Author:

Sara Rhodes

Date Of Creation:

10 February 2021

Update Date:

1 July 2024

Content

- Steps

- Part 1 of 3: Track Your Income and Expenses

- Part 2 of 3: Creating Your Budget

- Part 3 of 3: Becoming a Budget Planner

- Tips

- Resources and links

Planning a budget can help you get out of debt, build confidence in your financial future, and even make you happier. Depending on your circumstances, planning your budget properly may not require you to spend less. Instead, you may simply need to make better financial decisions.

Steps

Part 1 of 3: Track Your Income and Expenses

1 Collect everything you need to start tracking your spending history. Collect past bills, credit card and bank card usage reports, and receipts that can allow you to accurately estimate how much money you are spending each month.

1 Collect everything you need to start tracking your spending history. Collect past bills, credit card and bank card usage reports, and receipts that can allow you to accurately estimate how much money you are spending each month.  2 Use dedicated budget planning apps. Personal finance apps are fast becoming the new trend in personal finance. These programs have built-in budget planning tools to help tune your budget, along with analytics to help you forecast future cash flows and better understand your habits. Some popular personal finance programs include:

2 Use dedicated budget planning apps. Personal finance apps are fast becoming the new trend in personal finance. These programs have built-in budget planning tools to help tune your budget, along with analytics to help you forecast future cash flows and better understand your habits. Some popular personal finance programs include: - Mint

- Queeken

- Microsoft Money

- Ace Money

- Budget Pals

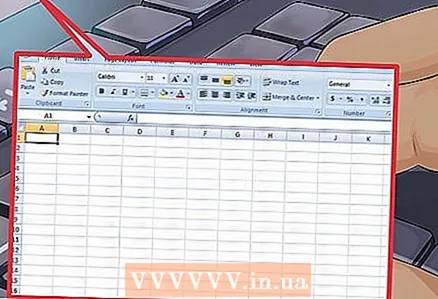

3 Create a table in Excel. If you don't want to use budgeting software, you can define your own budget using a simple spreadsheet. Your goal is to map all of your expenses and income throughout the year so that you create a spreadsheet that clearly shows all the information, allowing you to quickly identify areas where you can be smarter about spending.

3 Create a table in Excel. If you don't want to use budgeting software, you can define your own budget using a simple spreadsheet. Your goal is to map all of your expenses and income throughout the year so that you create a spreadsheet that clearly shows all the information, allowing you to quickly identify areas where you can be smarter about spending. - Break the row of cells at the top (starting with cell B1) into 12 months.

- Create an expense and income column in column A. At first you can list either income or expenses, but try to group all expenses and all income separately to avoid confusion.

- You must group expenses together by category. For example, you can create a category called "utilities" that includes all of your electricity, gas, water, and telephone bills.

- Decide if you want to include items that are deducted directly from your paycheck, such as insurance, pension contributions, or taxes. If you do not include them in your spreadsheet, make sure that in the Income section you are reporting your net income (after deducting all mandatory contributions) and not “dirty” (total, before deducting all contributions).

4 Document your accumulated budget data over the past 12 months. Add all your expenses and income for the past 12 months using data from your bank and credit card usage reports to provide an accurate view of all your income and expenses.

4 Document your accumulated budget data over the past 12 months. Add all your expenses and income for the past 12 months using data from your bank and credit card usage reports to provide an accurate view of all your income and expenses.  5 Determine the history of your total monthly income. Do you get a fixed salary and know for sure how much you bring home each week? Are you a freelancer whose salary varies every month? A documented history of income from the previous year can help you get an accurate picture of your average monthly income.

5 Determine the history of your total monthly income. Do you get a fixed salary and know for sure how much you bring home each week? Are you a freelancer whose salary varies every month? A documented history of income from the previous year can help you get an accurate picture of your average monthly income. - If you are an independent contractor or freelancer, keep in mind that you are not bringing home what you earn. For example, you might be bringing home $ 2,500 every month, but that's a pre-tax amount. Find out how much you are likely to pay in taxes and subtract that amount from your monthly income to arrive at a more accurate number.

- If you are an employee, do not include possible tax refunds in your total income. Your monthly income should only reflect what you bring home after taxes. If you get a refund of the tax withheld, you can do whatever you want with it; if she doesn’t come back to you, you don’t have to worry about it.

6 List all of your monthly expenses in a table. What bills do you have to pay each month? How much do you spend each week on groceries and gas? Do you have dinner with friends every Friday or go to the movies once a week? How much money do you spend on shopping? Keeping track of your actual spending from the previous year will help you develop an accurate picture of your spending habits, as most people underestimate the amount of money they think they are spending each month.

6 List all of your monthly expenses in a table. What bills do you have to pay each month? How much do you spend each week on groceries and gas? Do you have dinner with friends every Friday or go to the movies once a week? How much money do you spend on shopping? Keeping track of your actual spending from the previous year will help you develop an accurate picture of your spending habits, as most people underestimate the amount of money they think they are spending each month.  7 Analyze your income and expenses. If your expenses exceed your income, you are living beyond your means. Your budget should be divided into two groups:

7 Analyze your income and expenses. If your expenses exceed your income, you are living beyond your means. Your budget should be divided into two groups: - Fixed costs... These include regular monthly expenses such as utility bills, insurance, loan debts, food, and other necessities such as clothing and household items.

- Optional expenses... Optional expenses are non-fixed expenses that can arise “at your will”. Items that fall under this category include savings, entertainment, recreation, and other luxury items.

Part 2 of 3: Creating Your Budget

1 Create a preliminary budget. The budget history mentioned in Part 1 will help you create an accurate preliminary budget. You must calculate your fixed expenses and income and then decide how you want to spend your free money.

1 Create a preliminary budget. The budget history mentioned in Part 1 will help you create an accurate preliminary budget. You must calculate your fixed expenses and income and then decide how you want to spend your free money. - To calculate the fixed costs, take the arithmetic average of the costs for each month of the past year, and then add about 5%. For example, if your electricity bills change every season, but average about $ 210 per month, you would have to factor in $ 220 per month in your electricity bill.

- Make sure to factor in changes in basic expenses, such as paying off your student loan or getting a loan for a new car.

2 Define a goal for most of your optional expenses. Now that you've determined how much free money you should have each month, decide how you want to spend it. Your goal should be clear, accurate, and real. Some short term goals might be:

2 Define a goal for most of your optional expenses. Now that you've determined how much free money you should have each month, decide how you want to spend it. Your goal should be clear, accurate, and real. Some short term goals might be: - Save $ 8,000 for a rainy day

- Transfer 5% of each salary to a savings account

- Pay off credit card debts in 12 months

- Save $ 6,000 for Vacation

3 Tax incentives. There are ways to save money and still get tax breaks. If you transfer money to your savings account directly from your paycheck, the money may be credited before tax. Some companies even offer something like pension contributions that have even more tax incentives.

3 Tax incentives. There are ways to save money and still get tax breaks. If you transfer money to your savings account directly from your paycheck, the money may be credited before tax. Some companies even offer something like pension contributions that have even more tax incentives.  4 Plan out the rest of your spare money. This part of your budget is about value. What values do you have and how do you want to spend your money on their realization? Money, after all, is a means to an end, not an end in itself.

4 Plan out the rest of your spare money. This part of your budget is about value. What values do you have and how do you want to spend your money on their realization? Money, after all, is a means to an end, not an end in itself. - What kind of person are you and what do you like to do? Many people end up spending money on hobbies, interests, or charity. Think of it as investing in an experience or gaining a sense of contentment.

- Think about what makes you really happy. There is a popular theory that people who spend money on experiences are actually happier than people who spend money on items.

- Consider saving more money for travel and recreation.

Part 3 of 3: Becoming a Budget Planner

1 Stick to your budget and don't waste money. This is the first rule of budgeting, and, in fact, the only one. Sounds pretty obvious, but going over budget is easy, even after careful planning. Be mindful of your habits and where your money goes.

1 Stick to your budget and don't waste money. This is the first rule of budgeting, and, in fact, the only one. Sounds pretty obvious, but going over budget is easy, even after careful planning. Be mindful of your habits and where your money goes.  2 Try to reduce your expenses. High spending can be the most frustrating but most effective way to stay on budget. If you are taking annual leave, consider staying at home this year. Lower costs can also contribute.

2 Try to reduce your expenses. High spending can be the most frustrating but most effective way to stay on budget. If you are taking annual leave, consider staying at home this year. Lower costs can also contribute. - Try to identify and cut down on any expensive expenses you enjoy. If you enjoy a weekly massage or have a preference for expensive wines, reduce the frequency of those pleasures to once a month or two.

- Save money on petty bills by switching to public brands and cooking at home. Try not to eat in restaurants more than once, twice a week.

- See if you can reduce any of your major expenses by switching to a less expensive mobile plan, reducing your TV package, or reducing your home's energy consumption.

3 Pamper yourself periodically, but within reason. Your money should work for you, not the other way around. You don't have to feel like a slave to your budget or money in general, so it's important to allow yourself some small pleasures every month that won't exceed your budget.

3 Pamper yourself periodically, but within reason. Your money should work for you, not the other way around. You don't have to feel like a slave to your budget or money in general, so it's important to allow yourself some small pleasures every month that won't exceed your budget. - Don't abuse your own reward system. Revisit it if it becomes counterproductive and negatively affects your budget. The idea is to pamper yourself with small, inexpensive items like a latte or a new shirt, and not waste money on more expensive items like a vacation or an expensive pair of shoes.

4 Pay off your credit card debts on a monthly basis. If you use credit cards, you should try to keep them on a zero balance to avoid high interest charges. If you are unable to pay your current balances, make it a goal to pay them within a reasonable period of time.

4 Pay off your credit card debts on a monthly basis. If you use credit cards, you should try to keep them on a zero balance to avoid high interest charges. If you are unable to pay your current balances, make it a goal to pay them within a reasonable period of time. - Make sure to spend most of your weekly spending with cash, especially if you are spending extra money on your lunch or coffee outside the home. This will help you control your spending, as people have a better sense of how much they are spending when they pay in cash instead of with a card.

5 Cut your taxes. Take advantage of an itemized deduction when you record your tax payments annually.

5 Cut your taxes. Take advantage of an itemized deduction when you record your tax payments annually. - Start saving your receipts, especially if you are an independent contractor working from home or remotely. When it comes to taxes, there are many amenities that you can use as part of your contract work.

- It is a good idea to find a way to get a better tax refund for you as a contractor, or ask your accountant about these benefits.

6 Reassess your home. If you own real estate and have sufficient proof, you could cut your real estate taxes by questioning the appraiser's value of the home.

6 Reassess your home. If you own real estate and have sufficient proof, you could cut your real estate taxes by questioning the appraiser's value of the home.  7 Don't count on windfall profits. Don't factor in potential earnings like year-end bonuses, inheritance, or tax refunds. You should only include guaranteed money in your budget.

7 Don't count on windfall profits. Don't factor in potential earnings like year-end bonuses, inheritance, or tax refunds. You should only include guaranteed money in your budget.

Tips

- Put the change in the bank and then bring it to the bank for hire. You will be surprised how much your small investment can make.

- Avoid high-interest credit card debt and payday loans as these will carry high interest rates and end up costing you a lot of money, especially if you struggle to pay off your debt on time every month.

Resources and links

- ↑ http://money.cnn.com/magazines/moneymag/money101/lesson2/

- ↑ https://www.bankofamerica.com/deposits/manage/creating-a-budget.go

- ↑ https://www.bankofamerica.com/deposits/manage/creating-a-budget.go

- ↑ https://www.bankofamerica.com/deposits/manage/creating-a-budget.go

- ↑ http://www.psychologytoday.com/blog/ulterior-motives/201303/why-are-experiences-often-better-purchases-things

- ↑ http://www.learnvest.com/knowledge-center/your-ultimate-budget-guideline-the-502030-rule/

- ↑ https://www.bankofamerica.com/deposits/manage/creating-a-budget.go

- ↑ http://money.cnn.com/magazines/moneymag/money101/lesson2/

- ↑ http://www.learnvest.com/knowledge-center/your-taxes-if-youre-a-freelancer/

- ↑ http://money.cnn.com/magazines/moneymag/money101/lesson2/

- ↑ http://americasaves.org/for-savers/make-a-plan-how-to-save-money/saving-on-a-tight-budget

- ↑ http://americasaves.org/for-savers/make-a-plan-how-to-save-money/saving-on-a-tight-budget