Author:

Bobbie Johnson

Date Of Creation:

6 April 2021

Update Date:

1 July 2024

Content

The principles of Zakat are essential to understand your responsibilities. This guide will help you determine your personal Zakat. If you are an entrepreneur, you need additional advice.

Steps

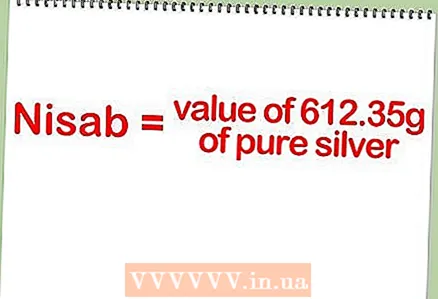

1 Calculate Nisab (proportions).

1 Calculate Nisab (proportions).- Nisab is equal to 612.35 grams of pure silver, expressed in the prevailing market value at the time of calculation.

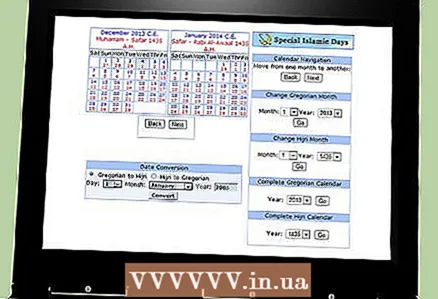

2 Determine your cycle of Zakat days.

2 Determine your cycle of Zakat days.- Since Zakat is an annual obligation, the beginning and end of the cycle of Zakat should be determined according to the Hijri calendar. To convert Gregorian dates to Hijri calendar, go here: IslamicFinder Converting dates between Gregorian and Hijri calendar

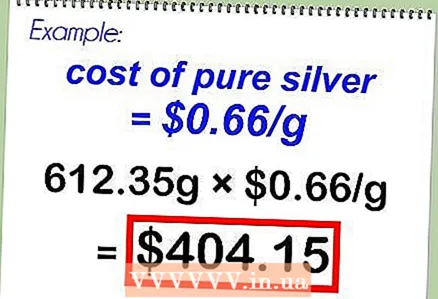

3 Base your Zakat calculations on silver: Zakat is calculated using the price of silver, as it is cheaper than gold, which means more people will be able to pay Zakat and then more people will get help. However, Zakat can be calculated based on gold prices.

3 Base your Zakat calculations on silver: Zakat is calculated using the price of silver, as it is cheaper than gold, which means more people will be able to pay Zakat and then more people will get help. However, Zakat can be calculated based on gold prices. - The starting date is set at the moment when the amount of Zakat exceeds the limit of Nisab.

- The end date is set one year after the start date.

- Example. If 1 gram of pure silver costs $ 0.66, then the starting date is set when your Rakyat equals Nisab (612.35 grams X $ 0.66 = $ 404.51). Let's say the start date is 08/02/2013, then the end date is 08/01/2014.

- 4 Check your financial status.

- Prepare up-to-date information on the market value of your wealth as of the end date.

5 Determine your Zakat assets.

5 Determine your Zakat assets.- Zakat assets are what you own as of the end date of Zakat. You need to calculate the sum of the values of your wealth items. For example:

- Money: cash, checking accounts, savings accounts, deposits

- Securities: stocks and bonds denominated in market closing value

- Your account with the company in which you are a partner

- Accumulative plans: their redemption value

- Investment in gold: based on market price

- If you should receive a certain amount of money during the Zakat cycle, but this has not happened yet, it also needs to be taken into account in assets.

- Your personal belongings, car and house are not counted in the assets of Zakat.

- Zakat assets are what you own as of the end date of Zakat. You need to calculate the sum of the values of your wealth items. For example:

6 Determine your Zakat debts.

6 Determine your Zakat debts.- Zakat debts are your financial obligations. If any obligation has been settled during the cycle, it should not be taken into account. However, if an amount was due to you during the cycle, but has not yet been paid, it must be taken into account in the liability.

- If you have taken out a personal loan of any kind, you must factor in the fees you pay during the cycle. You don't have to do anything with a full debt.

7 Calculate the amount of Zakat.

7 Calculate the amount of Zakat.- The Zakat amount is the assets of the Zakat (step 5) minus the liabilities of the Zakat (step 6).

8 Compare with Nisab.

8 Compare with Nisab.- If the amount of Zakat exceeds the amount of Nisab, you must get rid of the Zakat debt.

9 Calculate the amount of your debt according to Zakat.

9 Calculate the amount of your debt according to Zakat.- Zakat debt = Zakat amount (step 7) X 2.557%. The result obtained is the amount to be paid.

- The Zakat rate is 2.5% if the calculations are based on the Hijri calendar, and 2.557% if the calculations are based on the Gregorian calendar.

Tips

- The cost of the house or car you rent is also not included. However, any investment income should be considered.

- Personal house and car are not counted.

- Any income that does not comply with Sharia law (such as the rate on bonds) is not counted. However, the value of the eligible liabilities is taken into account.

- Lowering the amount of Zakat below the Nisab level during the cycle does not affect the calculations, if by the end date all conditions are met.