Author:

Florence Bailey

Date Of Creation:

23 March 2021

Update Date:

1 July 2024

Content

The income statement is one of the key financial documents. It determines the profitability of the company over a certain period of time and is used to analyze the income and expenses of the company. This article will show you how to write a simple income statement.

Steps

Method 1 of 1: Profit and Loss Statement

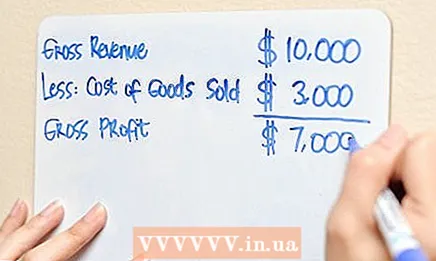

1 Record your sales. Or, in other words, sales volume, sales volume, sales proceeds.

1 Record your sales. Or, in other words, sales volume, sales volume, sales proceeds.  2 Subtract the cost of goods sold. The cost price includes all expenses for the production / purchase of goods.

2 Subtract the cost of goods sold. The cost price includes all expenses for the production / purchase of goods.  3 Calculate your gross margin. It is equal to the difference between the volume of sales and the cost of goods.

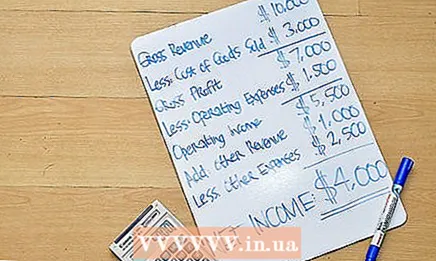

3 Calculate your gross margin. It is equal to the difference between the volume of sales and the cost of goods.  4 Subtract operating costs (running costs, operating costs). These include sales and office / administrative expenses (salaries, advertising, rent, utilities, depreciation).

4 Subtract operating costs (running costs, operating costs). These include sales and office / administrative expenses (salaries, advertising, rent, utilities, depreciation).  5 Calculate your operating income. It is equal to the difference between gross profit and operating expenses.

5 Calculate your operating income. It is equal to the difference between gross profit and operating expenses.  6 Add in other income (non-operating income) such as interest earned on promissory notes.

6 Add in other income (non-operating income) such as interest earned on promissory notes. 7 Subtract other expenses (non-operating expenses) such as interest paid on loans.

7 Subtract other expenses (non-operating expenses) such as interest paid on loans. 8 Calculate your net income. It is equal to: operating income plus other income minus other expenses.

8 Calculate your net income. It is equal to: operating income plus other income minus other expenses.

Tips

- The income statement covers a specific period of time. All of the above values should be considered within this time period. The time period should be listed at the top of the income statement.

Warnings

- The profit and loss statement does not show the sources of cash receipts and the directions of their spending. They are reflected in the statement of cash flows.