Author:

Marcus Baldwin

Date Of Creation:

15 June 2021

Update Date:

1 July 2024

Content

If you have received a new bank card, you need to sign on the back of it before using it. Sign the card after you activate it online or by phone. Use a permanent marker to sign the card as you would sign a document. Do not leave blank the signature field on the card and do not write “see. passport "instead of a signature.

Steps

Part 1 of 2: How to Sign Clearly

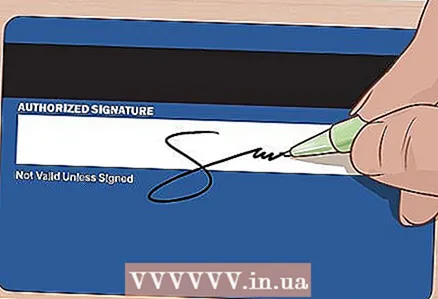

1 Find the signature field on the map. This field is on the back of the card. Flip the card over and look for a light gray or white box.

1 Find the signature field on the map. This field is on the back of the card. Flip the card over and look for a light gray or white box. - On some cards, the signature field is covered with a sticker. In this case, remove the sticker before signing the card.

2 Sign with a permanent marker. Since the card is made of plastic, it cannot absorb the ink of a regular pen like paper does. The permanent marker will definitely leave a mark on the plastic, and the ink will not smear all over the map.

2 Sign with a permanent marker. Since the card is made of plastic, it cannot absorb the ink of a regular pen like paper does. The permanent marker will definitely leave a mark on the plastic, and the ink will not smear all over the map. - Some people prefer to sign the map with a capillary pen. This ink will probably not smudge either.

- Do not pick up a marker with a bright ink color (such as red or green).

- Also, you cannot sign the card with a regular ballpoint pen. Such a pen can scratch plastic or leave only an imperceptible mark on the card.

3 Sign your usual signature. Write confidently and legibly; the signature on the card must match your signature on other documents.

3 Sign your usual signature. Write confidently and legibly; the signature on the card must match your signature on other documents. - It's okay if your signature is difficult to read, as long as it looks like signatures in other documents.

- If the merchant suspects you of fraudulent credit card fraud, the first step is to ask you to provide an identity document to compare the signature on it with the signature on the card.

4 Let the ink dry. Do not put your card back in your wallet immediately after you sign it. Doing so may smudge ink and make your signature illegible.

4 Let the ink dry. Do not put your card back in your wallet immediately after you sign it. Doing so may smudge ink and make your signature illegible. - It can take up to half an hour to dry, depending on the ink you are using.

Part 2 of 2: Common mistakes

1 Don't write on the map "cm. the passport". Some believe that this is how you can protect yourself from credit card fraud. The logic here is simple: if suddenly someone steals your bank card, he will not be able to use it without your passport. However, for large purchases, the seller may play it safe and not accept your card if it does not have a signature. For ATM and online transactions, the presence or absence of a signature does not matter.

1 Don't write on the map "cm. the passport". Some believe that this is how you can protect yourself from credit card fraud. The logic here is simple: if suddenly someone steals your bank card, he will not be able to use it without your passport. However, for large purchases, the seller may play it safe and not accept your card if it does not have a signature. For ATM and online transactions, the presence or absence of a signature does not matter. - Read carefully what is written on the back of your card in small print. You will most likely find the phrase “Not valid unless signed”.

- In most cases, cashiers do not pay attention to customers' bank cards.

2 Do not leave the signature field blank. Technically, according to the terms of the agreement between you and the bank, you are required to sign your card before using it in order for it to become valid. Likewise, any merchant who works with your bank's terminal has every right to refuse to use your card if he sees that it is not signed.

2 Do not leave the signature field blank. Technically, according to the terms of the agreement between you and the bank, you are required to sign your card before using it in order for it to become valid. Likewise, any merchant who works with your bank's terminal has every right to refuse to use your card if he sees that it is not signed. - Nowadays, contactless microchip readers in cards and self-service counters (for example, at gas stations and car washes) are becoming more common, so no one may see your card.

- An empty signature field on the card does not in any way protect you from fraud. A potential thief can safely use your card, whether it has your signature on it or not.

3 Find out if your card is protected against fraud. If you are concerned that someone might steal and spend money on your signed card, it is best to check with your bank to see if they provide fraud protection to cardholders. Contact the support service of the bank serving you and find out if your card is insured against fraud.

3 Find out if your card is protected against fraud. If you are concerned that someone might steal and spend money on your signed card, it is best to check with your bank to see if they provide fraud protection to cardholders. Contact the support service of the bank serving you and find out if your card is insured against fraud. - You can find out the terms of payment of the sum insured from the representative of the bank serving you.