Author:

Sara Rhodes

Date Of Creation:

16 February 2021

Update Date:

1 July 2024

Content

- Steps

- Method 1 of 2: How to report tax evasion anonymously

- Method 2 of 2: How to Report Remuneration Tax Evasion

- Tips

- Warnings

- What do you need

Some US taxpayers find themselves in an embarrassing situation when they notice that someone is evading taxes. Such people must be reported to the Internal Tax Service. The service has several programs that allow you to report non-payment of taxes on remuneration, while filing anonymously.

Steps

Method 1 of 2: How to report tax evasion anonymously

1 You must substantiate the claim. The IRS believes that the best applications come from former employees, ex-spouses and former business partners. If you just comment on the non-payment of taxes or the purchase of an expensive car or equipment, this will not be enough to substantiate the claim.

1 You must substantiate the claim. The IRS believes that the best applications come from former employees, ex-spouses and former business partners. If you just comment on the non-payment of taxes or the purchase of an expensive car or equipment, this will not be enough to substantiate the claim. - It is not advisable to report tax evasion in any way that concerns you, as you may be prosecuted for assistance.

2 Remember that the higher the tax evasion rate, the more likely it is that the case will be processed by the IRS. If your counterparty accepts payment in cash, it is less likely that you will be able to claim it than if the business is evading millions of dollars in taxes. Internal Tax Service spends more time and money on large cases.

2 Remember that the higher the tax evasion rate, the more likely it is that the case will be processed by the IRS. If your counterparty accepts payment in cash, it is less likely that you will be able to claim it than if the business is evading millions of dollars in taxes. Internal Tax Service spends more time and money on large cases.  3 Go to IRS.gov. Look for Form 3949-A for Submission of Information. Print the form and read the instructions carefully.

3 Go to IRS.gov. Look for Form 3949-A for Submission of Information. Print the form and read the instructions carefully.  4 Fill out the form with as much personal information as possible about the person or business you are applying for. Indicate areas of tax evasion that you have noticed. Describe what you know in the comments section on the first page.

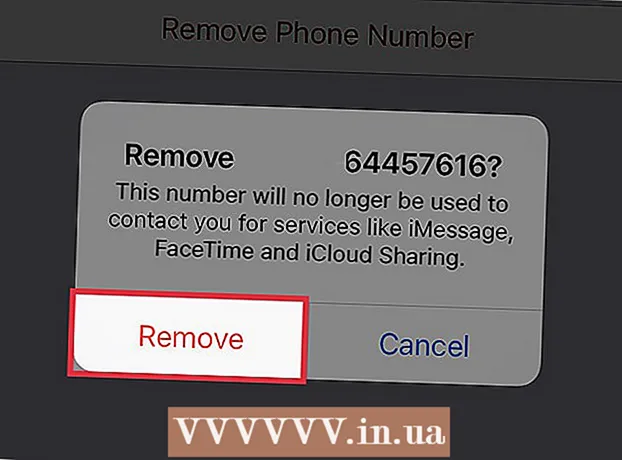

4 Fill out the form with as much personal information as possible about the person or business you are applying for. Indicate areas of tax evasion that you have noticed. Describe what you know in the comments section on the first page.  5 If you want to do everything anonymously, leave section C and information about yourself blank. Your personal information will not be known to the person you are reporting; but you are not protected from legal action if that person or organization learns about your application in another way.

5 If you want to do everything anonymously, leave section C and information about yourself blank. Your personal information will not be known to the person you are reporting; but you are not protected from legal action if that person or organization learns about your application in another way.  6 You can attach an additional letter detailing what you know about a specific person's tax evasion. Remember that all evidence must be collected in a legal manner. You must not break the law in an attempt to prove tax evasion.

6 You can attach an additional letter detailing what you know about a specific person's tax evasion. Remember that all evidence must be collected in a legal manner. You must not break the law in an attempt to prove tax evasion.  7 Submit the form with all additional evidence to Internal Revenue Service, Stop 31313, Fresno, CA 93888.

7 Submit the form with all additional evidence to Internal Revenue Service, Stop 31313, Fresno, CA 93888.

Method 2 of 2: How to Report Remuneration Tax Evasion

1 You must understand the rules of the IRS program. Those who successfully filed less than $ 2 million in tax evasion can receive 15% of taxes, fines and interest. Those who reported tax evasion above $ 2 million can receive 30% of taxes, interest and fines.

1 You must understand the rules of the IRS program. Those who successfully filed less than $ 2 million in tax evasion can receive 15% of taxes, fines and interest. Those who reported tax evasion above $ 2 million can receive 30% of taxes, interest and fines. - The tax evasion process takes one to seven years.

- There is no guarantee that your case will be investigated.

- You can be held liable if you helped in tax evasion.

- You can only get one reward if the money is paid out. If the government does not receive the money, you will not receive a reward, even if the IRS successfully pursues the defaulter or the organization.

2 Go to IRS.gov and look for Form 3949-A. This is a form for providing information. Print it out and read the instructions carefully.

2 Go to IRS.gov and look for Form 3949-A. This is a form for providing information. Print it out and read the instructions carefully.  3 Return to the IRS website. Look for Form 211, Claiming Benefit for Truthfulness. To apply for the service program, you must complete this form.

3 Return to the IRS website. Look for Form 211, Claiming Benefit for Truthfulness. To apply for the service program, you must complete this form.  4 Complete Form 3949-A. You must provide personal information in section C.

4 Complete Form 3949-A. You must provide personal information in section C.  5 You can attach a letter with additional information about tax evasion. The more details you provide, the more likely you are to receive a reward.

5 You can attach a letter with additional information about tax evasion. The more details you provide, the more likely you are to receive a reward.  6 Submit the signed forms to the Internal Revenue Service at the appropriate office, 1973 N. Rulon White Blvd., M / S 4110, Ogden, UT 84404.

6 Submit the signed forms to the Internal Revenue Service at the appropriate office, 1973 N. Rulon White Blvd., M / S 4110, Ogden, UT 84404.  7 Wait for the Internal Tax Service to contact you; this can happen within seven years. If you receive a reward, the amount received will also be taxed.

7 Wait for the Internal Tax Service to contact you; this can happen within seven years. If you receive a reward, the amount received will also be taxed.

Tips

- If you need to testify in a case in court, it is recommended that you contact a lawyer who specializes in such cases. He will help you write your letter and defend you in court. If you successfully report tax evasion, the IRS will reimburse some of the costs.

- If you would like to report fraudulent activities with the help of a tax preparer, use Form 14157 instead of Form 3949-A. In this case, you will not be provided with a reward.

- If you would like to report potential fraud to a nonprofit organization, please use Form 13909.

Warnings

- If you report fraud but are involved in the matter yourself, you may be prosecuted or fined.

What do you need

- Form 3949-A

- Form 211

- True information or evidence

- Printer

- The envelope

- Postage