Author:

Sara Rhodes

Date Of Creation:

15 February 2021

Update Date:

1 July 2024

Content

- Steps

- Method 1 of 3: Calculating Debt Service Payments

- Method 2 of 3: Gathering Information to Calculate the Cost of Debt Service

- Method 3 of 3: Calculating the Debt Service Ratio

Debt service is a periodic (usually annual) payment of interest accrued for the period and part of the principal amount of the debt. Companies are required to disclose debt service data when applying for a loan. Based on the amount of debt service payments and the amount of net income, investors calculate the debt service ratio, which is the percentage of net income going to repay the loan.

Steps

Method 1 of 3: Calculating Debt Service Payments

1 Find out what the cost of debt service is. Debt service cost is a certain amount of money required to pay interest accrued over a certain period and part of the principal amount of the debt. Typically, debt service payments are paid once a year. When applying for a loan, legal entities and individuals are advised to prepare data on the total spending to cover debts.

1 Find out what the cost of debt service is. Debt service cost is a certain amount of money required to pay interest accrued over a certain period and part of the principal amount of the debt. Typically, debt service payments are paid once a year. When applying for a loan, legal entities and individuals are advised to prepare data on the total spending to cover debts. - An individual can make mortgage or student loan payments.

- Companies (legal entities) pay the principal and interest on the loan.

- An individual or legal entity that is unable to make debt service payments is insolvent (that is, it is unable to service the debt).

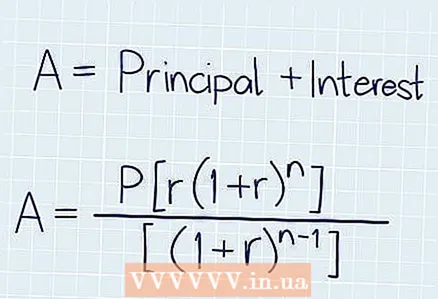

2 Calculate your monthly debt payments. As a rule, the lender (the person or organization that issued the loan) is responsible for calculating the amount of monthly payments to pay off the loan, but you can do it yourself. First, calculate your monthly interest rate; to do this, divide the annual interest rate by 12.Then, using the following formula, calculate the amount of monthly payments:

2 Calculate your monthly debt payments. As a rule, the lender (the person or organization that issued the loan) is responsible for calculating the amount of monthly payments to pay off the loan, but you can do it yourself. First, calculate your monthly interest rate; to do this, divide the annual interest rate by 12.Then, using the following formula, calculate the amount of monthly payments:.

- In the above formula, A is the amount of monthly payments, P is the principal amount of the loan, r is the interest rate for a certain period, n is the total number of payments.

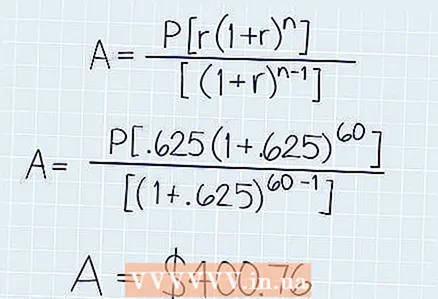

- Let's look at an example. You bought a car for 2,100,000 rubles, with the initial payment of 100,000 rubles. Thus, you need to take out a loan of 2,000,000 rubles. You take out a loan at 7.5% per annum for 60 months.

- We calculate the monthly interest rate: 7.5 / 12 = 0.625% (per month).

- Substitute these values into the above formula:

.

- In our example, monthly loan payments will be 40,076 rubles.

3 Calculate your total monthly debt payments. In this case, start by calculating the monthly payments for each of your loans. Then add the numbers together to calculate your total monthly payments. Once you have determined the total debt service payments, you can calculate the debt service ratio.

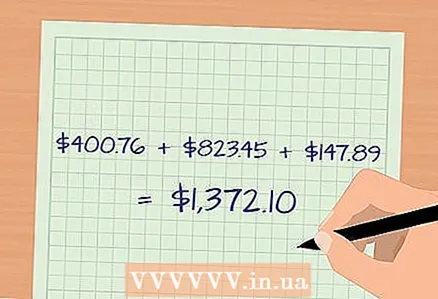

3 Calculate your total monthly debt payments. In this case, start by calculating the monthly payments for each of your loans. Then add the numbers together to calculate your total monthly payments. Once you have determined the total debt service payments, you can calculate the debt service ratio. - Let's say that in addition to a car loan, you have mortgage and educational loans, monthly payments for which are 82,345 and 14,789 rubles, respectively.

- In our example, the total monthly payments for all loans will be: 40076 + 82345 + 14789 = 137,210 rubles.

Method 2 of 3: Gathering Information to Calculate the Cost of Debt Service

1 Determine the cost of debt service. Debt service cost is the total amount spent on interest payments and part of the principal amount of the debt during the year. In the case of companies (legal entities), the cost of debt service includes interest, debts that must be paid during the year, and payments for repayment of principal amounts of long-term liabilities.

1 Determine the cost of debt service. Debt service cost is the total amount spent on interest payments and part of the principal amount of the debt during the year. In the case of companies (legal entities), the cost of debt service includes interest, debts that must be paid during the year, and payments for repayment of principal amounts of long-term liabilities. - Short-term debt is any debt that must be paid off within one year.

- The current portion of long-term debt is the portion of long-term debt that must be paid off in the current year.

- In the financial statements of companies, data on the cost of debt service is not provided - they are indicated in a note to the financial statement.

2 Consider any debt due this year. This includes interest and principal that must be paid during the year. Companies (legal entities) must account for payments to the buyout fund, which is created as a guarantee for the repayment of the bonded loan. Moreover, lease payments that are required to be paid in the current year are taken into account.

2 Consider any debt due this year. This includes interest and principal that must be paid during the year. Companies (legal entities) must account for payments to the buyout fund, which is created as a guarantee for the repayment of the bonded loan. Moreover, lease payments that are required to be paid in the current year are taken into account.  3 When determining the cost of debt service, consider the portion of long-term debt that is due to expire. The portion of long-term debt with expiring maturity is the portion of long-term debt due to be paid off within the next 12 months. Use the payments you made on the portion of the long-term debt that is due in the previous 12 months to determine your ability to service the debt for the current year. Use the payments you make over the next 12 months for the portion of the long-term debt that is due to expire to determine the ability to service new debts.

3 When determining the cost of debt service, consider the portion of long-term debt that is due to expire. The portion of long-term debt with expiring maturity is the portion of long-term debt due to be paid off within the next 12 months. Use the payments you made on the portion of the long-term debt that is due in the previous 12 months to determine your ability to service the debt for the current year. Use the payments you make over the next 12 months for the portion of the long-term debt that is due to expire to determine the ability to service new debts.  4 When calculating the cost of debt service, consider dealing with lines of credit and revolving debt. The company (legal entity) can plan to repay the line of credit within a year or convert it to another loan.

4 When calculating the cost of debt service, consider dealing with lines of credit and revolving debt. The company (legal entity) can plan to repay the line of credit within a year or convert it to another loan. - A credit line can be converted into an amortization loan.

- An amortization loan is a loan whose recurring payments include both accrued interest and a portion of the principal amount of the debt.

5 Adjust the payments of the accrued interest and part of the principal to include income tax. Payments on accrued interest are not subject to approach tax, which cannot be said about payments to repay the principal amount of debt (to verify the correctness of this statement, check the legislation of your country). Adjust the portion of the principal that is subject to income tax. If you don't, you will underestimate the cost of debt service and overestimate your debt service capabilities.

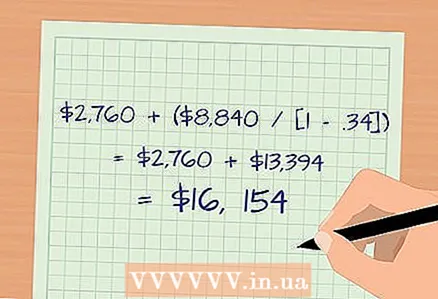

5 Adjust the payments of the accrued interest and part of the principal to include income tax. Payments on accrued interest are not subject to approach tax, which cannot be said about payments to repay the principal amount of debt (to verify the correctness of this statement, check the legislation of your country). Adjust the portion of the principal that is subject to income tax. If you don't, you will underestimate the cost of debt service and overestimate your debt service capabilities. - Adjust using the following formula: interest accrued + (principal / [1 - tax rate]).

- For example, the corporate income tax rate is 34%. The company takes out a five-year loan in the amount of 5,000,000 rubles at 6% per annum. In the current year, the company will pay part of the principal amount of the debt in the amount of 884,000 rubles, and the amount of accrued interest will be 276,000.

- Calculate the debt service cost using the above formula: 276,000 + (884,000 / [1 - 0.34]) = 276,000 + 1,339,400 = 1,615,400 rubles.

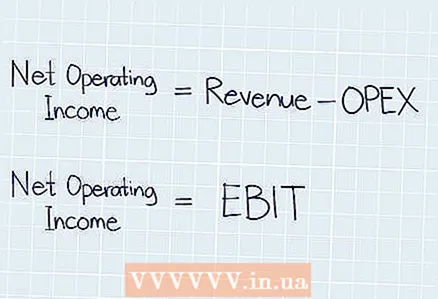

6 Determine your bottom line. Net operating income is profit less operating expenses, but before taxes and accrued interest. Net operating income is the equivalent of earnings before interest and taxes (EBIT). Net operating income is recognized in the income statement.

6 Determine your bottom line. Net operating income is profit less operating expenses, but before taxes and accrued interest. Net operating income is the equivalent of earnings before interest and taxes (EBIT). Net operating income is recognized in the income statement. - Operating expenses are expenses related to the core business of a company, such as salaries and research and development costs.

Method 3 of 3: Calculating the Debt Service Ratio

1 Find out what a debt service ratio is. It is important to know the total monthly debt service payments, but in order to assess your creditworthiness, it is recommended to determine the ratio of net income to the cost of debt service. This ratio is called the debt service ratio. The debt service ratio is equal to a certain percentage of net profit, which is used to pay off debt obligations. The debt service ratio is calculated using the following formula: debt service ratio = net income / debt service cost. Lenders use this ratio to determine the borrower's ability to service current and future debt obligations. Lenders want to make sure that the borrower's operating income is sufficient to cover not only current but also future debts. The higher the value of the ratio, the more confident the company is in repaying its loans.

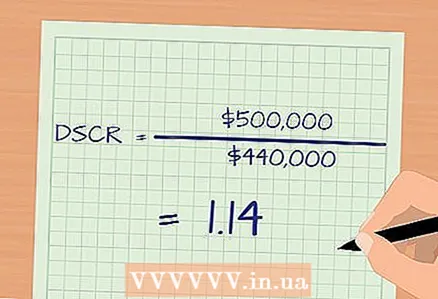

1 Find out what a debt service ratio is. It is important to know the total monthly debt service payments, but in order to assess your creditworthiness, it is recommended to determine the ratio of net income to the cost of debt service. This ratio is called the debt service ratio. The debt service ratio is equal to a certain percentage of net profit, which is used to pay off debt obligations. The debt service ratio is calculated using the following formula: debt service ratio = net income / debt service cost. Lenders use this ratio to determine the borrower's ability to service current and future debt obligations. Lenders want to make sure that the borrower's operating income is sufficient to cover not only current but also future debts. The higher the value of the ratio, the more confident the company is in repaying its loans.  2 Calculate the Debt Service Ratio (DSCR). To do this, use the following formula: Debt Service Ratio = Net Income / Debt Service Cost. For example, a certain company has a net profit of 50,000,000 rubles, and the cost of debt service for that company is 44,000,000. In this case, the cost of servicing the debt is payments on mortgages on real estate that the company owns.

2 Calculate the Debt Service Ratio (DSCR). To do this, use the following formula: Debt Service Ratio = Net Income / Debt Service Cost. For example, a certain company has a net profit of 50,000,000 rubles, and the cost of debt service for that company is 44,000,000. In this case, the cost of servicing the debt is payments on mortgages on real estate that the company owns. - In our example, the debt service ratio is 50,000,000 / 44,000,000 = 1.14.

- That is, the company's profit is 14% higher than the amount required to cover the company's debt obligations.

3 Analyze the value of the debt service ratio. The minimum value of this ratio, which is necessary to obtain new loans, depends on the state of the economy. During periods of economic growth, creditors may be oblivious to low debt service ratios. On the other hand, this behavior of lenders is very risky due to the possible default of a large number of borrowers whose loans were issued in violation of the rules.

3 Analyze the value of the debt service ratio. The minimum value of this ratio, which is necessary to obtain new loans, depends on the state of the economy. During periods of economic growth, creditors may be oblivious to low debt service ratios. On the other hand, this behavior of lenders is very risky due to the possible default of a large number of borrowers whose loans were issued in violation of the rules. - If the debt service ratio is greater than 1, then the legal entity or individual has sufficient funds to service the debt.

- If the debt service ratio is less than 1, then there are not enough funds to service the debt.For example, if the debt service ratio is 0.87, then the legal entity or individual has funds to pay off only 87% of the debt, which includes the payment of accrued interest and part of the principal. In this case, the borrower will have to either spend the savings or take out a new loan, which will be used to pay off the current debt.

- Some lenders require that the borrower's debt service ratio does not fall below a certain specified value during the maturity of the loan.

- Many lenders require a debt service ratio of 2 (or more) to issue a new loan.