Author:

Judy Howell

Date Of Creation:

3 July 2021

Update Date:

1 July 2024

Content

- To step

- Part 1 of 4: Prepare for your success

- Part 2 of 4: Increase your basic knowledge of investing

- Part 3 of 4: Investing safely

- Part 4 of 4: Investing with more risk

- Tips

- Warnings

Whether you have $ 20 or $ 200,000 (or $ 20 or $ 165 ...) to invest, the goal is the same: to grow your capital. But the way you do that is highly dependent on how much money you have available and your investment style. Below you can read how to invest effectively so that you can live on the proceeds.

To step

Part 1 of 4: Prepare for your success

Make sure you have an emergency fund on hand. If you don't have a spare savings bank yet, you would do well to save enough money to live on for 3 to 6 months, in case that - or an emergency fund. You are not supposed to invest this money; you must have direct access to it and it must not be subject to market fluctuations.You can split the amount you have left every month by putting one part in your emergency fund and investing the other part.

Make sure you have an emergency fund on hand. If you don't have a spare savings bank yet, you would do well to save enough money to live on for 3 to 6 months, in case that - or an emergency fund. You are not supposed to invest this money; you must have direct access to it and it must not be subject to market fluctuations.You can split the amount you have left every month by putting one part in your emergency fund and investing the other part. - Whatever you do, do not commit all your money to investments, but always have a financial safety net on hand. After all, everything can go wrong (you can lose your job, get hurt or become ill) and it is irresponsible not to be prepared for that.

Pay off any debts you have, especially if they are burdened with a high interest rate. If you have yet to pay off a loan or have a credit card debt that you pay a high interest on (more than 10%), there is no point in investing the money that you have worked so hard for. Of what you will earn in interest by investing (this is usually less than 10%) you will not have much left because you will spend more on paying off your debt.

Pay off any debts you have, especially if they are burdened with a high interest rate. If you have yet to pay off a loan or have a credit card debt that you pay a high interest on (more than 10%), there is no point in investing the money that you have worked so hard for. Of what you will earn in interest by investing (this is usually less than 10%) you will not have much left because you will spend more on paying off your debt. - For example, Sam has saved $ 4,000 to invest, but he also has a $ 4,000 credit card debt on which he pays 14% interest. He could invest that $ 4,000 if he got a 12% return on investment (aka return on investment or ROI for short) - and this is a very optimistic scenario), because then he would have earned $ 480 in interest within a year. But he will have to pay $ 560 in interest to the credit card company at the same time. So he is left with a negative balance of $ 80 while he is still always who has not paid off principal debt of $ 4,000. So why would he go to all that trouble?

- So first pay that debt charged with high interest so that everything you earn with your investment is really yours. Otherwise, the only investors who make any money out of it are those who lent you the money at that high interest rate.

- For example, Sam has saved $ 4,000 to invest, but he also has a $ 4,000 credit card debt on which he pays 14% interest. He could invest that $ 4,000 if he got a 12% return on investment (aka return on investment or ROI for short) - and this is a very optimistic scenario), because then he would have earned $ 480 in interest within a year. But he will have to pay $ 560 in interest to the credit card company at the same time. So he is left with a negative balance of $ 80 while he is still always who has not paid off principal debt of $ 4,000. So why would he go to all that trouble?

Write down your goals. As you pay off your debts and build your emergency fund, think about why you want to invest. How much money would you like to make, and how long would you like to spend on it? Based on your objectives, you then determine whether you want to invest in a more aggressive or a more conservative way. If you want to go back to college in three years, you probably choose a safe way to invest. If you're saving for retirement at the age of 30, you can afford to bet a little higher and take a little more risk. In summary, the objectives are different for every investor. And those objectives determine which investment strategy you can best follow. Would you:

Write down your goals. As you pay off your debts and build your emergency fund, think about why you want to invest. How much money would you like to make, and how long would you like to spend on it? Based on your objectives, you then determine whether you want to invest in a more aggressive or a more conservative way. If you want to go back to college in three years, you probably choose a safe way to invest. If you're saving for retirement at the age of 30, you can afford to bet a little higher and take a little more risk. In summary, the objectives are different for every investor. And those objectives determine which investment strategy you can best follow. Would you: - Securing money so that the value stays just above inflation?

- Have money available for a down payment that you plan to make in 10 years?

- Saving for your retirement in the distant future?

- Saving up for one of your children or grandchildren to study?

Decide whether you want to work with a financial planner. A financial partner is a kind of coach who knows the rules of the game: he or she knows what you can do best in certain situations, and what results you can expect. Although to invest, you are not necessarily a financial planner required you will quickly realize that it is very useful to work with someone who knows the trends in the market, understands investment strategies and helps you spread your risks.

Decide whether you want to work with a financial planner. A financial partner is a kind of coach who knows the rules of the game: he or she knows what you can do best in certain situations, and what results you can expect. Although to invest, you are not necessarily a financial planner required you will quickly realize that it is very useful to work with someone who knows the trends in the market, understands investment strategies and helps you spread your risks. - Keep in mind that you have to pay your financial planner either a flat fee or a percentage between 1% and 3% of the total amount you ask him or her to manage for you. So if you start with $ 10,000, expect a fee of $ 300 per year. Keep in mind that most are financial top planners only advise clients with a portfolio of at least $ 100,000, $ 500,000 or $ 1 million.

- Does this seem like a lot to spend on advice? Maybe at first glance, but not anymore once you find out that a good financial planner will help you make money. If a financial planner earns 2% of your total portfolio of $ 100,000 but helps you earn 8%, you will earn roughly $ 6,000 net. And that's not a bad deal.

Part 2 of 4: Increase your basic knowledge of investing

The higher the risk of your investment, the greater the potential return. The reason for this is that investors want to earn more from taking greater risks - like a bookmaker or addsmaker calculating odds in sports betting. Investments with a very low risk, such as bonds or term deposits, usually yield very little. Investments that yield more are usually much more risky, such as very low value stocks (so-called penny stocks) or consumer goods. In summary, with more risky investments the chance that things will go wrong is high, while there is a small chance of a high profit, while with a conservative bet the chance that it will go wrong is small, while you have a high chance of a low profit.

The higher the risk of your investment, the greater the potential return. The reason for this is that investors want to earn more from taking greater risks - like a bookmaker or addsmaker calculating odds in sports betting. Investments with a very low risk, such as bonds or term deposits, usually yield very little. Investments that yield more are usually much more risky, such as very low value stocks (so-called penny stocks) or consumer goods. In summary, with more risky investments the chance that things will go wrong is high, while there is a small chance of a high profit, while with a conservative bet the chance that it will go wrong is small, while you have a high chance of a low profit.  Spread the risk as much as possible. You always run the risk that the amount you invest will shrink or disappear due to incorrect management. Strive to keep it alive for as long as possible so that it has as many opportunities as possible to grow and multiply. With a well-diversified portfolio you have limited exposure to risk so that your investments have enough time to generate serious profit. Professional investors not only invest their money in different types of investments - stocks, bonds, index funds - but also in different sectors.

Spread the risk as much as possible. You always run the risk that the amount you invest will shrink or disappear due to incorrect management. Strive to keep it alive for as long as possible so that it has as many opportunities as possible to grow and multiply. With a well-diversified portfolio you have limited exposure to risk so that your investments have enough time to generate serious profit. Professional investors not only invest their money in different types of investments - stocks, bonds, index funds - but also in different sectors. - Consider spreading your investments in this way. If you only have one stock, your fate depends entirely on how well this stock is doing. If the stock is doing well, that's fine, but if not, you're left with the baked pears. If you have 100 stocks, 10 bonds, and trade 35 consumer goods, you have a higher chance of success: even if 10 of your stocks are performing poorly, or all of your consumer goods suddenly become worthless, you still won't go out of business.

Always buy, sell and invest for a clear reason. Before you decide to invest even one cent, always determine for yourself the reason (s) why you choose to invest in that share. Just the fact that you have seen a stock's value rise steadily over the past three months and want to take advantage of it at the right time is not enough. That's called gamble, instead of investing; you then rely on your luck instead of following a strategy. The most successful investors can always explain why their investments have a good chance of success on the basis of a theory, even if the future is uncertain.

Always buy, sell and invest for a clear reason. Before you decide to invest even one cent, always determine for yourself the reason (s) why you choose to invest in that share. Just the fact that you have seen a stock's value rise steadily over the past three months and want to take advantage of it at the right time is not enough. That's called gamble, instead of investing; you then rely on your luck instead of following a strategy. The most successful investors can always explain why their investments have a good chance of success on the basis of a theory, even if the future is uncertain. - For example, ask yourself why you plan to invest in an index fund like the Dow Jones. Continue. Why? Because gambling on the Dow Jones is the same as gambling on the US economy. Why? Because the Dow Jones is a collection of 30 top US stocks. Why is that good? Because the US economy is recovering from recession and the picture of its larger financial gauges is favorable.

Invest - especially in stocks - in the long term. Many people see the stock market as an opportunity to make a quick buck. And while it is certainly possible to make a lot of profit on shares in a short period of time, the odds are not that great. For any person who makes a lot of money by investing for a short period of time, 99 others quickly make big losses. Again, if you are investing money in an investment for a short period of time hoping to make a big profit, you are gambling instead of investing. And as far as bettors are concerned, it is only a matter of time before they bet wrong and lose everything.

Invest - especially in stocks - in the long term. Many people see the stock market as an opportunity to make a quick buck. And while it is certainly possible to make a lot of profit on shares in a short period of time, the odds are not that great. For any person who makes a lot of money by investing for a short period of time, 99 others quickly make big losses. Again, if you are investing money in an investment for a short period of time hoping to make a big profit, you are gambling instead of investing. And as far as bettors are concerned, it is only a matter of time before they bet wrong and lose everything. - Day trading in the stock market is not a good strategy for success for two reasons: Because of the unpredictability of the market and because of the costs.

- In particular, the market is unpredictable short-term. It is virtually impossible to determine how a stock will behave per day. Even large companies with very good prospects can have their days that are not so good. Long-term investors beat short-term investors when it comes to predictability. Historically, the long-term yield of stocks has always been about 10%. You can never be so sure that you will make a 10% profit on any given day, so why risk it?

- You have to pay costs and taxes on every purchase or sale. Simply put, investors who buy and sell on a daily basis spend a lot more on costs than investors who simply grow their piggy bank. All those costs and taxes add up to a large amount that you have to deduct from any profit you may have made.

Invest in companies and sectors that you understand. Invest in something you understand, because then you will know better when the company or industry is doing well and when it is not. A corollary of this is a statement by famous American investor Warren Buffet: "... buy shares of companies that are doing so well that any idiot can run them. Because sooner or later they will indeed be run by an idiot." The most profitable acquisitions of the famous investor included Coca Cola, McDonald's and the waste management industry.

Invest in companies and sectors that you understand. Invest in something you understand, because then you will know better when the company or industry is doing well and when it is not. A corollary of this is a statement by famous American investor Warren Buffet: "... buy shares of companies that are doing so well that any idiot can run them. Because sooner or later they will indeed be run by an idiot." The most profitable acquisitions of the famous investor included Coca Cola, McDonald's and the waste management industry.  Get good coverage. Covering yourself means making sure you have an investment plan “B” in hand. Coverages are intended to offset losses by investing in the scenario of which you are not want it to become reality. It may sound contradictory to bet on something and not at the same time, but when you think about it, it lowers your risk significantly, and a lower risk is good. A few good options for an investor to hedge are trading futures or forward contracts and selling or “going short”.

Get good coverage. Covering yourself means making sure you have an investment plan “B” in hand. Coverages are intended to offset losses by investing in the scenario of which you are not want it to become reality. It may sound contradictory to bet on something and not at the same time, but when you think about it, it lowers your risk significantly, and a lower risk is good. A few good options for an investor to hedge are trading futures or forward contracts and selling or “going short”.  Buy at a low price. Whatever you decide to invest in, try to buy it when it is "for sale" - in other words, buy it when no one else is buying it. For example, the best time to buy property is at a buyer's market, which means that there are many homes for sale in relation to the number of potential buyers. When people are very eager to sell, you have more room to negotiate, especially if you can see what the potential return on the investment will be when others cannot.

Buy at a low price. Whatever you decide to invest in, try to buy it when it is "for sale" - in other words, buy it when no one else is buying it. For example, the best time to buy property is at a buyer's market, which means that there are many homes for sale in relation to the number of potential buyers. When people are very eager to sell, you have more room to negotiate, especially if you can see what the potential return on the investment will be when others cannot. - An alternative to buying at a low price (after all, you never know for sure when the price is low enough) is to buy at a reasonable price and sell at a higher price. When a stock is "cheap", say 80% of the 52-Week High (the highest price the stock has traded in the last 12 months), there is always a reason. Shares don't fall in value in the same way as houses. When stocks fall in value it usually means that there is a problem with the business, while house prices are falling not because there is a problem with the house, but because the overall demand for houses is low.

- However, during a period of general economic downturn, you can often find stocks that have fallen in value due to an overall "sell-off." To find these good attractive offers, you have to evaluate extensively. Try to buy stock on sale when the company's valuation indicates that the stock price in question should be higher.

Stay calm in troubled times. If you invest in more volatile resources, you may be tempted to gamble. When you see that the value of your investments is falling, you will soon start seeing ghosts. However, doing a little research will probably give you a better understanding of what you are getting into and can decide at an early stage how to respond to fluctuations in the market. If your stocks fall in value, re-research and see how the fundamentals are doing. If you are confident in the stock, keep it or, even better, buy more at a better price. But if you no longer trust the stock and there have been significant changes in fundamentals, you better sell it. However, keep in mind that when you sell your stock out of fear, everyone does the same. When you want to get rid of your share, you give someone else the chance to buy it cheaply.

Stay calm in troubled times. If you invest in more volatile resources, you may be tempted to gamble. When you see that the value of your investments is falling, you will soon start seeing ghosts. However, doing a little research will probably give you a better understanding of what you are getting into and can decide at an early stage how to respond to fluctuations in the market. If your stocks fall in value, re-research and see how the fundamentals are doing. If you are confident in the stock, keep it or, even better, buy more at a better price. But if you no longer trust the stock and there have been significant changes in fundamentals, you better sell it. However, keep in mind that when you sell your stock out of fear, everyone does the same. When you want to get rid of your share, you give someone else the chance to buy it cheaply.  Sell at a high price. When the stock market picks up again, it is a good time to sell your investments again, especially the cyclical stocks. Use the profit for a new investment that is valued higher (but of course by buying at a low price) and try to do this under a tax regime that allows you to completely reinvest (instead of of having to pay tax on it first). Examples of this in the United States are the so-called 1031 exchanges (in real estate) and Roth IRAs.

Sell at a high price. When the stock market picks up again, it is a good time to sell your investments again, especially the cyclical stocks. Use the profit for a new investment that is valued higher (but of course by buying at a low price) and try to do this under a tax regime that allows you to completely reinvest (instead of of having to pay tax on it first). Examples of this in the United States are the so-called 1031 exchanges (in real estate) and Roth IRAs.

Part 3 of 4: Investing safely

Invest in savings accounts. Savings accounts, while a savings account is not officially an investment vehicle, requires a low or no minimum balance. They are liquid assets, so you are free to withdraw and use the money, but you usually only have a limited number of accesses to the account. Interest rates are low (usually much lower than inflation) and they are predictable. You will never lose money in a savings account, but you will never earn much from it.

Invest in savings accounts. Savings accounts, while a savings account is not officially an investment vehicle, requires a low or no minimum balance. They are liquid assets, so you are free to withdraw and use the money, but you usually only have a limited number of accesses to the account. Interest rates are low (usually much lower than inflation) and they are predictable. You will never lose money in a savings account, but you will never earn much from it.  Try a so-called money market account (a Money Market Account or MMA in English for short). A money market account requires a higher minimum balance than a savings account, but the interest can be twice as high as the interest earned in a savings account. Money market accounts are liquid but the number of times you can access the account is limited. The interest rates of many money market accounts are the same as those of the prevailing market interest rates.

Try a so-called money market account (a Money Market Account or MMA in English for short). A money market account requires a higher minimum balance than a savings account, but the interest can be twice as high as the interest earned in a savings account. Money market accounts are liquid but the number of times you can access the account is limited. The interest rates of many money market accounts are the same as those of the prevailing market interest rates.  You can also save by means of a term deposit. In a term deposit, an investor lays down an amount for a specific period, usually 1, 5, 10, or 25 years. During this period, the investor cannot access the money. The longer the term of the term deposit, the higher the interest. Term deposits are offered by banks, companies specializing in stock brokering and independent sellers. They carry a low risk, but the liquidity they offer is therefore relatively very limited. Term deposits can be very useful as collateral, especially if you don't need your cash right away.

You can also save by means of a term deposit. In a term deposit, an investor lays down an amount for a specific period, usually 1, 5, 10, or 25 years. During this period, the investor cannot access the money. The longer the term of the term deposit, the higher the interest. Term deposits are offered by banks, companies specializing in stock brokering and independent sellers. They carry a low risk, but the liquidity they offer is therefore relatively very limited. Term deposits can be very useful as collateral, especially if you don't need your cash right away. - Invest in bonds. A bond is basically a loan taken out by the government or a company that is later repaid with interest. Bonds are considered a guarantee of a "steady income" because they provide a steady income that is independent of market conditions. She will need to know the face value (the amount borrowed), the coupon rate (fixed rate), and the term (when the principal loan and interest are due) of each bond you buy or sell. The safest bond for investors in the US is currently a US Treasury note (T-note).

- A bond works like this: Company ABC issues a 5-year bond with a value of $ 10,000 and a coupon rate of 3%. Investor XYZ buys the bond and lends $ 10,000 to ABC company. Typically, company ABC pays investor XYZ 3% of the $ 10,000, or $ 300, every six months for the right to use the money. After five years and 10 payments of $ 300, investor XYZ will get back his or her original $ 10,000 loan.

Invest in stocks. Shares are usually sold through intermediaries; you buy pieces (shares) of a public company, which gives you decision-making power (usually the right to vote to elect the board). You may also receive a part of the profit in the form of a dividend. Another option is dividend reinvestment plans (DRPs) and direct share buyback plans (DSPs). Within these plans, the buyer avoids the middleman (and the commissions they charge) by buying the stock directly from the companies or their agents. This plan is offered by more than 1,000 major companies. Stock market amateurs can invest from as little as $ 20-30 per month and it is also possible to buy fractions of shares.

Invest in stocks. Shares are usually sold through intermediaries; you buy pieces (shares) of a public company, which gives you decision-making power (usually the right to vote to elect the board). You may also receive a part of the profit in the form of a dividend. Another option is dividend reinvestment plans (DRPs) and direct share buyback plans (DSPs). Within these plans, the buyer avoids the middleman (and the commissions they charge) by buying the stock directly from the companies or their agents. This plan is offered by more than 1,000 major companies. Stock market amateurs can invest from as little as $ 20-30 per month and it is also possible to buy fractions of shares. - Is investing in stocks really "safe"? It depends on! If you follow the investment advice above, invest in good stocks and manage them well over a longer period of time, they are very safe and very profitable. If you start speculating with stocks by buying them in the morning and selling them in the evening, they are a much riskier form of investing.

- If you prefer an extra safe share package, you can also opt for a mutual fund. Mutual funds are collections of shares bundled by a fund manager. Fund managers, who are not insured through a government body, build in diversification. Some funds require a low purchase amount at the outset, and sometimes you will have to pay an annual management fee.

Invest in retirement accounts. For the common man, retirement accounts are perhaps the most popular way to invest. There are a wide variety of retirement accounts that are safe, stable and provide good returns for the investor. But within the US, none is as popular as the 401 (k) and Roth IRAs.

Invest in retirement accounts. For the common man, retirement accounts are perhaps the most popular way to invest. There are a wide variety of retirement accounts that are safe, stable and provide good returns for the investor. But within the US, none is as popular as the 401 (k) and Roth IRAs. - In the US, your regular 401 (k) retirement account is opened by your employer. You decide how much of your salary you want your employer withhold - before tax - and pay it into the retirement account. Sometimes your employer supplements this amount. That money is then invested in plans, such as stocks, bonds, or a combination thereof. Within the US, it has been possible to deposit up to $ 17,500 of your salary into your 401 (k) fund annually since 2013.

- In addition, you can save in the US through a so-called Roth IRA, or individual retirement plan, into which you can deposit $ 5,500 of your salary (before tax). The first advantage of a Roth IRA is that if you don't take the money out of your account until you're 60, you don't have to pay tax on it. The other big advantage of a Roth IRA is that you receive compound interest or interest-on-interest on it.This means that the interest you earn is reinvested in your fund, making it even more interest, and so on. Someone who makes a one-time deposit of $ 5,000 into his or her Roth IRA will have saved $ 160,000 by the time he or she is 65 and retires (assuming a return of 8%) without doing anything.

Part 4 of 4: Investing with more risk

You can consider investing in real estate. For various reasons, investing in real estate is riskier than investing in, for example, a mutual fund. First, property values are cyclical, and many people who invest in real estate do so when the market is booming, not in a boom. If you buy at the peak of the market, you may be left with a commodity that costs you a lot of money (in property taxes, agent fees, etc.). Second, by investing in real estate, you lock up your money, which means that it is not easy to make your investment liquid again. It often takes months or even years to find a buyer if you no longer want the property.

You can consider investing in real estate. For various reasons, investing in real estate is riskier than investing in, for example, a mutual fund. First, property values are cyclical, and many people who invest in real estate do so when the market is booming, not in a boom. If you buy at the peak of the market, you may be left with a commodity that costs you a lot of money (in property taxes, agent fees, etc.). Second, by investing in real estate, you lock up your money, which means that it is not easy to make your investment liquid again. It often takes months or even years to find a buyer if you no longer want the property. - Learn how to invest in pre-construction real estate

- Learn how to invest in incentives

- Learn how to “flip” houses (quite risky!)

Invest in so-called Real Estate Investment Trusts (REITs for short). REITs are a type of mutual fund for property. Instead of investing in a package of stocks or bonds, you invest in a combination of real estate. Sometimes these combinations take the form of real properties (REITs in the form of shares), sometimes in the form of mortgages or mortgage-backed securities (REITs with mortgage as collateral), and sometimes they are a combination of both ( Hybrid REITs).

Invest in so-called Real Estate Investment Trusts (REITs for short). REITs are a type of mutual fund for property. Instead of investing in a package of stocks or bonds, you invest in a combination of real estate. Sometimes these combinations take the form of real properties (REITs in the form of shares), sometimes in the form of mortgages or mortgage-backed securities (REITs with mortgage as collateral), and sometimes they are a combination of both ( Hybrid REITs).  Invest in foreign currencies. Investing in foreign currencies can be risky as they usually reflect the strength of the economy using them. The only problem with this is that the relationship between the economy as a whole and the factors that influence that economy - the labor market, interest rates, the stock market, laws and regulations - are not always stable or straightforward, and can change very quickly. Moreover, investing in a foreign currency is always a bet on a specific currency relative to another currency, because currencies are exchanged for each other. All these factors make investing in foreign currencies relatively difficult.

Invest in foreign currencies. Investing in foreign currencies can be risky as they usually reflect the strength of the economy using them. The only problem with this is that the relationship between the economy as a whole and the factors that influence that economy - the labor market, interest rates, the stock market, laws and regulations - are not always stable or straightforward, and can change very quickly. Moreover, investing in a foreign currency is always a bet on a specific currency relative to another currency, because currencies are exchanged for each other. All these factors make investing in foreign currencies relatively difficult.  Invest in gold and silver. While having some of these products in your possession can be a great way to set your money aside and protect it from depreciating inflation, relying too much on these resources and making full use of them can be risky. Just look at the table with gold prices since 1900 and compare it with a table of the stock market since 1900. The trend of the stock market is relatively clear, but this does not apply to gold. Yet there are still many people who believe that investing in gold and silver is worthwhile in the long term and that they are a way to store timeless value (which cannot be said of fiat money). These precious metals are not subject to taxation, are easy to store and very liquid (you can easily buy and sell them).

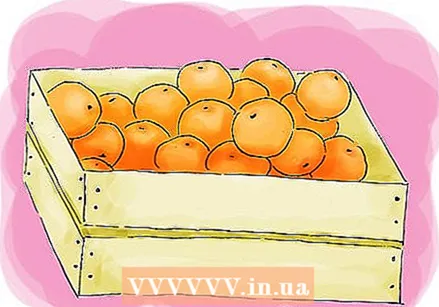

Invest in gold and silver. While having some of these products in your possession can be a great way to set your money aside and protect it from depreciating inflation, relying too much on these resources and making full use of them can be risky. Just look at the table with gold prices since 1900 and compare it with a table of the stock market since 1900. The trend of the stock market is relatively clear, but this does not apply to gold. Yet there are still many people who believe that investing in gold and silver is worthwhile in the long term and that they are a way to store timeless value (which cannot be said of fiat money). These precious metals are not subject to taxation, are easy to store and very liquid (you can easily buy and sell them).  Invest in consumer goods. Consumer goods, such as oranges or pork bellies, can be a great way to diversify your portfolio provided that which is big enough. This is because consumer goods do not earn interest or dividends and are usually above inflation. They just lie there and are subject to relatively high price fluctuations under the influence of all kinds of climatic and cyclical factors. It is extremely difficult to determine the right timing. If you don't have more than $ 25,000 to invest, limit yourself to stocks, bonds, and mutual funds.

Invest in consumer goods. Consumer goods, such as oranges or pork bellies, can be a great way to diversify your portfolio provided that which is big enough. This is because consumer goods do not earn interest or dividends and are usually above inflation. They just lie there and are subject to relatively high price fluctuations under the influence of all kinds of climatic and cyclical factors. It is extremely difficult to determine the right timing. If you don't have more than $ 25,000 to invest, limit yourself to stocks, bonds, and mutual funds.

Tips

- Learn to make a fundamental and a technical analysis. A fundamental analysis can help you know if a stock is worth buying, while a technical analysis can help you know exactly when to buy a stock.

Warnings

- Try to follow the news about stocks as little as possible. When new messages arrive, it is usually too late to take action. Stock news stories are often written far too positively and enthusiastically when the stock market rises, and panic when the market falls, tempting you to buy at a high price and sell at a low price, which is the exact opposite of what to do. However, you can get a sense of how to interpret stock market news so that you can buy and sell based on “feeling”.