Author:

Monica Porter

Date Of Creation:

17 March 2021

Update Date:

17 September 2024

Content

Investing in the equity market can be a great way to make money, especially in today's economic times when long-term savings accounts and bank bills aren't as profitable. Stock trading is not without risk, and losses are inevitable. However, if you research carefully and invest in the right company, you can make a lot of money.

Steps

Part 1 of 3: Getting Started

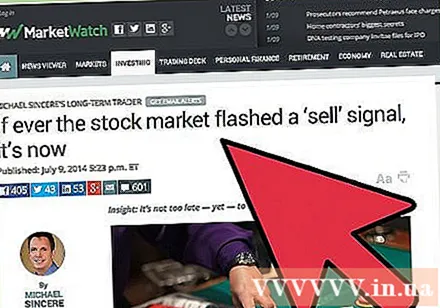

Research the current trend of the market. There are many reputable sources of market trend reporting. You can subscribe to stock exchange magazines like Kiplinger, Investor's Business Daily, Traders World, The Economist, or Bloomberg BusinessWeek.

- You can also follow the blogs of successful market analysts such as Abnormal Returns, Deal Book, Footnoted, Calculated Risk, or Zero Hedge.

Choose an exchange. Some highly regarded exchanges like Scottrade, OptionsHouse, TD Ameritrade, Motif Investing and TradeKing. Before deciding on which exchange to join, make sure you are fully informed about all transaction costs or deductible percentages.- Make sure to use a reputable service. You can refer to the article reviews about businesses online.

- Choose a service that offers a variety of utilities such as mobile apps, investment research and training tools, low transaction fees, easy-to-read data, and 24/7 customer service.

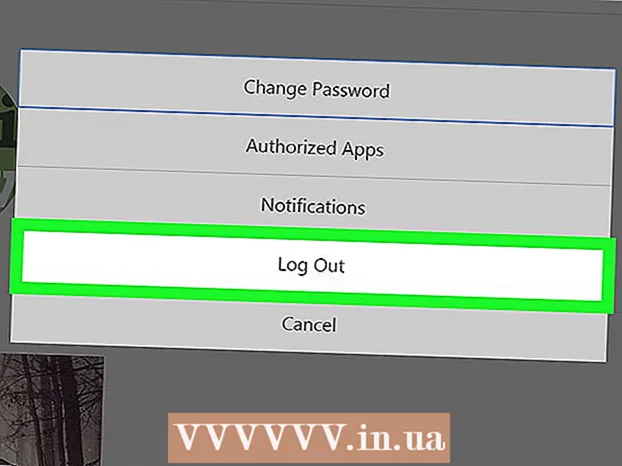

Create an account on one or more exchanges. You don't need to sign up for multiple exchanges, but when you get started you can create an account on two or more exchanges and then gradually narrow your options to the one you like best.- Remember to check the minimum balance requirements on each floor. Maybe you only have enough budget to create an account on one or two exchanges.

- Start small, like $ 1,000, although this may only allow you to join certain trading platforms, as many exchanges require a higher minimum balance.

Practice before trading with real money. Some exchanges like ScottradeELITE, SureTrader and OptionsHouse will give you virtual trading platforms to test for a while to gauge your capabilities and you don't need to spend real money. Of course, you can't make money trading virtual, but you won't lose money either!- Practicing trading in this way will familiarize you with the method and type of decisions you will face when trading but virtual trading as a whole does not fully represent the characteristics of actual trading. In the actual transaction, if you are slow to buy or sell, the price may be far from what you originally expected. Moreover, trading with virtual money will not feel as stressful as trading with real money.

Choose a reliable stock. There are many different options, but of course everyone just wants to buy stock from a company that has a major advantage in their business, a company with a popular stock, a company with a well-known brand. reputation, and have a good business model and a long history of success.

- Review your company's public financial statements to gauge profitability. A company with a higher return usually means that its stock also yields higher returns.You can visit the company's website and find complete financial information about all public transactions of the company in their most recent annual report. If there are no reports on the web, you can call the company directly and request a hard copy.

- Check the worst quarter of trading and check if the potential profit is worth the risk of repeating that quarter.

- Research the company's leadership, operating costs and debts. Analyze your balance sheet and income statement to determine if the company is highly profitable or likely to be profitable in the future.

- Compare the stock history of a particular company with its competitor. If all of the tech stocks were falling at the same time, instead of comparing them to the whole market, you should rate the company against each of the competitors so you can see which companies are stronger in the industry. this.

- Join the corporate income conference. But before you join, you must analyze the company's quarterly earnings report that was posted online as a press release about an hour before the conference.

Buy stock first. When you're ready, you can start buying some trustworthy stock. Depending on your budget, you can buy more or less, but try to buy at least two stocks. Well-known companies with long trading histories with good reputations are those with the most stable stocks and are the best places to start. Start trading small and determine your willingness to lose money.

- $ 1,000 is a reasonable level for a beginner to trade. You just need to be careful to avoid transactions with high fees, as too high fees can wipe your profits when your account balance is quite small.

Mainly invests in companies with small and medium capitalization. A company by market cap is a company with a market cap of between $ 2 and $ 10 billion. A company with a large market cap is a company with a market cap greater than $ 10 billion, while a company with a market cap less than $ 2 billion is a company with small capital.

- The capital market is calculated by multiplying the company's share price by the number of shares outstanding.

Track the market everyday. The golden rule in equities trading is to buy low and sell high. So if the value of your stock goes up, you might consider selling it and reinvest your profits in other stocks (with a lower price).

Consider investing in a mutual fund. A mutual fund is a fund managed by a professional manager and often combines many different stocks. Thus mutual funds can help diversify your portfolio across sectors such as technology, retail, finance, energy or foreign companies. advertisement

Part 2 of 3: Learn the basics of trading

Buy low. That is, you will buy a stock when its price is at a relatively low level in its trading history. Of course, no one knows for sure when the stock price will go up or down - that's the challenge of investing in stocks.

- To determine whether a stock is undervalued, look at the company's earnings per share as well as the sales and purchases of its employees. Search for a company in a specific niche and market that is highly volatile, as this is where you can make a lot of money.

Selling high. That is, you sold your stock at the peak in trading history. You can make a profit selling stocks at a price higher than the buy level. The larger the bid and ask difference, the more money you will make.

Don't sell when you panic. When the stock falls below its bid, you instinctively sell it. While it is possible that the security may continue to fall and never recover, you should consider the possibility of it rebounding. Selling at a loss is not always the best idea, because if you sell at that time, you are sure to have lost money.

Study on technical and fundamental market analysis methods. These are the two basic models for understanding the stock market and predicting price trends. The model you use will determine how and when to buy and sell your stock.

- Fundamental analysis method that makes decisions about a company based on its performance, personality and reputation, and who leads the company. This analysis is intended to create real value for a company, and extend to that company's stock.

- Technical analysis method is to observe the market as a whole and what motivates investors to buy and sell stocks. This involves looking at trends and analyzing investor responses to events.

- Many investors combine both methods to make investment decisions.

Consider investing in companies that pay dividends. Some investors, called yield investors, often prefer to invest almost entirely in dividend stocks. In this way of investing, stocks that you hold can still be profitable even if they are not appreciated in terms of price. Dividend is the profit of a company that is paid directly to shareholders quarterly. Whether to invest in this type of stock or not depends entirely on your personal goals as an investor. advertisement

Part 3 of 3: Developing a Stock Portfolio

Diversify your holdings. Once you have held stocks, and understood the stock trading process, you should diversify your stock portfolio. This means investing money in a variety of stocks.

- A startup can be a good choice for you after establishing a stock base in an established company. If a big company buys a startup, you can quickly make a lot of money. Note, however, that 90% of startups are less than 5 years old, which makes them a risky investment.

- Consider many different fields. If your initial stakes are primarily in the tech sector, you might want to consider looking at manufacturing or retail. This will help diversify your portfolio against the negative trends of each sector.

Reinvestment. After selling the stock (expect the selling price to be higher than the buying price), you should include both the principal and the profit of buying the new stock. If you can make a little profit daily or weekly, then you are on your way to equity market success.

- Consider depositing a portion of your profits in a savings or retirement account.

Investment in IPO (the abbreviation of the English phrase Initial Public Offering). An IPO means the initial public offering of a company. This may be a great time to buy stock in a company that you believe will be successful, as the IPO price per share is usually (but not always) the lowest.

Evaluate measurable risks when choosing stocks. The only way to make a lot of money in the equity market is to take risks and get a little bit of luck. This doesn't mean you should invest it all in risky investments and hope to get the best results. Equity investing is not the same as gambling. You should research every investment carefully and make sure you can recover financially if the situation worsens.

- On the other hand, playing solidly with a stable stock will usually not allow you to "beat the market" and make a high return. However, this type of stock tends to be stable, ie the risk of loss is lower. And with stable dividends and risk-taking into account, companies of this type are likely to be a much better investment than risky companies.

- You can also reduce your risk by hedging your investments. You can read more articles on how to prevent investment risks.

Be aware of the downsides of day trading. The broker will usually charge a fee for each transaction that can actually go up. If you live in the US and you earn more than a fixed amount every week from trading, the Security Exchange Commission (SEC) will require you to set up an account with a pretty high minimum balance.In addition, intraday trading carries a lot of risk of huge loss and is very stressful, so it's better to invest over a long period of time.

Consult the Certified Public Accountant (CPA). When making a lot of money in the stock market, you may need to consult with your accountant about paying taxes on your profits. While it is best to consult a tax professional, you can still do full research on this information yourself so that you won't lose money on hiring an expert.

Recognize when to retreat. Trading on the stock market is like legal gambling and is not a loyal investment in the long run. This is the difference compared to investment, investment is longer and safer. Some people may become obsessed with trading, which can cost them a lot of money (even losing all their capital). If you feel that you are losing control of your ability to make the right choices for your investment, try to get help before losing out completely. If you know the expert who is good, discerning, objective, and not emotionally emotional, you can ask him or her to help you when you feel out of control. advertisement