Author:

Roger Morrison

Date Of Creation:

28 September 2021

Update Date:

1 July 2024

Content

This wikiHow teaches you how to calculate the Net Present Value (NPV) of an investment using Microsoft Excel. You can do this with both the Windows and Mac versions of Excel.

To step

Make sure you have the investment data to hand. To calculate NPV, you need the annual discount rate (e.g., 1 percent), the initial amount invested and at least one year of return on investment.

Make sure you have the investment data to hand. To calculate NPV, you need the annual discount rate (e.g., 1 percent), the initial amount invested and at least one year of return on investment. - Three or more years of return on investment is ideal, but not necessary.

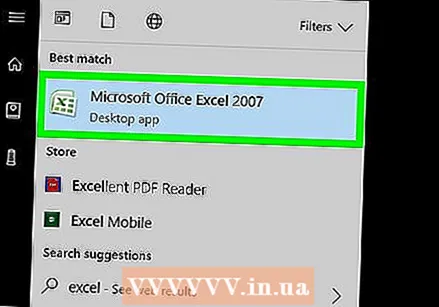

Open Microsoft Excel. This program's icon is a green square with a white "X" in it.

Open Microsoft Excel. This program's icon is a green square with a white "X" in it.  click on Blank briefcase. You can find this at the top left of the Excel window.

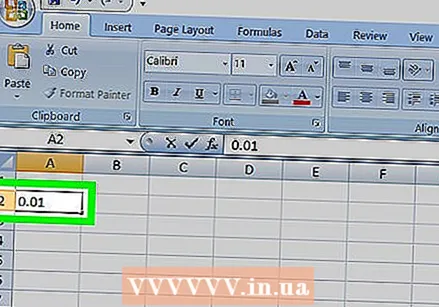

click on Blank briefcase. You can find this at the top left of the Excel window.  Enter your discount rate. Select a cell (e.g., A2), and enter the decimal equivalent of your annual discount rate.

Enter your discount rate. Select a cell (e.g., A2), and enter the decimal equivalent of your annual discount rate. - For example, if the discount rate is 1 percent, enter here 0,01 in.

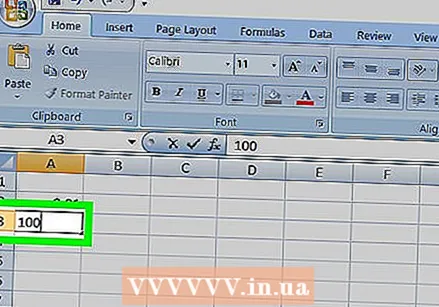

Enter the initial amount invested. Select an empty cell (e.g., A3) and enter the initial amount invested.

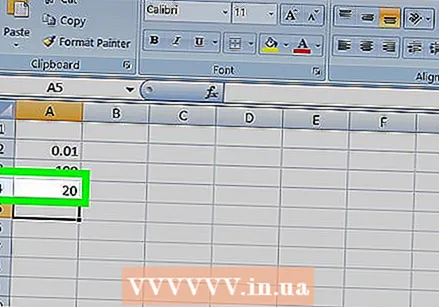

Enter the initial amount invested. Select an empty cell (e.g., A3) and enter the initial amount invested.  Enter the return on investment for each year. Select an empty cell (e.g., A4), enter the first year return on investment, and repeat for each subsequent year for which you have a return.

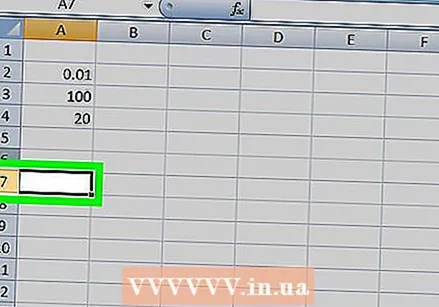

Enter the return on investment for each year. Select an empty cell (e.g., A4), enter the first year return on investment, and repeat for each subsequent year for which you have a return.  Select a cell. Click on a cell in which you want to calculate the NPV.

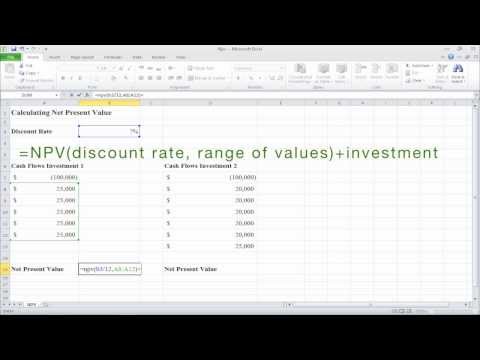

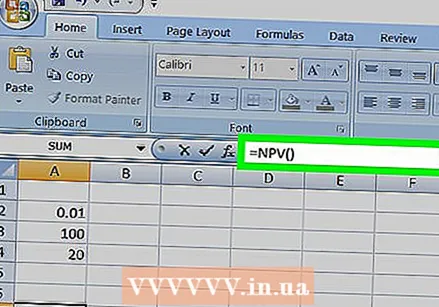

Select a cell. Click on a cell in which you want to calculate the NPV.  Enter the start of the NPV formula. Type = NPV (). The information about your investment is shown in brackets.

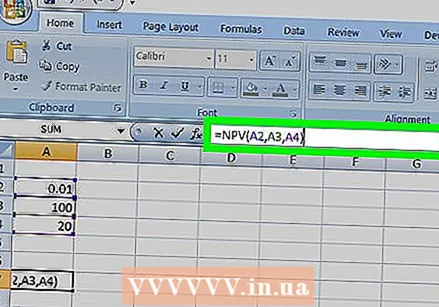

Enter the start of the NPV formula. Type = NPV (). The information about your investment is shown in brackets.  Add values to the NPV formula. Within the brackets, enter the numbers of the cells with the discount rate, the amount invested and at least one return on investment.

Add values to the NPV formula. Within the brackets, enter the numbers of the cells with the discount rate, the amount invested and at least one return on investment. - For example, if your discount rate is in cell A2 state, the amount invested A3, and the return on investment in A4, your formula will look like this: = NPV (A2, A3, A4).

Press ↵ Enter. This will allow Excel to calculate the NPV and display it in the selected cell.

Press ↵ Enter. This will allow Excel to calculate the NPV and display it in the selected cell. - If the NPV is red, the value of the investment is negative.

Tips

- The NPV can be used to predict future investments, if you are confident in the current returns.

Warnings

- You cannot calculate NPV without an investment return.