Author:

Bobbie Johnson

Date Of Creation:

9 April 2021

Update Date:

26 June 2024

Content

When you decide to borrow from a friend, colleague, or a member of your family, then you will probably want to draw up a legal document about your loan, or an IOU. The IOU contains all the terms and conditions of the debt, and if it is written and executed correctly, then it is officially legally valid. This is easy enough to do. Just start from the first step!

Steps

Method 1 of 1: How to Write Your Own Legal Document

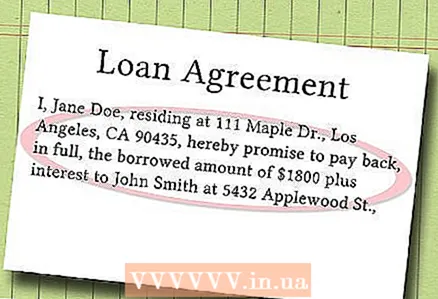

1 Write a title for your document. The title for your document should be short and descriptive, such as "Loan Agreement" or "IOU".

1 Write a title for your document. The title for your document should be short and descriptive, such as "Loan Agreement" or "IOU".  2 Indicate the participants of the parties. Include the full names of the participants, identifying him or her as “lender” or “borrower”. For example, "John Doe (" lender ") and Jane Smith (" borrower ")". So you can contact the parties to the agreement, up to the end of the entire IOU.

2 Indicate the participants of the parties. Include the full names of the participants, identifying him or her as “lender” or “borrower”. For example, "John Doe (" lender ") and Jane Smith (" borrower ")". So you can contact the parties to the agreement, up to the end of the entire IOU.  3 Date the document. Your best bet is to include the date in the same sentence as the names of the participants and the title of the document, for example, "John Doe ('lender') and Jane Smith ('borrower') hereby enter into this loan agreement on June 5, 2009." . "

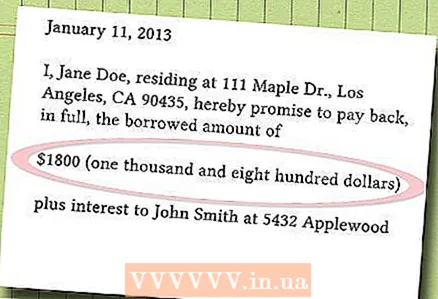

3 Date the document. Your best bet is to include the date in the same sentence as the names of the participants and the title of the document, for example, "John Doe ('lender') and Jane Smith ('borrower') hereby enter into this loan agreement on June 5, 2009." . "  4 Indicate the amount of borrowed funds. To avoid confusion in the future, it would be nice to write the amount not only in numbers, but in words, for example, five thousand dollars ($ 5,000) or six thousand five hundred dollars ($ 6,500).

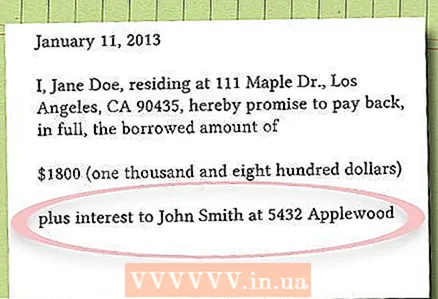

4 Indicate the amount of borrowed funds. To avoid confusion in the future, it would be nice to write the amount not only in numbers, but in words, for example, five thousand dollars ($ 5,000) or six thousand five hundred dollars ($ 6,500).  5 Describe the interest rate. If your agreement includes the payment of interest on a monetary debt, then you must describe the interest rate and how it is calculated.To avoid confusion in the future, write it down both in numbers and in words, for example, eight percent (8%) or six and a half percent (6.5%). Interest is calculated in one of two ways:

5 Describe the interest rate. If your agreement includes the payment of interest on a monetary debt, then you must describe the interest rate and how it is calculated.To avoid confusion in the future, write it down both in numbers and in words, for example, eight percent (8%) or six and a half percent (6.5%). Interest is calculated in one of two ways: - Simple percentage basis. Simple Interest Base is the most commonly used and fastest way to calculate interest on personal debt based on the original amount of debt.

- Compound interest rate. When you use this method of calculating interest, the interest is calculated based on the current balance of the debt, and not on the original amount, and then interest is calculated on the principal amount.

6 Set a due date for the debt. Make sure to describe the terms in full and in clear language. Your payment terms must cover:

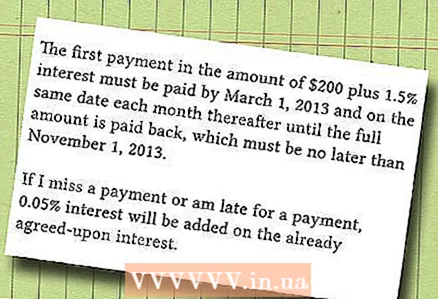

6 Set a due date for the debt. Make sure to describe the terms in full and in clear language. Your payment terms must cover: - Monthly payments. Includes the amount to be paid in, percentage, and the total amount of the monthly payment, the date of the deposit and where exactly should be sent or delivered.

- Delayed payments. Describe clearly when the payment is considered late and what the penalty will be. For example, “Payment is made on the 1st day of each month, and will be considered overdue if it is not made before the 15th day of the same month. The penalty for non-payment will be $ 25 for all late payments. ”

- Contract time. Indicate when payments will start and when they will end, as well as how many payments will be. For example, “Payments will start on 1st March 2009, with the last payment on 1st February 2010, for the contract term of twelve (12) months”.

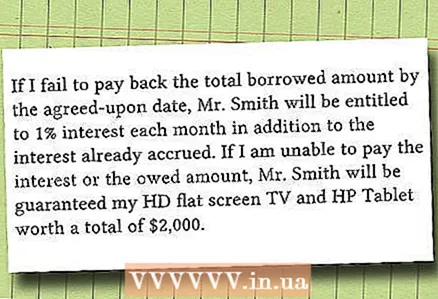

7 Describe what happens if the borrower defaults on the loan. As a rule, the borrower is provided with a notice of non-fulfillment of the conditions, and a short period for fulfillment of obligations (usually 10 days), and if the borrower does not take any action, then the lender has the right to claim the entire amount of the debt. Here are some more facts you should know in case of non-compliance with the terms of the contract:

7 Describe what happens if the borrower defaults on the loan. As a rule, the borrower is provided with a notice of non-fulfillment of the conditions, and a short period for fulfillment of obligations (usually 10 days), and if the borrower does not take any action, then the lender has the right to claim the entire amount of the debt. Here are some more facts you should know in case of non-compliance with the terms of the contract: - Lawyer and legal fees. Most likely, you will want the borrower to be responsible for the costs of a lawyer in case of non-payment of the debt, and for the costs in court if the lender decides to sue the borrower to recover the debts.

- Pledge. Often, the borrower must provide a debt repayment guarantee as collateral. If your case requires such a deposit, then you need to describe it and indicate all the conditions that the lender will do with it in case of non-payment. The description should include information on whether the borrower's property will be confiscated and, if confiscated, whether the borrower is responsible for the difference in amounts.

8 Decide which standard items to include. Many of the standard clauses are unnecessary, but in some situations, they can be very useful. Here are some of them:

8 Decide which standard items to include. Many of the standard clauses are unnecessary, but in some situations, they can be very useful. Here are some of them: - Choice of jurisdiction. This clause indicates which jurisdiction will govern your contract. Usually this is the jurisdiction of the state in which the agreement was agreed and signed. If the parties to the agreement are from two different states, then most likely you will decide to add this clause to clarify the laws of which state will apply, and which court will have jurisdiction in the event of a dispute.

- Salvatory clause. The salvatory clause states that if any of the provisions of the agreement are found to be invalid, then all other provisions remain in effect. It may look like this: “if any provision of this agreement is found by a court to be illegal, invalid or unenforceable, (a) this provision will be recognized as amended in order to achieve the same economic effect as the original provision, and (b) legality , the validity and enforceability of the remaining provisions of this agreement cannot be affected or violated. "

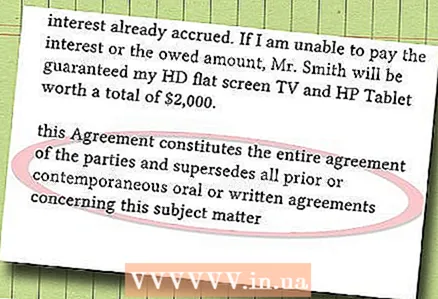

- Complete Agreement. This clause provides that the written agreement is the entire agreement of the parties, and supersedes any prior oral or written agreement. It might look something like this: "This agreement constitutes the entire agreement between the parties, and supersedes any prior or present oral or written agreement as to what is going on." The purpose of this clause is to prevent any of the parties from arguing that the contract does not include certain conditions, and that they should be included in the contract.

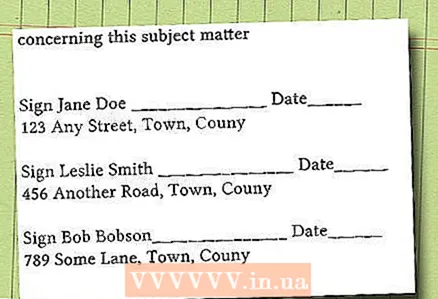

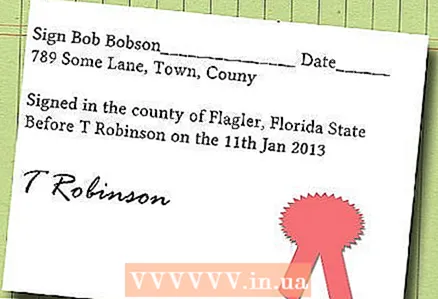

9 Leave room for signatures. The place for signatures should include lines for the signature of each party to the agreement, the date, and the printed names, address and telephone of each of the parties, under the line for signature.

9 Leave room for signatures. The place for signatures should include lines for the signature of each party to the agreement, the date, and the printed names, address and telephone of each of the parties, under the line for signature.  10 Leave room for a notary. The place for the notary must include the province and the administrative district, a statement that the participants voluntarily signed the agreement in the presence of the notary, a place for the date, a line for the notary to sign, and a large space for the notary to print.

10 Leave room for a notary. The place for the notary must include the province and the administrative district, a statement that the participants voluntarily signed the agreement in the presence of the notary, a place for the date, a line for the notary to sign, and a large space for the notary to print.

Warnings

- Before entering into any agreement that affects your rights and obligations, consult a licensed attorney.

- For a debt to be considered a loan and not a gift by the Federal Tax Service (FSN) for tax purposes, the interest accrued on the loan must comply with the Applicable Federal Rate (FAR) for the year and month in which the IOU was signed. A list of PFCs can be found on the FSN website http://www.irs.gov/app/picklist/list/federalRates.html.

- If in doubt, check your document first.

- Everywhere has its own laws that offer the maximum allowable interest rate on the loan. Take an interest in the laws in your state, or check with a lawyer how much interest you are officially allowed to charge on a personal loan.