Author:

Joan Hall

Date Of Creation:

26 July 2021

Update Date:

1 July 2024

Content

Do you want to easily save money and at the same time indulge in entertainment? There is an easy way to save money, enjoy life and not worry about your financial condition every day. Read this article to learn about the first steps towards your financial discipline.

Steps

Part 1 of 2: Get Started

1 Organize your financial documents. Set aside a folder or drawer or box with sections for all your documents on expenses, insurance, assets, income and liabilities. You can divide financial documents into sections with the following titles:

1 Organize your financial documents. Set aside a folder or drawer or box with sections for all your documents on expenses, insurance, assets, income and liabilities. You can divide financial documents into sections with the following titles: - House / Apartment

- Monthly expenses

- Income

- Insurance

- Medical expenses

- Vehicle

- Utilities

- Tax

2 Place all relevant documents in each section. For example, in the “House / Apartment” section, you need to put documents on a mortgage or rent. In the section "Utilities" - bills for gas / electricity, water, sewerage, TV / Internet, telephone. The Monthly Payments section will contain all bills for entertainment, food, gas, and so on.

2 Place all relevant documents in each section. For example, in the “House / Apartment” section, you need to put documents on a mortgage or rent. In the section "Utilities" - bills for gas / electricity, water, sewerage, TV / Internet, telephone. The Monthly Payments section will contain all bills for entertainment, food, gas, and so on.  3 Now determine the amount of your expenses in each category. Some expenses, such as mortgage / rent payments and utility bills, are necessary. However, you can reduce your monthly expenses by first determining how much you spend on entertainment, food, gas, and how much you withdraw cash.

3 Now determine the amount of your expenses in each category. Some expenses, such as mortgage / rent payments and utility bills, are necessary. However, you can reduce your monthly expenses by first determining how much you spend on entertainment, food, gas, and how much you withdraw cash.  4 Make a balance sheet with all your income in one column and all your expenses in the other. Do this for about three months to get the big picture. By balancing it over three months, you can see how much you spend on food, or going to the movies, or whatever. It also helps you understand what costs you could cut.

4 Make a balance sheet with all your income in one column and all your expenses in the other. Do this for about three months to get the big picture. By balancing it over three months, you can see how much you spend on food, or going to the movies, or whatever. It also helps you understand what costs you could cut.  5 Set goals. Write down everything you want to accomplish. In addition to the goals themselves, write down how much it will cost you to achieve those goals and how long it will take. For example,

5 Set goals. Write down everything you want to accomplish. In addition to the goals themselves, write down how much it will cost you to achieve those goals and how long it will take. For example, - Buy a house - 7.8 million rubles x5% payment = 390 thousand rubles, save up - until June 2010. This will give you an understanding of how much you need to save to achieve your goals.

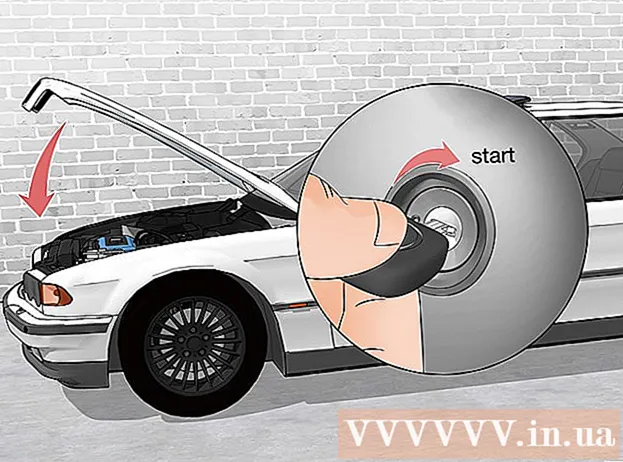

6 After you write down your goals, decide which ones are short-term (to be achieved within 5 years) and calculate how much you need to save each month. Let's say you want to buy a car that will cost you 1.17 million rubles. You can take out a loan for 1.17 million rubles, which you will need to repay within three years.Your monthly payment (excluding interest) will be approximately 32.5 thousand rubles

6 After you write down your goals, decide which ones are short-term (to be achieved within 5 years) and calculate how much you need to save each month. Let's say you want to buy a car that will cost you 1.17 million rubles. You can take out a loan for 1.17 million rubles, which you will need to repay within three years.Your monthly payment (excluding interest) will be approximately 32.5 thousand rubles  7 Now you could set aside some money to reduce the amount of borrowed or not to borrow, accumulating the full amount. Be realistic as you also need to consider your day-to-day expenses.

7 Now you could set aside some money to reduce the amount of borrowed or not to borrow, accumulating the full amount. Be realistic as you also need to consider your day-to-day expenses.  8 You could ask your payroll department to transfer a certain amount of money to your savings account before the payroll is credited to your checking account. First of all, save some of the money, and then only spend the amount that was credited to your checking account.

8 You could ask your payroll department to transfer a certain amount of money to your savings account before the payroll is credited to your checking account. First of all, save some of the money, and then only spend the amount that was credited to your checking account.  9 You can use a special setting for your accounts so that money is credited to your retirement or savings account before you see the money in your checking account. This will help you automatically accumulate a certain amount of money in case of an emergency and for future needs.

9 You can use a special setting for your accounts so that money is credited to your retirement or savings account before you see the money in your checking account. This will help you automatically accumulate a certain amount of money in case of an emergency and for future needs.  10 Look for options to cut costs. In fact, there are more ways than you might think when looking at your budget. Here are some examples:

10 Look for options to cut costs. In fact, there are more ways than you might think when looking at your budget. Here are some examples: - Go to the morning screenings in theaters instead of the later ones, which are at full cost.

- Visit restaurants once a week / month instead of several times a week

- Make coffee at home and take food with you to work / college instead of stopping by a coffee shop on your way to work / college

- Leave your credit card at home when shopping

- Don't go to the grocery store when you are hungry (you tend to buy more food when you feel hungry).

Part 2 of 2: Use envelopes

1 Budget every paycheck. You need to know where each ruble of your salary goes. To do this, you need to create categories such as food, clothing, electricity, even entertainment expenses. Divide your salary into these categories.

1 Budget every paycheck. You need to know where each ruble of your salary goes. To do this, you need to create categories such as food, clothing, electricity, even entertainment expenses. Divide your salary into these categories. - It totally depends on how you distribute your paycheck and how much you tend to spend on groceries and clothing and the like.

- Sometimes, you will have to cut certain types of expenses to save money and be sure you are not feeling financially stressed.

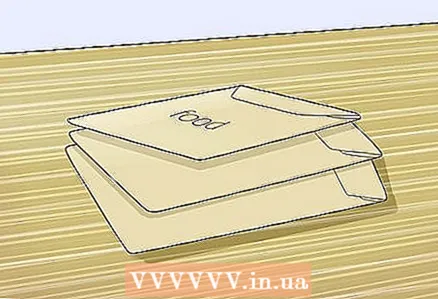

2 Fill in the envelopes. After you have allocated your salary, you will need to put in an envelope the amount of money allocated for each category. For example, if you allocated RUB 4,000 for a Food envelope, you put RUB 4,000 in that envelope.

2 Fill in the envelopes. After you have allocated your salary, you will need to put in an envelope the amount of money allocated for each category. For example, if you allocated RUB 4,000 for a Food envelope, you put RUB 4,000 in that envelope.  3 Don't refill envelopes until your next paycheck. This means that if you spent money from any envelope, there is nothing else in it, it was all the money that you allocated from your last salary. For example, if you spent all 5850 rubles at once from the category of expenses on entertainment, you do not have to go to an ATM to withdraw money and top up an envelope.

3 Don't refill envelopes until your next paycheck. This means that if you spent money from any envelope, there is nothing else in it, it was all the money that you allocated from your last salary. For example, if you spent all 5850 rubles at once from the category of expenses on entertainment, you do not have to go to an ATM to withdraw money and top up an envelope. - Of course, you shouldn't be stupid. If you need to eat and you have already spent all the money allocated for food, you can withdraw cash from your account. This is fine. You need to remember what your budget was until your next paycheck.

4 The perfect result will come to you over time. At first, the system will not work 100% smoothly. This is fine. It will take you a few months to get used to the budgeting process and to understand how much you need to spend on essential items like food and electricity before you can set aside more money for clothing and entertainment.

4 The perfect result will come to you over time. At first, the system will not work 100% smoothly. This is fine. It will take you a few months to get used to the budgeting process and to understand how much you need to spend on essential items like food and electricity before you can set aside more money for clothing and entertainment.  5 Try to avoid using plastic cards. Obviously there will be times when you need to use a debit or credit card, or even write a check (yes, this is old-fashioned). Just remember that it is much easier to pay with your card and not feel like you are spending money than it is to observe the actual amount of money that you give out of your hands.

5 Try to avoid using plastic cards. Obviously there will be times when you need to use a debit or credit card, or even write a check (yes, this is old-fashioned). Just remember that it is much easier to pay with your card and not feel like you are spending money than it is to observe the actual amount of money that you give out of your hands.

Tips

- Wait for discounts and shop out of season. There is nothing better than buying a sweater that costs 1950 rubles for 312 rubles at the summer sale!

- Financial discipline takes time, so adjust your spending gradually.

- Others are not always more fortunate. Just because your friend bought the trendiest shoes or iPod doesn't mean you need to buy that too. After all, you do not know the whole story .. you do not know in what financial situation this person is.

- You still want to enjoy life, but on a budget. You will need time to realize that there are not many things that you could not live without.

- Identify the difference between your wants and needs. What do you need to do to succeed in life?

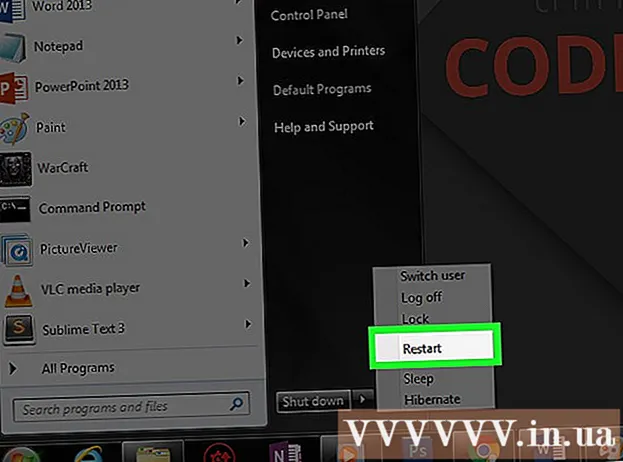

- You can create a spreadsheet in Excel to organize all types of expenses that you face in a month. You just need to enter all costs and you will automatically be able to get their total amount.