Author:

Christy White

Date Of Creation:

10 May 2021

Update Date:

1 July 2024

Content

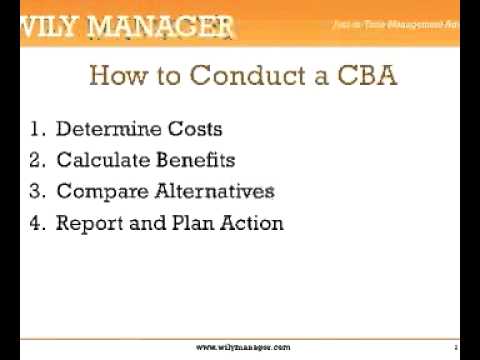

A cost-benefit analysis (CBA) is a detailed analysis of the potential risks and benefits of a project or topic. Many factors are involved, such as abstract considerations that make the creation of a CBA more of a creative process than a science, although a quantitative mindset is necessary. A CBA is useful for personal and business decision-making processes, especially when there is a potential for profit (although this may not necessarily be the case). While creating a CBA can be complicated, you don't have to be a Business Administration student to learn it. Anyone willing to brainstorm, research and analyze data can create an excellent cost-benefit analysis.

To step

Determine the units of the costs in your CBA. Since the purpose of a CBA is to determine whether a particular project or enterprise is worth the cost, it is important to establish at the outset what exactly the units of measure are in terms of cost. Normally, a CBA measures costs in terms of money, but in some cases where it is not about money, a CBA can measure costs in terms of time, energy consumption, etc.

Determine the units of the costs in your CBA. Since the purpose of a CBA is to determine whether a particular project or enterprise is worth the cost, it is important to establish at the outset what exactly the units of measure are in terms of cost. Normally, a CBA measures costs in terms of money, but in some cases where it is not about money, a CBA can measure costs in terms of time, energy consumption, etc. - For the purpose of our demonstration, let's prepare an example KBA in this article. Let's say we run a profitable lemonade stand on the summer weekends and we want to do a cost-benefit analysis to see if it's worth expanding to a second location on the other side of town. In this case, we mainly want to know whether a hypothetical second location will generate more money in the long run, or whether the cost of expansion is too high.

Specify the material costs of the project. Almost all projects cost money. For example, business ventures require seed capital to purchase goods and supplies, train staff, and so on. The first step of a CBA is to make a thorough, exhaustive breakdown of these costs. You may need to look at similar projects to discover costs to put on your list that you wouldn't have thought of otherwise. Costs can be one-off or recurring. Costs should be based on actual market prices and / or research where possible, or if not possible should be thoughtful and intelligent estimates.

Specify the material costs of the project. Almost all projects cost money. For example, business ventures require seed capital to purchase goods and supplies, train staff, and so on. The first step of a CBA is to make a thorough, exhaustive breakdown of these costs. You may need to look at similar projects to discover costs to put on your list that you wouldn't have thought of otherwise. Costs can be one-off or recurring. Costs should be based on actual market prices and / or research where possible, or if not possible should be thoughtful and intelligent estimates. - Below are the types of costs that you should include in your CBA:

- The price of goods or materials that you need for the company

- Shipping / transport costs

- Operating costs

- Personnel costs (wages, training, etc.)

- Real estate (office rental, etc.)

- Insurance and taxes

- Facilities (electricity, water, etc.)

- Let's do a quick breakdown of the cost of our hypothetical new lemonade stand:

- Stocks in the form of limes, ice and sugar € 20 / day

- Pay for 2 people market stall personnel: € 40 / day

- A good quality blender (for smoothies): one-time investment of € 80

- A high-volume cold store: one-time investment of € 15

- Wood, cardboard, etc. for the stand and the plate: one-time investment of € 20

- Our income from the lemonade stands is not taxed, the cost of the water we use to make the lemonade is negligible and we set up our stands in public parks so we don't have to pay taxes, facilities or real estate (unless you have a permit have to have).

- Below are the types of costs that you should include in your CBA:

Specify all intangible cost. It is rare for the cost of a project to consist only of material, actual costs. Normally CBAs also take into account the intangible requirements of a project - things such as time and energy required to complete the project. While these things cannot really be bought or sold, there can be actual costs associated with determining how much money you would hypothetically make if they were used for some other purpose. For example, quitting your job to take a year off so you can write a book is technically free, but you should also keep in mind that you won't receive a salary during that year. So in such a situation we replace money with time, with which you buy a year of time in exchange for a year's salary.

Specify all intangible cost. It is rare for the cost of a project to consist only of material, actual costs. Normally CBAs also take into account the intangible requirements of a project - things such as time and energy required to complete the project. While these things cannot really be bought or sold, there can be actual costs associated with determining how much money you would hypothetically make if they were used for some other purpose. For example, quitting your job to take a year off so you can write a book is technically free, but you should also keep in mind that you won't receive a salary during that year. So in such a situation we replace money with time, with which you buy a year of time in exchange for a year's salary. - Below are the types of intangible costs that you may need to include in your CBA:

- The time you spend on the project - in other words, the money that could have been earned if you had spent your time differently

- The energy costs that a project costs

- The cost of adjusting an established routine

- The costs of any losses incurred by the company during the implementation of the project / company

- The risk factor of intangible things such as security and customer loyalty

- Let's take a look at the intangible costs of opening a new lemonade stand. We assume that our current booth brings in about € 20 / hour for 8 hours of work a day, 2 days a week (Saturday and Sunday):

- Closing the existing lemonade stand for a day so that we can build the new stand, make the signs and scout new places: one-time loss of € 160 in profit.

- Spending 2 hours a week in the first two weeks solving problems in the supply chain: one-time loss of € 80 in profit in the first two weeks.

- Below are the types of intangible costs that you may need to include in your CBA:

Specify the expected benefits. The goal of any CBA is to compare the benefits of a project with the costs - if the former clearly outweighs the latter, the project is likely to receive approval. Specifying the benefits is the same as the costs, but you should probably use more estimates than with the costs. Try to support your estimates with research results from similar projects, and give a sum of money to tangible or intangible ways in which you expect to generate profit.

Specify the expected benefits. The goal of any CBA is to compare the benefits of a project with the costs - if the former clearly outweighs the latter, the project is likely to receive approval. Specifying the benefits is the same as the costs, but you should probably use more estimates than with the costs. Try to support your estimates with research results from similar projects, and give a sum of money to tangible or intangible ways in which you expect to generate profit. - Below are the types of benefits that you can include in your CBA:

- Income

- Saves money

- Increased interest

- Active power

- Saved time and energy

- Regular customers

- Intangible things such as referrals, customer satisfaction, happy employees, a safe workplace, etc.

- Let's calculate the expected benefits of our new lemonade stand and give a rationale for each estimate:

- Due to heavy traffic, a competing lemonade stand near the hypothetical location of our new stand earns an extraordinary income of € 40 / hour. Since our new booth would compete with this booth and the same customer base, and we don't have word of mouth in this area yet, we can cautiously assume we would earn less than that - € 15 / hour or € 120 / day - and that that potential can grow when it goes round that we have cheaper prices.

- Most weeks, we end up throwing $ 5 worth of limes that are rotten. We expect to be able to distribute our stocks more efficiently between the two stalls and eliminate this loss. Since we are open two days a week (Saturday and Sunday), these savings can add up to € 2.5 / day.

- One of our current maternity assistants happens to live very close to the site of the new maternity. If we use her for the new booth (by hiring someone to replace her at the old booth), she estimates that she can use her gained travel time to keep the booth open for an extra half hour per day, which amounts to an extra € 7.5. Day, based on our estimate of the profit from our new booth.

- Below are the types of benefits that you can include in your CBA:

Add up and compare the costs and benefits of the project. This is the hardest part of any CBA. Ultimately, we determine whether the benefits of our project outweigh the costs. Subtract the ongoing costs from the ongoing benefits, then add up all the one-time costs to get an idea of the start-up capital needed to start the project. With this information you can determine whether a project is feasible and profitable.

Add up and compare the costs and benefits of the project. This is the hardest part of any CBA. Ultimately, we determine whether the benefits of our project outweigh the costs. Subtract the ongoing costs from the ongoing benefits, then add up all the one-time costs to get an idea of the start-up capital needed to start the project. With this information you can determine whether a project is feasible and profitable. - Let's compare the costs and benefits of opening a second lemonade stand:

- Ongoing costs: € 20 / day (stocks) + € 40 / day (wages) =€ 60 / day

- Continuous benefits: € 120 / day (income) + € 7.5 / day (extra half hour) + € 2.5 / day (savings on limes) =€ 130 / day

- One-time costs: € 160 (closing the old stall for a day) + € 80 (supply chain problems) + € $ 80 (blender) + € 15 (cold store) + € 20 (wood, cardboard) =€355

- So with a starting capital of € 355 we can expect to be around € 130- € 60 =€ 70 / day to earn. Not bad.

- Let's compare the costs and benefits of opening a second lemonade stand:

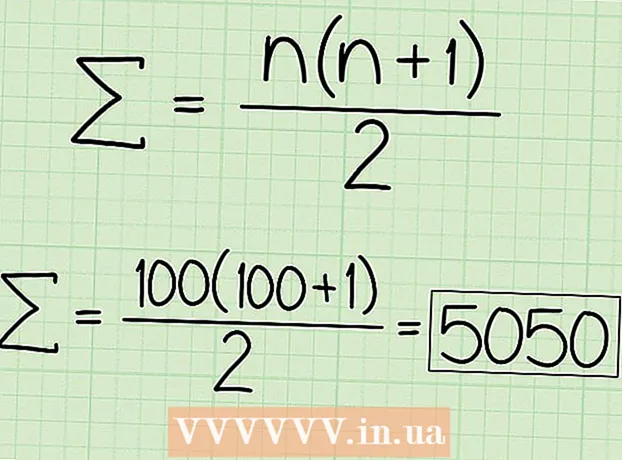

Calculate the return for the company. The faster a project can pay for itself, the better. Taking into account the cost and benefit totals, determine the time it will take to recover the expected costs of your initial investment. In other words, divide the cost of your investment by the expected income per day, week, month, etc. to determine how long it will take to recoup your initial investment and start making a profit.

Calculate the return for the company. The faster a project can pay for itself, the better. Taking into account the cost and benefit totals, determine the time it will take to recover the expected costs of your initial investment. In other words, divide the cost of your investment by the expected income per day, week, month, etc. to determine how long it will take to recoup your initial investment and start making a profit. - Our hypothetical lemonade stand has $ 355 as an initial cost and is expected to yield at $ 70 / day. 355/70 = about 5, so we know that assuming our estimates are correct, our new stall will pay for itself in 5 days. Because our stalls are only open on weekends, this will take about 2-3 weeks.

Use your CBA to make a decision whether or not to continue a project. If the expected benefits of your business clearly outweigh the costs, and the project can pay for itself in a reasonable amount of time, you may want to consider executing your project. However, if it is not clear that a project can generate enough profit in the long term or pay for itself in a reasonable amount of time, you probably need to rethink the project or scrap it altogether.

Use your CBA to make a decision whether or not to continue a project. If the expected benefits of your business clearly outweigh the costs, and the project can pay for itself in a reasonable amount of time, you may want to consider executing your project. However, if it is not clear that a project can generate enough profit in the long term or pay for itself in a reasonable amount of time, you probably need to rethink the project or scrap it altogether. - Based on our CBA, our new lemonade stand appears to be a success. It is expected to pay for itself in a few weeks, and then turn a profit afterward. The summer is several weeks long, so if we're lucky we can make a lot more money this summer with two lemonade stands than with one.

Tips

- Every business has different costs and benefits. Be as thorough as possible when specifying the expected amounts and do not omit anything. Remember that every bit counts.

- Calculate the value of intangible costs / benefits by calculating the potential amount and the statistical probability of it happening. For example, if a customer recommends you, you can expect a net profit of $ 20. The statistical chance that a customer will recommend you is 30%. This equates to a cost-benefit analysis of € 6 for customer references.

- You can also manage costs by determining which activities are most profitable and which are least profitable.