Author:

Lewis Jackson

Date Of Creation:

9 May 2021

Update Date:

1 July 2024

Content

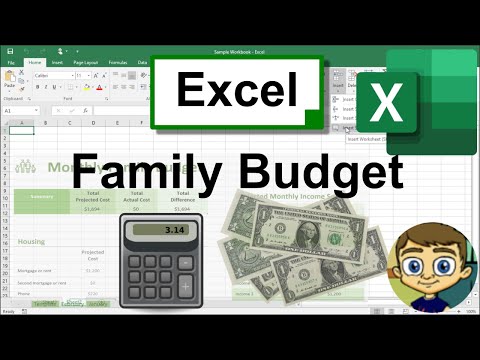

Adhering to the family budget is a great habit to promote. This way you can reduce spending, save more and avoid payment problems or overpayment on credit cards. Creating a family budget requires you to keep track of your current expenses and income, and develop financial discipline to regulate your expenses and build a stronger financial foundation.

Steps

Part 1 of 3: Create spreadsheets or notebooks

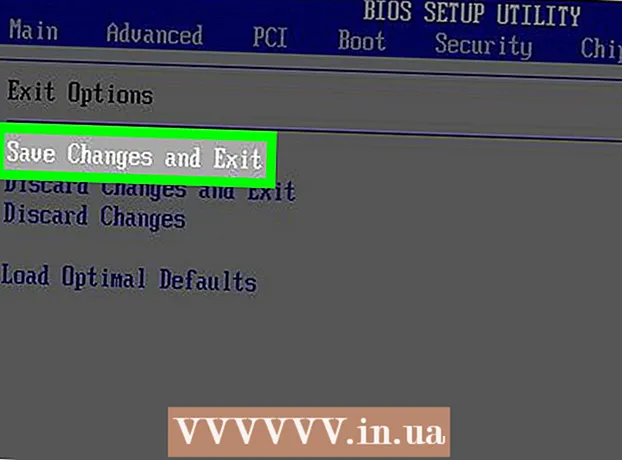

Decide how your household expenses, income, and budget are recorded. You can just use a pen and paper, but if you can afford it, it will be much easier to do calculations using spreadsheet software or a simple accounting software.

- You can find a sample of Kiplinger's budget calculation here.

- Accounting software like Quicken are almost calculated automatically because they are designed for this type of project. In addition, such software also has useful tools for budgeting, such as savings calculator. However, this software is not free, so you will have to pay a small amount to use.

- Many spreadsheet software have family budget calculation templates built in. You may have to tailor it to your own needs, but it's still much easier than starting from scratch.

- You can also use e-budgeting software like Mint.com, which helps you track your expenses.

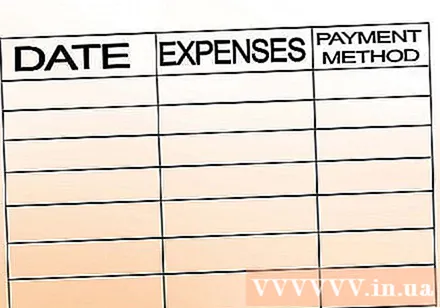

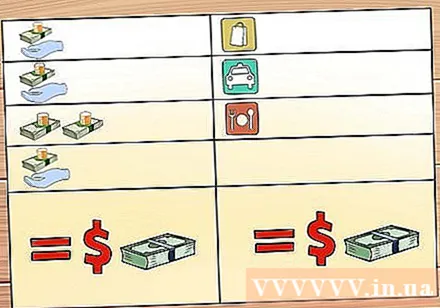

Format the columns in the spreadsheet. Starting from left to right, write down the headings for each column such as “pay date”, “amount spent”, “form of payment”, and “fixed / optional expense”.- You need to keep regular (daily or weekly) records of all your expenses and income. There are many software programs and applications on your mobile device that can help you record your expenses wherever you are.

- The form of payment column will help you know where to find your spending profile.For example, if you pay your monthly electricity bill by credit card to be redeemed for airline miles, note in the form of payment column.

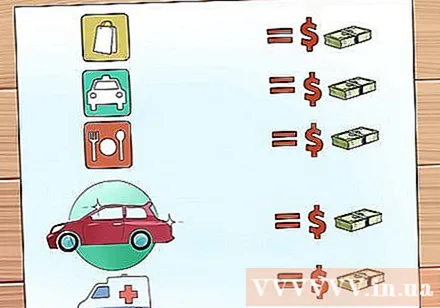

Sort your expenses. Each item needs to be itemized so you can easily see how much you spend on monthly or yearly bills, how much for regular necessities and how much you want to spend. This helps when you are spending money on expenses and when you want to review a specific expense. Common items include:- Rent / installment (remember to include insurance)

- Utilities such as electricity, water, and gas

- House cleaning services such as gardening services, housework

- Travel expenses (vehicle, gas, public transport fees, car insurance)

- Food and other dining expenses (going out to eat)

- Calculator software has the added benefit of being able to easily categorize expenses (food, gas, utilities, vehicles, insurance, etc.), as well as add totals in multiple ways. to know what you spend on, where, how much and by what form (credit card, cash, etc.) The software also allows you to divide your expenses by period and different priorities.

- If you are using a paper spreadsheet, you may have to dedicate a separate page to each item, depending on how much you spend in each item each month. If you use the software, you can easily insert rows so you can record more expenses.

Part 2 of 3: Recording expenses

Record large and regular expenses on a spreadsheet. Some examples include car payments, rent or mortgage payments, utilities (electricity, water, etc.), and insurance (health, etc.) Installments such as student loans. Membership and credit card are also listed here. Each expense is recorded in a separate row. Enter the estimated amount for the reservation until actual check is available.- Some costs like rent or installments are usually fixed monthly, while others fluctuate (like utilities). Enter an estimated amount of the bills (probably based on how much you paid the previous year for that expense), but once you have the bill sent in, write it down on the spreadsheet for the actual amount.

- Try to round up an estimated amount spent on each item.

- Some companies offer utility services that allow you to pay an average annual amount instead of monthly bills. You might consider this option if you focus on stability.

Calculate essential expenses. Think about the amounts you normally spend and how much. How much money do you spend on gas per week? How much food do you buy? Think about how much money you have to spend, not how much you want to spend. After recording these expenses in each row, write the estimated amount there. When you know your actual amount, write it down right away.- You should spend as you normally would, but need to get a receipt or note every time you withdraw your wallet to pay. At the end of the day add it up on paper or on your computer or phone. Remember to be specific about what you have spent, not as generic as "food" or "travel expenses".

- Software like Mint.com can help you categorize your expenses into categories like 'food', 'convenience' and 'junk shopping'. So you can see what you normally spend each month in each category.

You need to include any "discretionary" expenses on the spreadsheet. Here is the section for expensive items that you can cut or not give you the fun for the money. This category can cover everything from spending money in luxury places to lunch boxes and coffee.- Remember that each expense should be on a separate line. That way, your spreadsheets can be long until the end of the month, but you will be able to manage each expense if you separate them into separate rows.

Insert a row to record your savings. Not everyone can have enough money to save regularly, but everyone should make it a goal and do it if possible.- The ideal goal is to save 10% of your salary. That is enough for your savings to increase quite quickly but also without affecting other areas of your life. No one is strange that the scene is always at the end of the month. That is why we have to save first. Don't wait until the end of the month to save money.

- Adjust your savings if necessary, or better yet, adjust your spending patterns if possible! The money saved can later be used to invest or for other purposes such as buying a house, going to college, vacationing or other things.

- Some banks have free savings programs that you can sign up for, such as the Bank of America “keep money” program, where your money is rounded up with each transaction. by debit card, and the difference is credited to your savings account. You will also enjoy a certain percentage of this savings account. This type of program would be an easy and fuss-free way to save a little each month.

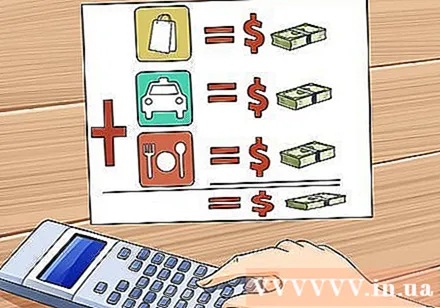

Add up all expenses each month. Add up each part, and then add all together. This way, you can see what the percentage of your income is spent in addition to your total expenses.

Record any income and add it up. List all revenues, including tips, earnings from “tax dodging” jobs (money you take home without filing taxes), earnings, and your wages (or balance sheet monthly if you are paid weekly).

- This is the amount of your salary, not the sum of your earnings for a period.

- Keep a record of income from all sources, just as detailed as you would when recording expenses. Add up weekly or monthly as appropriate.

Place total monthly income next to total monthly expenses. If your total spending exceeds your income then you have to think about cutting down on spending.

- Once you have detailed information on how much you spend on specific items and priorities, you will be able to determine which expenses you can cut.

- If your total monthly income is higher than your total expenses, you can save some money. This money can be used to buy another item in installments, pay college fees or be used for something big. Or you can "pick up" some money for small things like a trip or spa.

Part 3 of 3: Creating a new budget

Aim for expenses that can be cut. Set a specific limit on “discretionary” spending. Set a level of money that you cannot pass and stick to.

- You can still budget for whatever you want - you can't live without fun! However, setting a budget and sticking to the limit will help keep your spending under control. For example, if you regularly go to the movies, you should set the limit at 800,000 VND for movie tickets per month. Once you've spent all your 800,000, you'll have to stay away from the movies for the rest of the month.

- Even the essential spending part can be recalculated. Regular expenses should only make up a small part of your income. For example, food purchases should make up only 5 -15% of your budget. If you spend more than that, you should consider cutting back.

- Your spending percentage will change, of course; For example, food costs will fluctuate depending on the price of the food, the number of people in your family and special nutritional needs. It's important to make sure you don't spend money on unnecessary things. For example, do you often spend a lot of money on expensive processed foods that you can cook at home?

Estimate and include unexpected expenditures on the budget. By planning for unexpected, unexpected expenses like illness, car breakdown or home repairs won't have much of an impact on your overall budget and financial plan.

- Estimate how much money you'll have to spend on unexpected things in a year and divide the average by 12 to get a monthly budget.

- This provision will protect you from frightening fire and credit card debt, even if you exceed your weekly spending limit.

- If at the end of the year you don't have to use a backup, great! You will have an extra amount of money to put in a savings account or to save for investment plans in retirement.

Cost calculation for short, medium and long term goals. These are not unexpected expenses but are part of your plan. Do you need to change things in your home this year? Do you want to buy a new pair of boots? Or do you want to buy a car? Plan for them in advance and you won't have to withdraw money from your long-term savings account.

- Another important point, you should try to only shop when you have saved enough money for that item. Ask yourself, do I need it right now?

- Once you've actually spent your contingency on a surprise or planned expense, jot down your actual amount and delete the estimate, otherwise it may double.

Prepare a new budget. Combine your provisions and goals with your actual expenses and earnings. This way, you can not only create an effective budget but also save a fortune, so your life can be less busy and more relaxed. You will also be motivated to cut back to meet your goals and buy the things you always wanted without going into debt.

- Try to target on fixed amounts. Cut down on "impromptu" expenses whenever possible.

Advice

- Don't put all your money in one place or a bank account. Use checking accounts to pay for expenses, savings accounts for short-term goals, investment accounts for medium-term goals, and retirement accounts (in the US with 401k pension or IRA) for Long-term savings are tax deferred. Following this principle will help you get money in the right place when you need it, now and in the future.