Author:

Carl Weaver

Date Of Creation:

23 February 2021

Update Date:

1 July 2024

Content

- Steps

- Method 1 of 4: Learn How to Trade Stocks

- Method 2 of 4: Trade Stocks Effectively

- Method 3 of 4: Learn the Market

- Method 4 of 4: Get Good Results

- Tips

- Warnings

Trading in the stock market can be either big gains or painful losses. Many professional traders can earn from several hundred to several hundred thousand dollars a year, depending on the professionalism of the traders and the trading system used. And you can do this: you just have to know what to do. This article will teach you how to make money and control your losses.

Steps

Method 1 of 4: Learn How to Trade Stocks

1 Choose a broker. The easiest way to trade stocks is to pay for someone's services to trade stocks. There are a number of well-known stock brokers out there, and you can easily find someone to transact on your behalf and advise you.

1 Choose a broker. The easiest way to trade stocks is to pay for someone's services to trade stocks. There are a number of well-known stock brokers out there, and you can easily find someone to transact on your behalf and advise you.  2 Find a website or service through which you will trade stocks. For individuals who are determined to make transactions on their own, there are many sites that organize online trading. By acting on your own as a personal broker, you will gain a greater degree of control and save some money. E * Trade, Fidelity and Ameritrade are some of the most common websites for this purpose.

2 Find a website or service through which you will trade stocks. For individuals who are determined to make transactions on their own, there are many sites that organize online trading. By acting on your own as a personal broker, you will gain a greater degree of control and save some money. E * Trade, Fidelity and Ameritrade are some of the most common websites for this purpose. - Take a look at other services offered by some of these companies. Some offer additional advice, tutorials, debit cards, mortgages, and other perks. Weigh the benefits of each service and decide which is best for you.

3 Use market orders. When trading stocks, you can buy or sell stocks using a market order. This means that the trade will be executed at the best price at that point in time. However, it is important to remember that it takes some time to complete the trade, and since the market changes very quickly, you may get a very different price than what you initially saw.

3 Use market orders. When trading stocks, you can buy or sell stocks using a market order. This means that the trade will be executed at the best price at that point in time. However, it is important to remember that it takes some time to complete the trade, and since the market changes very quickly, you may get a very different price than what you initially saw. - Use market stop orders. They are also called loss insurance and are similar to market orders, except that the stock will be sold when it reaches a certain price to avoid losing your money.

4 Use trailing stop orders. They can be used to set an upper or lower limit at which a stock must be bought or sold, but instead of a fixed price, a floating percentage price is set. This is a very useful tool that can protect you from huge market fluctuations.

4 Use trailing stop orders. They can be used to set an upper or lower limit at which a stock must be bought or sold, but instead of a fixed price, a floating percentage price is set. This is a very useful tool that can protect you from huge market fluctuations.  5 Use limit orders. Limit orders are another option for you. They establish a certain price band outside which your shares will be bought or sold. This can help you to make a deal at a good price, but there is often a special commission for these types of orders.

5 Use limit orders. Limit orders are another option for you. They establish a certain price band outside which your shares will be bought or sold. This can help you to make a deal at a good price, but there is often a special commission for these types of orders. - Use stop-limit orders. This is a limit order that is executed when the specified stop price is reached. This provides even more control, but as with limit orders, you run the risk that your shares might not be sold.

6 Keep your money between trades. Many brokerage firms, like the ones mentioned above, offer to open accounts in which they can hold your money between trades and on which interest is often paid. This is very useful and you should really consider this in your plans if you are using an online service.

6 Keep your money between trades. Many brokerage firms, like the ones mentioned above, offer to open accounts in which they can hold your money between trades and on which interest is often paid. This is very useful and you should really consider this in your plans if you are using an online service.

Method 2 of 4: Trade Stocks Effectively

1 Keep enough money in your account. Make sure you have the minimum amount of money required to open and maintain an account. E * Trade usually has the lowest minimum amount to start trading, around $ 500. The Federal Reserve requires that you have at least half of the value of the shares you buy in your account, and that a percentage of your net worth is at least a quarter of your investment.

1 Keep enough money in your account. Make sure you have the minimum amount of money required to open and maintain an account. E * Trade usually has the lowest minimum amount to start trading, around $ 500. The Federal Reserve requires that you have at least half of the value of the shares you buy in your account, and that a percentage of your net worth is at least a quarter of your investment.  2 Make sure you are watching the current quotes. Remember that the market is changing rapidly and the quotes you are following may be lagging. Find a service that allows you to track prices in real time in order to get the best deal possible.

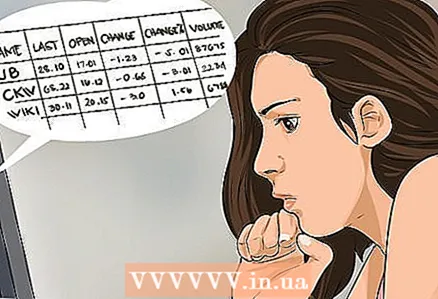

2 Make sure you are watching the current quotes. Remember that the market is changing rapidly and the quotes you are following may be lagging. Find a service that allows you to track prices in real time in order to get the best deal possible.  3 Read the stock price tables and quotes. Stock price tables are a great way to value stocks, but they can be difficult to read. You will have to learn how to interpret them and identify the most important information so that you can set your priorities and make the best decisions.

3 Read the stock price tables and quotes. Stock price tables are a great way to value stocks, but they can be difficult to read. You will have to learn how to interpret them and identify the most important information so that you can set your priorities and make the best decisions.  4 Determine the best time to buy and sell. The conventional wisdom is to buy shares at the lowest price and then sell them at the highest price. It would be great if it could be done this way always or with a high degree of probability, but in reality this rarely happens. It is never known if stocks will rise in the future. The best method is to find the optimal moment to trade stocks.Buy at the beginning of the rally and sell before the price retreats back.

4 Determine the best time to buy and sell. The conventional wisdom is to buy shares at the lowest price and then sell them at the highest price. It would be great if it could be done this way always or with a high degree of probability, but in reality this rarely happens. It is never known if stocks will rise in the future. The best method is to find the optimal moment to trade stocks.Buy at the beginning of the rally and sell before the price retreats back.  5 Set a good selling price, and offer a good buy price. If you have unreasonable expectations, it will be very difficult for you to buy and sell your shares. Only offer what makes sense to offer, and don't expect to be able to trade at a price significantly above or below market value.

5 Set a good selling price, and offer a good buy price. If you have unreasonable expectations, it will be very difficult for you to buy and sell your shares. Only offer what makes sense to offer, and don't expect to be able to trade at a price significantly above or below market value.  6 Don't just look at the stock price. You don't have to take into account only the share price, you have to analyze the whole company. Look at the company's profit and its performance. A stock can be expensive, but if the company continues to generate more and more profit, then it will be worth it.

6 Don't just look at the stock price. You don't have to take into account only the share price, you have to analyze the whole company. Look at the company's profit and its performance. A stock can be expensive, but if the company continues to generate more and more profit, then it will be worth it.  7 Start with blue chips. Blue-chip stocks are stocks of companies that perform well, and their stocks are highly quoted. If you are just learning, these promotions are a good place to start. Examples of such stocks are IBM, Johnson and Johnson, and Procter and Gamble.

7 Start with blue chips. Blue-chip stocks are stocks of companies that perform well, and their stocks are highly quoted. If you are just learning, these promotions are a good place to start. Examples of such stocks are IBM, Johnson and Johnson, and Procter and Gamble.  8 Don't be romantic. We've all seen movies in which stock brokers lavish wealth with a little effort and wisdom. The point is, investing also requires a certain degree of luck. Don't get romantic, and remember that you are not in the movies, and the first company you invest in will not be the next Microsoft. Make the right decisions and look for safe options if you want to be successful in the long term.

8 Don't be romantic. We've all seen movies in which stock brokers lavish wealth with a little effort and wisdom. The point is, investing also requires a certain degree of luck. Don't get romantic, and remember that you are not in the movies, and the first company you invest in will not be the next Microsoft. Make the right decisions and look for safe options if you want to be successful in the long term.  9 Avoid being scammed. There are many people in real life and on the internet who will try to sell you bad stocks. Turn your mind on: if something sounds too good to be true, it probably is. Make a safe investment, and don't be tempted by some quick-money schemes.

9 Avoid being scammed. There are many people in real life and on the internet who will try to sell you bad stocks. Turn your mind on: if something sounds too good to be true, it probably is. Make a safe investment, and don't be tempted by some quick-money schemes.

Method 3 of 4: Learn the Market

1 Do your research. Read as much as you can, constantly gather market intelligence, and even practice with virtual money before actually investing. Even if you have started investing, you need to constantly be aware of the development of the market and research the industry in which you are investing. You even need to be aware of your company's competitors! You will feel like school all the time, so if you have no desire to research the market, give up this idea.

1 Do your research. Read as much as you can, constantly gather market intelligence, and even practice with virtual money before actually investing. Even if you have started investing, you need to constantly be aware of the development of the market and research the industry in which you are investing. You even need to be aware of your company's competitors! You will feel like school all the time, so if you have no desire to research the market, give up this idea. - Read the company's annual report as well as the one they submit to the Stock Exchange Commission. This will provide you with important information about the development of the company and considerations for possible future problems.

- Get investment information from trusted sources, such as reports from Standard and Poor's, Wall Street Journal, Bloomberg, or Forbes.

2 Take time to get to know the market. You need to take some time to observe the market and to learn how it works. Watch stocks go up and down and watch for events that trigger a market reaction. When you feel like you understand how the market works, you can start.

2 Take time to get to know the market. You need to take some time to observe the market and to learn how it works. Watch stocks go up and down and watch for events that trigger a market reaction. When you feel like you understand how the market works, you can start.  3 Watch closely the companies you have invested in. When you invest in a company, you need to make sure that you fully research their financial situation and make sure they are on the right track. Look for problems and if there is a hint of potential problems, take the situation seriously.

3 Watch closely the companies you have invested in. When you invest in a company, you need to make sure that you fully research their financial situation and make sure they are on the right track. Look for problems and if there is a hint of potential problems, take the situation seriously. - You will need to look at their income, sales, debt and equity. Sales, income, and capital should grow over time, while debt should decrease.

- You also need to analyze the stock price to earnings ratio, stock price to sales volume, return on equity, earnings, and total debt to total assets ratio. This will give you an even deeper understanding of the company than just a look at earnings and debt.

4 Think about the product. A safe investment option is those items that people need and that people will still need, not caliphs for an hour (even if they are growing very fast now!). Examples of essential commodities are commodities such as oil, food, medicine, and certain types of technology.

4 Think about the product. A safe investment option is those items that people need and that people will still need, not caliphs for an hour (even if they are growing very fast now!). Examples of essential commodities are commodities such as oil, food, medicine, and certain types of technology.  5 Analyze indicators over a long period of time. The safer way to make money is to invest while earning lower returns for a long time.Stocks that rise in value very quickly can fall just as quickly. Especially when you are just starting out trading and trying to understand the market, look for companies that have a long, stable history that will guarantee continued good results.

5 Analyze indicators over a long period of time. The safer way to make money is to invest while earning lower returns for a long time.Stocks that rise in value very quickly can fall just as quickly. Especially when you are just starting out trading and trying to understand the market, look for companies that have a long, stable history that will guarantee continued good results.

Method 4 of 4: Get Good Results

1 Use analysis. Learn to conduct technical analysis efficiently and profitably. It consists of using previous indices and price evolution to anticipate future results. For example, if a stock has continued to rally in value over the past 6 months, it can be assumed that it will continue to climb further until the price chart shows otherwise. Technical traders trade by what they see, not by feeling what comes next. Arrogance kills. Search for "wall street newbie" for more information on technical analysis.

1 Use analysis. Learn to conduct technical analysis efficiently and profitably. It consists of using previous indices and price evolution to anticipate future results. For example, if a stock has continued to rally in value over the past 6 months, it can be assumed that it will continue to climb further until the price chart shows otherwise. Technical traders trade by what they see, not by feeling what comes next. Arrogance kills. Search for "wall street newbie" for more information on technical analysis. - Keep in mind that technical analysis is different from fundamental analysis, which is a different doctrine for stock selection. While both doctrines have their intended benefits, neither has historically proven superior to simply investing money in good stocks.

2 Identify the ups and downs. Understand what tension is, or the concept of support and resistance. Support and resistance are considered key indicators for the continuation of a price trend, decline, or reversal. These are the visual top and bottom charts of the price evolution of a stock. For example, the company's shares were trading between $ 55 and $ 65. Next time the share price is $ 55 (support), you can expect it to return to $ 65 (resistance) and vice versa.

2 Identify the ups and downs. Understand what tension is, or the concept of support and resistance. Support and resistance are considered key indicators for the continuation of a price trend, decline, or reversal. These are the visual top and bottom charts of the price evolution of a stock. For example, the company's shares were trading between $ 55 and $ 65. Next time the share price is $ 55 (support), you can expect it to return to $ 65 (resistance) and vice versa. - If the share price rises to $ 68, moving well beyond the $ 65 resistance line, you will no longer expect it to return to its old $ 55 support line. Instead, you would expect $ 65 to be the new support line, and the stock price will go to new highs. If the stock falls below $ 55, the opposite situation will arise.

3 Be consistent in your trading principles. This is very important for making a profit. You must develop systemic principles, rules for your trading game that you must follow. These rules should indicate when to start and when to end a trade. Follow these rules strictly, even if you are now or later in the red. For example, if you have a 10% loss limitation rule and a stock decreases in price by 10%, then you must sell that share. Don't argue with the market.

3 Be consistent in your trading principles. This is very important for making a profit. You must develop systemic principles, rules for your trading game that you must follow. These rules should indicate when to start and when to end a trade. Follow these rules strictly, even if you are now or later in the red. For example, if you have a 10% loss limitation rule and a stock decreases in price by 10%, then you must sell that share. Don't argue with the market.  4 Don't feel obligated to trade every day. If you are unsure about trading, wait and watch.

4 Don't feel obligated to trade every day. If you are unsure about trading, wait and watch.  5 Practice and learn more. Find a stock investing game that uses virtual money. Study the topic. Do what you need to do to learn how to analyze financial situations, make decisions, and analyze market movements.

5 Practice and learn more. Find a stock investing game that uses virtual money. Study the topic. Do what you need to do to learn how to analyze financial situations, make decisions, and analyze market movements.  6 Read all the trading books you can. More than 95% of traders follow losers as they read outdated books, buy old strategic systems, not knowing that all this obsolete material is being used by big money to ruin small traders. Find the latest works of the most successful traders to learn from their experience.

6 Read all the trading books you can. More than 95% of traders follow losers as they read outdated books, buy old strategic systems, not knowing that all this obsolete material is being used by big money to ruin small traders. Find the latest works of the most successful traders to learn from their experience.  7 Start small. Start small and increase your trading volume as you gain knowledge and confidence. Do not be discouraged at the first losses. On occasion, you can be a winner, constantly making a profit, not on your own merit, but with the help of support and guidance from the outside, actively trading with the help of a successful trader and your personal and professional trainer.

7 Start small. Start small and increase your trading volume as you gain knowledge and confidence. Do not be discouraged at the first losses. On occasion, you can be a winner, constantly making a profit, not on your own merit, but with the help of support and guidance from the outside, actively trading with the help of a successful trader and your personal and professional trainer.  8 Invest for the long term. Sure, it's not sexy, but does it make money? Still would. Investing in stocks for the long term - as opposed to daily trading - will bring you a lot more bottom line in the long term for a variety of reasons.Brokerage fees, unexpected ups and downs, and the general upward trend in the market make the patient investor a wealthy investor.

8 Invest for the long term. Sure, it's not sexy, but does it make money? Still would. Investing in stocks for the long term - as opposed to daily trading - will bring you a lot more bottom line in the long term for a variety of reasons.Brokerage fees, unexpected ups and downs, and the general upward trend in the market make the patient investor a wealthy investor.

Tips

- The primary market is the market where new shares are placed. The secondary market is the market in which previously placed shares are traded. Most "average" people trade in the secondary market, as the primary market is more risky.

- You have often heard the terms "bull" or "bear". A bull means a rising market, while a bear means a falling market. If you are having trouble remember why and just keep in mind: you should be able to take the bull by the horns, but if you see a bear, you should just run with all your might.

- Find several markets for yourself and explore them. Find out about the latest developments and try to guess the development of trends.

Warnings

- Never risk money used to support yourself or your family. Set aside money specifically for investing in stocks and never dive into the family budget.