Author:

Florence Bailey

Date Of Creation:

23 March 2021

Update Date:

1 July 2024

Content

- Steps

- Part 1 of 3: Using a Formula to Calculate Marginal Revenue

- Part 2 of 3: Using the Marginal Revenue Value

- Part 3 of 3: Understanding the Different Market Models

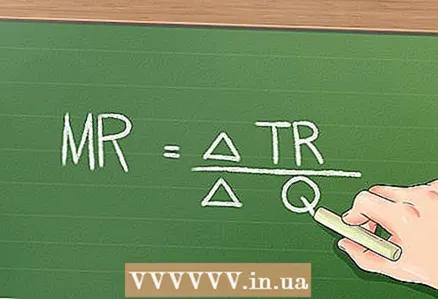

According to basic economic principles, if a company lowers the price of its products, then that company can sell more products. However, it will generate less profit for each additional unit sold. Marginal revenue is the increase in revenue resulting from the sale of an additional unit of production. Marginal revenue can be calculated using a simple formula: Marginal revenue = (change in total revenue) / (change in the number of units sold).

Steps

Part 1 of 3: Using a Formula to Calculate Marginal Revenue

1 Find the number of products sold. To calculate the marginal income, it is necessary to find the values (exact and estimated) of several quantities. First, you need to find the number of goods sold, namely one type of product in the company's range of products.

1 Find the number of products sold. To calculate the marginal income, it is necessary to find the values (exact and estimated) of several quantities. First, you need to find the number of goods sold, namely one type of product in the company's range of products. - Let's look at an example. A certain company sells three types of drinks: grape, orange and apple. In the 1st quarter of this year, the company sold 100 cans of grape juice, 200 cans of orange and 50 cans of apple. Find the marginal income for an orange drink.

- Please note that in order to obtain the exact values of the quantities you need (in this case, the quantity of goods sold), you need access to financial documents or other company reports.

2 Find the total revenue generated from the sale of a specific product. If you know the unit price of a product sold, then you can easily find the total revenue by multiplying the quantity sold by the unit price.

2 Find the total revenue generated from the sale of a specific product. If you know the unit price of a product sold, then you can easily find the total revenue by multiplying the quantity sold by the unit price. - In our example, the company sells an orange drink at $ 2 per can. Therefore, the total revenue from the sale of an orange drink is 200 x 2 = $ 400.

- The exact value of total revenue can be found in the income statement. Depending on the size of the company and the number of products sold in the reporting, you will most likely find revenue values not for a specific type of product, but for a category of products.

3 Determine the unit price to be charged in order to sell an additional unit. In tasks, such information is usually given. In real life, analysts have been trying to determine such a price for a long time.

3 Determine the unit price to be charged in order to sell an additional unit. In tasks, such information is usually given. In real life, analysts have been trying to determine such a price for a long time. - In our example, the company lowers the price for one can of orange drink from $ 2 to $ 1.95. For this price, the company can sell an additional unit of orange drink, bringing the total number of goods sold to 201.

4 Find the total proceeds from the sale of goods at the new (presumably lower) price. To do this, multiply the quantity sold by the unit price.

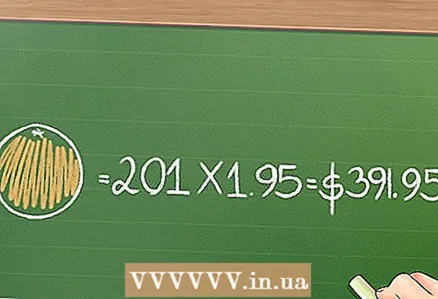

4 Find the total proceeds from the sale of goods at the new (presumably lower) price. To do this, multiply the quantity sold by the unit price. - In our example, the total revenue from the sale of 201 cans of orange drink at $ 1.95 per can is 201 x 1.95 = $ 391.95.

5 Divide the change in total revenue by the change in quantity sold to find the marginal revenue. In our example, the change in the number of products sold is 201 - 200 = 1, so here to calculate the marginal revenue simply subtract the old total revenue from the new value.

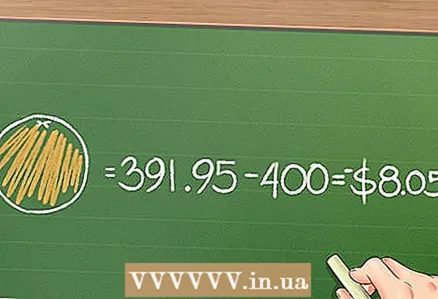

5 Divide the change in total revenue by the change in quantity sold to find the marginal revenue. In our example, the change in the number of products sold is 201 - 200 = 1, so here to calculate the marginal revenue simply subtract the old total revenue from the new value. - In our example, subtract the total revenue from the sale of the item at $ 2 (per unit) from the revenue from the sale of the item at $ 1.95 (per unit): 391.95 - 400 = - $ 8.05.

- Since in our example the change in the number of products sold is 1, here you do not divide the change in total revenue by the change in the number of products sold. However, in a situation where a decrease in price results in the sale of several (rather than one) units of products, you will need to divide the change in total revenue by the change in the number of products sold.

Part 2 of 3: Using the Marginal Revenue Value

1 Product prices should be such as to provide the highest revenue with an ideal price-to-product ratio. If the change in the unit price leads to a negative value of the marginal revenue, then the company suffers a loss, even if the decrease in price allows it to sell more goods. The company will gain additional profit if it raises the price and sells fewer products.

1 Product prices should be such as to provide the highest revenue with an ideal price-to-product ratio. If the change in the unit price leads to a negative value of the marginal revenue, then the company suffers a loss, even if the decrease in price allows it to sell more goods. The company will gain additional profit if it raises the price and sells fewer products. - In our example, the marginal revenue is $ 8.05. This means that when the price decreases and the additional unit is sold, the company incurs a loss. Most likely, in real life, the company will abandon plans to reduce prices.

2 Compare marginal cost and marginal revenue to determine the company's profitability. Companies with the ideal price-to-quantity ratio have marginal revenue equal to marginal cost. Following this logic, the greater the difference between total costs and total revenues, the more profitable the company is.

2 Compare marginal cost and marginal revenue to determine the company's profitability. Companies with the ideal price-to-quantity ratio have marginal revenue equal to marginal cost. Following this logic, the greater the difference between total costs and total revenues, the more profitable the company is. - Marginal cost is the ratio of the change in the cost of producing an additional unit of output to the change in the amount of output produced.

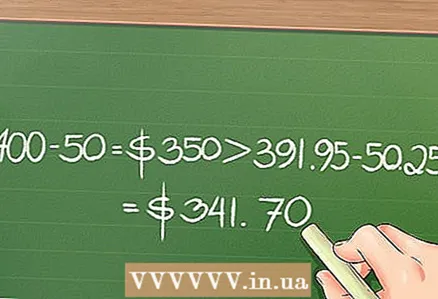

- For our example, let's say it costs $ 0.25 to produce one can of beverage. Therefore, for the production of 200 cans of the drink 0.25 x 200 = $ 50 are spent, and for the production of 201 cans of the drink: 0.25 x 201 = $ 50.25. Thus, the cost of producing an additional unit of output is $ 0.25. As noted above, the total income from the sale of 200 cans was $ 400, and from the sale of 201 cans was $ 391.95. Since 400 - 50 = $ 350 more than 391.95 - 50.25 = $ 341.70, it is more profitable to sell 200 cans at $ 2 apiece.

3 Companies use the marginal revenue value to determine the quantity of products produced and the price at which the company will receive the maximum revenue. Any company seeks as many products as it can sell at the best price; overproduction can lead to costs that won't pay off.

3 Companies use the marginal revenue value to determine the quantity of products produced and the price at which the company will receive the maximum revenue. Any company seeks as many products as it can sell at the best price; overproduction can lead to costs that won't pay off.

Part 3 of 3: Understanding the Different Market Models

1 Marginal revenue in perfect competition. In the examples above, a simplified market model was considered with only one company present. In real life, things are different. A company that controls the entire market for a certain type of product is called a monopoly. But in most cases, any company has competitors, which affects its pricing; in conditions of perfect competition, companies try to set minimum prices.In this case, the marginal revenue, as a rule, does not change with the change in the number of products sold, since the price, which is minimal, cannot be reduced.

1 Marginal revenue in perfect competition. In the examples above, a simplified market model was considered with only one company present. In real life, things are different. A company that controls the entire market for a certain type of product is called a monopoly. But in most cases, any company has competitors, which affects its pricing; in conditions of perfect competition, companies try to set minimum prices.In this case, the marginal revenue, as a rule, does not change with the change in the number of products sold, since the price, which is minimal, cannot be reduced. - In our example, suppose the company in question is competing with hundreds of other companies. As a result, the price for a can of the drink dropped to $ 0.50 (a decrease in price would lead to losses, while an increase would lead to a decrease in sales and the closure of the company). In this case, the number of cans sold does not depend on the price (since it is constant), so the marginal revenue will always be $ 0.50.

2 Marginal income in monopolistic competition. In real life, small competing firms do not immediately respond to price changes, they do not have complete information about their competitors, and they do not always set prices for maximum profit. This market model is called monopolistic competition; many small companies compete with each other, and since they are not “absolute” competitors, their marginal revenue can be reduced when an additional unit is sold.

2 Marginal income in monopolistic competition. In real life, small competing firms do not immediately respond to price changes, they do not have complete information about their competitors, and they do not always set prices for maximum profit. This market model is called monopolistic competition; many small companies compete with each other, and since they are not “absolute” competitors, their marginal revenue can be reduced when an additional unit is sold. - In our example, assume that the company in question operates in a monopolistic competition environment. If most drinks are sold for $ 1 (per can), then the company in question can sell a can of the drink for $ 0.85. Let's say that the competitors of the company are not aware of the price cut or cannot react to it. Likewise, consumers may not be aware of the lower priced beverage and continue to buy drinks for $ 1. In this case, marginal revenue tends to decrease because sales are only partially price driven (they are also driven by the behavior of consumers and competing firms).

3 Marginal income under oligopoly. The market is not always controlled by many small companies or one large company; the market can be controlled by several large firms that compete with each other. These firms can work together (like a monopoly) to stabilize the market over the long term. In an oligopoly, marginal revenue tends to decline as sales increase. However, in real life, under an oligopoly, companies are reluctant to lower prices because this can lead to price wars that will reduce the profits of all companies. Often, the only reason for price reductions under oligopoly is the desire to squeeze out a new or small competitor company from the market (after which prices rise). Thus, in cases where oligopoly companies agree and set the same prices, sales levels do not depend on price, but depend on advertising and other marketing moves.

3 Marginal income under oligopoly. The market is not always controlled by many small companies or one large company; the market can be controlled by several large firms that compete with each other. These firms can work together (like a monopoly) to stabilize the market over the long term. In an oligopoly, marginal revenue tends to decline as sales increase. However, in real life, under an oligopoly, companies are reluctant to lower prices because this can lead to price wars that will reduce the profits of all companies. Often, the only reason for price reductions under oligopoly is the desire to squeeze out a new or small competitor company from the market (after which prices rise). Thus, in cases where oligopoly companies agree and set the same prices, sales levels do not depend on price, but depend on advertising and other marketing moves. - In our example, suppose the company in question shares a market with two other companies. If three companies agree and charge the same price for a can of a drink, then the marginal revenue will remain the same regardless of price levels, since advertising affects sales, not prices. If a fourth company enters the market and starts selling a can of a drink at a lower price than the three aforementioned companies set, then they will reduce the price for a can of a drink so much that the new company will be forced to leave the market (since it will not be able to sell products at such low prices ). In this case, declining marginal revenue does not play a big role, as in the long run it will make the company in question more profitable.