Author:

Lewis Jackson

Date Of Creation:

11 May 2021

Update Date:

1 July 2024

Content

Do you find yourself spending a quick salary or bonus? When you start spending money, it will be very difficult to stop. Overspending can lead to mounting debt and zero savings. It can be difficult to avoid spending, but with a sensible approach, you can stop spending money and save.

Steps

Part 1 of 3: Evaluate your spending habits

Think about the hobbies, activities, or things you spend money on each month. Maybe you're a footwear fanatic, maybe you enjoy eating out, or you just can't stop subscribing to a beauty magazine. Finding joy from such objects or experiences is as good as you can afford. List the activities and things you would like to spend money on each month and call them optional monthly expenses.

- Ask yourself: Am I spending too much money on those optional expenses? Unlike fixed monthly payments (such as rent, living expenses, and other payments), optional expenses are not essential and easy to cut.

Check out your spending for the past quarter. See your bank and credit card statements and cash payments to see what you're spending. Take notes on trivial things like a cup of coffee, postage stamps, or meals along the way.- You will probably be very surprised at how much you spend in a week or a month.

- If possible, look at the data collected over a year. Most financial planners will look at spending for the year before suggesting adjustments.

- Optional expenses can make up a large part of your salary or bonus. Keeping track of these expenses will help you get a sense of where to cut back.

- Keep a record to see how you spend on hobbies versus needs (for example, drinking beer at a bar versus food for a week).

- Calculate what is the percentage of your fixed spending to your optional expenses. Fixed spending doesn't change every month, and option spending can be flexibly adjusted.

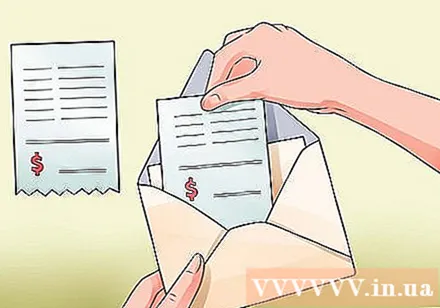

Keep the receipt. This is a great way to keep track of how much you spend on specific items every day. Instead of throwing bills away, keep them to record exactly how much you spend on an item or a meal. This way, if you overspend during the month, you can know exactly when and where you spent the money.- Try to use less cash and instead use your credit or debit card for convenience. You should pay your credit card balance in full every month if possible.

Use the Budget Planner app to evaluate spending. This is a program that calculates the expenses and income needed for a year. This app will tell you how much you can spend in a particular year based on your spending.- Ask yourself: Will you spend more than you make? If you use your savings to pay rent or use your credit card to pay off monthly make-up purchases, you're spending more than your earnings. This only causes more debt and less savings. So be honest with your monthly expenses and make sure you're only within the income limits. That means you need to allocate money to spend and save every month.

- You can also use financial management apps to control your daily spending. Download expense management software to your phone and record purchases as soon as they're done.

Part 2 of 3: Adjusting your spending habits

Create a fund to spend and spend within the limits of the fund. Identify your basic monthly expenses to avoid overspending. These expenses include:

- Rent and living expenses. Depending on your living conditions, you can share this cost with your roommate or spouse. The landlord can pay for gas or you pay for electricity monthly.

- Go. Do you walk to work every day? Cycling? Take the bus? Carpooling with others?

- Food. Allocate the average amount spent on meals each week for the whole month.

- Health care. It is important that you have health insurance in the event of an accident or accident as it is more expensive to pay for it than it is to be covered by insurance. Look online to choose the best premium rate.

- Allowances. If you have pets, you need to determine how much to feed your pet every month. If you and your spouse arrange an evening out once a month, treat it as an expense. Take into account all the expenses you can think of, so you'll know exactly what you're spending your money on.

- If you have to repay a loan, enter the required expense in the budget.

Always have your goals in mind when you shop. The goal could be: new socks to replace a pair that has been punctured. Or, replace a damaged phone. Having a goal when shopping, especially for non-essentials, will help you avoid shopping spontaneously. Focusing on what you need to buy also helps you know how much to spend for each purchase.

- When buying food, preview the recipe and list the necessary ingredients. That way, while in the store, you can stick to the list and know exactly how you will eat the foods.

- If it is difficult to focus on the grocery list, try buying online. This will help you calculate the total purchase amount and know exactly what you are spending money on.

Don't be attracted to discounted goods. That is an irresistible temptation! Retail store owners believe that customers will be attracted to discount shelves. It's important to resist the urge to shop just because the item is on sale. Big discounts still mean spending more money. Instead, you should only consider shopping in two cases: do you need the item? And do you have enough money to buy the item?

- If the answer is no to both of these questions, it's best to leave the item and save money to buy the item you need, rather than you want even on a discount.

Leave your credit card at home. Only bring the amount of cash you need based on your budget to have enough money to spend the whole week. That way, you'll avoid unnecessary purchases if you've spent all your money.

- If you have to take a credit card with you, treat it as a debit card, where every penny you spend on your credit card is the same as what you have to pay off your monthly debt. Treating your credit card like a debit means you won't be in a rush to swipe your card for every purchase.

Eat at home and bring lunch to work. Eating goods can be very expensive, especially if you spend 200,000-300,000 per day, 3-4 times per week. Reduce your food intake to once a week and gradually it to only once a month. You will know how much money you save by buying food to cook at home. You will also find it much more valuable to go out to eat on special occasions.

- Bring lunch every day instead of having to pay for lunch. Take 10 minutes before going to bed at night or before going to work in the morning to prepare lunch. You will find that you can save a lot of money each week just by bringing lunch to eat.

Limit your spending. Test your spending habits by buying only what you need for 30 days or a month. See how little you spent a month focusing on buying the things you need instead of the things you want.

- This will help you determine what is deemed necessary and what is for fun.In addition to obvious necessities like rent and food, you can assume a fitness center membership card is a need because this activity helps keep you healthy and happy. Or like going for a massage every week to help back pain. You can spend on these needs as long as they are within the budget you can afford.

DIY at home. It's a great way to learn new skills and save money. There are many blogs and DIY tutorials to help you create expensive objects on a limited budget. Instead of buying expensive artwork or decorations, make them yourself. This way will help you create the desired object and not be misused.

- Websites like Pinterest, ispydiy, and A Beautiful Mess all have fun ideas for making your own at home. You can also learn how to recycle existing items to make new ones, instead of spending money to buy them.

- Try to do housework yourself. Clean the entranceway yourself instead of hiring someone to do it. Encourage everyone in the family to do household chores like washing dishes or cleaning.

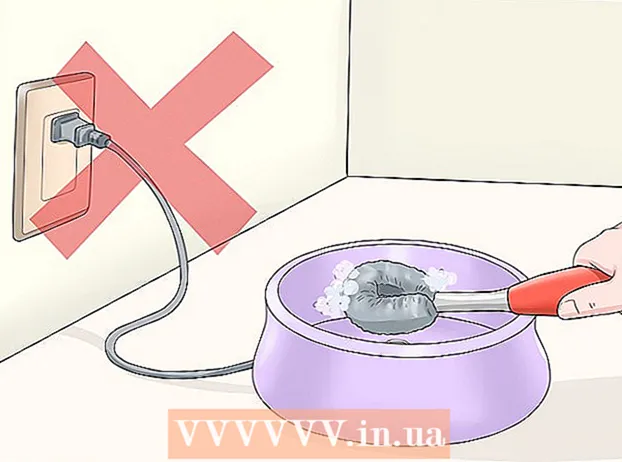

- DIY household cleaners and beauty products. Most of these products are made with simple ingredients you can buy at your local grocery or natural food store. Laundry detergents, multi-purpose cleaners, and even soaps can all be made by hand, and are cheaper than buying them at the store.

Save money for life goals. Work for a life goal, like traveling to Europe or buying a house, by saving money every month in a savings account. Remind yourself that the savings are not for clothes or weekly outings, but for the bigger goal of your life. advertisement

Part 3 of 3: Getting help

Understand the characteristics of impulse shopping. Impulsive shoppers often have no control over their emotional spending and spending habits. They "shop to the point of exhaustion" and keep shopping. However, uncontrolled shopping and spending often make people feel more depressed about themselves than satisfied.

- Women are more likely to buy impulsively than men. Women who shop impulsively have shelves with their stamps still intact. They go to the mall with the intention of buying only one thing but go home with many bags of clothes.

- Emotional shopping can be a temporary relief from stress, anxiety, and loneliness during the holiday season. It also happens when a person feels bored, lonely, and angry.

Recognize impulsive shopping signs. Are you participating in weekly drop-off shopping? Are you consistently spending more than you can earn?

- Are you in a hurry to shop and buy things you don't need? You may feel "excited" to buy a lot of things each week.

- Notice if you have large amounts of debt on your credit card or not.

- You can hide your family or spouse about shopping, or try to find overtime work to make money to cover this spending habit.

- Uncontrollable shoppers will either deny or accept that they have a problem.

Talk to a therapist. Impulsive shopping can be considered an addiction. So talking to a therapist or joining an impulsive shopper support group are important ways to work together to solve problems.

- During therapy, you can discover the underlying problems behind uncontrolled spending, as well as be aware of the dangers of overspending. Therapy also offers healthy alternatives to emotional problems.