Author:

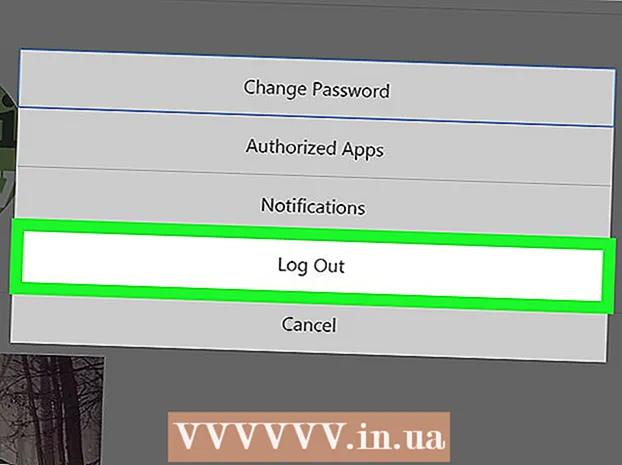

Eric Farmer

Date Of Creation:

10 March 2021

Update Date:

1 July 2024

Content

In the Christmas novel by O. Henry Gifts of the Magiclassic, Della Young is selling her most precious treasure - her long, luxurious hair - to buy a Christmas present for her husband Jim. She bought Jim a chain for his pocket watch - heirloom and the only valuable thing he had. When she gives her present to Jim, she learns that he sold his watch to buy her a set of decorated combs for her luxurious hair.The moral of the story is this: Buying things won't make you happy, so don't be tempted to waste your money.

Steps

1 Examine your spending habits. Is your decision to buy something based on your opinion or through advertising? Do not fall under the influence of consumption ideology and mania to waste money.

1 Examine your spending habits. Is your decision to buy something based on your opinion or through advertising? Do not fall under the influence of consumption ideology and mania to waste money. - Analyze why you are shopping and ask yourself what real needs your shopping trips fulfill. You do it out of habit because all your friends do it, and you get tired quickly? Finding other ways to share experiences — sports, hobbies, and common interest clubs — can help you break this vicious circle. Do you enjoy service because you have a choice and the salespeople respect you? You will also be treated well and you can shop at flea markets and thrift stores. Are you going to reward yourself for a small achievement? This is a good principle, but you can look at the type of reward that motivates you more and ask yourself if doing something fun would be the best reward.

2 Stay home. If you don't have to shop, don't shop just because you're bored. Don't make shopping fun or enjoyable. Find other activities or hobbies, and if you're feeling lonely, invite people over to your place or start a group to play games together. Games are a good alternative to socializing, and “shopping” RPGs with imaginary money won during a task may satisfy you more than a real shopping trip.

2 Stay home. If you don't have to shop, don't shop just because you're bored. Don't make shopping fun or enjoyable. Find other activities or hobbies, and if you're feeling lonely, invite people over to your place or start a group to play games together. Games are a good alternative to socializing, and “shopping” RPGs with imaginary money won during a task may satisfy you more than a real shopping trip.  3 Leave your money at home. The easiest way to not buy anything is to simply not take money, checks, payment cards, or credit cards with you when you leave your home. Bring only a small amount of money with you in case of emergency.

3 Leave your money at home. The easiest way to not buy anything is to simply not take money, checks, payment cards, or credit cards with you when you leave your home. Bring only a small amount of money with you in case of emergency.  4 Avoid plastic cards. Try putting your plastic card in a container of water and freezing it. This way, you can use it on vacation or in an emergency, and not just to buy things. Better yet, give it to a trusted relative for safekeeping.

4 Avoid plastic cards. Try putting your plastic card in a container of water and freezing it. This way, you can use it on vacation or in an emergency, and not just to buy things. Better yet, give it to a trusted relative for safekeeping.  5 Buy used. If you really need something and are unable to beg, borrow or find it, go to a thrift store and buy it for next to nothing. Electronic auctions and yard sales are also good, although there will still be the temptation to buy “things” that you don't really need.

5 Buy used. If you really need something and are unable to beg, borrow or find it, go to a thrift store and buy it for next to nothing. Electronic auctions and yard sales are also good, although there will still be the temptation to buy “things” that you don't really need.  6 Pay with cash. Research shows that the average person spends less when they pay in cash and much more when they pay with their credit card, perhaps because using a credit card feels like they are parting with “fake” money.

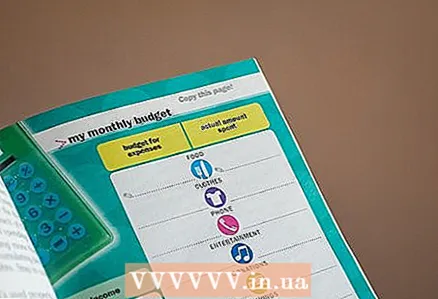

6 Pay with cash. Research shows that the average person spends less when they pay in cash and much more when they pay with their credit card, perhaps because using a credit card feels like they are parting with “fake” money.  7 Make a budget and stick to it. Don't think of your budget as a goal for the new year. While it will take self-control to plan your budget and stick to it, it's a really good way to keep your finances in check and avoid piling up huge debts and piles of worthless shit in the process of losing your self-esteem.

7 Make a budget and stick to it. Don't think of your budget as a goal for the new year. While it will take self-control to plan your budget and stick to it, it's a really good way to keep your finances in check and avoid piling up huge debts and piles of worthless shit in the process of losing your self-esteem. - Choose what you really like and buy yourself that item as a reward for sticking to your budget. When you live on your budget, halve your savings and pocket money, then spend your pocket money on knowledge, digital goods, or good, durable tools for creative hobbies.

- Always include spending on entertainment in any sustainable budget. This is done to make life worthwhile and to break the boom-bust cycle of being constantly poor and working tirelessly for nothing. It will also be a little stash for a rainy day.The likelihood that you will look for money in case of minor difficulties is reduced if you have reasonable funds for entertainment. Savings should at least match them.

8 Make a list and follow it. Make shopping decisions at home, where it will be obvious what you need, and not in stores where shelves are full of different products, distracting and seducing you. The checklist will also help you procrastinate and contemplate your purchases and decide what you need.

8 Make a list and follow it. Make shopping decisions at home, where it will be obvious what you need, and not in stores where shelves are full of different products, distracting and seducing you. The checklist will also help you procrastinate and contemplate your purchases and decide what you need.  9 Ask yourself a few questions. Will I be using this every day? Should I buy this item? How many hours did I have to work to pay for it? Apply a 3 month forecast. Ask yourself if you will be using this product regularly after 3 months. If you've lived so long without him, do you really need him? If you move frequently, consider whether this item is worth carrying with you whenever you move. If you are not relocating, ask yourself if this thing is worth taking up your precious living space.

9 Ask yourself a few questions. Will I be using this every day? Should I buy this item? How many hours did I have to work to pay for it? Apply a 3 month forecast. Ask yourself if you will be using this product regularly after 3 months. If you've lived so long without him, do you really need him? If you move frequently, consider whether this item is worth carrying with you whenever you move. If you are not relocating, ask yourself if this thing is worth taking up your precious living space.  10 Fix things, don't change them. If you have chosen a product carefully and it has broken down and has served you well, you should not think that you need to replace it when it breaks down. A good repair shop will be able to bring it to an "almost new" state, and it will cost you less than paying to replace it, as well as to take the garbage to a landfill.

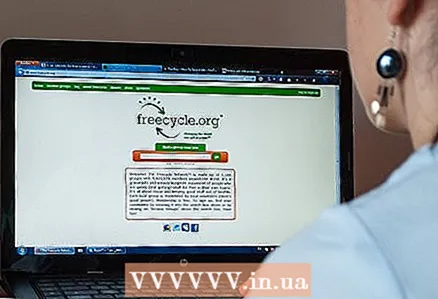

10 Fix things, don't change them. If you have chosen a product carefully and it has broken down and has served you well, you should not think that you need to replace it when it breaks down. A good repair shop will be able to bring it to an "almost new" state, and it will cost you less than paying to replace it, as well as to take the garbage to a landfill.  11 Try to get the things you need or want for free. Surprisingly, in some cases, you can get whatever you want without spending a penny.

11 Try to get the things you need or want for free. Surprisingly, in some cases, you can get whatever you want without spending a penny. - Check out local free sales. Visit sites like freecycle, Freesharing, or Sharing is Giving. These sites are so useful precisely for the reason that many people buy things that they don't need or change quite decent things for similar ones, only newer. You may be smarter than them.

- Take it for a while. If you only need a thing for a certain time, why not take it from someone? There is no shame in borrowing something if you can also share when someone needs to borrow something from you.

- Try sharing. It is possible that due to your past quirks, you have many things left that you no longer need, but may be useful to other people. Feel profit from tradethat economists always talk about.

12 Avoid large shopping malls whenever possible. if you necessary to buy something - go to the store where this product is sold. Don't automatically go to the mall where you might be persuaded to buy things you don't need. Plus, shopping malls tend to be more expensive as they pay more rent. If you go to a mall just to hang out with friends, consider making new hobbies or new friends. If you need to walk through a mall to get to a restaurant or movie theater, keep yourself busy with conversation (with yourself or with your companions) so that you are not distracted by your surroundings. Concentrate on where you are going, but ignore the shops along the way.

12 Avoid large shopping malls whenever possible. if you necessary to buy something - go to the store where this product is sold. Don't automatically go to the mall where you might be persuaded to buy things you don't need. Plus, shopping malls tend to be more expensive as they pay more rent. If you go to a mall just to hang out with friends, consider making new hobbies or new friends. If you need to walk through a mall to get to a restaurant or movie theater, keep yourself busy with conversation (with yourself or with your companions) so that you are not distracted by your surroundings. Concentrate on where you are going, but ignore the shops along the way. - 13 Use a buddy system. If you are out with friends, you may find that you are having so much fun that you don’t even think about buying something. All of you can put together a no-shopping pact. This is similar to the 12-step program to free yourself from the ideology of consumption.

14 Avoid unnecessary updates. Yes, this toaster beeps and can toast eight slices in one go, but seriously, how often do you need eight slices of bread toasted at the same time? Our consumer culture forces people to swap decent products for newer ones for stupid reasons like fashion. Remember, an avocado oven works just as well as a mango oven.

14 Avoid unnecessary updates. Yes, this toaster beeps and can toast eight slices in one go, but seriously, how often do you need eight slices of bread toasted at the same time? Our consumer culture forces people to swap decent products for newer ones for stupid reasons like fashion. Remember, an avocado oven works just as well as a mango oven.  15 Buy durable products. If you decide to purchase something, choose something that will not wear out quickly and will not become unusable. Also, try to avoid buying things that can go out of style quickly. Consider how you will use this item and how much your choice will suit your needs, as long as possible. In the long run, a more durable item that costs 30% more will save you money if you use it twice as long as usual.

15 Buy durable products. If you decide to purchase something, choose something that will not wear out quickly and will not become unusable. Also, try to avoid buying things that can go out of style quickly. Consider how you will use this item and how much your choice will suit your needs, as long as possible. In the long run, a more durable item that costs 30% more will save you money if you use it twice as long as usual.  16 Buy things that go with the rest. If you really liked the item, think carefully about how it will look with what you already have. It may be new and beautiful, but if it doesn't match with at least two or three of the things you already own, you will either have to wear it less often, or worse, you will 'have to' purchase some other thing to wear together.

16 Buy things that go with the rest. If you really liked the item, think carefully about how it will look with what you already have. It may be new and beautiful, but if it doesn't match with at least two or three of the things you already own, you will either have to wear it less often, or worse, you will 'have to' purchase some other thing to wear together.  17 Apply "rule 7". If the item you want to buy is worth more than $ 7, wait 7 days and ask 7 people you trust if the purchase is worth it. If you still think this is a good idea, then buy it. This rule will reduce the number of spontaneous purchases. Over time, as you feel more financially secure and you have a better income at your disposal, you can gradually raise the $ 7 threshold.

17 Apply "rule 7". If the item you want to buy is worth more than $ 7, wait 7 days and ask 7 people you trust if the purchase is worth it. If you still think this is a good idea, then buy it. This rule will reduce the number of spontaneous purchases. Over time, as you feel more financially secure and you have a better income at your disposal, you can gradually raise the $ 7 threshold.  18 Give gifts to people. Use your skill (or learn how to do it) to make gifts for people that will be remembered for a long time, as opposed to gifts bought in the store. Remember that gifts do not need to be wrapped. You can also DIY a gift for life. Remember the moral of the novel Gifts of the Magi: in fact, it is not the gift that is important, but the attention. You won't buy happiness or self-worth or worthwhile friends with money.

18 Give gifts to people. Use your skill (or learn how to do it) to make gifts for people that will be remembered for a long time, as opposed to gifts bought in the store. Remember that gifts do not need to be wrapped. You can also DIY a gift for life. Remember the moral of the novel Gifts of the Magi: in fact, it is not the gift that is important, but the attention. You won't buy happiness or self-worth or worthwhile friends with money.  19 Tax yourself. Every time you make a purchase over $ 10 (or $ 50, your choice), take 10% of the cost and set aside as a savings or investment. Thus, you discourage yourself from buying this or that thing, just because it is "at a reduced price" or seems to you "a bargain" and will improve your financial position every time you make a significant purchase. If you use a payment or credit card, try to use the one for which the savings program is provided; American Express offers a card with a savings account, and Bank of America offers its No Change program to automatically transfer money to your savings account.

19 Tax yourself. Every time you make a purchase over $ 10 (or $ 50, your choice), take 10% of the cost and set aside as a savings or investment. Thus, you discourage yourself from buying this or that thing, just because it is "at a reduced price" or seems to you "a bargain" and will improve your financial position every time you make a significant purchase. If you use a payment or credit card, try to use the one for which the savings program is provided; American Express offers a card with a savings account, and Bank of America offers its No Change program to automatically transfer money to your savings account. - If you are using a credit union for your needs, keep your money in your "unit" savings account until you have to pay the bills. You will receive not only a small benefit, but also pleasure, knowing that this money has been invested locally in the homes, cars and businesses of other members of the union.

- No interest is charged on payment cards. But you might be in debt on a credit card. It's easier to avoid debt with a debit card and maintain your credit limit for serious emergencies such as extra doctor fees. Pay off your debt as soon as possible, and then your rainy day savings will once again be at your disposal.

20 Grow your own food. If you have at least a small vegetable garden, growing your own food is easy.

20 Grow your own food. If you have at least a small vegetable garden, growing your own food is easy.  21 Ask yourself 3 questions - want, need and afford. Can I afford it? Do I need this? and do I want it? If your answer to 3 questions is YES, then you can buy this. It is very likely that the most difficult question to answer is whether you need this item. Thinking about life, social and emotional needs and comparing them to each other can help you find other ways to meet your needs without stuffing your home with different things.

21 Ask yourself 3 questions - want, need and afford. Can I afford it? Do I need this? and do I want it? If your answer to 3 questions is YES, then you can buy this. It is very likely that the most difficult question to answer is whether you need this item. Thinking about life, social and emotional needs and comparing them to each other can help you find other ways to meet your needs without stuffing your home with different things. - Ask yourself if this thing is cost effective in the long run.An eight-slice toaster can be cost-effective if your home has a lot of people, uses less energy than four separate two-cell toasters and is heavily used every morning. Energy Star devices can reduce your electricity bill and pay off in the amount of money you save. Plan your purchases carefully and save up for them rather than buying on credit. You will notice that this will greatly reduce the amount of items you buy, but you will be grateful when you have more money and less junk lying around.

22 Try to be a smart shopper. If you want to buy something for someone's birthday, buy something that looks more expensive than its price. It is also worth remembering that something personal and meaningful will make a much larger impression than something expensive or trendy. Digital goods and experiences such as dining at a restaurant, concerts, films can be a special gift that does not oblige a person to keep it and will be remembered forever.

22 Try to be a smart shopper. If you want to buy something for someone's birthday, buy something that looks more expensive than its price. It is also worth remembering that something personal and meaningful will make a much larger impression than something expensive or trendy. Digital goods and experiences such as dining at a restaurant, concerts, films can be a special gift that does not oblige a person to keep it and will be remembered forever.

Tips

- Buy used goods! This way, you will save money and the environment by reducing waste, and you are more likely to support a charitable organization.

- Read books like Why do we buy, in order to understand the tactics sellers use to get people to buy things they don't need. Take books from the library; no need to buy them!

- No Shopping Day is held on the fourth Friday of November (ie the day of the Black Friday Christmas sales) in North America and November 24 in other countries. Join this action without participating in this day of insane and often pointless holiday shopping for goods.

- Instead of renting movies, check out your local library. Many libraries offer a wide variety of films for free. While there, check out their other offerings as well. Remember, the library is a great place to hang out and read for free.

- If you are very faint, freeze your credit cards in a tin coffee can full of water so that you have to defrost them before use. Or if you have a trusted neighbor, give him your credit cards, explaining that you are trying to limit your costs. In all likelihood, you won't be able to come to him and ask for your cards unless you have a compelling reason.

- Can't think of anything other than hanging out at the mall? Try going to a friend's house, going on a hiking trail, going to a free concert or event, or playing in the park. Your life will become richer in many ways if you start avoiding shopping malls.

- Growing herbs, cut flowers and vegetables in your garden can pay off beyond your use, depending on the size of your garden and your gardening talent.

- Shop online for less overhead, resulting in lower prices. When you buy an item online, you have a good reason to think it over and wait. In any case, you will have to wait for the goods to be delivered, which will diminish your shopping ardor. Looking for good things on the internet for days or weeks while you are planning to buy can actually increase your enjoyment, as you will be looking forward to receiving the packages like Christmas.

- Good products pay off when used. Anything you do with your own hands can save money, especially if the materials from which it is made can be purchased for free or at low prices.Time and diligence spent on decorating "new" household items that you made with your own hands - sewed or built - can not only save you money, but also make your home special and beautiful, since it will not be stuffed with things that everyone can buy at Target Department Store.

- Be attentive on the day when your neighbors display furniture and large items. Sometimes you will find work computers and other appliances, furniture that just needs to be cleaned, repaired or painted, curtains, pillows and old clothes that can be worn or used on rags, decorative pillows, stuffed toys, curtains and wall hangings.

- Find out if the stores offer goods in exchange for services.

- Look for old bunks to disassemble into logs or make firewood. You can also disassemble broken furniture into its component wood pieces, and by making them furniture for yourself, save the trees. Even small pieces can be glued and pinched to make timber for countertops and other uses.

- Remove the padding from the old sofa. Tie it up in pillowcases to rinse thoroughly before use, then decorate your old furniture with throw pillows, stuffed animals, or new cushions.

- Try to find out if your friends are going to throw out what you need, for example, your friend has grown out of her shoes and is going to throw them away; ask her for them in exchange for a plate of cookies or something else.

- Take up creative hobbies such as painting and drawing, singing, playing a musical instrument, dancing, digital remixing, website design, jewelry making, poetry. Already at the entry level, your creative work will begin to generate some income. This also applies to skills such as making curtains decorated with beads for Shrovetide or making decorative pillows from used clothing and upholstery. Sell your craft items to a thrift store. Hang the illustrations in restaurants where framed pictures are hung for sale. Any creative or building hobby will not only bring you spiritual satisfaction, but also give you a chance to exchange for other things that you need or want.

- Broken crockery and colored glass can be used to create mosaics. Make small concrete shapes and wait for them to harden, then press the broken objects into the shapes and create interesting patterns to make a path in the garden. Deepen your knowledge of this in the library before doing this. They can also make good gifts if you have enough of them in your garden.

Warnings

- Don't be petty or wasteful. If you really need something, it's better to get a good thing that will last a long time than to pay more for not having it. When you buy something, there is one factor to consider - whether the item is cost effective. If the bread maker saves you money and pays off quickly, buy it, but only if you actually use it and can find it on Freecycle, where people give things away for free.

- At first, you will feel uncomfortable telling your friends that you would rather not buy what you don’t need or you will not hang out with them at the mall this weekend. Remember that you need time to make new decisions to be comfortable.