Author:

Bobbie Johnson

Date Of Creation:

4 April 2021

Update Date:

26 June 2024

Content

- Steps

- Method 1 of 2: Determining the Product Margin

- Method 2 of 2: Using Profit Margin Values

- Tips

- What do you need

Profit margin is a technique commonly used in management accounting and is known as Operational Analysis (CVP). The specific contribution to the coverage is obtained using the formula P-V, where P is the cost of the product and V is its variable costs. While this is a useful method for calculating the amount of profit that a business can generate from the sale of a product to pay fixed costs and make a profit, it is also suitable for determining the revenue ratio, the value of which is defined as CM / Pwhere CM is gross profit and P is production cost. The latter value is the fraction of the available selling price of the product available to cover fixed costs and profit.

Steps

Method 1 of 2: Determining the Product Margin

1 Determine the income per unit (price) of the product. The first variable you need to find the value of the margin equation is specific income; in other words, the price at which the product is being sold. The confusing term “unit income” is used in economics because the price of a product is equal to the income earned from the sale of one product (or one “unit”).

1 Determine the income per unit (price) of the product. The first variable you need to find the value of the margin equation is specific income; in other words, the price at which the product is being sold. The confusing term “unit income” is used in economics because the price of a product is equal to the income earned from the sale of one product (or one “unit”). - Let's continue this part with a practical example. As an example, let's say we run a factory that makes baseballs. If we sell balls for $ 3 each, we will use the value 3$ for the specific income from balls.

2 Determine the variable costs spent on the production of the item. In addition to the cost of the product, we need its variable costs to determine the contribution to cover. The variable costs associated with production are those that change with the quantity of goods produced, such as wages, raw materials, and utilities - electricity, water, and others. The more goods are produced, the higher the costs will be - since these costs changetherefore they are called "variable" costs.

2 Determine the variable costs spent on the production of the item. In addition to the cost of the product, we need its variable costs to determine the contribution to cover. The variable costs associated with production are those that change with the quantity of goods produced, such as wages, raw materials, and utilities - electricity, water, and others. The more goods are produced, the higher the costs will be - since these costs changetherefore they are called "variable" costs. - Using our baseball factory as an example, let's say the total cost of rubber and leather used to make balls last month was $ 1,500. In addition, we paid our workers $ 2,400 and our factory's utility bill was $ 100. If the company produced 2,000 balls that month, then the variable cost of each baseball is (4,000 / 2,000) = 2,00$.

- Please note that, unlike variable costs, permanent costs do not change when production volumes change. For an illustrative example: the rent paid by the company for the factory building will always be the same, it does not depend on how many balls are produced. This means that rent is a fixed cost. Other common fixed costs are buildings, equipment, patent usage, and others.

3 Subtract variable costs from the price. Once you know the variable cost and the price of a product, you can easily calculate the profit margin by simply subtracting the variable cost from the price. Your answer is a certain amount from the sale of one unit of production, from which the company is able to pay fixed costs and make a profit.

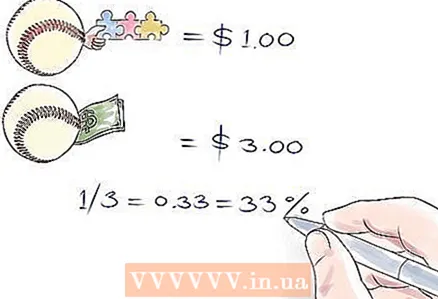

3 Subtract variable costs from the price. Once you know the variable cost and the price of a product, you can easily calculate the profit margin by simply subtracting the variable cost from the price. Your answer is a certain amount from the sale of one unit of production, from which the company is able to pay fixed costs and make a profit. - In our example, it is easy to calculate the contribution to the coverage of each baseball. Simply subtract the variable cost per ball ($ 2.00) from the price of one ball ($ 3.00) to get (3 - 2) = 1,00$.

- Keep in mind that in real life, the contribution to coverage can be found in the profit and loss statement of the enterprise, which companies specifically publish for existing and prospective investors.

4 Use profit margins to pay for fixed costs. Positive profit margins are always beneficial - the product pays for its variable costs and invests (hence the "profitable" margin) a certain amount to fixed costs. Since fixed costs do not increase with the amount of product produced, therefore, once they have paid off, the profit margin left over from the rest of the product sold becomes net profit.

4 Use profit margins to pay for fixed costs. Positive profit margins are always beneficial - the product pays for its variable costs and invests (hence the "profitable" margin) a certain amount to fixed costs. Since fixed costs do not increase with the amount of product produced, therefore, once they have paid off, the profit margin left over from the rest of the product sold becomes net profit. - In our example, each baseball defines a $ 1.00 profit margin. If the rent for the factory is $ 1,500 and there are no other fixed costs, to recoup the fixed costs, you need to sell 1,500 balls per month. After this amount, each ball sold gives $ 1.00 in profit.

Method 2 of 2: Using Profit Margin Values

1 Find the profit margin ratio by dividing the profit value by the price. Once you find the product's margin, you can use it to find multiple financial values. For example, you can find coefficient profit margin required value, by simply dividing margin profit by product price. This value reflects the portion from each sale that makes up the profit margin — in other words, the portion used for fixed costs and profits.

1 Find the profit margin ratio by dividing the profit value by the price. Once you find the product's margin, you can use it to find multiple financial values. For example, you can find coefficient profit margin required value, by simply dividing margin profit by product price. This value reflects the portion from each sale that makes up the profit margin — in other words, the portion used for fixed costs and profits. - In our example above, the baseball margin was $ 1.00 and the unit price was $ 3.00. In this case, the ratio of the profit margin was 1/3 = 0,33 = 33%... 33 percent of each sale goes towards paying off fixed costs and making a profit.

- Note that you can also determine the profit margin for two or more products by dividing the total profit margin by the total product price.

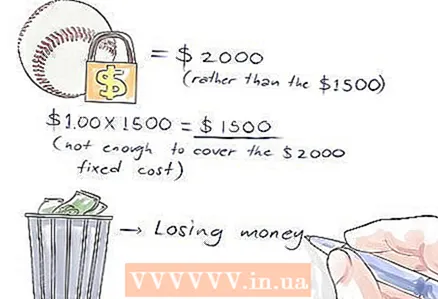

2 Use profit margin for urgent break-even analysis. In simplified business scenarios, if you know the margins of a company's products and their fixed costs, you can quickly assess whether the company is profitable or not. Assuming that the sale of the company's products is not at a loss, all you need to do to make a profit is to sell enough products to cover its fixed costs - the output will already cover its variable costs. If you sell enough products to cover fixed costs, the company will start making a profit.

2 Use profit margin for urgent break-even analysis. In simplified business scenarios, if you know the margins of a company's products and their fixed costs, you can quickly assess whether the company is profitable or not. Assuming that the sale of the company's products is not at a loss, all you need to do to make a profit is to sell enough products to cover its fixed costs - the output will already cover its variable costs. If you sell enough products to cover fixed costs, the company will start making a profit. - For example, let's say our baseball company has a fixed cost of $ 2,000 (not $ 1,500) as above. If we still sell the same number of balls, we get $ 1.00 * 1500 = $ 1500. This will not be enough to cover the fixed costs of $ 2,000, so in this situation we losing money.

3 Use the profit margin (and ratio) to critically evaluate the business plan. Coverage contributions can also be used to make decisions about how a business is run. This is especially useful if the business is not profitable. In this case, you can use your profit margin to set a new sales plan or find a way to reduce your fixed or variable costs.

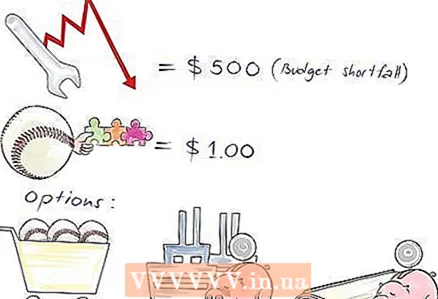

3 Use the profit margin (and ratio) to critically evaluate the business plan. Coverage contributions can also be used to make decisions about how a business is run. This is especially useful if the business is not profitable. In this case, you can use your profit margin to set a new sales plan or find a way to reduce your fixed or variable costs. - Let's assume we have a $ 500 deficit cap for the example above. In this case, we have several options. Since the profit margin is $ 1.00 per ball, we could just try to sell 500 more balls. However, we can also try to move production to a building with a lower rent to lower our fixed costs. We may even try to use more affordable materials to keep our variable costs down.

- For example, if we could cut $ 0.50 from the production of each baseball, we would get $ 1.50 per unit instead of $ 1.00, so if we sell the same 1,500 balls, we will bail out 2250$, thereby making a profit.

4 Use profit margins to prioritize products. If your company manufactures more than one product, the margins for each product will help you decide how much of each product to produce. This is especially important if the same materials and manufacturing techniques are used for all products. In such situations, you should definitely choose one product from all, so choose the one that brings the highest profit margin.

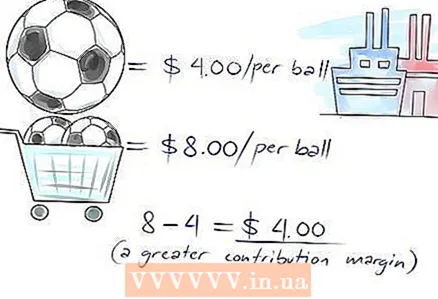

4 Use profit margins to prioritize products. If your company manufactures more than one product, the margins for each product will help you decide how much of each product to produce. This is especially important if the same materials and manufacturing techniques are used for all products. In such situations, you should definitely choose one product from all, so choose the one that brings the highest profit margin. - For example, suppose our factory also makes soccer balls in addition to baseballs. Soccer balls come out at a higher price tag of $ 4 per ball, but they also sell for $ 8 per unit, giving a higher profit margin: 8-4 = $ 4.00. If soccer balls and baseballs are made from the same leather, we definitely need to prioritize the production of soccer balls - we will get four times more from them than $ 1.00 baseballs.

Tips

- The above calculation is also suitable for expression in other currencies.

What do you need

- Calculator