Content

- To step

- Method 1 of 3: Understanding the necessary conditions

- Method 2 of 3: Trading binary options

- Method 3 of 3: Understanding the costs and where to buy

- Tips

- Warnings

A binary option, also referred to as a digital option, is a type of option where the trader takes a Yes or No stance on the price of shares or other assets, such as ETFs or currencies, and the resulting payout is all or nothing. Because of this characteristic, binary options are easier to understand and trade than traditional options. Binary options can only be traded on the expiration / expiration date. If the option stabilizes above a certain price upon expiration, the buyer or seller of the option will receive a predetermined amount. However, if the option stabilizes below a certain price, the buyer or seller will not receive anything. This requires a known upside (profit) or downside (loss) risk assessment. Unlike traditional options, a binary option offers a full payout regardless of how far above or below the strike price ("strike" or target price).

To step

Method 1 of 3: Understanding the necessary conditions

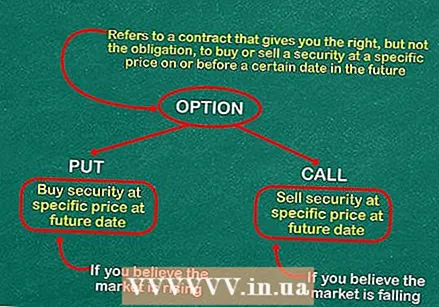

Learn about options trading. An "option" in the stock market refers to a contract that gives you the right, but not the obligation, to buy or sell securities at a specified price, on or before a specified future date. If you think the market is going to rise, you can buy a "call", which entitles you to purchase securities at a specified price at a future date. This means that you think the price will increase. If you think the market is going to fall, buy a "put" that gives you the right to sell the securities at a specified time at a specified price. This means you are betting that the price will be lower in the future than the one it is trading in now.

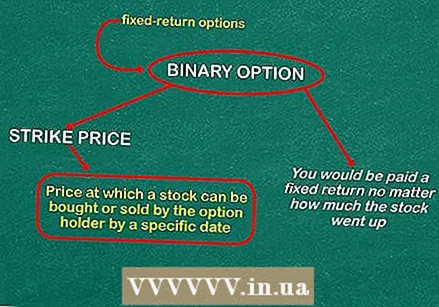

Learn about options trading. An "option" in the stock market refers to a contract that gives you the right, but not the obligation, to buy or sell securities at a specified price, on or before a specified future date. If you think the market is going to rise, you can buy a "call", which entitles you to purchase securities at a specified price at a future date. This means that you think the price will increase. If you think the market is going to fall, buy a "put" that gives you the right to sell the securities at a specified time at a specified price. This means you are betting that the price will be lower in the future than the one it is trading in now.  Learn about binary options. These options (also called fixed-return options) have an expiration date and also a "strike price". A strike price or exercise price is the price at which a stock can be bought or sold by the option holder on a specified date. This is stated in the binary options contract.

Learn about binary options. These options (also called fixed-return options) have an expiration date and also a "strike price". A strike price or exercise price is the price at which a stock can be bought or sold by the option holder on a specified date. This is stated in the binary options contract. - If you have correctly guessed the direction of the market, and the expiration price is higher than the strike price, you will receive a fixed return, regardless of how much the price has gone up. If you bet incorrectly on the market direction, you will lose your entire investment.

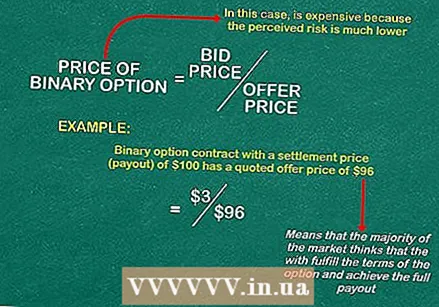

Learn how a contract price is determined. The asking price of a binary options contract is roughly equal to the market's perception of the probability that an event will occur. The price of a binary option is displayed as a bid / ask price, with the bid price (sell) shown first and the ask price (buy) second, for example 3/96, where the bid price is $ 3 and the ask price is $ 96.

Learn how a contract price is determined. The asking price of a binary options contract is roughly equal to the market's perception of the probability that an event will occur. The price of a binary option is displayed as a bid / ask price, with the bid price (sell) shown first and the ask price (buy) second, for example 3/96, where the bid price is $ 3 and the ask price is $ 96. - For example, if a binary options contract with a rate / price on settlement (payout) of $ 100 has a quoted price of $ 96, this means that the majority of the market believes the underlying commodity will meet the conditions. of the option and will reach the full payout of € 100, whether that means ending above or below a certain market price.

- This is why the option, in this case, is so expensive; the expected risks are much lower.

Learn the terms "in-the-money" and "out-of-the-money."In a call option, in-the-money occurs when the strike price of the option is lower than the market price of the stock or other asset. If it is a put option, in-the-money occurs when the strike price ends above the market price of the stock or other assets. Out-of-the-money is the opposite when the strike price ends above the market price for a call option and below the market price for a put option.

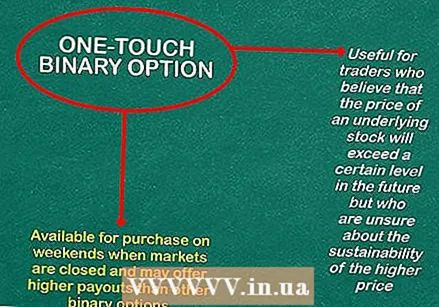

Learn the terms "in-the-money" and "out-of-the-money."In a call option, in-the-money occurs when the strike price of the option is lower than the market price of the stock or other asset. If it is a put option, in-the-money occurs when the strike price ends above the market price of the stock or other assets. Out-of-the-money is the opposite when the strike price ends above the market price for a call option and below the market price for a put option.  Understand one touch binary options. These are a type of options that are increasingly popular among commodity and foreign exchange traders. These types of options are useful for traders who believe that the price of an underlying stock will exceed a certain level in the future, but are unsure about the duration of that higher price. These can also be bought on weekends when exchanges are closed and can offer higher payouts than other binary options.

Understand one touch binary options. These are a type of options that are increasingly popular among commodity and foreign exchange traders. These types of options are useful for traders who believe that the price of an underlying stock will exceed a certain level in the future, but are unsure about the duration of that higher price. These can also be bought on weekends when exchanges are closed and can offer higher payouts than other binary options.

Method 2 of 3: Trading binary options

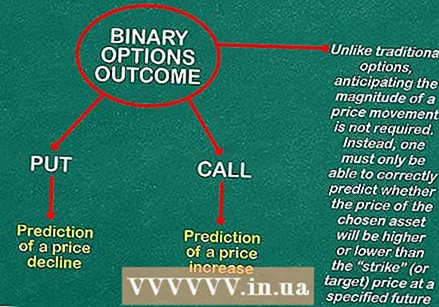

Know the two possible outcomes. A binary options trader should have a sense of the expected direction in the price of the stock or other assets, such as commodity futures or exchange rates. Within most platforms, the two choices are referred to as "put" and "call." Put is the prediction of a price fall, and a call is the prediction of a price rise.

Know the two possible outcomes. A binary options trader should have a sense of the expected direction in the price of the stock or other assets, such as commodity futures or exchange rates. Within most platforms, the two choices are referred to as "put" and "call." Put is the prediction of a price fall, and a call is the prediction of a price rise. - Unlike traditional options, anticipating the size of a price movement is not required. Instead, the investor should only be able to correctly predict whether the price of the chosen asset will end above or below the strike price (target price) at some point in the future.

Decide which position to take. Evaluate the current market conditions around your chosen stock or other assets and determine if the price is more likely to rise or fall. If your expectation is correct on the due date, your payout will be the exchange rate / price on the day of settlement, as stated in your original contract. The rate of return on any profitable trade is set by the broker and announced in advance.

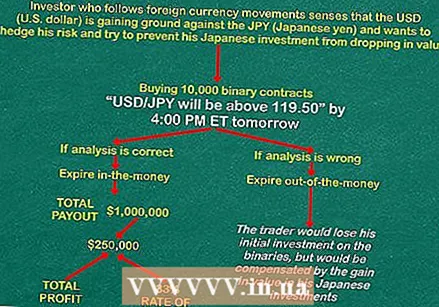

Decide which position to take. Evaluate the current market conditions around your chosen stock or other assets and determine if the price is more likely to rise or fall. If your expectation is correct on the due date, your payout will be the exchange rate / price on the day of settlement, as stated in your original contract. The rate of return on any profitable trade is set by the broker and announced in advance. - Suppose we have an investor who tracks foreign exchange movements and notices that the USD (US dollar) is gaining ground against the JPY (Japanese yen) and wants to hedge his risk to prevent his Japanese investment from falling in value. He can do this by buying 10,000 binary contracts indicating that at 4:00 pm tomorrow the "USD / JPY will be above 119.50". If his analysis is correct and the USD gains ground on the Yen, reaching above 119.50, the 10,000 binary contracts will expire in-the-money, yielding a total payout of € 1,000,000. If the investor pays $ 75 per contract, he will earn $ 25 per contract, making a total profit of $ 250,000 - a 33% return on his investment. However, if the yen does not end above 119.50, the 10,000 binary contracts will expire out-of-the-money. In this case, the trader loses his initial investment on the binary options, but is offset by the gain in value of his Japanese investments.

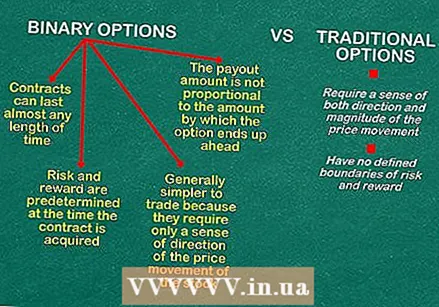

Learn the advantages of binary options trading over traditional options. Binary options are generally easier to trade because they only require a feel for the direction of the stock's price. Traditional options require a sense of both the direction and magnitude of price movement. Actual stocks are never bought or sold, so stock sales and stop losses are not part of this process.

Learn the advantages of binary options trading over traditional options. Binary options are generally easier to trade because they only require a feel for the direction of the stock's price. Traditional options require a sense of both the direction and magnitude of price movement. Actual stocks are never bought or sold, so stock sales and stop losses are not part of this process. - A stop-loss is an order that you place with a stock broker to buy or sell a stock once it has reached a certain value.

- Binary options always have a controlled risk-to-payout ratio, which means that risk and payout are determined at the time the agreement is won. Traditional options have no set limits for risk and reward, so the gains and losses can be unlimited.

- Binary options can relate to the trading and hedging strategies used in traditional options trading. You should always conduct a market analysis before any trade. There are many variables to consider when trying to decide whether the price of a stock or other asset is going to rise or fall within a period of time. Without analysis, the risk of losing money will increase significantly.

- Unlike a traditional option, the payout amount is not proportional to the amount by which the option ends up higher. As long as a binary option ends even one tick higher, the winner will receive the entire fixed payout amount.

- The length of binary options contracts can be anything from minutes to months. Some brokers offer contract times as low as thirty seconds. Others can take a year. This offers great flexibility and almost unlimited opportunities to make (and lose) money. Traders need to know exactly what they are doing.

Method 3 of 3: Understanding the costs and where to buy

Learn where binary options are traded. Binary options are extremely popular in Europe and are traded extensively on major European stock exchanges such as EUREX. In the United States, there are a few places where binary options can be traded:

Learn where binary options are traded. Binary options are extremely popular in Europe and are traded extensively on major European stock exchanges such as EUREX. In the United States, there are a few places where binary options can be traded: - The Chicago Board of Trade (CBOT) offers binary options trading at the Target Fed Funds Rate. To trade in these contracts, traders must be members of the exchange. Other investors must trade through a member. The value of each contract is $ 1000.

- Nadex is a U.S. regulated binary options exchange. Nadex offers a range of expiration options (hourly, daily, weekly) that allow traders to take a position based on market developments. The choice is huge with over 2,400 binary options contracts every day. These range from popular currency pairs (such as GBP / USD) to major commodities such as gold and oil. Member balances are held in a separate US bank account, in accordance with the provisions of the Commodities Futures Trading Commission (CFTC), to add an extra layer of security.

Be aware of transaction costs and potential profit. Binary options brokers should not charge a fee per trade, nor should they charge a commission. You also need to understand the percentage of time, if you are right, to take advantage of the binary option you are considering.

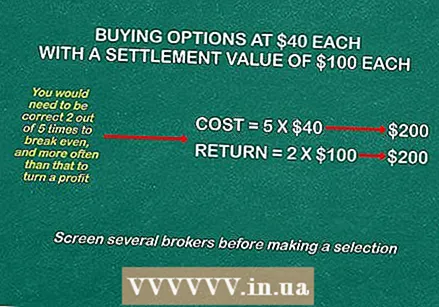

Be aware of transaction costs and potential profit. Binary options brokers should not charge a fee per trade, nor should they charge a commission. You also need to understand the percentage of time, if you are right, to take advantage of the binary option you are considering. - For example, if you bought options for $ 40 each, and each has a set value of $ 100 if you are right, then you need to get it right 2 out of 5 times to break even, and more often than that to make a profit (cost: 5 * $ 40 = $ 200, return: 2 * $ 100 = $ 200).

- Research the different brokers before making your choice. Each broker provides its own trading platform, contract terms, assets, return rates and education information. Each of these elements can have an impact on the overall profit potential.

Know in advance what the transaction costs are. It is extremely rare and difficult to consistently outperform the market. That means options traders usually engage in many trades in order to eventually take a profitable position. Consequently, a trader is faced with the possibility of high transaction costs and lower profits.

Know in advance what the transaction costs are. It is extremely rare and difficult to consistently outperform the market. That means options traders usually engage in many trades in order to eventually take a profitable position. Consequently, a trader is faced with the possibility of high transaction costs and lower profits.  Understand the trading terms for each deal. How different are the conditions (for example, the "strike price" or "strike price") on one side of the trade (above the strike price) from the other side (below the strike price)? If they differ significantly, the buyer would be forced into an unusual position, one that requires predicting both the magnitude and direction of a price movement.

Understand the trading terms for each deal. How different are the conditions (for example, the "strike price" or "strike price") on one side of the trade (above the strike price) from the other side (below the strike price)? If they differ significantly, the buyer would be forced into an unusual position, one that requires predicting both the magnitude and direction of a price movement.

Tips

- Know how to interpret the price of a binary option. The price at which a binary option is traded is an indicator of whether the contract will end in-the-money or out-of-the-money.

- Understand the relationship between risk and reward. These go hand in hand in binary options trading. The less likely the outcome is, the greater the reward associated with choosing it. An intelligent investor understands and weighs each contract on these two matrices before taking a position on a contract.

- Know when to get out of a position. An intuitive trader trades immediately as soon as he senses that his binary contract is going to end out-of-the-money upon expiration. Example: You have a silver contract for $ 75.00 that you feel is not expiring in-the-money. Rather than holding it until the expiration or maturity date, selling it at $ 30.00 and neutralizing your open interest will help limit the loss (losing $ 45 instead of $ 75. once it was confirmed that it would end out-of-the-money).

- Know the underlying stock of other assets. Binary options derive their financial value from underlying assets. Before investing in a binary option, you will need to understand the underlying value of the underlying asset. Familiarize yourself with the relevant financial markets and where the asset is traded. Example: Futures in silver are listed on the NYMEX / COMEX.

Warnings

- If the above description of binary options trading sounds more like gambling, it's because it is. Binary options are very similar to placing bets in a casino. It is possible to make money in a casino or options trading, but both games require knowledge, skills, experience and strong nerves. Make sure you gain enough experience in options trading to be able to consistently make money trading traditional or binary options.

- Resist the temptation to accept bonuses from the broker. Bonuses are basically free money that is given to binary options traders on certain online trading platforms. However, these bonuses will increase your losses just as quickly as they can increase your profits, which can potentially make you rush your initial investment through with a small number of bad trades. In addition, the bonuses may come with conditions that require you to invest a fixed number of times (before you can withdraw money), or other restrictive rules.