Author:

John Stephens

Date Of Creation:

28 January 2021

Update Date:

1 July 2024

Content

The opportunity cost is defined as what you sacrifice to make another choice. This concept compares what you lose with what you gain based on your decision. The opportunity cost can be measured, or it can also be difficult to quantify. Understanding the concept of opportunity cost can help you make a more accurate decision.

Steps

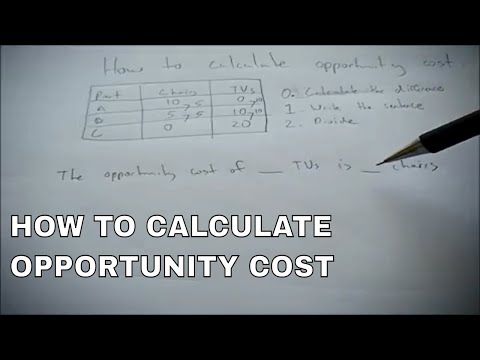

Part 1 of 3: Calculating the opportunity cost

Identify different options. When faced with two different options, you have to calculate the potential benefits these two options bring. Since you can only choose one of the two options, you will miss out on the benefits of the other. The missed benefit is the opportunity cost.

- For example, let's say your company has $ 100,000 in sub-funds, and you have to decide whether to invest in stocks or buy production equipment.

- If you decide to invest in stocks, you can get a return on that investment, but at the same time you lose the profits that can be made from the purchase of new production equipment.

- On the other hand, if you decide to buy new production equipment, you can also profit from the revenue increase, but you will lose the profit earned from investing in stocks.

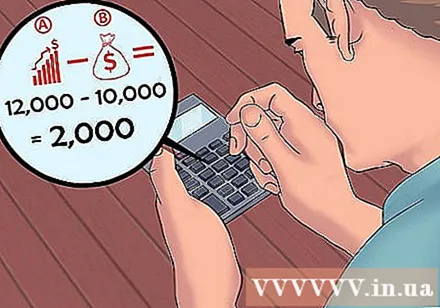

Calculate the potential profitability of each option. Research each option and estimate the profits that each will bring. Also in the above example, suppose the estimated return on investment in the stock market is 12%. Thus, you can earn $ 12,000 by investing in stocks. On the other hand, suppose that investing in new production equipment can help you earn 10% of your profits, which means you will make $ 10,000 by buying fixed assets.

Choose the best option. Sometimes the best option is not the most unprofitable one, especially in the short term. Decide which is best based on long-term goals, rather than just the potential returns. The company in the example above could choose to invest in new fixed assets rather than in the stock market. Because while stock market investments have higher potential returns in the short term, new production equipment will allow this company to increase efficiency and lower opportunity costs. This will have long-term effects on the company's profit margin.

Calculate the opportunity cost. The opportunity cost is the profit difference between the most attractive option and the chosen option. In the example above, the most attractive option is investing in stocks, yielding $ 12,000 in potential return. However, the option the company chose was to invest in new production equipment, bringing in $ 10,000.- Opportunity cost = the most attractive option - the option selected.

- Thus, the opportunity cost of choosing to buy new equipment is $ 2,000.

Part 2 of 3: Evaluating business decisions

Establish capital structure for businesses. Capital structure is the degree to which a company pays for its operations and development. It is a combination of debt and corporate equity. Debt can be in the form of issuing bonds or borrowing from financial institutions. Equity can be in the form of securities or retained earnings.

- Companies must evaluate the opportunity cost when choosing between debt and equity.

- If the company chooses to borrow money to support its development, the money to pay off the principal and interest is no longer available to invest in securities.

- A company must evaluate the opportunity cost to ensure that the expansion from the borrowed money yields enough long-term returns to justify a neglect of investing in securities.

Evaluate non-financial resources. The opportunity cost is often calculated to evaluate a financial decision. However, many companies can use opportunity cost to coordinate the use of other resources, such as manpower, time or manufacturing output. The opportunity cost can be applied to any limited company resource.

- Companies must make decisions about how to allocate resources to different projects. If you spend time on one project then you won't have time on another project.

- For example, suppose that the furniture company has 450 hours of work each week, and to complete a chair, it takes 10 hours of work for the company to produce 45 units per week. The company decided to produce 10 sofas per week, each of which takes 15 hours to complete. That means the company will spend 150 hours producing 10 sofas.

- Except for the time to make sofas, the company has 300 hours of work left, and thus can only produce 30 chairs. Therefore, the opportunity cost of 10 sofas is 15 recliner.

Consider whether your time is paying off if you are an entrepreneur. If you are an entrepreneur, you will spend all of your time in your new business. However, this is the time that you can devote to doing different jobs. That is your opportunity cost. If you have high earning potential with another job segment, you must consider whether it is worth opening a new business or not.

- For example, let's say you are a chef earning 23 USD / hour and you decide to quit your job to open your own restaurant. Before making money from this new business, it will take you a long time to buy food, hire employees, rent a house and open a restaurant. You may make money eventually, but the opportunity cost will be the amount that will be paid if you don't quit during this time.

Part 3 of 3: Evaluation of individual decisions

Decide whether to hire a maid. Determine which housework is consuming a lot of your time. Consider whether the time spent doing chores takes time away from more valuable work. Chores like laundry and cleaning can interfere with your job if they take you too long. In addition, the time spent on chores can prevent you from participating in other more enjoyable activities, such as taking care of your kids or pursuing your own hobbies.

- Calculate the financial opportunity cost. Let's say you work from home and make 25 USD per hour. If you hire a maid, you will have to pay 20 USD / hour. The opportunity cost of doing self-employment is $ 5 / hour.

- Calculate the opportunity cost in terms of time. Let's say you spend 5 hours every Saturday doing laundry, grocery shopping, and cleaning. If you hire a maid to clean and do the laundry once a week, it will only take you 3 hours on Saturdays to finish the laundry and buy food. Right now, the opportunity cost of doing housework is 2 hours.

Calculate the real cost of going to college. Let's say you will have to pay 4,000 USD / year to go to college. The government will subsidize an additional $ 8,000 in tuition fees. However, you must also calculate the opportunity cost of not being able to work while you are studying. Let's say you can earn $ 20,000 a year instead of going to college. This means that the real cost of a year of college is tuition plus the opportunity cost of not working.

- The total amount of tuition is the amount you have to pay ($ 4,000) plus a government subsidy ($ 8,000), which is $ 12,000.

- The opportunity cost of not working is $ 20,000.

- Thus the opportunity fee exam of one year of college study is.

- Other opportunity costs associated with college studies include the value of the experience of 4 years of practical work, the value of time spent studying instead of other activities, or value of objects you might have. buy with money you pay for tuition or the benefit that money can bring if you invest.

- On the other hand, however, the average weekly income of a person with a college degree will be $ 400 more than a person with a third degree. If you decide not to go to college, the opportunity costs are worthwhile. income will increase gradually in the future.

Consider opportunity cost in everyday selection. Whenever you make one choice, you will have to leave another option. The opportunity cost is the value of an option that you did not choose. That value can be personal, financial or environmental.

- If you choose to buy a new car over a used one, the opportunity cost is how much money you can save on buying a used car and how you spend the difference.

- Let's say you decide to use your tax refund to let the whole family travel instead of saving or investing. Thus, the opportunity cost is the interest value of a savings or return on an investment.

- Remember that value here is not necessarily money or tangible assets. So when deciding, you should also consider how your choices will affect your intangible assets, such as your happiness, your health, and your free time.