Author:

Laura McKinney

Date Of Creation:

9 August 2021

Update Date:

21 June 2024

Content

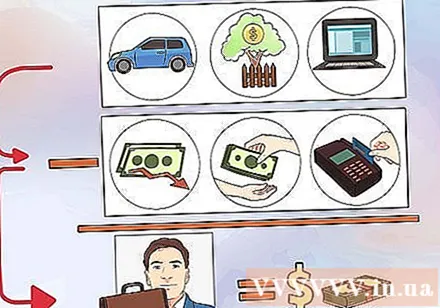

A financial advisor can help you plan for a specific goal like retirement or investing. They can also give you advice on many other financial matters such as tax, savings, insurance, etc. Although hiring a financial advisor before making complicated decisions is always wise. Well, learning how to make a financial plan not only helps you understand and manage your own finances, but also saves you some professional fees.

Steps

Part 1 of 6: Set financial goals

Identify your key financial and personal goals. Before you can create a sound financial plan, you need to know your goals clearly. Common financial goals include: retirement planning, school expenses, buying a home, building a family heirloom, developing an "insurance net" to cover expenses. unexpected events, unfortunate events or changes in life.

- You can search the internet for forms to help you identify your financial goals.

Identify exactly the goals you want to accomplish. Make sure the goals stick to the SMART principles. These are the first letters of the words Specific (specific), measurable (measurable), attainable (workable), realistic (practical) and timely (limited time).- For example, you're not saving money right now, and your goal is to save more. Aim to spend 5% of your monthly income for savings is not only specific but also measurable (you can easily see if you can achieve it), and is feasible in a reasonable amount of time. .

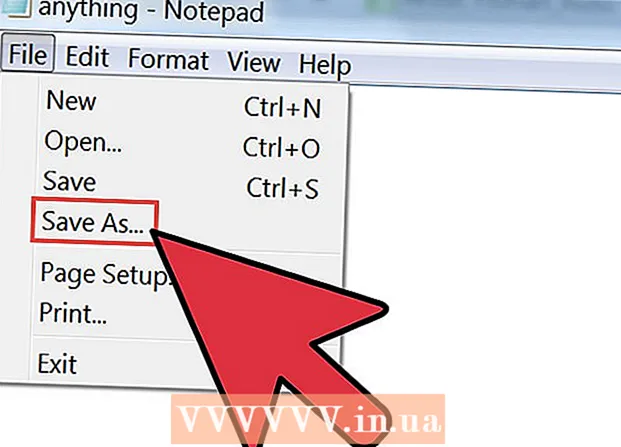

- Write down your goals. This not only helps you remember, but also makes you responsible. A good plan should include short, medium and long term goals.

Determine how much money is needed to achieve your main goals. For a financial plan to work successfully, it is essential to determine the amount of money spent on your goals. This means that you need to choose a goal and paraphrase it.- For example, a common financial goal is to plan for retirement when you are 60 or 65 years old. Although it is often thought that 70-80% of current income is a reasonable target for retirement income, others claim that it is 50-60% of a married person's income and 60- 70% of a single person's income is more reasonable.

- In the US, for example, if your current annual income is $ 80,000, and you are unmarried, then your retirement income could be around $ 40,000 per year, based on 50%. on. Here's an example of interpreting a goal (retiring at age 65) into a specific amount ($ 50,000 per year). Once you know this, you can create a plan that defines how much money you need to save and / or invest to supplement other sources of retirement income to reach $ 50,000 per year.

- You can search online for forms to help calculate retirement needs and other goals.

Part 2 of 6: Determining Current Financial Situation

Calculate your real property value. Real equity is determined by subtracting your liabilities from the value of your assets. This number will tell you exactly about your current financial situation, and help you make the right decisions and achieve your goals. You can make a simple spreadsheet to calculate your real assets, or find a form online.- Start by creating two columns, a credit and a debit.

List of properties. Assets are simply anything you own, which can include cash, savings and checking accounts, retirement funds, real estate, personal property, investments, etc. .

- Next to each asset class, list its value. For example, if you own a home, write down the value of the house next to you. The same applies to other types of assets, for example stocks or cars.

- Add up all of the above values to find the total value of the property you have.

List your debts. Debt includes installments such as installments, credit loans, student loans, car loans, personal loans, etc.

- Add all of the above values to find your total debt.

Subtract the total debt from the total value. The result is your net worth. If it is a negative number then you owe more than you have. Conversely, if you have $ 100,000 and you owe $ 50,000, then your net worth is $ 50,000. If your financial plan progresses and you save more, your assets will increase (with an increase in savings) and lower debt (as you get rid of your debts). advertisement

Part 3 of 6: Monthly budget calculation

Decide on financial planning. Real estate calculations give you a picture of your credit and debt. However, it is even more important that you know the cash in and out every month. This will help you keep track of your monthly expenses, and keeping a record of all these will tell you exactly where to find the savings. This is the central part of any financial plan.

Identify sources of income. List sources of monthly income (salary, child support, etc.) Add them all up to find your total monthly income.

Determine your monthly expenses. This section you should sort into items. For example, in the “housing” section, you can list the rent or mortgage, home or tenant insurance and utilities such as electricity, water, etc.; Under the “Travel” section, you can list car installments, gas costs, maintenance fees and car insurance. Add them all together to find the total monthly cost. Remember to include things like entertainment, food, clothing, credit card payments, taxes and other unexpected expenses.

Calculate occasional and variable costs. Remember that some costs are "fixed" (equal or nearly the same amount every month), but others do fluctuate (often change or happen unexpectedly). When calculating your budget, you'll need to include variable costs, including expenses that don't happen monthly.- You can list the variable costs that occurred over a period of months, add them all up and divide them equally by the number of months. The result will be the average number of variable costs that you can include in your monthly budget.

Subtract your total expenses from your total income. If your income outweighs your expenses, you'll have a balance you can save, invest, or consume, depending on your financial goals. If your expenses are greater than your income, review your budget and work out what expenses can be cut.- If you do not know your exact income and / or expenses, you need to keep track for several months to get data.

- Regularly review and update your budget. Remember to add in new expenses and delete any no more expenses.

Part 4 of 6: Save money

Make money you save. Regardless of your financial goals, saving is still important. Whether you plan to buy a home, retire early, or invest in your children's education, saving is a key way to achieving your goals.- Review the budget to do this. Look at your monthly expenses and find out what unnecessary expenses you can cut. For example, if you eat a restaurant three times a month, or buy lunch every day at work, now you should decide to only eat the restaurant once a month, or bring lunch from home to work.

- Look at your budget and decide what is "wanted" and what is "needed". Aim for "wants" to save. Likewise, look at the items you think are "needed" and ask yourself if they are really necessary. Mobile phone is required, for example, but you may not need the 3GB plan and only need the 1GB plan.

Learn saving habits. Start by opening a covered account with reputable banks. Experts recommend applying the motto "pay yourself first", that is, for each payment period, you must definitely spend a certain amount of money to save as a part of the plan. You can work with multiple banks to automatically withdraw an amount from your check for this purpose.

- Save an amount that you are comfortable with, that fits your needs and your budget. Your savings may increase (or decrease) over time. It's important to have something to save, even if it's a small amount.

- Ten percent of your income is the right amount to get started, but as much as you can save, less is less.

- Even a small amount of money saved in an interest-earning account (checking account, savings account, deposit account, etc.) benefits from compound interest - that is, the amount of interest on the initial capital will be added. adding in capital and then earning interest, and so on - making the total value of the account even more.

- Practice a lot will get used to. When you save some money each month or use the "pay yourself first" approach, gradually everything becomes automatic, and you will learn to live without your savings as if you didn't have any. it. Treat your savings as a necessary expense like rent or mortgage.

Set up an emergency fund. Experts recommend to save some money to spend as needed for at least three months as an emergency fund, in case of job loss or illness, etc. Keep this fund in an insured account to fit safe and ready to use when needed.

- You can also protect yourself from financial trouble by enrolling in the right insurance. If you have questions about homeowner / tenant insurance, health insurance, life insurance, unemployment insurance, incapacity insurance or car insurance, talk to your employer. related reason.

Take advantage of all the special savings benefits. Take advantage if there are incentives from the government or employer on savings (for example, education or retirement incentives). If the government or employer contributes to savings plans or offers other incentives (such as tax breaks), it can help you move closer to your financial goals.- In the US, for example, your 401 (k) retirement account can be increased by your employer contributing an amount equal to the amount you put in. Likewise, anyone can open a personal retirement account (IRA) and enjoy tax benefits.

Part 5 of 6: Financial investment

Consider investing. Investing is a necessary part of most financial planning, allowing you to achieve your financial goals faster with less money through profit. However, you should also note that every investment is risky and you could lose money.- Popular investment areas include stocks, mutual funds, bonds, real estate, and commodities.

- Each type of investment has different potential for profit, cost and risk.

- You can put money in a variety of investments (such as bonds, stocks and mutual funds) through banks, brokers and sometimes directly through corporations, governments, or municipalities.

- There are currently many types of investments that can be traded entirely online, but there are many investment brokers that you can consult directly with. However, the fee for a one-on-one consultation is likely to be higher than for transactions that you do yourself online.

Understand the different types of investments. While there are so many types of investment listed, there are three important types of investments: stocks, bonds, and mutual funds.- Stocks represent ownership in a company. When you buy stock, you buy a piece of the business, and its value goes up or down depending on how many people want to buy or sell. For that reason, stocks can be extremely volatile, and although stocks generally are more profitable than any other type of investment (average annual return of 8% since 1029), they can also depreciate dramatically in a year. In 2008, US stocks fell 50%. Stocks are a good choice for long-term investors, such as those preparing for retirement.

- Bonds are a form of debt investment. When you lend money to the government or a company, you buy the bonds. In return, you will receive interest on the money you borrowed, usually paid annually or semi-annually. Usually, bonds are less risky than stocks.

- A mutual fund is a collection of investments (usually stocks), managed by a professional investor. Buying a fund means you bought ownership in the stock basket, and whether you make or lose money depends on how the baskets work. Mutual funds are a good choice for passive investors, as you will benefit from a variety of sources, and rely on a professional manager to buy, sell and manage portfolio based on market conditions and their strategies. However you have to pay the fee.

Determine how much risk you are likely to face. Every investment is risky, and it is important before you invest that you know how risky you are to put your sweat and tear money into.

- Examine your goals to make your decisions. For example, if you are saving for 6 months to spend on vacation, then investing in stocks is probably a bad decision, as stocks are highly risky and can fluctuate greatly over time. space. This means you may have a chance to quickly reach your savings goal with a small amount of savings, but also the possibility that you may have to postpone your vacation due to your investment losing money. much. Perhaps investing in bonds (less risk) is better, or even just keeping money in a high interest savings account.

- A general rule from experience is that the higher the potential return, the higher the risk - it also means that the lower the risk, the lower the potential return.

- Relatively "safe" investment forms include savings accounts and US Treasury bonds. Stocks are more likely to yield higher returns but are also risky. Mutual funds reduce the risk of investing in a wide range of stocks and securities and can be a good choice for long-term investments.

- Never invest money you need for the short term or spend on essentials like food, rent or gas.

Choose the right investments. Once you know your goals, understand your types of investments, and know your risk tolerance, you can choose an investment.

- Stock investing is appropriate if you have medium to high risk tolerance and plan to save money for a long term. For example, if you are saving up for a retirement plan then buying stocks is worth thinking about. Remember that not all stocks are high risk. For example, investing in a small (discouraged) pharmaceutical company can be extremely risky, while investing in large companies with stable cash flow and market competitiveness like Wal- Mart, Wells Fargo, or Coca-Cola might be less risky.

- If you don't have the time, comfort, or risk tolerance to buy personal stocks, think about a mutual fund. This type of investment is suitable for medium and long term goals like retirement or saving for your children's education, but more “passive”, and you usually only need to check once every year or half a year. to make sure investments work as you want them to. You can find out about mutual funds and invest through an online broker or visit a bank or financial advisor to choose from.

- Bonds are suitable for low-risk individuals who are interested in preserving their savings, while still growing at a low but steady rate. It is important to note that bonds are in any portfolio, and generally it is recommended that those aged 20 to 40 should invest in larger stocks and mutual funds, while those in Near retirement, you should switch to bonds to preserve your savings. Bonds can be an effective way to balance portfolios and reduce risk. A good rule of thumb is to subtract 100 from your age, and that is the percentage you should keep in stock.

Diversify your investments. Not all sectors of the economy have performed equally well (or badly) in the same time period. If you spread out multiple financial portfolios of different types, you can minimize the risk of losing all of your value in the event that one or more parts of your investments lose money. This approach is called diversification.

- For example, a retirement plan might span a wide variety of investments, including mutual funds, stocks, and savings accounts. In this case, the long-term goal mutual fund can save the loss if the personal shares invested in the retirement plan lose value. The money kept in a savings account, although low in interest, is guaranteed and can be easily retrieved when needed.

Part 6 of 6: Focus on sound financial decisions

Think carefully when making financial decisions. The SAVED (Stop - Stop, Ask - Ask, Verify - Verify, Estimate - Estimate, Decide - Decision) method is a guiding principle when it comes to making financial decisions:

- Stop and take some time to think before making any decisions. Don't let the salespeople, broker, etc. put pressure on you. Tell them (and myself) that you need time to think.

- Ask about costs (taxes, fees, guarantees, etc.) and risks. Make sure to know what the worst possible scenario is.

- Verify all information to ensure accuracy and reliability.

- Estimate the cost for that decision and think about if it is right for your budget.

- Decide if you think it makes sense.

Use caution when using credit cards. Sometimes a loan can be a good choice - buying a home, paying for school, or buying necessities, for example. However, borrowing - especially high-interest debt - will reduce the value of your real assets and delay the fulfillment of some of your financial goals.

- Do not misuse credit cards. Try to spend only the money you earn.

- Pay off your high-interest debt as soon as possible. This can be the best tactic for financial growth in the long run, as even good investments are often not enough to pay off high interest debt.

- If you have multiple credit accounts, try to give priority to prepay for the one with the highest interest rates.

Seek reliable advice when needed. Usually you can succeed with financial planning on your own, but if you don't have the time to research and manage your finances, don't know where to start, or if you're dealing with a surprise event. (such as inheritance or sickness), you should consider seeking advice from a certified financial advisor.- Beware of unreliable advice, investments, etc. If any offer sounds so good that it is unbelievably true, it most likely is.

Advice

- The laws, regulations and procedures involved in financial planning can vary widely, depending on where you live and / or work. You must know this information well before making financial decisions, and consult an expert if there is something not understood.