Author:

Mark Sanchez

Date Of Creation:

2 January 2021

Update Date:

1 July 2024

Content

- Steps

- Part 1 of 3: Making a plan

- Part 2 of 3: Going by Plan

- Part 3 of 3: Getting Around the Trouble

- Similar articles

Financial difficulties can start suddenly in every sense. Job loss? Excessive spending on a credit card? Didn't the investments "shoot" and turned into candy wrappers? Be that as it may, the most important thing is to stop, identify the problem and draw up a plan to solve it. This is the only way to get on the road to financial well-being.

Steps

Part 1 of 3: Making a plan

1 Determine where the problem is. In the event of a job loss or loss of money due to one particular mistake, it is still more or less understandable, but there are also people who may not notice the fact that they are living completely beyond their means. And if you suddenly noticed for yourself that you cannot pay your debts, think about how you got to this life and what you spend your money on.

1 Determine where the problem is. In the event of a job loss or loss of money due to one particular mistake, it is still more or less understandable, but there are also people who may not notice the fact that they are living completely beyond their means. And if you suddenly noticed for yourself that you cannot pay your debts, think about how you got to this life and what you spend your money on. - List your biggest financial problems. Of course, you don't need to write everything down right away - you need to try to prioritize (for example, "paying off a mortgage" or "looking for a job"). Believe me, having solved serious problems, you yourself will not notice how you can cope with small ones!

- After you identify the problems and prioritize, try to determine for yourself the dates for solving each of the problems on your list. For example, "job search - by the end of the month" or "mortgage payment - in the next 5 years."

- If you are married or in a serious relationship, make sure your partner is involved as well.

2 Make a list of solutions to your problems. After all, this is what remains now! Identify the very specific actions and steps that will get you out of the crisis and write them down.

2 Make a list of solutions to your problems. After all, this is what remains now! Identify the very specific actions and steps that will get you out of the crisis and write them down. - So, you set out to pay off your mortgage in the next 5 years. To do this, you need to calculate how much you will need to pay monthly, and also not to miss payments.

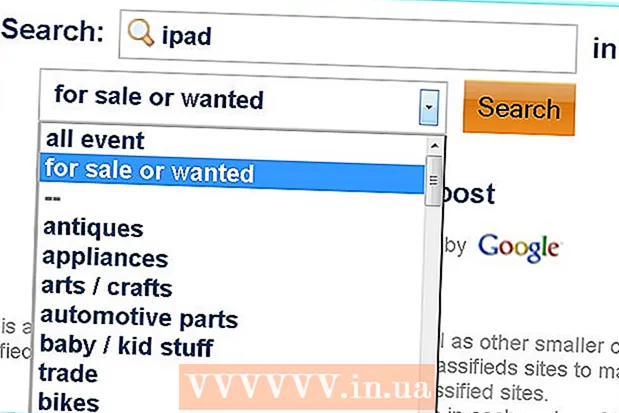

- Do you want to find a job? Check the relevant sites daily, send out resumes for 10 vacancies per week and call back yourself if you were promised to call back after the interview, but have not received a call for a week.

3 Check your debts. One of the first steps towards restoring financial health may be calling your creditors and asking if you really owe them that much money. If it seems to you that the amount of debt should be less - discuss it. If it does not help, you may have to use the help of lawyers.

3 Check your debts. One of the first steps towards restoring financial health may be calling your creditors and asking if you really owe them that much money. If it seems to you that the amount of debt should be less - discuss it. If it does not help, you may have to use the help of lawyers. - However, if the whole problem is that you simply cannot pay the debts, then try asking your creditors to draw up a new payment schedule for you. There is every chance that they will meet you halfway in this matter. After all, if you declare yourself bankrupt, they get nothing! So give them a call, explain the situation, and try to negotiate.

4 Plan your budget. With the help of the budget, you will be able to track your income and expenses, you will be able to understand where you are earning and what you are spending on. After you find out more or less exactly where and what your money is spent on during the month, you will be able to understand what you can save on in order, accordingly, to pay off debts as quickly as possible. When you look at your current spending, budget for a month (for each month!) And set aside fixed amounts for each of the spending categories (food, entertainment, car, and so on). Of course, the budget must be adhered to.

4 Plan your budget. With the help of the budget, you will be able to track your income and expenses, you will be able to understand where you are earning and what you are spending on. After you find out more or less exactly where and what your money is spent on during the month, you will be able to understand what you can save on in order, accordingly, to pay off debts as quickly as possible. When you look at your current spending, budget for a month (for each month!) And set aside fixed amounts for each of the spending categories (food, entertainment, car, and so on). Of course, the budget must be adhered to. - Review your expenses carefully. There is every chance that somewhere you are spending extra and even more. Take a very close look at what you are spending your money on and try to determine where you are leaving more money that should be. Maybe you shouldn't go to that cafe on your lunch break? Maybe you should take food from home with you? Maybe it's better not to buy books, but to borrow from the library? Make a plan to reduce your expenses so that you can get as much of the financial burden off your shoulders as possible.

- Read the article: How to create a personal budget in Excel

5 Connect your family. If your spouse or other people living with you under the same roof do not agree with your ideas, then it will be difficult to get the situation off the ground. Constant arguments about money and its best use will not lead to anything, moreover, this way you will lose time, nerves and strength. Be sure to make sure your family members agree with you before starting to follow the plan.

5 Connect your family. If your spouse or other people living with you under the same roof do not agree with your ideas, then it will be difficult to get the situation off the ground. Constant arguments about money and its best use will not lead to anything, moreover, this way you will lose time, nerves and strength. Be sure to make sure your family members agree with you before starting to follow the plan.

Part 2 of 3: Going by Plan

1 Stick to a budget. After you plan your budget, try to stick to it as closely as possible - otherwise, it will lose all meaning. Keeping track of your expenses will be easier if you don't throw away your checks and regularly ask your bank for your card statement. But remember that the budget is not a sacred cow, and you can and should make changes to the limits by category if they are too large and small!

1 Stick to a budget. After you plan your budget, try to stick to it as closely as possible - otherwise, it will lose all meaning. Keeping track of your expenses will be easier if you don't throw away your checks and regularly ask your bank for your card statement. But remember that the budget is not a sacred cow, and you can and should make changes to the limits by category if they are too large and small!  2 Continue to cut costs wherever you can. After a few weeks or months of thoughtful budgeting, review your spending again. Look for areas where you can shrink even more. For example, instead of going to the movies for money, you can take a walk in the park for free. Also, consider whether you can opt out of cable TV, or your cellular, or subscriptions to services and services you don't use.

2 Continue to cut costs wherever you can. After a few weeks or months of thoughtful budgeting, review your spending again. Look for areas where you can shrink even more. For example, instead of going to the movies for money, you can take a walk in the park for free. Also, consider whether you can opt out of cable TV, or your cellular, or subscriptions to services and services you don't use. - Read on for tips on how to live with a minimum of money.

3 Let others help you. When they help you deal with financial problems, even if just with a kind word or advice, it is much easier to stay on track and keep moving towards your goal. This is all psychology, pure human psychology.

3 Let others help you. When they help you deal with financial problems, even if just with a kind word or advice, it is much easier to stay on track and keep moving towards your goal. This is all psychology, pure human psychology. - A relative or close friend should be someone close to you.

- Tell him about your financial goals, your actions to achieve those goals, and the time frame by which these goals should be met.

- Talk regularly (once a week or a month) with this person about your plans and successes.

4 A spoon is good for dinner, and money is good for the date of the invoice. In other words, pay your debts first! Received a salary? Set aside as much money as possible to pay your debt bills right away. If possible, try to set up your salary card this way. The main thing here is that the money should come to your account before the bills are paid, because it is undesirable to pay for the overdraft in your current financial situation.

4 A spoon is good for dinner, and money is good for the date of the invoice. In other words, pay your debts first! Received a salary? Set aside as much money as possible to pay your debt bills right away. If possible, try to set up your salary card this way. The main thing here is that the money should come to your account before the bills are paid, because it is undesirable to pay for the overdraft in your current financial situation.  5 Stay on track, even if something goes wrong somewhere. We all push ourselves out of bounds, including budgetary ones - it happens! And if in any month you spent too much, do not worry. If, for some special reason, your expenses for the period exceeded the expected ones, just try to save more actively later in order to keep up with the plan.

5 Stay on track, even if something goes wrong somewhere. We all push ourselves out of bounds, including budgetary ones - it happens! And if in any month you spent too much, do not worry. If, for some special reason, your expenses for the period exceeded the expected ones, just try to save more actively later in order to keep up with the plan.  6 If necessary, resort to more radical methods. If you have become a guru of living on a budget, but you still can't see a glimpse, then it makes sense to switch to heavy artillery. For example, you can turn to appropriate financial professionals and join a debt management program.

6 If necessary, resort to more radical methods. If you have become a guru of living on a budget, but you still can't see a glimpse, then it makes sense to switch to heavy artillery. For example, you can turn to appropriate financial professionals and join a debt management program. - An extreme, literally the most extreme measure - filing an application for declaring an individual bankrupt. But know that it is 1) long; 2) destroys credit history.

Part 3 of 3: Getting Around the Trouble

1 Continue to spend money wisely and save even when debt is a thing of the past. So, you did it, got out and generally well done. Isn't that a reason to continue to stick to a proven budget ?! If you've been living on budget for months or even years, why change anything? The money that you save in this way can be profitably invested - save for your old age or, say, spend on teaching children.

1 Continue to spend money wisely and save even when debt is a thing of the past. So, you did it, got out and generally well done. Isn't that a reason to continue to stick to a proven budget ?! If you've been living on budget for months or even years, why change anything? The money that you save in this way can be profitably invested - save for your old age or, say, spend on teaching children.  2 Consider every purchase you make. Before you buy something, especially something expensive (a car or even a yacht), study the available offers and check if there is something the same somewhere, but cheaper. Do not forget about thinking about whether that thing is really so needed, whether you can pay for it and whether you will endlessly pour money into it. This will help you avoid unnecessary and unnecessary purchases, as well as extra interest. Plus, you don't have to buy something just because it is discounted or seems like a bargain.

2 Consider every purchase you make. Before you buy something, especially something expensive (a car or even a yacht), study the available offers and check if there is something the same somewhere, but cheaper. Do not forget about thinking about whether that thing is really so needed, whether you can pay for it and whether you will endlessly pour money into it. This will help you avoid unnecessary and unnecessary purchases, as well as extra interest. Plus, you don't have to buy something just because it is discounted or seems like a bargain.  3 Keep track of your credit history. Needless to say, a good credit history is one of the foundations of financial well-being. An excellent credit history is a non-illusory chance to get more favorable terms on a loan, be it rates, limits or something else. In addition, a good credit history can help you get a loan at a low interest rate if, due to new financial difficulties, you need money again, and quickly.

3 Keep track of your credit history. Needless to say, a good credit history is one of the foundations of financial well-being. An excellent credit history is a non-illusory chance to get more favorable terms on a loan, be it rates, limits or something else. In addition, a good credit history can help you get a loan at a low interest rate if, due to new financial difficulties, you need money again, and quickly.  4 Save money for a rainy day. Open yourself a savings account or debit card and save money there for a rainy day and other force majeure situations. The main thing is that you can quickly withdraw money. Experts advise deferring about 6 of your monthly salaries to have a full financial cushion. However, even much smaller amounts can be indescribably useful both in case of unforeseen expenses, and simply to hedge against financial troubles.

4 Save money for a rainy day. Open yourself a savings account or debit card and save money there for a rainy day and other force majeure situations. The main thing is that you can quickly withdraw money. Experts advise deferring about 6 of your monthly salaries to have a full financial cushion. However, even much smaller amounts can be indescribably useful both in case of unforeseen expenses, and simply to hedge against financial troubles.

Similar articles

- How to live within your means

- How to handle your money

- How to celebrate Christmas without going broke

- How not to waste money

- How to live with little or no cost

- How to act if you won the lottery