured against credit card transfers canceled by the customer.

- As a self-employed person, you can only withdraw $ 500 per month from your PayPal account. If you exceed this amount, your account will be blocked. To remove this block, you will have to fill in additional information and in some cases create a business account.