Author:

Ellen Moore

Date Of Creation:

13 January 2021

Update Date:

24 June 2024

Content

- Steps

- Part 1 of 3: Calculating the Present Value of the Principal of a Bond

- Part 2 of 3: Calculating the Present Value of Coupon Payments

- Part 3 of 3: Calculating the Bonds Discount Rate

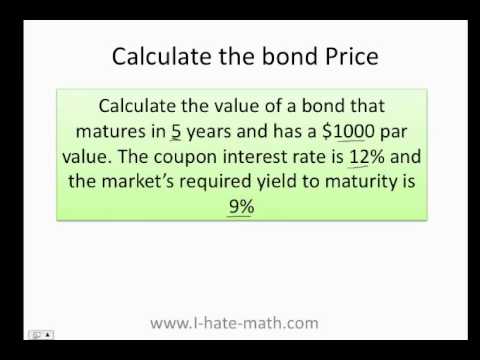

A bond discount is the difference between the face value of a bond and its selling price. The par value of a bond is paid to its owner at maturity. Bonds are sold at a discount (discount) when the market interest rate is higher than the coupon rate. To calculate the amount of the discount, you need to find the present value of the principal of the bond and the present value of the coupon payments.

Steps

Part 1 of 3: Calculating the Present Value of the Principal of a Bond

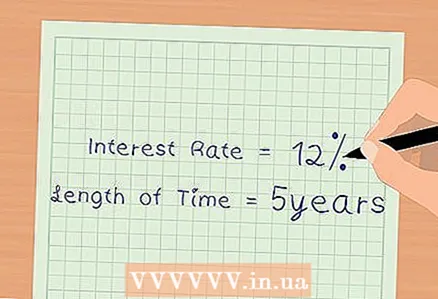

1 Find the information you need. The fair value of the principal is calculated based on current market interest rates. Therefore, you need to find out the size of the current market interest rate. You also need to find out the maturity of the bond and the number of coupon payments (payments) per year.

1 Find the information you need. The fair value of the principal is calculated based on current market interest rates. Therefore, you need to find out the size of the current market interest rate. You also need to find out the maturity of the bond and the number of coupon payments (payments) per year. - For example, ABV company issues 5-year bonds in the volume of 500,000 rubles at 10% per annum. Interest is paid semi-annually. The current market interest rate is 12%.

- In our example, the current market interest rate is 12%.

- The maturity date is 5 years.

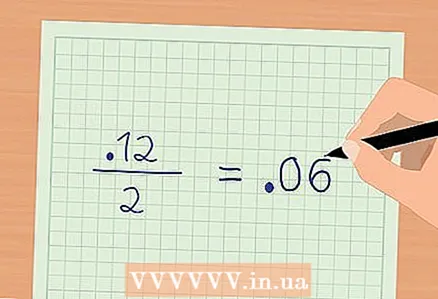

2 Calculate the current market interest rate for one payment period. To do this, divide the current annual market interest rate by the number of coupon payments. In our example, the annual market interest rate is 12%. Coupon payments are made semi-annually or twice a year. Thus, the market interest rate for one payment period is 6% (0.12 / 2 = 0.06).

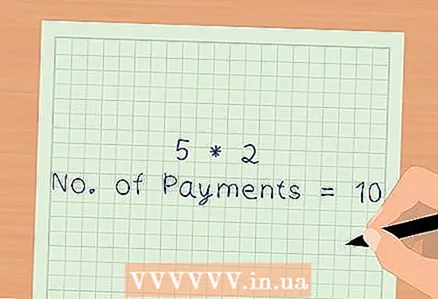

2 Calculate the current market interest rate for one payment period. To do this, divide the current annual market interest rate by the number of coupon payments. In our example, the annual market interest rate is 12%. Coupon payments are made semi-annually or twice a year. Thus, the market interest rate for one payment period is 6% (0.12 / 2 = 0.06).  3 Calculate the total number of coupon payments. To do this, multiply the number of coupon payments for the year and the number of years to maturity of the bonds. You will find the number of coupon payments from the time the bond is purchased until it is redeemed. In our example, coupon payments are made semi-annually or twice a year. The maturity date is 5 years. The total number of coupon payments: 5 * 2 = 10.

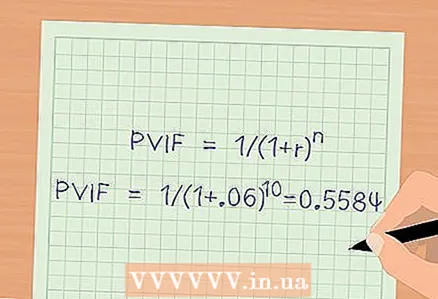

3 Calculate the total number of coupon payments. To do this, multiply the number of coupon payments for the year and the number of years to maturity of the bonds. You will find the number of coupon payments from the time the bond is purchased until it is redeemed. In our example, coupon payments are made semi-annually or twice a year. The maturity date is 5 years. The total number of coupon payments: 5 * 2 = 10.  4 Calculate the Conversion Factor (PVIF). It is used to calculate the present value of a bond based on the current market interest rate. Formula for calculating the reduction factor:

4 Calculate the Conversion Factor (PVIF). It is used to calculate the present value of a bond based on the current market interest rate. Formula for calculating the reduction factor: , where r is the interest rate for the period, n is the total number of coupon payments.

- PVIF =

- Present value of the principal of the bond = principal * PVIF

rubles.

- PVIF =

Part 2 of 3: Calculating the Present Value of Coupon Payments

1 Find the information you need. The present value of coupon payments is calculated based on current market interest rates. Therefore, you need to find out the size of the annual coupon rate and the annual market interest rate. You also need to find out the number of coupon payments (payments) for the year and the total number of coupon payments.

1 Find the information you need. The present value of coupon payments is calculated based on current market interest rates. Therefore, you need to find out the size of the annual coupon rate and the annual market interest rate. You also need to find out the number of coupon payments (payments) for the year and the total number of coupon payments. - In our example, the annual coupon rate is 10% and the current annual market interest rate is 12%.

- Coupon payments are made twice a year, so the total number of coupon payments (before bond maturity) is 10.

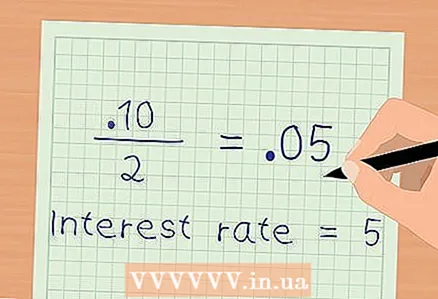

2 Calculate the coupon rate for one payment period. To do this, divide the annual coupon rate by the number of coupon payments. In our example, the annual coupon rate is 10%. Coupon payments are made twice a year. Therefore, the coupon rate for one payment period is 5% (0.10 / 2 = 0.05).

2 Calculate the coupon rate for one payment period. To do this, divide the annual coupon rate by the number of coupon payments. In our example, the annual coupon rate is 10%. Coupon payments are made twice a year. Therefore, the coupon rate for one payment period is 5% (0.10 / 2 = 0.05).  3 Calculate the amount of the coupon payment. To do this, multiply the principal amount of the bond and the coupon rate for one payment period. In our example, the principal amount of the bond is RUB 500,000. The coupon rate for one payment period is 5%. The amount of each coupon payment is 25,000 rubles (500,000 * 0.05 = 25,000).

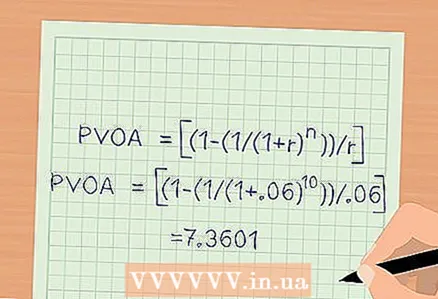

3 Calculate the amount of the coupon payment. To do this, multiply the principal amount of the bond and the coupon rate for one payment period. In our example, the principal amount of the bond is RUB 500,000. The coupon rate for one payment period is 5%. The amount of each coupon payment is 25,000 rubles (500,000 * 0.05 = 25,000).  4 Calculate the present value ratio of a simple annuity (PVOA). It is used to calculate the amount of coupon payments that would be paid at the moment.This ratio is calculated based on the current market interest rate. Formula:

4 Calculate the present value ratio of a simple annuity (PVOA). It is used to calculate the amount of coupon payments that would be paid at the moment.This ratio is calculated based on the current market interest rate. Formula: , where r is the current market interest rate for the period, n is the total number of coupon payments.

5 Calculate the present value of coupon payments. To do this, multiply the amount of one payment and PVOA. You will find the present value of the coupon payments if they would have been paid at the moment. Calculation: 25000 * 7.3601 = 184002 rubles - this is the current value of coupon payments.

5 Calculate the present value of coupon payments. To do this, multiply the amount of one payment and PVOA. You will find the present value of the coupon payments if they would have been paid at the moment. Calculation: 25000 * 7.3601 = 184002 rubles - this is the current value of coupon payments.

Part 3 of 3: Calculating the Bonds Discount Rate

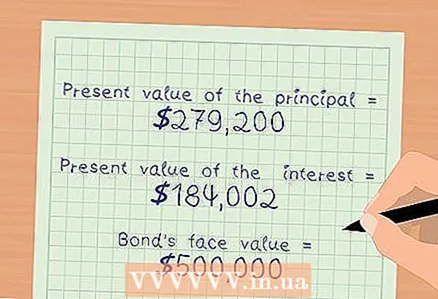

1 Find the information you need. You will need the results of the two previous calculations, that is, you need to know the present value of the bond principal and the present value of the coupon payments. You will also need the par value of the bond.

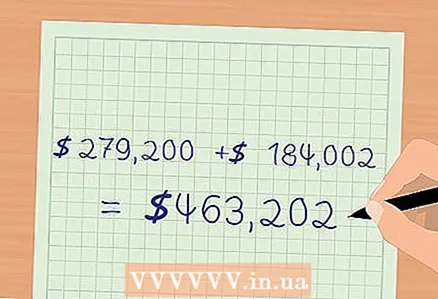

1 Find the information you need. You will need the results of the two previous calculations, that is, you need to know the present value of the bond principal and the present value of the coupon payments. You will also need the par value of the bond. - In our example, the present value of the principal is $ 279,200.

- The current value of coupon payments is RUB 184002.

- The par value of the bonds is 500,000 rubles.

2 Calculate the market price of the bond. This is the price at which a bond can be sold and is calculated based on the current market interest rate. The market price is equal to the sum of the present value of the principal and the present value of the coupon payments.

2 Calculate the market price of the bond. This is the price at which a bond can be sold and is calculated based on the current market interest rate. The market price is equal to the sum of the present value of the principal and the present value of the coupon payments. - In our example, the market price of the bond is: 279200 + 184002 = 463202 rubles.

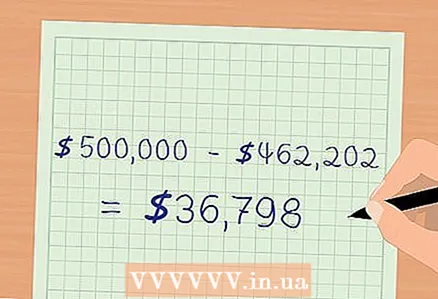

3 Calculate the bond discount. Compare the calculated market price of the bond with its par value. In our example, the market price is less than par. Consequently, bonds are being sold at a discount.

3 Calculate the bond discount. Compare the calculated market price of the bond with its par value. In our example, the market price is less than par. Consequently, bonds are being sold at a discount. rubles.

- The bond discount is equal to 36798 rubles.

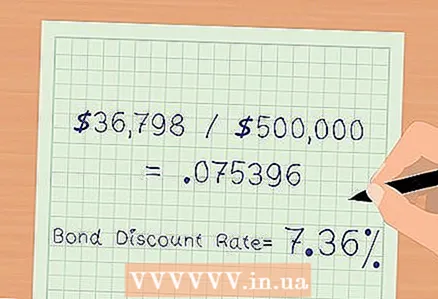

4 Calculate the bond discount rate. It is expressed as a percentage and characterizes the amount of the discount. Divide the amount of the discount by the face value of the bond. In our example, divide $ 36,798 by $ 500,000.

4 Calculate the bond discount rate. It is expressed as a percentage and characterizes the amount of the discount. Divide the amount of the discount by the face value of the bond. In our example, divide $ 36,798 by $ 500,000. - The discount rate on bonds is 7.36%.