Author:

Bobbie Johnson

Date Of Creation:

3 April 2021

Update Date:

1 July 2024

Content

An IOU is needed when someone lends money to someone and really wants the debt to be repaid by a certain date. In addition, this document can be used as an agreement that payment for a product or service will be made later.

Steps

Method 1 of 2: Writing an IOU

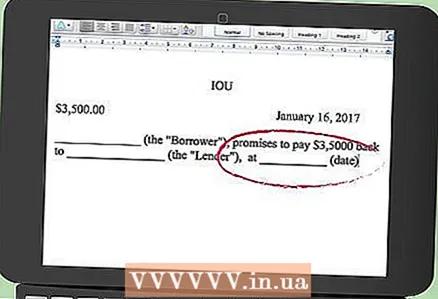

1 Write the date and amount borrowed, or the cost of a product or service. The point is to indicate the amount of debt.

1 Write the date and amount borrowed, or the cost of a product or service. The point is to indicate the amount of debt.  2 Write the date of the debt repayment. When should the borrower return the funds to you? Should he do it in one payment or in several? If for a few, then in what time frame?

2 Write the date of the debt repayment. When should the borrower return the funds to you? Should he do it in one payment or in several? If for a few, then in what time frame?  3 Write down what percentage you get. Yes, when lending money to a relative, it is better not to remember the interest. However, the idea of getting a percentage of the data borrowed money is not so bad, because:

3 Write down what percentage you get. Yes, when lending money to a relative, it is better not to remember the interest. However, the idea of getting a percentage of the data borrowed money is not so bad, because: - Without interest, you are essentially losing money due to inflation and losing purchasing power.

- Interest can force the borrower to repay the debt ahead of schedule. The logic is simple: the longer the borrower keeps the money, the more interest he has to pay. Is it profitable for him?

- Don't raise your interest rate above 15-20%. To tell you the truth, such numbers are simply beyond the bounds of decency. Let the interest rate be beneficial to both parties.

4 Sign the document. Don't forget to decipher the signature.

4 Sign the document. Don't forget to decipher the signature.  5 The borrower must also sign the receipt. Yes, and decrypt the signature too.

5 The borrower must also sign the receipt. Yes, and decrypt the signature too.  6 It is advisable that someone witness the transaction. If the situation comes to court, a witness to the transaction will be very helpful for the lender, even if the transaction was concluded verbally.

6 It is advisable that someone witness the transaction. If the situation comes to court, a witness to the transaction will be very helpful for the lender, even if the transaction was concluded verbally.

Method 2 of 2: Legal Aspects

1 Obligatory Receipt will help in the event of an audit of your company. Accordingly, if you lend a large amount of money, it is important to correctly draw up a receipt.

1 Obligatory Receipt will help in the event of an audit of your company. Accordingly, if you lend a large amount of money, it is important to correctly draw up a receipt.  2 Know the difference between a receipt and a promissory note. It is often difficult to obtain a decision on receipts in court, especially if they were concluded without a witness. Also, the receipt contains only the amount of the debt, and the obligation also contains actions to pay off the debt and the consequences of a delay in debt.

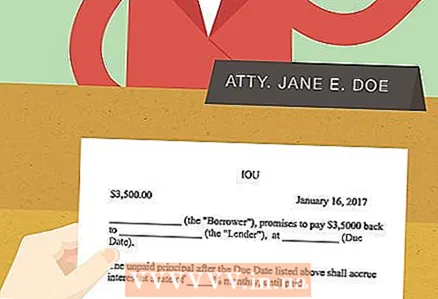

2 Know the difference between a receipt and a promissory note. It is often difficult to obtain a decision on receipts in court, especially if they were concluded without a witness. Also, the receipt contains only the amount of the debt, and the obligation also contains actions to pay off the debt and the consequences of a delay in debt. - If you are lending a large amount of money, then, for the sake of peace of mind, prepare a promissory note - it is easier with them to defend your position in court.

- The debt obligation must be notarized.

3 If you are in doubt about the strength of a receipt, consult a lawyer. The lawyer will be able to explain to you the details and nuances, as well as give you useful advice on how to arrange the transfer of money in debt.

3 If you are in doubt about the strength of a receipt, consult a lawyer. The lawyer will be able to explain to you the details and nuances, as well as give you useful advice on how to arrange the transfer of money in debt.

Tips

- Keep the receipt in a safe place.

- Make copies of the document for each party to the transaction.