Author:

Frank Hunt

Date Of Creation:

19 March 2021

Update Date:

1 July 2024

Content

- To step

- Method 1 of 3: Be careful and change habits

- Method 2 of 3: Create and use protection

- Method 3 of 3: Keep your debit or credit card safe when making online purchases

- Tips

- Warnings

- Necessities

Chip cards with RFID use radio frequencies to transmit data. These cards have only recently emerged in the US, but have been in use in Europe for many years. The idea is that consumers can use these cards in shops and restaurants to pay for purchases without having to pass the card through a scanner. However, many people remain concerned that RFID technology allows thieves to use the scanners to intercept the radio waves and steal the information from the card. While the technology has become significantly more secure in recent years, some concerns still remain.

To step

Method 1 of 3: Be careful and change habits

Place your RFID cards side by side in your wallet. This can make it more difficult for thieves to read a particular card, but protection is limited.

Place your RFID cards side by side in your wallet. This can make it more difficult for thieves to read a particular card, but protection is limited.  Carry your RFID cards in a front pocket. If you usually carry your credit cards in a wallet in your back pocket, you may be more vulnerable to thieves who can get behind you with a scanning device. If you put the cards in a front pocket, you will be more aware of people in front of you and less likely to be a victim of theft.

Carry your RFID cards in a front pocket. If you usually carry your credit cards in a wallet in your back pocket, you may be more vulnerable to thieves who can get behind you with a scanning device. If you put the cards in a front pocket, you will be more aware of people in front of you and less likely to be a victim of theft.  Be aware of other people around you when using your credit cards. Some of the latest RFID technology limits the ability to scan your cards at short distances and only at the point of sale, making it more difficult for thieves. Before using your card at a store, look around to make sure no one is within a few feet of you to keep your transaction safe.

Be aware of other people around you when using your credit cards. Some of the latest RFID technology limits the ability to scan your cards at short distances and only at the point of sale, making it more difficult for thieves. Before using your card at a store, look around to make sure no one is within a few feet of you to keep your transaction safe.  Only use your RFID cards at home for online purchases. If you are really concerned about the RFID technology, this is one possible way to deal with it and you can then use other credit cards or cash to buy things outside the home. However, identity theft via online computing is likely to be a greater risk than using the RFID technology in a store.

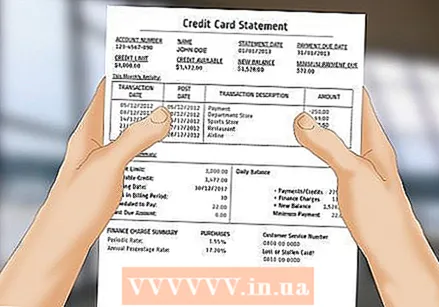

Only use your RFID cards at home for online purchases. If you are really concerned about the RFID technology, this is one possible way to deal with it and you can then use other credit cards or cash to buy things outside the home. However, identity theft via online computing is likely to be a greater risk than using the RFID technology in a store.  Check your credit card statements for unusual activity or errors. This cannot prevent thieves from stealing information from your card, but checking your statements regularly will help you and the credit card company identify unauthorized purchases and reduce your potential losses. Some sources say that checking your credit card statements regularly is actually the "best" protection against identity theft.

Check your credit card statements for unusual activity or errors. This cannot prevent thieves from stealing information from your card, but checking your statements regularly will help you and the credit card company identify unauthorized purchases and reduce your potential losses. Some sources say that checking your credit card statements regularly is actually the "best" protection against identity theft.

Method 2 of 3: Create and use protection

Buy a wallet or case with RFID shield for credit cards. There are several commercial products available that claim to block RFID scanners from obtaining your personal information. These can be individual cases for your RFID cards or wallets that are covered with material to block scanners.

Buy a wallet or case with RFID shield for credit cards. There are several commercial products available that claim to block RFID scanners from obtaining your personal information. These can be individual cases for your RFID cards or wallets that are covered with material to block scanners.  Buy an RFID jamming card or device. Some companies have developed a credit card-sized device that emits its own RFID signal to stop scanners trying to read your credit card information.

Buy an RFID jamming card or device. Some companies have developed a credit card-sized device that emits its own RFID signal to stop scanners trying to read your credit card information.  Make a foil shield. This is the "low-tech" way to try, but it's cheap and easy. Cut two pieces of credit card-sized paper or cardstock, wrap each piece in aluminum foil, and carry them around your credit cards in your wallet. The aluminum will interfere with most electronic signals.

Make a foil shield. This is the "low-tech" way to try, but it's cheap and easy. Cut two pieces of credit card-sized paper or cardstock, wrap each piece in aluminum foil, and carry them around your credit cards in your wallet. The aluminum will interfere with most electronic signals.  You can also wrap each credit card in aluminum foil and place the wrapped cards in your wallet. The foil protects the card from scanners.

You can also wrap each credit card in aluminum foil and place the wrapped cards in your wallet. The foil protects the card from scanners.

Method 3 of 3: Keep your debit or credit card safe when making online purchases

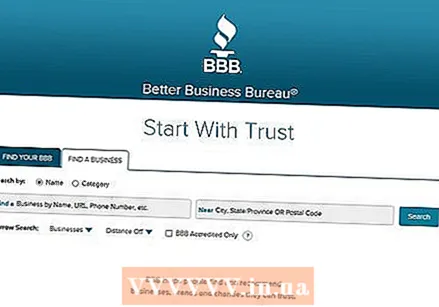

Verify that suppliers you use online are legitimate. Keep it with suppliers you have previously purchased from and who you know and trust. If you are concerned, you can check through the Better Business Bureau website at http://www.bbb.org/ or in the region where the company is located.

Verify that suppliers you use online are legitimate. Keep it with suppliers you have previously purchased from and who you know and trust. If you are concerned, you can check through the Better Business Bureau website at http://www.bbb.org/ or in the region where the company is located.  Look for indications that it is a "secure" website. Truly secure websites use an extra protection called a Secure Sockets Layer or SSL, and the website address starts with "https" instead of the usual "http". In addition, a secure site will show a closed lock icon in the status bar at the bottom of the page. If you don't see the "https" address or the padlock at the bottom, you should consider using a different website for your purchase.

Look for indications that it is a "secure" website. Truly secure websites use an extra protection called a Secure Sockets Layer or SSL, and the website address starts with "https" instead of the usual "http". In addition, a secure site will show a closed lock icon in the status bar at the bottom of the page. If you don't see the "https" address or the padlock at the bottom, you should consider using a different website for your purchase.  Maintain your own computer. For safer online shopping, it is important to keep your own computer free of viruses and spyware. There are software products that you can buy or download online for free to keep your computer clean.

Maintain your own computer. For safer online shopping, it is important to keep your own computer free of viruses and spyware. There are software products that you can buy or download online for free to keep your computer clean.  Limit purchases over Wi-Fi. Since anything wireless is potentially at risk from hackers who can intercept the radio signal, the safest method to shop online is via a wired internet connection.

Limit purchases over Wi-Fi. Since anything wireless is potentially at risk from hackers who can intercept the radio signal, the safest method to shop online is via a wired internet connection.  Use a temporary credit card for online shopping. Many banks and credit companies offer this service for free. You can get a card number that is separate from your actual bank account, but the bank will link it to your account so that you can make reliable purchases.

Use a temporary credit card for online shopping. Many banks and credit companies offer this service for free. You can get a card number that is separate from your actual bank account, but the bank will link it to your account so that you can make reliable purchases.

Tips

- Check with your bank to see if it automatically sends you RFID cards, in case you don't know if you have one (or more). If you don't want one, make this clear to the bank. You may not have a choice, but it doesn't hurt to ask.

- Check your statements regularly. The three major credit rating agencies, Equifax, Experian and Transunion, will provide you with a free copy of your credit report once a year. If you see any discrepancies, investigate them right away and notify the credit bureau.

- http://www.equifax.com/home/en_us

- http://www.experian.com/

- http://www.transunion.com/

Warnings

- Contact your credit card company or bank immediately if you notice anomalies or suspicious activity on your statements.

Necessities

- Aluminium foil

- Cardboard

- Scissors