Content

Whether due to illness, unemployment, or unexpected financial problems, you may one day have to deal with a collection agency. This information will not help you avoid paying off old debts; she will explain how to handle the phone call in such a way that you and the collection agency representative are both happy with the conversation.

Steps

1 Prepare a complete conversation script and keep a copy on every phone in the house. This scenario should begin like this: “Before going any further, I must tell you that I really want to work with you. However, if you threaten me, be aggressive, rude or disrespectful to me, I will hang up and not take calls from you. Can you agree with this? " If the agent starts to argue ("This is not how we work ..."), listen to him and read your phrase again in a calm and well-delivered voice until the agent agrees with your basic rules.

1 Prepare a complete conversation script and keep a copy on every phone in the house. This scenario should begin like this: “Before going any further, I must tell you that I really want to work with you. However, if you threaten me, be aggressive, rude or disrespectful to me, I will hang up and not take calls from you. Can you agree with this? " If the agent starts to argue ("This is not how we work ..."), listen to him and read your phrase again in a calm and well-delivered voice until the agent agrees with your basic rules.  2 Listen to the agent's information. The next thing you should read from your conversation script is, "Now, before we start, I need to find out your name, your company name, and your phone number." Many agents will be taken aback by your calmness and direct approach. He may say, “I will mark you as the one who refused to cooperate,” or something like that. Tell him that you do not refuse to cooperate, but rather want to cooperate. Record this information with the time and date of this call. Put all this information in a file and store it, as this process can take a long time.

2 Listen to the agent's information. The next thing you should read from your conversation script is, "Now, before we start, I need to find out your name, your company name, and your phone number." Many agents will be taken aback by your calmness and direct approach. He may say, “I will mark you as the one who refused to cooperate,” or something like that. Tell him that you do not refuse to cooperate, but rather want to cooperate. Record this information with the time and date of this call. Put all this information in a file and store it, as this process can take a long time.  3 Record the telephone conversation. In many states, you can record your own phone calls without informing anyone. And in some states, all parties to a conversation must be notified that the recording has been made. The agent may tell you that he is going to record the conversation "for quality assurance." This notice usually counts as consent to your recording. Check and follow the laws of your state before you start recording.

3 Record the telephone conversation. In many states, you can record your own phone calls without informing anyone. And in some states, all parties to a conversation must be notified that the recording has been made. The agent may tell you that he is going to record the conversation "for quality assurance." This notice usually counts as consent to your recording. Check and follow the laws of your state before you start recording.  4 Ask for proof that you are in debt. Within the first five days that the agency contacted you (by phone or email), it must send you a notification of the debt, this must be a letter that will give you the right to challenge the justification for the debt within 30 days. If you do not dispute the debt within 30 days, the agent may consider the debt to be valid. To dispute a debt, submit a request in writing. Once you do this, the agent will not be able to continue trying and demanding that you pay off the debt until the challenge is over.

4 Ask for proof that you are in debt. Within the first five days that the agency contacted you (by phone or email), it must send you a notification of the debt, this must be a letter that will give you the right to challenge the justification for the debt within 30 days. If you do not dispute the debt within 30 days, the agent may consider the debt to be valid. To dispute a debt, submit a request in writing. Once you do this, the agent will not be able to continue trying and demanding that you pay off the debt until the challenge is over. - Submit your debt statement by certified mail with return receipt (so you have proof that you sent the letter and received it). See below for a sample letter.

- Whatever you do, don't admit this debt.Keep repeating: “I want to see evidence of this debt in writing. I do not acknowledge this debt. " This is a precautionary measure against fake debts - when the agent tries to get you to pay off debts for which you are not responsible.

5 Check your debt. In response to your debt approval letter, the agency should send the following:

5 Check your debt. In response to your debt approval letter, the agency should send the following: - Proof that you have a debt to the agency or a debt assigned by the original creditor

- A copy of the original contract that you signed with the lender

- Lender documentation showing that you are in arrears

- Check out the documentation. If the agency does not provide sufficient evidence, write another letter indicating violations of the Good Debt Collection Practices (FDA) law and ask the agency to stop asking for payment and notify the credit bureaus or you file a lawsuit. If they don't stop, go to small claims court in two weeks. If the agency has sent you the evidence you need, check the statute of limitations to make sure you are no longer liable for the debt. The statute of limitations essentially determines how long you have to avoid paying the debt before the agent's right to collect it through the shipping system expires. Every state in the US has its own rules and exceptions as to when the pay period officially begins, how long it lasts, and what can "revive" the statutory deadline, so you really need to check the laws or consult a lawyer in your state. If you are not responsible for the debt, send a written notice explaining this and ask the agency to stop harassing you or you go to court. If you recognize debt, move on to the next step.

6 Keep in mind the amount that you can easily pay by sending it out every month or every week, no matter how small it is. Most likely, the agency will insist on a larger amount. Be steadfast and explain that this is all you have and you cannot pay more. All this time, stand your ground that you really want to pay off this debt, but, at the moment, this amount is all you have. Explain that if they accept this offer, you will agree to speak with the agent after another six months to try to increase the amount paid by then. Do not agree to have an agent withdraw money from your bank account through a bank transfer system.

6 Keep in mind the amount that you can easily pay by sending it out every month or every week, no matter how small it is. Most likely, the agency will insist on a larger amount. Be steadfast and explain that this is all you have and you cannot pay more. All this time, stand your ground that you really want to pay off this debt, but, at the moment, this amount is all you have. Explain that if they accept this offer, you will agree to speak with the agent after another six months to try to increase the amount paid by then. Do not agree to have an agent withdraw money from your bank account through a bank transfer system.  7 Make sure the agency agrees to stop charging interest on debt. Tell the agents to stop calling you until you call them yourself.

7 Make sure the agency agrees to stop charging interest on debt. Tell the agents to stop calling you until you call them yourself. - 8 When they agree on your payments, ask them to sign and fax you a bill of exchange with your balance and agreed terms, you sign and mail it back. Be sure to read this bill of exchange carefully before signing, as it will be a legal (and ethical of course) binding contract.

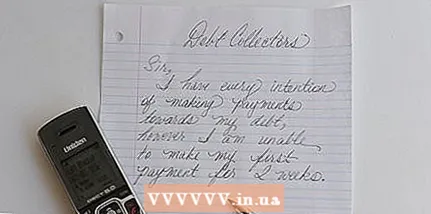

Method 1 of 1: Sample Debt Confirmation Letter

the date

Name address zip code

Tax collector name address zip code account number

Dear Tax Collector:

I am writing to you in response to your call / letter> from date>. In accordance with my rights under federal tax collection laws, I am asking you to provide proof of this debt. Note that this is not a refusal to pay off a debt, but a request that your office provide me with evidence that I have to pay you under a legal obligation.

If you do not grant this request, I will immediately file a complaint with the FTC and [name of your state] Attorney General. Civil and criminal claims will be filed.

Sincerely,

your name

Tips

- Tax collectors start to act much more judiciously if they think they can collect something. Therefore, if the debt is valid, start by saying that you just received a large salary, tax return, etc. and want to pay off the loan. Then tell us that you have loans and more (rent, utilities, etc.), and how much you left in order to pay off the remaining debts, such as this agency. With an introduction like this, you can ask for simple politeness and certain concessions.

- Record the call: If the agent becomes aggressive despite your efforts to resolve the debt problem, you can use the record later against him.

- Write everything down on a piece of paper - the date and time of the telephone conversation, information about the agent who is calling you, what he wants, what you offered, etc.

- You must remain calm, be judicious, and your voice must be confident. Any yelling, uttering names or other verbal tricks will undermine your image that you have been working on.

- Be very careful about paying any payments if the debt has a certain limitation period, or about the possibility that the loan can be renewed and you will need to pay the full amount later, even if the agent said that you only need to pay a small amount, and then the agent will leave you alone with the problem.

- It often happens that the name of the tax collector is not real. One way to test this is to send a signed receipt by letter addressed only to that particular collector. If the receipt is returned to you with his signature, then it really is a tax collector (otherwise, it could be a federal fraud offense).

- Sometimes you may lose this battle, the tax collector will not listen to your excuses, or will not admit that you legally owe nothing. In this case, put together long written evidence that indicates that the agent did not want to collect your debt in good faith. When the agent accepts your payment at the credit institution, electronic copies of your evidence that they violated the good debt collection law will be on file and will require the immediate removal of the claim from your credit report.

- If the agent speaks to you in a way that you find unpleasant, alert the agent once, as indicated in your opening speech. If this happens a second time, ask to speak with management. When you are connected to him, start all over again.

Warnings

- Remember, your goal is to speak while controlling the conversation so that you both get what you want. Having lost your composure, sounding alarmed or tambourine, you transfer the control of the situation into the hands of the agent.

What do you need

- Complete conversation script as described at the beginning

- A paper and pen near the phone (or in a pocket, in the case of a mobile phone)

- Telephone with a recording device. The radio room has good options