Author:

Lewis Jackson

Date Of Creation:

5 May 2021

Update Date:

1 July 2024

Content

Everyone wants to be rich, but only a handful of people really know what they need to do to get there. Getting rich requires a combination of many factors including luck, skill and perseverance. You should have at least some luck and combine it with your skillful decisions; Then, you will face many other difficulties as you get richer. The obvious truth is that getting rich isn't easy, but with a little bit of persistence and the right information at the right time, you can.

Steps

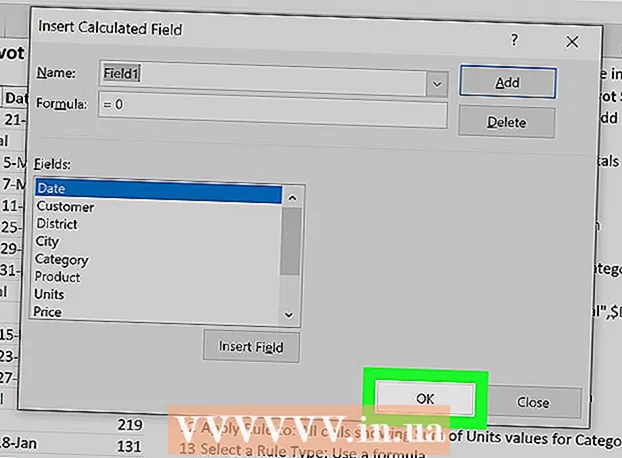

Method 1 of 5: Investment

Invest in the stock market. Investing in stocks, bonds or other investment instruments can give you a rate of return (ROI) large enough for you to rest assured when you retire. For example, if you have $ 1 million invested at 7% ROI, you make $ 70,000 a year, excluding inflation.

- Don't be lured by the day tellers who will show you tricks to make money very quickly. Buying and selling dozens of shares every day is like gambling. If you trade wrongly - what is easier to do than trade right, you can lost lots of money. This cannot be a good way to get rich.

- Instead, learn to invest in the long term. Choose stocks with good fundamentals, industry leaders, and high growth potential. Then just leave your stock there and do nothing. Good stocks will overcome all ups and downs. If you invest smart, you'll always make a return.

Save for retirement. Always be frugal. Few people save enough to retire. Some even feel they won't be able to retire. Take advantage of tax deferral programs like the IRA or the 401k. Tax incentives will help you save your retirement account faster.- Don't put all your expectations on Social Insurance (social insurance). The social insurance program will certainly run for the next 20 years, but some data shows that if the US Congress doesn't make changes - either by raising taxes or reducing benefits - the program won't be able to. continue operation. However, the US Congress may act to "amend" the social insurance. In any case, working and about to retire should not see Social Security as the only cure. Therefore, the more you need to know how to save and invest in the future.

- Invest in the Roth IRA program. The Roth IRA gives you a retirement account that you can deposit into $ 5,500 a year. This money is used to invest and get a compound return. If you withdraw money during retirement, it won't be taxed because it was taxed the first time you first earned your income.

- Join the 401 (k) program. A 401 (k) account is opened by your company with pre-tax contributions invested in. Your company may pay you wholly or in part. This is also how you get the rare "free money" in life! Please contribute enough to enjoy all the incentives from the program.

Invest in real estate. Stable assets like rental homes or land plots in a developing area are a good way to get rich. These investments have no guarantee in nature. But many people still make great profits from real estate. These investments will increase in value over time. For example, some assume that an apartment in Manhattan is guaranteed to increase in price every 5 years.

Invest your time. For example, you might want to have free time to give yourself a few hours to enjoy. But if you invest this time to get rich, you will have up to 20 years of free time (24 hours a day!) Thanks to early retirement. Can you trade what you have now to get richer in the future? Dave Ramsey, an investment advisor, told his audience: "Live yourself today and be yourself tomorrow."

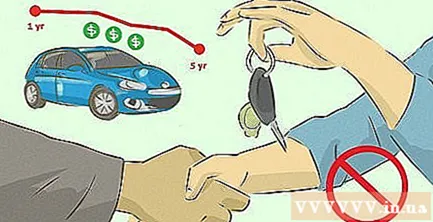

Don't buy things that devaluate quickly. Spending $ 50,000 on a car is sometimes wasteful because it will be half the price after 5 years, no matter how you maintain it. Or when you drive the car to the street, it has lost about 20% -25% of its value and continues to lose value like that every year. So consider carefully about buying a car.

Don't spend on nonsense. Making a living is never easy. But it is difficult and it hurts much more when we spend our own sweat and tears on useless things. Take a look at what you bought. Try to find out if they're really "worth the money." Here are a few things not to spend if you want to get rich:

- Tickets to the casino and lottery tickets. Only the very lucky few of us who make the rest of the money lose.

- Bad habits like smoking. Heavy smokers will only see their nets fly in the smoke.

- The included allowance such as candy at the cinema or drinks at the club.

- Sunbathing and cosmetic surgery. You could get skin cancer just because of this hobby. Do nose fixes and botox injections bring you the beauty in advertising? Learn to live with old age. Everyone will come old age.

- First class air ticket. What better do you get by losing $ 1,000 more? Warm wipes and 10cm legroom? Use that money to invest, not throw money through the window like that, and practice being a budget passenger!

Maintain wealth. Getting rich was difficult, maintaining wealth was even more difficult. Your stock portfolio is affected by the fluctuating capital stock market. If you only feel comfortable when the market is good, you will panic when the market plunges and take risks. If you get a promotion, raise your salary or your ROI is high, don't spend the excess money. Be economical on your job precautions when there are problems and when ROI drops 2 percentage points! advertisement

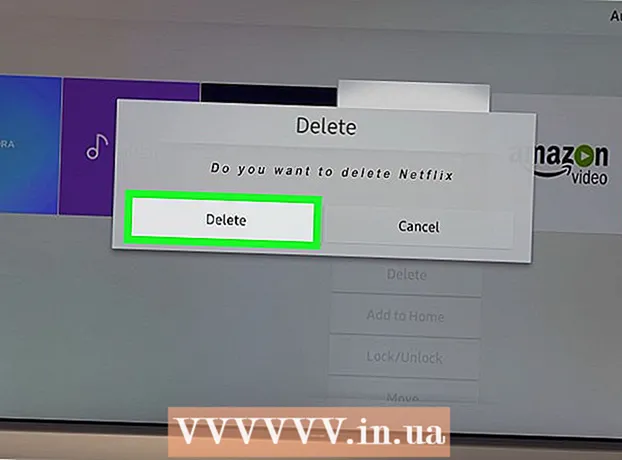

Method 2 of 5: Learning throughout a Career

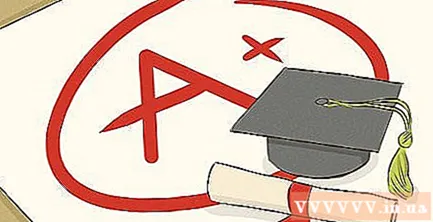

Study well when young. Whether attending formal college or apprenticeship, successful people often pursue education after high school. In the early stages of your career, employers do not have much information to assess you beyond your education. A high college GPA usually guarantees a higher salary.

Choose the right career. Take a look at a survey of average annual wages for selected occupations. Your chances of getting rich will be greatly reduced if you choose to be a teacher instead of a finance professional. Here are some of the highest-earning occupations in the US:

- Doctors and Surgeons. The anesthetist alone makes more than 200,000 dollars a year.

- Petroleum Engineers. Engineers working in the oil and gas industry often have a fairly high standard of living. On average, they earn between 135,000 dollars or more.

- Lawyer. Senior group attorneys make more than $ 130,000 a year, making it a very attractive profession if you invest your time and effort.

- Information Technology (IT) Manager and Software Engineer. If you are good at programming and have a talent for computers, look into this highly paying field. IT managers make $ 125,000 per year.

Choose The Right Place The Right Place. Go to a place with a good and suitable job. For example, if you want to go to finance, go to big cities to look for opportunities, not rural or sparsely populated areas. If you want to start a business, go to places like Silicon Valley. If you want to work in the entertainment industry, go to Los Angeles or New York.

Let's start small. But let's play the flyer game first. Apply to as many companies as possible and take exams and interviews to choose the job that you like best. Once you have chosen a job, please pursue it and accumulate experience to advance and develop.

When appropriate, change jobs and companies. As you gain experience in the field you work in, consider looking for a new job. Change jobs, you can get a raise as well as experience different business environments. Don't be shy, just switch a few times. If you are a good employee, your current company may increase your salary and other benefits to retain you. advertisement

Method 3 of 5: Cut Spending

Make the most of coupons. There's nothing better than being paid to take things home. If you know how, you will Use coupons to make purchases. At the very least, you'll save a few dollars in room for those tough times. If you are more fortunate, you get a lot for free and save a lot of money.

Buy in bulk. While not the easiest way to shop, this is the most effective way to shop. If you can borrow a card or buy membership fees from a retail store like Costco, you will save considerable money. In some cases, you will find many reputable brands with great discounts.

- If you are hungry and love to eat chickens, buy four pre-cooked ones at Costco at the end of the day when they're on sale. Occasionally, they are discounted from $ 5 to $ 2.5 per piece, meaning you get 10 delicious meals for just $ 1 each! Freeze any meals you have not consumed immediately.

Learn how to preserve food. Up to 40% of food in the United States is discarded but not eaten. Fresh peaches and even meat can be stored and used for a while if you know how. Take a closer look at the foods you buy. You buy to eat, not throw away. Wasting food is wasting money.

Find ways to reduce utility costs. Electricity, gas and other utility costs can have a big impact on monthly expenses if left unchecked. Therefore, please stop using it indiscriminately. Use the air conditioner wisely to keep your home cool in the summer and warm in the winter and save energy. You should think about investing or building solar panels to generate electricity. Generally keep utility costs low and you'll save a lot of money.

Check your home's energy consumption. This will help you see how much money you lose due to energy loss.

- You can check your own energy consumption if you are dumb and know how to do it, otherwise just hire an expert in the field instead. Rental costs range from $ 300 to $ 500, which is not cheap, but you will save more later (especially when you want to renovate entire gas lines, electricity, etc. in the house).

Hunting and foraging. You need hunting gear and a permit, but if you already have one, this is a very cheap way to get more food. And if you have faith in killing animals, you can still easily find more food, depending on where you live. Just look for food that you know the source of. Saving a little money on food and getting sick or getting food poisoning is terrible.

- You can hunt deer, ducks or turkeys.

- Fishing with a fishing rod or by artificial fly

- Look for flowers or wild mushrooms that are edible or forage in the fall.

- Look for abandoned land to grow vegetables or make your own greenhouse.

Method 4 of 5: Save Money

Pay yourself first. Before running to the store to buy a new pair of shoes or golf clubs that you don't need, set aside an amount and don't touch it. Do this every time you get your paycheck and notice how your savings are growing.

Make a budget (and stick to it thoroughly). Make a monthly budget that covers all of your major expenses and leaves some money for "fun". Sticking to your budget plan and saving a little bit of money each month is a great way to build a foundation in your get-rich efforts.

Lower your housing and vehicle standards. Can you live in an apartment instead of a house, or share a room instead of a private one? Can you buy a used car instead of a new one and use it economically? Just doing that will save you a lot of money.

Cut down the costs. Review how you spend wasted money and rethink things. For example, stop drinking coffee at Starbucks every morning. You will save $ 4 per day and save $ 20 per week or $ 1,040 for the whole year!

Keep track of your expenses. To get the most out of your spending cuts, you need to keep track of them. Choose an expense tracking app like Like Lover or Mint and record every penny you spend and collect. After about 3 months, you will know exactly where your expenses go and have a way to improve it.

Spend your tax refunds reasonably. In 2007, the average tax refund received by Americans was $ 2,733. A pretty large number! Can you use that money to pay off debt or create an Emergency Fund instead of spending on things that lose half the price over time? If you wisely invested close to $ 3,000, you could make 10 times that amount over the years.

Let's break with credit cards. Did you know that credit card users shop more often than people who use cash? That's because cash payments are always uncomfortable. When you swipe your credit card, you won't experience that feeling. If you can, give up on your credit card and feel free to use the cash. In the end you will save a ton of money.

- If you still want to use a credit card, find ways to cut costs. Pay all your loan every month and on time. That way, you won't be charged interest. If not, at least pay the minimum amount due to avoid overdue fees.

Method 5 of 5: Mortgage Restructuring

Debt your home mortgage. This repayment can give you 15 years instead of 30 years of interest. This will make you pay a few hundred dollars more each month, but your total interest expense will be much lower.

- Example: To pay off a 30-year $ 200,000 home mortgage, you would have to pay $ 186,500 in interest, which means you are paying a total amount of $ 386,500 over 30 years. In other words, if you are willing to pay a few hundred more dollars (for example, $ 350) by reversing to a 15-year loan (which will have a lower interest rate), you could pay the mortgage within 15 year and the best part is that you save $ 123,700 in interest. That money will belong to you. So talk to your debt manager right away about this new option.

Advice

- Shop for clothes in the fall or spring as there are many discounts these two seasons.

- Buy only what you need, not what you want. Stop shopping for inspiration and spend money showing it to your neighbors, friends, co-workers, and more. Buy what you really need, Not what you want. Be disciplined with your money - If you don't need to buy, don't buy. Make your choices very carefully.

- List things to buy, prices and see where your money is going. In doing so, we will be amazed at how well we spend our money!

- Pay the highest rate bill first and then the second highest bill until you've paid off all your bills. This will help you pay the least interest. Another way is to pay off the smallest debts first. The advantage of this way is that it helps you see your progress on paying bills and debts.

- Look for each opportunity to make money. Sell anything you don't use, old newspapers, scrap paper, beer cans, etc.

- Keep your credit profile good. Having a low credit score will make it harder for you to get the credit or credit line needed when you need it.

- If you want to reward yourself with an expensive item, go from a lot of money to a little money. Do not think about expensive dresses or fashion handbags, buy ice cream cone or go to the movies for example. The $ 8 movie ticket is obviously much cheaper than a $ 800 handbag but still gives you the same feeling of doing something "just for yourself".

- You can borrow money to use to buy income-generating assets.

- Try to cook at home and do the housework yourself. You should not hire services such as laundry or maid to save money.

- If you like going to a bar or club, switch to going once a week for a while and then every two weeks.

- Money is never free unless you inherit it. The other exception is the company you pay for you under the IRA or 401 mentioned above.

- Having multiple sources of income in the family will ensure a better financial situation than one source.

- Every night before bed, put all the change (usually coins) in a bottle. After about a year, you'll have at least $ 150 in change in savings. Periodically, deposit this money into your savings account.

- If you're in a business, keep your personal spending as low as possible and use the excess money to reinvest in your company until you're financially independent. During that time, build up an emergency fund the equivalent of about 6 months of spending. Place the money in a savings account, a short-term financial instrument trading account or a certificate of short-term deposit (CD).

- If you are really looking for an expensive item (a new car even though the current one is doing well), make yourself wait a month before buying. Ask a trusted family member or friend to keep the money to stop the urge to buy then. Take some time to consider: the actual cost of what you want to buy; pros and cons; buy now and buy later; how better could that money be spent.

- Learn about self-made millionaires for motivation. Find out everything about how the rich started making money and what they do to maintain their wealth.

- Sometimes you have to spend money to make money.

- If you want to get rich quickly, you will certainly face many risks. A better way is to accumulate money more slowly, but more safely.

- Resist the urge to buy expensive goods. Cheaper items are still of equally good quality, and tight spending control always has a lasting effect.

- When you want to buy clothes (eg clothes) think "Where can I wear this?". If you can't think of at least 5 locations, don't buy. Ask questions to prevent you from wasting money on unnecessary things.

- Get to know your business ideas thoroughly before you get started.

- Always ask yourself, "Is this what I need or want?". If the answer is "need", buy it, but if it's just want, stop.