Author:

Monica Porter

Date Of Creation:

14 March 2021

Update Date:

1 July 2024

Content

A third party check is a personal or business check drawn for payment to another person. Financial institutions in the US have no obligation to accept third-party checks, and many other banks rarely accept these checks than in the past. However, if you are in a situation where filing a third-party check is your best option, take note of the best practices of this process in advance to improve your chances of success.

Steps

Part 1 of 3: Pre-Issue Plan

Consider your options. Due to stricter identity and banking security in the United States, you may have difficulty finding a bank that accepts a third-party check.

- If you have a bank account and have margin or cash on a check signed for you, the easier it will be for you to do it, the next thing is just to sign your check (or transfer cash) to third-party

- Drawing on a check is probably more convenient (by separating an intermediary, to talk), but it doesn't seem that way anymore.

- Consider transferring funds electronically to your third party, either through an existing bank account or a service like PayPal, if you are looking for a convenient option.

- If you: 1) have a check drawn for you; 2) no bank account; 3) needing to pay a third party with the money on a check you have drawn, this is the only real scenario you might want to try to sign a check. See Part III of this article for the cases in this scenario.

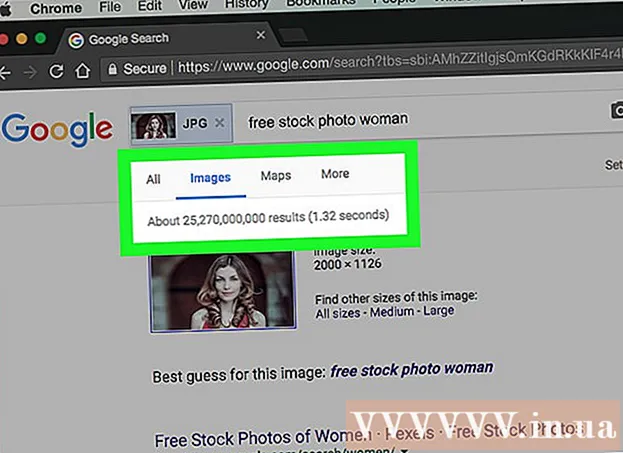

Verify that the person you want to put on the back of the check, as a third party, will accept the signed check.- Ask the person if he / she used a third-party check at his / her bank earlier. This will improve your chances of success, as there is no law requiring a bank to accept a third-party check.

Verify that the third-party bank accepts checks of this type and knows its specific procedures. If you can't reach them right away but know their branch, call customer service number to request a special confirmation for this check.- Ask the bank any special procedures that are required for them to accept third party checks. Some banks have their own rules governing these procedures, for example requiring both parties to have a bank account to ensure there is enough money to transfer.

Meet with a third party in person at their bank. Completion of this direct signing process may be required by your bank and if so will almost certainly improve your chances of success.- Bring appropriate identification, especially if it is not the bank where you opened your account.

Part 2 of 3: Draw On Check

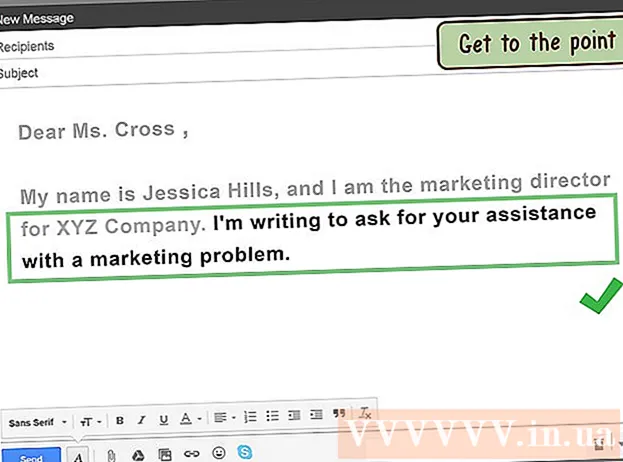

End the check as usual, except keeping your signature on the upper part of the confirmation area. If there are 3 lines on the check, sign on the top line. This is no time for rhetoric, because you will need all of the time to complete the procedure.

- Please print “Pay to the Order of” and the name of the third party in the middle (or 2nd line) of the confirmation area. If you don't have enough space, you can use “FBO” (Beneficiary), but you may want to check with the bank first.

- Write neatly, especially the name of the third party. Spell check.

Don't let a third party sign the check until it has been deposited or paid in cash. Have a third party (payee) sign the bottom (or third line) of the validation area. If he / she doesn't show up, leave an “X” to indicate where he / she should sign, and / or politely attach a note reminding him of where to sign. cheque..

- Give the check to the beneficiary to receive his / her deposit money as usual. As long as the bank accepts third-party checks, the escrow process will work exactly as the check was signed in person. advertisement

Part 3 of 3: Consideration of Alternatives

Open a bank account, make a deposit for check use, then pay it off to a third party. As noted, you can only draw one check because you don't have a bank account. If you can open a bank account, do so, because it will be simpler.

- To open a checking account with a US bank, you need to be 18 years of age or older, provide basic information such as your full name, contact information (phone / email number), and security number. social birth; and provide government-issued identification ..

- You should find a free checking account at one of your local banks. Or look at the banks online, where free checking accounts are typically open.

Ask the original check issuers to void the check and sign a new one for a third party. This is more like working with your aunt than a big company sending you the check back, of course ..

Ask your original check issuer to add a "or who has a check paid on demand" after your name on the check (and a check future checks will pay you). Checks with a 'or payee paid on demand' entry after the payee's name can be deposited or paid in cash (basically, this depends on the bank's policy) by the person shown on the check ..

- A third party should be prepared to show identification when depositing or cashing a check, depending on the policy of the financial institution, especially for checks with large amounts.

- Checks signed with the item "cashed or paid to the person to bring checks" or just written "pay to the person who brings checks" will have the same effect.

Use a cash check service. You will pay for this service, but you will have the cash to use for your third party payments.

- Cash costs for a check are between 1% and 12% of the amount on a check, so shop around for the best price. Several local retailers, including Wal-Mart, provide this service.

- You will need an identification photo to cash your check.

Advice

- You will have no proof or invoice for the check in your bank account. Since the check is initially accepted, you may want to copy it as an evidence or invoice before you draw it out.

Warning

- Third-party checks can be the target of many dishonesty, so only becoming a cardholder in signing third-party checks with people you know and trust.