Author:

John Stephens

Date Of Creation:

26 January 2021

Update Date:

1 July 2024

Content

Regardless of your reasons, finding a bank account number is easy to do. There are several ways to define an account number, so you can access it whether at home or on the go. Don't forget to take steps to keep your account secure, such as properly storing and destroying documents containing account number information.

Steps

Method 1 of 2: Determine the account number

Find the second row of numbers at the bottom of the check. The first row of numbers printed in the lower left corner of the check is a 9-digit bank routing number. The second sequence of numbers, usually 10-12 digits, is your account number. The third and also the shortest sequence of numbers printed at the bottom of the page is the check digit.

- Account numbers will be enclosed in brackets with the same symbol. For example, the account number would look like this: “⑆0123456789⑆”

View paper statements or online statements if you have access to them. The account number will be printed on every bank statement you receive, whether it appears in your online mailbox or in the mailbox as a paper statement. Find your most recent bank statement and look for a 10-digit row that says "Account Number". It is usually located in the top right or left corner of each document.

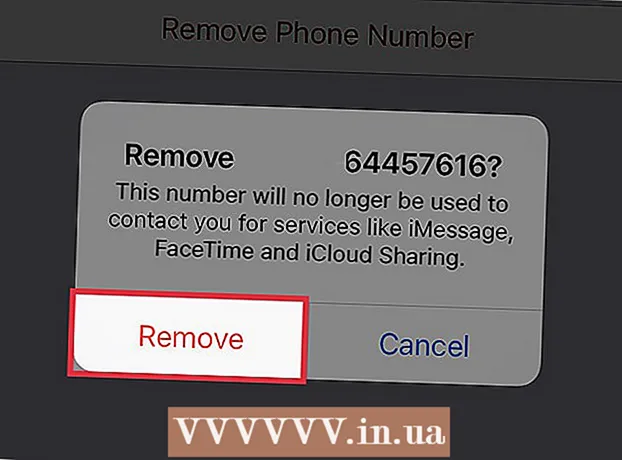

Visit your website or mobile banking app to find your account number online. Navigate to the banking website on your computer or open your bank's mobile app on your phone or tablet. Sign in and tap the tab to view a summary of your account information. Usually, the account number will be listed on this page. If not, go to the website or use the "Help" function to search.

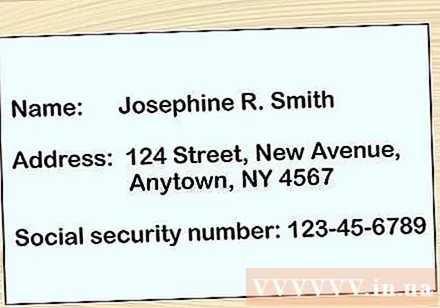

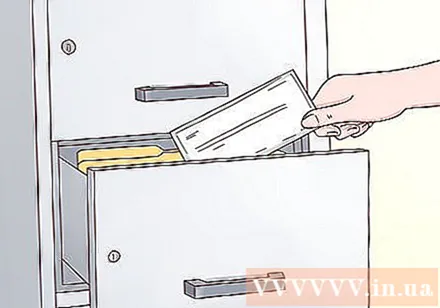

Contact your bank if all search fails. Call the phone number on the back of your credit / debit card or look up the customer service number online. You will need to provide your name, address and social security number so they can verify your identity. They will then indicate your account number.- If you write down your account number, be sure to keep it in a safe place, like in your wallet or filing cabinet.

Method 2 of 2: Keep your account safe

Use a secure Internet connection to access your personal online accounts. Even if you want to check your bank account in a coffee shop, store or station, you really shouldn't. Using an unsecured wireless connection puts you at risk of identity theft. Access your account online or through a mobile application only when you have access to a secure Internet connection.

Provide your account number only on secure websites. If you need to provide an online account number to pay your bills or transfer money, make sure the site is secure. The website address should start with "https" because the letter "s" stands for "secure" which means safe. You should also look for the padlock icon and / or the word "Secure" in the upper left corner of the address bar before providing an account number.

- Without the above safety conditions, do not enter an account number because your information may not be kept confidential.

- You don't need to provide your account number for online shopping, so be wary of sites that ask for this.

Keep track of checks and bank statements. Don't leave your checkbook or bank statements scattered around your home or car. Instead, open and view your statements when they come due, then store them and any other papers that contain your account information in a safe place, such as a filing cabinet. Also, keep your checkbook in a safe location. Don't forget to destroy rather than recycle or throw away old checks and bank statements to prevent others from getting your account information.

Monitor your account regularly to avoid fraudulent activities. It's important to check your checking and savings accounts on a regular basis with your bank statements. Make sure all transactions are charged properly. If you find any charges unreasonable, contact the bank immediately for more information. advertisement