Author:

Ellen Moore

Date Of Creation:

17 January 2021

Update Date:

1 July 2024

Content

- Steps

- Method 1 of 3: Invest through Direct Share Purchase Plans (DRAs)

- Method 2 of 3: Invest through Dividend Reinvestment Plans (Dividend Reinvestment Plans)

- Method 3 of 3: Become Your Own Broker

- Tips

- Warnings

If the global financial crisis has taught us anything, it is that stock brokers are not always demigods, as they are said to be. The good news is that if you are willing to spend a little time, then you can completely do without the services of brokers to replenish your investment portfolio. Here are some ways to do this.

Steps

Method 1 of 3: Invest through Direct Share Purchase Plans (DRAs)

1 Look for companies that offer PPPA. Most companies offer potential investors the option of buying securities directly from them, which allows parties to dispense with the intermediary services of brokers (and all the resulting commissions). If you are not sure if a particular company offers this option, you can contact their representatives by phone or email.

1 Look for companies that offer PPPA. Most companies offer potential investors the option of buying securities directly from them, which allows parties to dispense with the intermediary services of brokers (and all the resulting commissions). If you are not sure if a particular company offers this option, you can contact their representatives by phone or email. - Start by visiting the official website of the company you are interested in and look for links like Investors, Investments, Investor Relations, or the like. In such sections, companies post information as to whether they offer PPP or not. You can also type in the name of the company plus the words "direct plan to buy shares" into a Google search box.

2 Review their proposed investment options. While every company has different options, here are a few of the most common ones:

2 Review their proposed investment options. While every company has different options, here are a few of the most common ones: - One-time investment. Such investments are made once and you can pay with checks, electronic money or via telephone. Companies usually have a minimum contribution requirement (eg $ 50).

- Automatic monthly investments. Such investments are made in accordance with a monthly schedule by withdrawing the required amount of money from your account. Since these investments are recurring, the minimum contribution, if any, is generally lower than for a one-time investment (eg $ 25).

- Automatic reinvestment of dividends. This means that any return on investment will automatically be credited towards subsequent investments. For more information, read the Dividend Reinvestment section below.

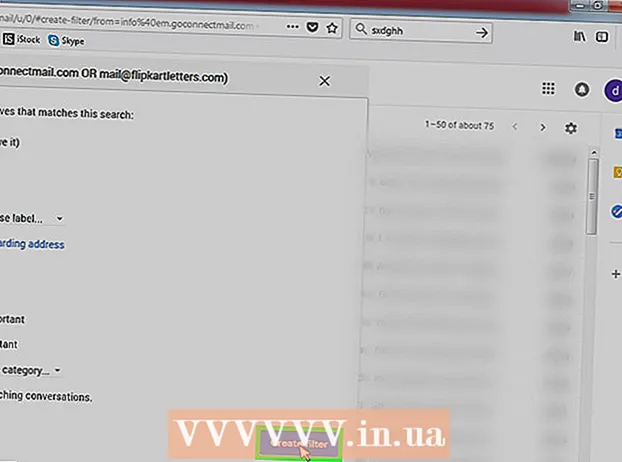

3 Register. If you find information about PPA companies on their websites, you will most likely need to register with their websites. Or leave a request so that the share transfer agent can contact you.

3 Register. If you find information about PPA companies on their websites, you will most likely need to register with their websites. Or leave a request so that the share transfer agent can contact you. - Keep in mind that you will most likely need a minimum registration fee unless you already have stocks that you would like to transfer to their plan.

- Some companies have a flat monthly commission, but usually it is only a few dollars.

4 Know what to expect. It doesn't matter if you make a one-time investment or make monthly contributions, you should be aware that you will not be able to control the date when your block of shares can be sold or bought. In fact, your buy order can be considered for several weeks, which means you will not know the price per share until you pay for the shares. Due to the lack of control over your shares, PPA is not suitable for short-term investments. However, as a long-term deal with a reputable company, this type of investment has the least hurdles.

4 Know what to expect. It doesn't matter if you make a one-time investment or make monthly contributions, you should be aware that you will not be able to control the date when your block of shares can be sold or bought. In fact, your buy order can be considered for several weeks, which means you will not know the price per share until you pay for the shares. Due to the lack of control over your shares, PPA is not suitable for short-term investments. However, as a long-term deal with a reputable company, this type of investment has the least hurdles.

Method 2 of 3: Invest through Dividend Reinvestment Plans (Dividend Reinvestment Plans)

1 Look for companies that offer PRID. Many companies that offer PID also have dividend reinvestment options. Therefore, the above steps are a good way to get started.

1 Look for companies that offer PRID. Many companies that offer PID also have dividend reinvestment options. Therefore, the above steps are a good way to get started.  2 Buy at least one share. The best thing about PID is that any profit earned from an investment in just one share will be reinvested; assuming the investment is sound, your one share will end up snowballing with the least amount of effort.

2 Buy at least one share. The best thing about PID is that any profit earned from an investment in just one share will be reinvested; assuming the investment is sound, your one share will end up snowballing with the least amount of effort. - If the company you wish to invest in offers a dividend reinvestment option, but not an outright purchase of shares, the mediation of a broker or transfer agent will be necessary. However, since you only need one share, the estimated commissions will be small.

3 Sign up for a dividend reinvestment. The fees for this should be minimal.

3 Sign up for a dividend reinvestment. The fees for this should be minimal.  4 Know what to expect. Reinvesting dividends tends to force an investor to buy the same stock over and over again, making it unsuitable for short-term investments and unprofitable if the company fails to maintain its position. Thus, PID is a simple, “buy and forget” slow investment method with the lowest initial investment. Some companies will even periodically pay out small amounts to their investors instead of waiting for the investors to take their investments.

4 Know what to expect. Reinvesting dividends tends to force an investor to buy the same stock over and over again, making it unsuitable for short-term investments and unprofitable if the company fails to maintain its position. Thus, PID is a simple, “buy and forget” slow investment method with the lowest initial investment. Some companies will even periodically pay out small amounts to their investors instead of waiting for the investors to take their investments.

Method 3 of 3: Become Your Own Broker

1 Create a reserve. Becoming your own broker means constantly investing large sums of money in the stock market, which can make you insolvent if you run into unexpected expenses. The standard recommendation is to set aside a minimum amount of 6 months' salary in your savings account before playing with your other funds.

1 Create a reserve. Becoming your own broker means constantly investing large sums of money in the stock market, which can make you insolvent if you run into unexpected expenses. The standard recommendation is to set aside a minimum amount of 6 months' salary in your savings account before playing with your other funds. - If you are likely to face unforeseen expenses due to long-term health problems, childcare, or working in an unstable industry, aim for the minimum annual salary.

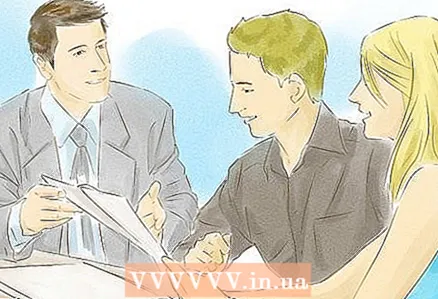

2 Research investment options. Online brokerage is a great place to start as it is generally low cost and offers investment advice. Companies such as Fidelity, Charles Schwab, TD Ameritrade, E * Trade and Scottrade are recommended by Forbes magazine.

2 Research investment options. Online brokerage is a great place to start as it is generally low cost and offers investment advice. Companies such as Fidelity, Charles Schwab, TD Ameritrade, E * Trade and Scottrade are recommended by Forbes magazine. - If you plan to trade frequently, which is not recommended, look for companies with low trading fees. In some cases, the brokerage will waive trading fees (but not others that apply) if you are trading with their own ETF.

- If you don't have enough money to get started, look for companies that won't ring out about a lack of balance.

- Keep an eye out for companies that offer additional perks like free checkbooks or debit cards.

3 Open a brokerage account. Once you transfer money to such an account, start building a portfolio.

3 Open a brokerage account. Once you transfer money to such an account, start building a portfolio.  4 Know what to expect. Trading stocks is volatile at best, horrible at worst. This is not to say that she is constantly dangerous, but if you are the type of person looking for a quick daily income, your best bet is to raise rabbits and not trade stocks. In general, it is best to diversify your investment portfolio, trade infrequently, and bet on long-term results rather than short-term opportunities. Stick to safe, high-end stocks and don't get discouraged by short-term bumps.

4 Know what to expect. Trading stocks is volatile at best, horrible at worst. This is not to say that she is constantly dangerous, but if you are the type of person looking for a quick daily income, your best bet is to raise rabbits and not trade stocks. In general, it is best to diversify your investment portfolio, trade infrequently, and bet on long-term results rather than short-term opportunities. Stick to safe, high-end stocks and don't get discouraged by short-term bumps.

Tips

- Keep a complete record of all your trades, including options investments, monthly investments, and dividend reinvestments. Include the purchase date, number of shares, security number and base price. You will need this information on the sale when capital gains tax arises.

Warnings

- Make sure to read the company brochure carefully and pay attention to all sorts of fees, if any. Sometimes, the commissions charged can exceed the costs of broker services, which usually cost as little as $ 2.50 to $ 10 per trade.

- If you are thinking of investing in mutual funds as an alternative to stocks, beware of high fees. Mutual funds charge annual fees that can exceed the cost of a broker to trade stocks. For example, a 1% cost share of your initial $ 100,000 investment in a mutual fund will cost you $ 10,000 over ten years. If you instead bought individual stock through a “discount” broker, it would cost you about $ 2.50 to $ 10, much less than a mutual fund. To make matters worse, actively managed mutual funds generate large brokerage fees and short-term capital gains that go entirely directly to mutual fund investors. In general, mutual funds are not a profitable way of investing. It's best to stick with individual stocks, even if you have to buy from a broker.