Author:

Marcus Baldwin

Date Of Creation:

15 June 2021

Update Date:

24 June 2024

Content

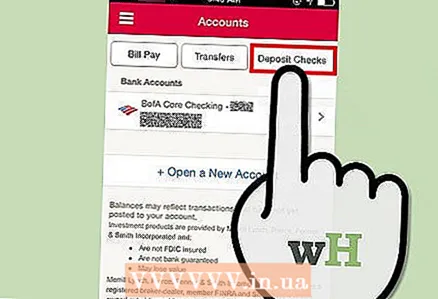

The Bank of America iPhone app has a feature that allows you to deposit your checks right from your phone. Use this article to find out how to deposit a check from your phone, and you won’t have to travel to the bank ever again.

Steps

1 Download, install and open the Bank of America app from the AppStore (or update the app after August 7, 2012). If you have run this app on your Android smartphone, please update to the version dated August 16, 2012.

1 Download, install and open the Bank of America app from the AppStore (or update the app after August 7, 2012). If you have run this app on your Android smartphone, please update to the version dated August 16, 2012.  2 Log in to your Bank of America page using your account details.

2 Log in to your Bank of America page using your account details. 3 Click the "Deposit" button in the upper right corner of the screen. If this is the first time, you will need to confirm (with a confirmation button) that you would like to use this service.

3 Click the "Deposit" button in the upper right corner of the screen. If this is the first time, you will need to confirm (with a confirmation button) that you would like to use this service.  4 Click the button "Front side of the check".

4 Click the button "Front side of the check". 5 Scan the front of the receipt using your phone camera. Make sure there is adequate lighting. A blurred photo will require you to scan the receipt again.

5 Scan the front of the receipt using your phone camera. Make sure there is adequate lighting. A blurred photo will require you to scan the receipt again.  6 Click the "Use" button if you are sure that you have a good photograph of the receipt and that the entire receipt is framed.

6 Click the "Use" button if you are sure that you have a good photograph of the receipt and that the entire receipt is framed.- 7Sign on the back of the check "For Deposits" or "For Deposits Only" (either of these phrases, however the application will display "For Deposits Only").

8 Click the "Reverse side of the check" button.

8 Click the "Reverse side of the check" button. 9 Flip this document 180 degrees and scan this part of the receipt so that the part you signed "For deposits only" appears on the left side of the photo and the "Original Document" watermark appears upside down in the photo.

9 Flip this document 180 degrees and scan this part of the receipt so that the part you signed "For deposits only" appears on the left side of the photo and the "Original Document" watermark appears upside down in the photo. 10 Click the "Use" button if you are sure that this is a good snapshot of the receipt and that the entire receipt is visible within the required limits.

10 Click the "Use" button if you are sure that this is a good snapshot of the receipt and that the entire receipt is visible within the required limits. 11 Check the "Place to" checkbox.

11 Check the "Place to" checkbox.- Select the account where you would like to deposit money from the check.

12 Check the "Amount" checkbox. This is a check cell, as the phone is not capable of ICR (Intelligent Character Recognition) of the receipt image at this stage.

12 Check the "Amount" checkbox. This is a check cell, as the phone is not capable of ICR (Intelligent Character Recognition) of the receipt image at this stage.  13 Enter the value from cell to cell, starting with the dollar value. Make sure you end up with cents (even if the check contains only dollars, no cents), then you need to enter 00 in this space.

13 Enter the value from cell to cell, starting with the dollar value. Make sure you end up with cents (even if the check contains only dollars, no cents), then you need to enter 00 in this space.  14 Click the Finish button.

14 Click the Finish button. 15 Confirm the amount of the deposit and the invoice for correctness

15 Confirm the amount of the deposit and the invoice for correctness - Click the "Continue" button when you're done.

16 Click the "Place a Deposit" button in the upper right corner.

16 Click the "Place a Deposit" button in the upper right corner. 17 Write down the confirmation number from the screen (optional). Click the "Finish" button after you have entered the confirmation number.

17 Write down the confirmation number from the screen (optional). Click the "Finish" button after you have entered the confirmation number.

Tips

- Android phone updates added this feature on August 16, 2012, so please update the app accordingly.

- If the image was a little blurry, move to a brighter area or scan again each side of the receipt on which the program has put an "x" (within the frames).

- The full withdrawal from the payer's account will take place the next business day, but the loan will be pending during this period. Thus, the deposit will not be immediately available.

- As with most Bank of America ideas, when you deposit money from a check using this app, you don't need a notification. However, if you want to receive a paper that the funds were deposited on such and such a day, keep the slip close at hand and write down the dates and confirmation numbers on it, just as you would if you were in the bank.

- While most other banks that have this option only provide it for commercial accounts, the feature of Bank of America mobile check deposit is that it can be placed for any type of account, so any account holder can use it!

- Destroy the check with a shredder (even easier, just rip the check completely, making sure the routing and account numbers are completely unreadable) to prevent fraudsters from using your account data.

- Remember that the account number and check number can be found in two places on it, and that both of them must be illegible to maintain the confidentiality of the depositor.

- Keep your receipt in a safe place for 14 days. If the check is not accepted or other questions arise, you will be forced to transfer it to your bank.

Warnings

- As of now (September 2013), you cannot deposit to your personal retirement account as a contribution, no matter how hard you try. There is no such option in the list. (This is because contributions can only be made in cash, not by check!)

What do you need

- iOS device

- Bank of America app

- Check to place money (any check will do)

- Pen (to write "For Deposit")

- Bank of America account (regular or savings account)