Author:

Clyde Lopez

Date Of Creation:

21 June 2021

Update Date:

1 July 2024

Content

- Steps

- Method 1 of 2: Gather the information you need

- Method 2 of 2: Calculating the effective interest rate

- Tips

- What do you need

When analyzing a loan or investment, it is sometimes difficult to determine the true cost of a loan or the return on investment. There are various terms used to describe the loan rate or investment return: annual interest rate, annual interest rate, effective interest rate, nominal interest rate, and others. Of all this, perhaps the most useful is the effective interest rate, which gives a relatively complete picture of the cost of the loan. To calculate the effective interest rate on a loan, you must carefully study the terms of the loan and make simple calculations.

Steps

Method 1 of 2: Gather the information you need

1 What is the effective interest rate for? The effective interest rate is one way to estimate the full cost of a loan. It takes into account the effect of accrued income, which does not take into account the nominal, or "declared" interest rate.

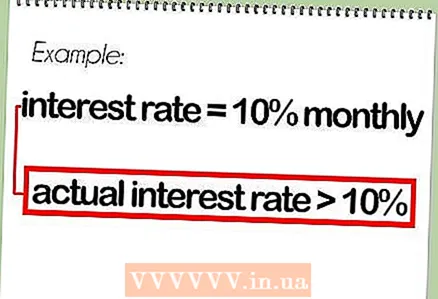

1 What is the effective interest rate for? The effective interest rate is one way to estimate the full cost of a loan. It takes into account the effect of accrued income, which does not take into account the nominal, or "declared" interest rate. - For example, if the interest rate is 10%, and interest is calculated monthly, then the real interest rate will be higher than 10%, since monthly interest on the loan is added to the loan amount.

- When calculating the effective interest rate, one-off fees (as loan arrangement fees) are not taken into account. However, they are taken into account when calculating the annual interest rate.

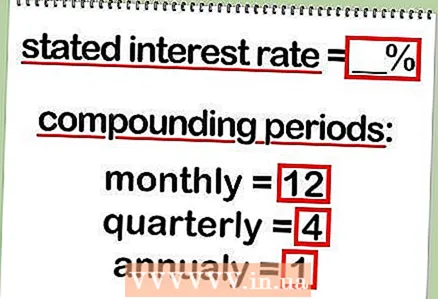

2 Determine the stated interest rate. The stated interest rate (also called nominal) is expressed as a percentage.

2 Determine the stated interest rate. The stated interest rate (also called nominal) is expressed as a percentage. - The nominal interest rate is usually the very "interest rate" advertised by many banks or companies.

- 3 Determine the number of periods for calculating interest on the loan. Interest accrual per year can be monthly, quarterly, annual, continuous, or others. This refers to how often interest is calculated.

- Usually, interest is charged monthly, however, we recommend that you check with a bank employee or borrower about this.

Method 2 of 2: Calculating the effective interest rate

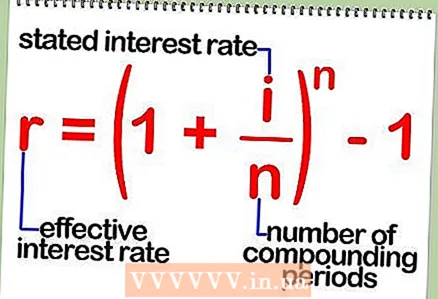

1 Formula for calculating the effective interest rate based on the nominal interest rate. The effective interest rate is calculated using a simple formula: r = (1 + i / n) ^ n - 1.

1 Formula for calculating the effective interest rate based on the nominal interest rate. The effective interest rate is calculated using a simple formula: r = (1 + i / n) ^ n - 1. - In this formula: r is the effective interest rate, i is the nominal interest rate, n is the number of interest accrual periods per year.

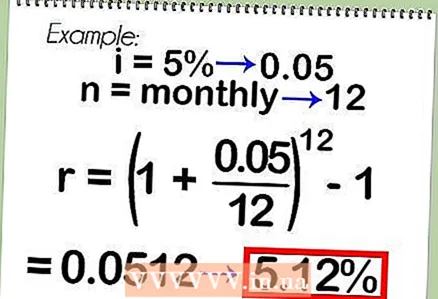

2 An example of calculating the effective interest rate using the above formula. For example, consider a loan with a nominal interest rate of 5%, which is charged monthly.According to the formula: r = (1 + 0.05 / 12) ^ 12 - 1 = 5.12%. If the nominal interest rate of 5% is charged daily, then: r = (1 + 0.05 / 365) ^ 365 - 1 = 5.13%. Please note that the effective interest rate is always greater than the nominal rate.

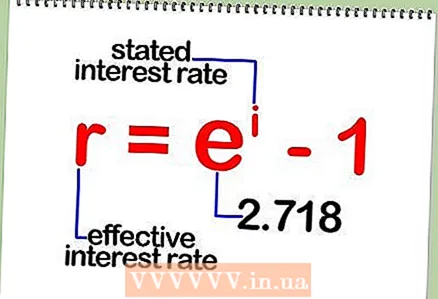

2 An example of calculating the effective interest rate using the above formula. For example, consider a loan with a nominal interest rate of 5%, which is charged monthly.According to the formula: r = (1 + 0.05 / 12) ^ 12 - 1 = 5.12%. If the nominal interest rate of 5% is charged daily, then: r = (1 + 0.05 / 365) ^ 365 - 1 = 5.13%. Please note that the effective interest rate is always greater than the nominal rate.  3 Formula for calculating the effective interest rate on a continuous basis. If interest is calculated continuously, then you must calculate the effective interest rate using a different formula: r = e ^ i - 1. In this formula, r is the effective interest rate, i is the nominal interest rate, and e is a constant 2.718.

3 Formula for calculating the effective interest rate on a continuous basis. If interest is calculated continuously, then you must calculate the effective interest rate using a different formula: r = e ^ i - 1. In this formula, r is the effective interest rate, i is the nominal interest rate, and e is a constant 2.718.  4 An example of calculating the effective interest rate that is calculated continuously. For example, consider a loan with a nominal interest rate of 9%, which is accrued continuously. According to the formula: r = 2.718 ^ 0.09 - 1 = 9.417%.

4 An example of calculating the effective interest rate that is calculated continuously. For example, consider a loan with a nominal interest rate of 9%, which is accrued continuously. According to the formula: r = 2.718 ^ 0.09 - 1 = 9.417%.

Tips

- On the internet, you can find online calculators that quickly calculate the effective interest rate. In addition, in Microsoft Excel, the EFFECT () function calculates the effective rate at a given nominal rate and the number of interest calculation periods.

What do you need

- Pencil

- Paper

- Calculator