Author:

William Ramirez

Date Of Creation:

21 September 2021

Update Date:

1 July 2024

Content

- Steps

- Method 1 of 3: Using Net Income and Dividends

- Method 2 of 3: Using Annual Dividends and Earnings Per Share

- Method 3 of 3: Using a Dividend Payout Ratio

- Tips

- Warnings

Share of income paid out in dividends is a way of measuring the share of a company's profit that is paid to investors in the form of dividends over a set period (usually a year), rather than going towards the development of the company. In general, older and established companies have higher dividend ratios - their income levels have already increased significantly, while companies with lower dividend ratios are young companies with rapidly growing potential. To calculate the proportion of a company's income paid as dividends over a given period, use the calculation algorithm paid dividends / net income or annual dividend per share / net income per share - they are equivalent.

Steps

Method 1 of 3: Using Net Income and Dividends

1 Find out what the company's net profit is. To find the share of a company's income paid as dividends, first calculate its net income for the time period you are considering (note that one year is the base period for calculating the share of income paid as dividends). This information is listed in the company's income statement. To be clear, you need to calculate the company's profit, taking into account all costs - taxes, costs of doing business, discounts for spoilage, depreciation and interest.

1 Find out what the company's net profit is. To find the share of a company's income paid as dividends, first calculate its net income for the time period you are considering (note that one year is the base period for calculating the share of income paid as dividends). This information is listed in the company's income statement. To be clear, you need to calculate the company's profit, taking into account all costs - taxes, costs of doing business, discounts for spoilage, depreciation and interest. - For example, suppose new firm Jim's Light Bulbs made $ 200,000 in its first year in the market, but had to spend $ 50,000 on the costs listed above. In this case, the net income of Jim's Light Bulbs will be equal to 200,000 - 50,000 = 150000 dollars.

2 Determine the amount of dividends to be paid. Then calculate the amount paid by the company in the form of dividends during the period of time you are considering. Dividends are funds that are paid to investors, and not go to the development of the company.Dividends are usually not reported on the income statement, but are included on the balance sheet and cash flow statement.

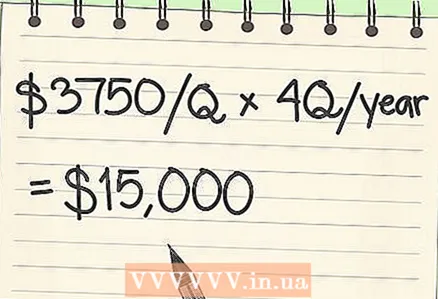

2 Determine the amount of dividends to be paid. Then calculate the amount paid by the company in the form of dividends during the period of time you are considering. Dividends are funds that are paid to investors, and not go to the development of the company.Dividends are usually not reported on the income statement, but are included on the balance sheet and cash flow statement. - Imagine that Jim's Light Bulbs, a relatively young company, decided to invest most of its net income in expanding its manufacturing capabilities and paid only $ 3,750 in quarterly dividends. In this case, we are multiplying 3750 by 4 times = 15000 dollars. This is the amount of dividends paid by the company in its first year of operation.

3 Divide dividends by net income. Once you know how much net income a company has made and how much it has paid in dividends over a given period of time, it will be relatively easy to find the share of income paid out in dividends. All you have to do is divide the company's dividend payout by its net income - the amount received will be the share of the income paid in the form of dividends.

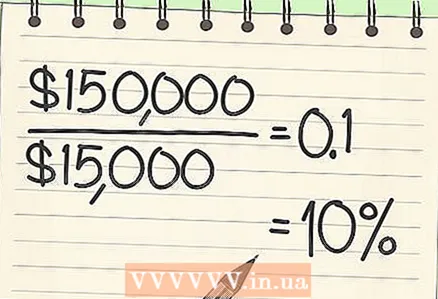

3 Divide dividends by net income. Once you know how much net income a company has made and how much it has paid in dividends over a given period of time, it will be relatively easy to find the share of income paid out in dividends. All you have to do is divide the company's dividend payout by its net income - the amount received will be the share of the income paid in the form of dividends. - In the case of Jim's Light Bulbs, we can calculate the share of income paid in the form of dividends by dividing 15,000 / 150,000 = 0.10 (or 10%). This means that Jim’s Light Bulbs paid 10% of its income to investors, and invested the rest (90%) in the development of the company.

Method 2 of 3: Using Annual Dividends and Earnings Per Share

1 Find out how much dividend each share is. The above method is not the only way to calculate the share of income that a company pays out in dividends. It can also be calculated with two pieces of financial data. If you are interested in this alternative method, first calculate the company's dividend per share (or DPS). This is the amount of funds received by each investor for every share in the share capital. This information is usually listed on the Quarterly Quotes pages, so you may have to find the sum of several numbers if you are going to do an analysis for the whole year.

1 Find out how much dividend each share is. The above method is not the only way to calculate the share of income that a company pays out in dividends. It can also be calculated with two pieces of financial data. If you are interested in this alternative method, first calculate the company's dividend per share (or DPS). This is the amount of funds received by each investor for every share in the share capital. This information is usually listed on the Quarterly Quotes pages, so you may have to find the sum of several numbers if you are going to do an analysis for the whole year. - Let's take another example. Rita's Rugs is an old, established company that lacks the space to grow in today's market and instead of using its profits to expand production, it gives it to its investors. Imagine that Rita's Rugs paid $ 1 per share as dividends in the first quarter, $ 0.75 in the second quarter, $ 1.50 in the third, and $ 1.75 in the fourth. If we want to calculate the share of income paid in the form of dividends for the whole year, we will consider: 1 + 0.75 + 1.50 + 1.75 = $ 4.00 per share, that is, the company's dividend per share (DPS).

2 Determine earnings per share. Then calculate the company's EPS per share over the time period you are considering. EPS is a measure of the amount of net income divided by the number of shares held by investors, or, in other words, the amount of money that the investor is expected to receive if the company pays 100% of its income in the form of dividends. Usually this information is indicated in the company's income tax return.

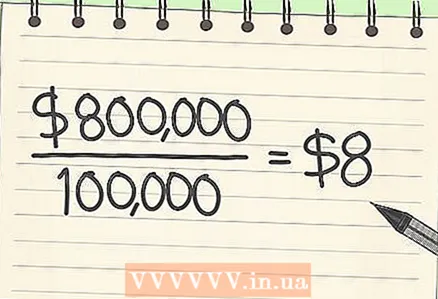

2 Determine earnings per share. Then calculate the company's EPS per share over the time period you are considering. EPS is a measure of the amount of net income divided by the number of shares held by investors, or, in other words, the amount of money that the investor is expected to receive if the company pays 100% of its income in the form of dividends. Usually this information is indicated in the company's income tax return. - Imagine that 100,000 shares of Rita's Rugs are in the hands of investors, and in the last year of the company’s operations were $ 800,000. In this case, EPS will be 800000/100000 = $ 8 per share.

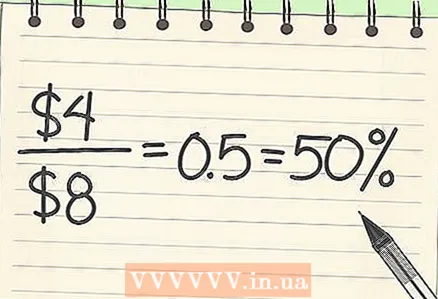

3 Divide the annual dividend per share by the earnings per share. As noted above, all you have to do is divide the two amounts. Calculate the share of income your company pays out as dividends by dividing the amount of dividend per share by the amount of profit earned on each share.

3 Divide the annual dividend per share by the earnings per share. As noted above, all you have to do is divide the two amounts. Calculate the share of income your company pays out as dividends by dividing the amount of dividend per share by the amount of profit earned on each share. - In the case of Rita's Rugs, the share of the company's dividend income can be calculated by dividing 4 by 8 = 0.50 (or 50%)... In other words, over the past year, the company has given half its profit to investors in the form of dividends.

Method 3 of 3: Using a Dividend Payout Ratio

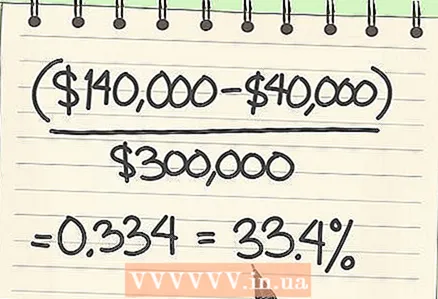

1 One-time dividends can be calculated on special terms. Strictly speaking, the dividend payout ratio is calculated only if regular dividends are paid to investors. But sometimes companies offer to pay one-time dividends to everyone (or only some) to their investors.To obtain the most accurate payout amount, these “special” dividends should not be taken into account when calculating the share of income paid as dividends. Thus, the modified formula for calculating dividend payout ratios for periods that include special dividends is (Total Dividends - Special Dividends) / Net Income.

1 One-time dividends can be calculated on special terms. Strictly speaking, the dividend payout ratio is calculated only if regular dividends are paid to investors. But sometimes companies offer to pay one-time dividends to everyone (or only some) to their investors.To obtain the most accurate payout amount, these “special” dividends should not be taken into account when calculating the share of income paid as dividends. Thus, the modified formula for calculating dividend payout ratios for periods that include special dividends is (Total Dividends - Special Dividends) / Net Income. - For example, if a company pays quarterly dividends of up to $ 1,000,000 during the year, but also pays special dividends to its investors of $ 400,000 due to windfall profits, we will not count those special dividends when calculating the share of income paid as dividends. Assuming a net income of $ 3,000,000, the proportion of income paid as dividends would be (1,400,000 - 400,000) / 3,000,000 = 0.334 (or 33.4%).

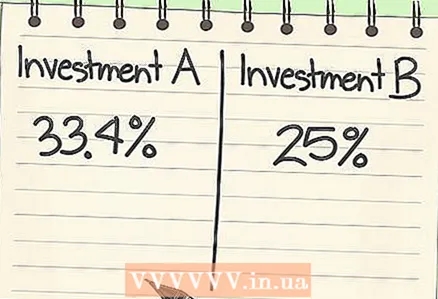

2 Use shares of dividend income to compare investments. It is known that rich people want to invest money where there are opportunities for investment, and for this they will want to familiarize themselves with the history of the company, where the dividend paid ratio is indicated. Investors usually pay attention to the value of the ratio (in other words, how much of the profit the company returns to investors), as well as its stability (that is, how much the ratio jumps from year to year). Payout ratios that are suitable for investors vary depending on their goals, but in general, payout ratios that are too low or too high (and those that jump or drop dramatically over time) are considered risky to invest.

2 Use shares of dividend income to compare investments. It is known that rich people want to invest money where there are opportunities for investment, and for this they will want to familiarize themselves with the history of the company, where the dividend paid ratio is indicated. Investors usually pay attention to the value of the ratio (in other words, how much of the profit the company returns to investors), as well as its stability (that is, how much the ratio jumps from year to year). Payout ratios that are suitable for investors vary depending on their goals, but in general, payout ratios that are too low or too high (and those that jump or drop dramatically over time) are considered risky to invest.  3 Choose high ratios for consistent income and low for growing potential. As noted above, there are reasons why both high and low ratios can be attractive to an investor. For those who want to invest in a reliable business that will generate a stable income, high payout ratios will serve as a signal that the company has already reached the level where it almost does not have to invest in the development of production, and this is a reliable capital investment. On the other hand, for those who are ready to work for future profits, hoping to ultimately receive large profits, low payout ratios will serve as a signal that they need to invest heavily in order to develop the company in the future. If the company thrives as a result, it will serve as proof of a profitable investment, but it can also be risky as the company's long-term potential is still unknown.

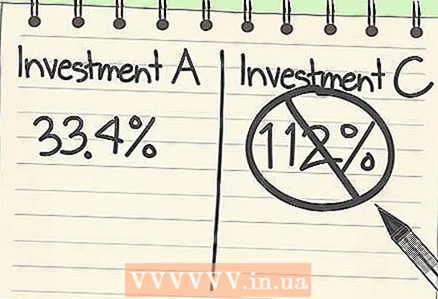

3 Choose high ratios for consistent income and low for growing potential. As noted above, there are reasons why both high and low ratios can be attractive to an investor. For those who want to invest in a reliable business that will generate a stable income, high payout ratios will serve as a signal that the company has already reached the level where it almost does not have to invest in the development of production, and this is a reliable capital investment. On the other hand, for those who are ready to work for future profits, hoping to ultimately receive large profits, low payout ratios will serve as a signal that they need to invest heavily in order to develop the company in the future. If the company thrives as a result, it will serve as proof of a profitable investment, but it can also be risky as the company's long-term potential is still unknown.  4 Beware of too high dividend payout ratios. A company that gives away 100% or more of its earnings may to appear a good investment option, but in practice this is very often a sign of the company's precarious financial position. A payout ratio of 100% or more of earnings means that the company is paying investors more money than it is making itself — in other words, it is losing money by giving it back to investors. Since very often these payments become overwhelming, this may indicate a significant decrease in the dividend payout ratio in the future.

4 Beware of too high dividend payout ratios. A company that gives away 100% or more of its earnings may to appear a good investment option, but in practice this is very often a sign of the company's precarious financial position. A payout ratio of 100% or more of earnings means that the company is paying investors more money than it is making itself — in other words, it is losing money by giving it back to investors. Since very often these payments become overwhelming, this may indicate a significant decrease in the dividend payout ratio in the future. - However, despite this trend, there are exceptions. Established companies with high growth potential in the future can sometimes cope with a dividend payout ratio of more than 100%. For example, in 2011, AT&T paid out about $ 1.75 in dividends per share, earning only $ 0.77 per share - a dividend payout ratio of over 200%. But for the reason that the company's net profit per share in 2012-2013. was more than $ 2, short-term volatility in dividend payments could not undermine the company's long-term financial outlook.

Tips

- Also check out the financial ratios and estimates at http://pages.stern.nyu.edu/~adamodar/

Warnings

- Do not confuse the dividend payout ratio with the dividend yield, which is calculated as follows;

- Dividend Yield = DPS (Dividend Per Share) / Share Market Price

- It can also be calculated like this: (DIVIDEND PAYMENT RATIO X EPS) / MARKET PRICE