Author:

Christy White

Date Of Creation:

6 May 2021

Update Date:

1 July 2024

Content

- To step

- Method 1 of 3: Calculate compound interest

- Method 3 of 3: Using a worksheet to calculate compound interest

- Tips

While the interest on savings deposits is sometimes easy to calculate by multiplying the interest rate by the opening balance, in most cases it is not that easy. For example, many savings accounts report interest on an annual basis, but charge compound interest on a monthly basis. Each month, a fraction of the annual interest is calculated and added to your balance, which in turn affects the calculation of the following months. This interest cycle, where interest is calculated incrementally and continuously added to your balance, is called compound interest, and the easiest way to calculate future balance is to use a compound interest formula. Read on to learn the ins and outs of these types of interest calculations.

To step

Method 1 of 3: Calculate compound interest

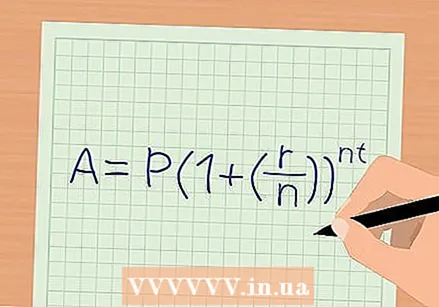

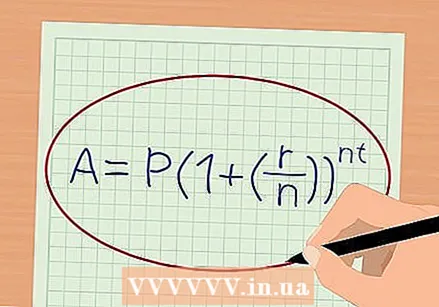

Know the formula for calculating the effect of compound interest. The formula for calculating compound interest accumulation on a given balance is:

Know the formula for calculating the effect of compound interest. The formula for calculating compound interest accumulation on a given balance is:  Determine the variables used in the formula. Read the conditions of your private account or contact an employee of your bank to complete the equation.

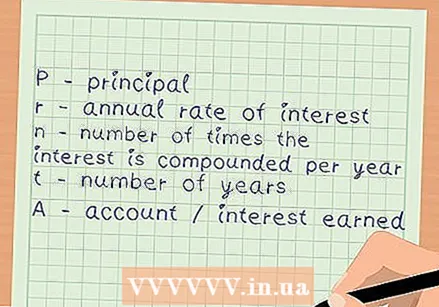

Determine the variables used in the formula. Read the conditions of your private account or contact an employee of your bank to complete the equation. - The capital (P) is the first amount deposited into the account or the current amount that you assume for the interest calculation.

- The interest rate (r) must be in decimal form. An interest of 3% must be entered as 0.03. To do this, divide the stated interest rate by 100.

- The value of (n) is the number of times per year that the interest is calculated and added to your balance (also called compound). Interest is usually compounded monthly (n = 12), quarterly (n = 4), or annually (n = 1), but there may be other options depending on your specific account terms.

Plug your values into the formula. Once you determine the values for each variable, you can enter them into the compound interest formula to determine the interest over the specified timescale. For example, with the values P = 1000, r = 0.05 (5%), n = 4 (compounded per quarter) and t = 1 year, we get the following equation:

Plug your values into the formula. Once you determine the values for each variable, you can enter them into the compound interest formula to determine the interest over the specified timescale. For example, with the values P = 1000, r = 0.05 (5%), n = 4 (compounded per quarter) and t = 1 year, we get the following equation:  Do the calculation. Now that the numbers have been entered, it is time to solve the formula. Start by simplifying the simple parts of the equation. Divide the annual interest by the number of installments to get the periodic interest rate (in this case

Do the calculation. Now that the numbers have been entered, it is time to solve the formula. Start by simplifying the simple parts of the equation. Divide the annual interest by the number of installments to get the periodic interest rate (in this case  Solve the equation. Then solve for the exponent by raising the last step to the power of four (i.e.

Solve the equation. Then solve for the exponent by raising the last step to the power of four (i.e.  First, use the accumulated interest formula. You can also calculate interest on an account to which you transfer regular monthly contributions. This is useful if you save a certain amount every month and put that money in your savings account. The full equation goes like this:

First, use the accumulated interest formula. You can also calculate interest on an account to which you transfer regular monthly contributions. This is useful if you save a certain amount every month and put that money in your savings account. The full equation goes like this:  Use the second part of the formula to calculate the interest on your deposits. (PMT) represents the amount of your monthly deposit.

Use the second part of the formula to calculate the interest on your deposits. (PMT) represents the amount of your monthly deposit.  Determine your variables. Check your account or investment agreement to find the following variables: capital "P", the annual interest rate "r" and the number of installments per year "n". If these variables are not immediately available, please contact your bank to request this information. The variable "t" represents the number of years (or parts thereof) over which is calculated and "PMT" represents the payment / contribution per month. The value "A" represents the total value of the account after a period of your choice and deposits.

Determine your variables. Check your account or investment agreement to find the following variables: capital "P", the annual interest rate "r" and the number of installments per year "n". If these variables are not immediately available, please contact your bank to request this information. The variable "t" represents the number of years (or parts thereof) over which is calculated and "PMT" represents the payment / contribution per month. The value "A" represents the total value of the account after a period of your choice and deposits. - The principal or capital "P" represents the balance of the account on the date you initiate the calculation.

- The interest rate "r" represents the interest paid on the account each year. It must be expressed as a decimal number in the equation. That is to say: an interest of 3% is noted as 0.03. You get this number by dividing the specified cost percentage by 100.

- The value "n" represents the number of times the interest is compounded annually. This is 365 for a daily, 12 monthly and 4 for a quarterly compounded interest.

- The value for "t" represents the number of years over which you calculate future interest. This is the number of years or a fraction of a year, assuming less than a year (eg 0.0833 (1/12) for one month).

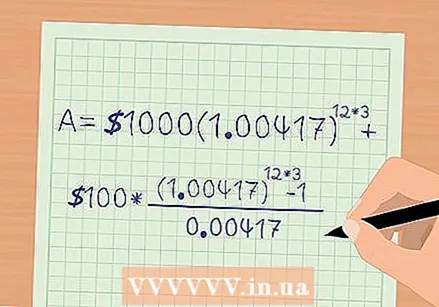

Plug your values into the formula. Using the example of P = 1000, r = 0.05 (5%), n = 12 (compounded monthly), t = 3 years, and PMT = 100, we get the following equation:

Plug your values into the formula. Using the example of P = 1000, r = 0.05 (5%), n = 12 (compounded monthly), t = 3 years, and PMT = 100, we get the following equation:  Simplify the equation. Start by simplifying the goal

Simplify the equation. Start by simplifying the goal  Solve the exponents. First solve the terms within the exponents,

Solve the exponents. First solve the terms within the exponents,  Do the final calculations. Multiply the first part of the equation and you get $ 1,616. Solve the second part of the equation by first dividing the numerator by the denominator of the fraction, and you get

Do the final calculations. Multiply the first part of the equation and you get $ 1,616. Solve the second part of the equation by first dividing the numerator by the denominator of the fraction, and you get  Calculate your total interest earned. In this equation, the actual interest is the total amount (A) minus the principal (P) and the number of payments times the deposit (PMT * n * t). So in the example:

Calculate your total interest earned. In this equation, the actual interest is the total amount (A) minus the principal (P) and the number of payments times the deposit (PMT * n * t). So in the example: and after that

.

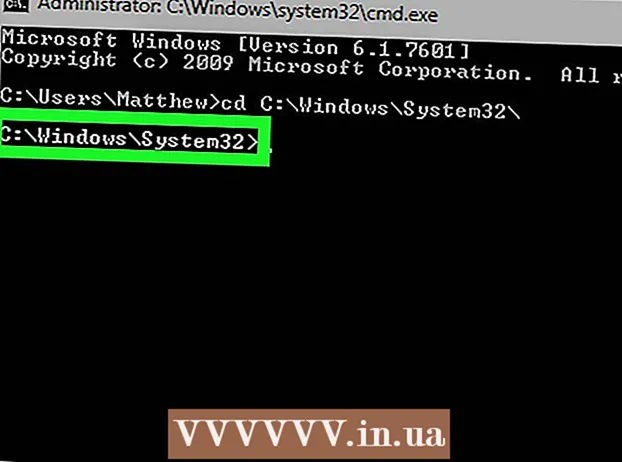

Method 3 of 3: Using a worksheet to calculate compound interest

- Open a new worksheet. Excel and similar spreadsheet programs (such as Google Sheets) can save you time doing these calculations for you, and even provide shortcuts in the form of built-in financial functions to help calculate compound interest.

- Name your variables. When using a worksheet it is always helpful to be as organized and clear as possible. Start by naming a column of cells with the important information you will use in your calculation (e.g., interest, principal, time, n, deposits).

- Enter your variables. Now enter the information you have about your specific account in the next column. Not only does this make the worksheet easier to read and interpret later, it also leaves room for you to change one or more of the variables at a later time to look at different potential savings scenarios.

- Draw up your equation. The next step is to enter your own version of the accrued interest equation (

), or the extended version that takes into account your regular monthly deposits (

). Using any empty cell, start with a "=", and use normal mathematical conventions (parentheses where necessary) to enter the correct equation. Instead of entering variables such as (P) and (n), type the corresponding names of the cell where you have stored the data values, or else simply click the desired cell while editing your equation.

- Use financial functions. Excel also offers certain financial functions that can help you with your calculation. Especially "future value" (TW) can be used because it calculates the value of an account at some point in the future, given the same variables you have become accustomed to by now. To access this function, go to an empty cell and type "= TW (". Excel will then display a help box once you open the function bracket to help you enter the correct parameters for the function.

- The "future value" feature is designed to prepay an account balance while it continues to accumulate interest, rather than with accumulating savings interest. As a result, it automatically returns a negative number. You can work around this problem by typing:

- The TW function takes similar data parameters separated by commas, but not exactly the same. For example: "interest" refers to

(the annual interest rate divided by "n"). This will automatically calculate the terms within parentheses of the TW function.

- The "number of installments" parameter refers to the variable

the total number of installments over which the accumulation is calculated and the total number of payments. In other words, if your PMT is not 0, the TW function will assume you are adding the PMT amount over each period, as defined by "number of terms".

- Note that this function is mostly used for (things like) calculating how the principal of a mortgage has been paid off over time, through regular payments. For example, if you plan to pay every month for five years, then "number of installments" becomes 60 (5 years x 12 months).

- "Bet" is your regular contribution during the entire period (one contribution per "n")

- "[Hw]" (present value) is the principal - the opening balance of your account.

- The last variable, "[type_num]" can be left blank for this calculation (in which case the function automatically sets it to 0).

- The TW function offers the possibility to do some basic calculations within the function parameters, for example the fully completed function TW can look like this:

. This indicates an annual interest of 5% that is compounded monthly for 12 months, over which period you deposit € 100 / month with an opening balance (principal) of € 5,000. The answer to this function will give you the account balance after 1 year ($ 6,483.70).

- The "future value" feature is designed to prepay an account balance while it continues to accumulate interest, rather than with accumulating savings interest. As a result, it automatically returns a negative number. You can work around this problem by typing:

Tips

- It is also possible, albeit more complex, to calculate compound interest on an account with irregular payments. This method calculates the interest accumulation of each payment / contribution individually (using the same equation as described above) and is best done with a worksheet to make the calculation easier.

- You can also use a free online annual interest calculator to determine the interest on your savings account. Search the Internet for "annual interest calculator" or "annual percentage interest calculator" for a list of websites that offer this service for free.