Content

- Steps

- Method 1 of 2: Calculate the Compounding Annual Growth Rate to determine the subject's past growth rates

- Method 2 of 2: Using CAGR to Calculate Future Growth Rate

- Tips

- What do you need

Compound Annual Growth Rate (CAGR) is a measure of the percentage of growth over a period of time. This indicator can be used to measure growth in the past and thus to calculate the planned population growth rates, the expected growth time of an organic cell, measure sales growth, etc.The use of not entirely accurate variables is allowed, for example, the rise and fall of interest rates, the birth rate in the regions, inflation or deflation. Nonetheless, compounding annual growth rate is a useful descriptive tool that can be used to determine whether the growth rate will change positively or negatively. Before using this indicator to calculate future growth, you can start by determining the rate of growth that has taken place in the past, as there are two ways to use it. Investors, salespeople, and business planners must be able to calculate CAGR, as this is the most commonly used metric in the business and investment industry.

Steps

Method 1 of 2: Calculate the Compounding Annual Growth Rate to determine the subject's past growth rates

1 Find the values of the variables used for this case:

1 Find the values of the variables used for this case:- Find the initial value of the value (SV), for example, the market value of an equity stake.

- Find the final or current market value of the value (FV).

- Find the time period you are studying (T), for example, the number of years, months, quarters, etc.

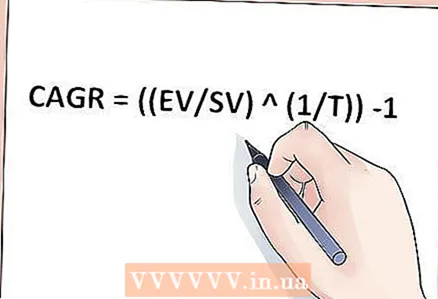

2 Substitute these values into the formula: CAGR = ((EV / SV) ^ (1 / T)) -1

2 Substitute these values into the formula: CAGR = ((EV / SV) ^ (1 / T)) -1 - A variation of this formula is as follows: CAGR = (FV - SV) / SV * 100

- Note that the growth rate shown by the CAGR is a “rounded” or “smoothed” value. This means that it will be reliable only under the assumption that during the period under consideration there were no significant fluctuations in the economic history of the object.

Method 2 of 2: Using CAGR to Calculate Future Growth Rate

1 Define the inputs to calculate the future value of value (FV):

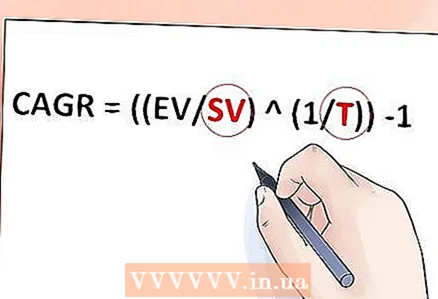

1 Define the inputs to calculate the future value of value (FV):- Determine the initial (current) market value of the value (SV).

- Determine the time period of interest (T), for example, the number of years, months, quarters, etc.

- Present CAGR (R) as a decimal fraction.

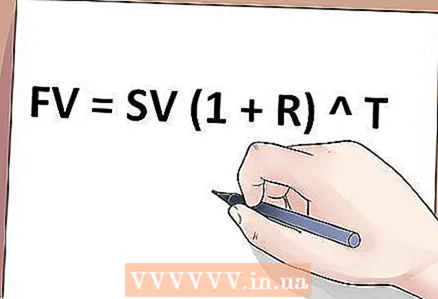

2 Calculate the future value of an asset using the formula FV = SV (1 + R) ^ T.

2 Calculate the future value of an asset using the formula FV = SV (1 + R) ^ T.

Tips

- Fundamentals of mathematics suggest that the longer the period under consideration, the less accurate the final result.

- Calculations can be performed in software using spreadsheets. You may want to fill in more complete data for scatter plotting to track growth trends, as the CAGR calculation is comparable to trend detection methods.

What do you need

- Calculator

- Software that works with spreadsheets, graphs and formulas.