Author:

Randy Alexander

Date Of Creation:

1 April 2021

Update Date:

1 July 2024

Content

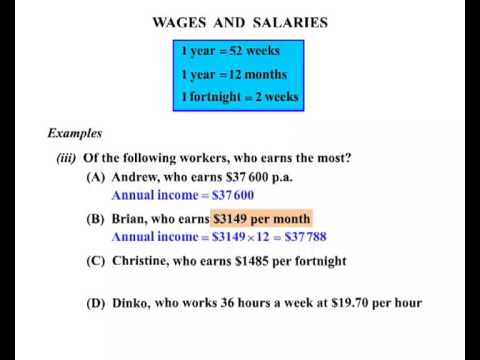

In general, it is easy to calculate the salary for an employee; Usually, you just need to determine the rate of the regular pay period the employee worked and pay the appropriate amount. Both the daily payment method and the% payroll method comply with US federal law. The result would be the same if workers received weekly wages, and often very close together if workers were paid monthly.

Steps

Method 1 of 2: Daily payment method

Determine the annual salary before tax. Start with the official annual employee salary. Tax is not included in this step; They will be deducted at the end of this section.

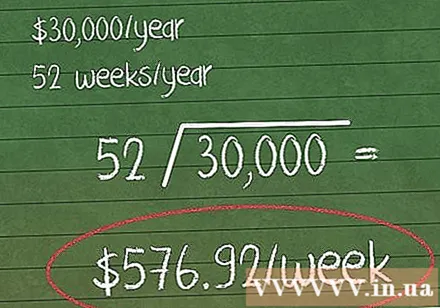

Divide the annual salary by the number of working weeks in the year. This is the amount employees receive in 1 week. Use annual salary before taxes and deductions.- For employees working all year, the working time is 52 weeks.

- For example, an employee makes $ 30,000 a year; earnings per week would be 30,000 ÷ 52 = 576.92 dollars.

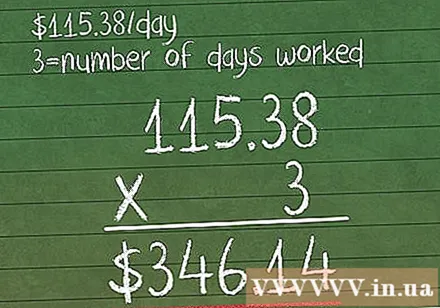

Divide the weekly salary by the number of working days per week. This is the daily salary, or daily earnings of the employee.- Continuing the example above, the employee with a weekly wage of 576.92 worked 5 days a week. This person's daily salary is 576.92 ÷ 5 = $ 115.38. "

Multiply the above result by the number of working days. Calculate the number of employee days worked in the pay period for which you are prorating. Multiply them by the daily wages you calculated above.

- In our example, if the employee has worked for 3 days in the prorated period, his salary is 115.38 x 3 = $ 346.14.

Ordinary tax deduction. Don't forget that prorated wage payments are calculated as normal wages. This means that you will need to subtract your earnings percentage for your taxes, just like a regular paycheck. If the employee has a retirement account or other special deduction, these deductions also count.- If you work in the US, see our article on federal withholding for more information. Additional state taxes may also apply.

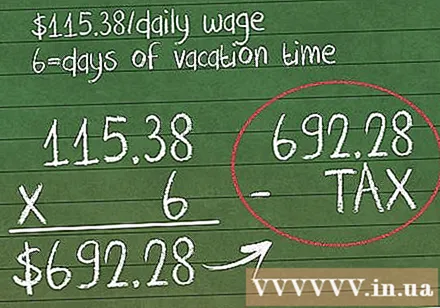

Compensation for the former employee during the leave is not used. If the employee leaves the company due to vacation or sick leave, the employer is still required by law to pay the employee for this period of time. Use the same methodology to calculate the amount due per day.

- If the worker in the above example has 6 days off, she should be paid an additional $ 115.38 (daily wage) for each day, or a total of 115.38 x 6 = $ 692.28. la.

- Withhold tax from this amount.

Method 2 of 2: Percentage method of payment period

Write down the employee's annual salary before tax. This is the first step in figuring out how much money the employee will earn during the working period. Use the official salary, not the amount received after taxes.

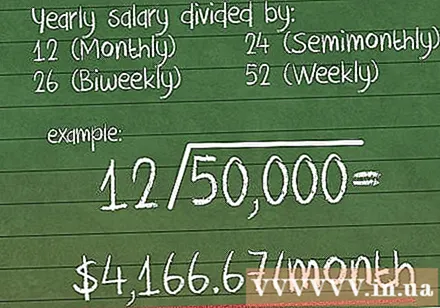

Find out how much money is earned per pay period. This is the amount the employee receives each payment period. If you don't have this information available, calculate it based on how much your employee usually receives:

- Monthly salary → divide the annual salary by 12

- Twice a month → divide by 24.

- Every 2 weeks → divide by 26.

- Weekly → divide by 52.

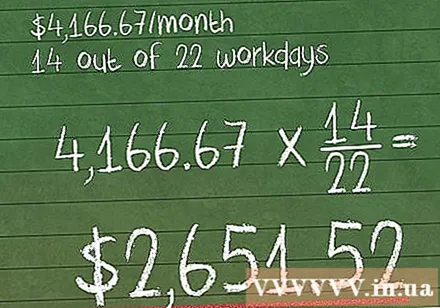

- For example, an employee has an income of 50,000 dollars and a monthly salary of 50,000 ÷ 12 = $ 4,166.67.

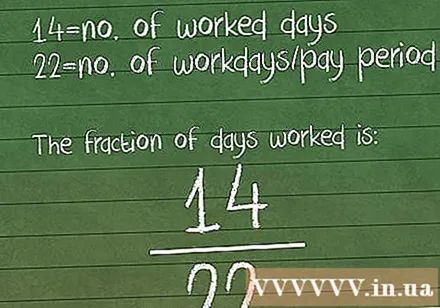

Calculates the ratio of the number of days worked during pay period. Take a look at the specific pay period that you are divided into and calculate the following:

- Enter the number of days the employee works (with the salary you are calculating).

- Divide the number of workdays in that pay period. Calculate carefully. Don't assume that each pay period has the same number of workdays.

- For example, an employee only worked 14 days in September when he normally worked 22 days. His working day rate will be /22.

Multiply this ratio by the amount you pay each period. This calculation will tell you exactly how much you will pay the employee.

- For example, an employee who is paid $ 4,166.67 per month but only works 14 days instead of 22 days in September, will receive the split salary 4,166.67 x /22 = 2.651,52 đô.

Tax deduction. Calculate any income taxes, retirement deductions, and other specific deductions you would normally charge that employee.

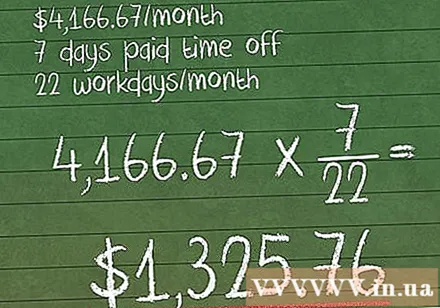

Payment to employees for sick and vacation time. In these cases, the employer is often required to pay cash for any vacation time the employee has not legally spent. Pay workers the regular wage for this period using the same pro rata method above.

- For example, if the employee in the example above has 7 cumulative leave paid, he will be paid an additional amount of 4,166.67 x /22 = $ 1,325.76.

- This compensation is also taxed, like regular wages.

Advice

- For hourly workers, you do not need to use the above method. Simply multiply your pay per hour by the number of hours worked during the pay period. Hourly wage payments to employees are also tax deductible as usual.

- Salary paid for overtime work is also calculated in the same way as prorated wages as above.

- Don't forget that many states have their own set of tax / income tax rules that are out of federal law. When prorated wages are taxable, you will also need to deduct these amounts to determine the amount paid to the employee.

Warning

- In the United States, a salaried worker can only be prorated under specific terms, most commonly when work begins or ends in the middle of a pay period. You cannot reduce their wages because of reduced hours.

- Employers may have to appear in court with the option of paying lower amounts of money to employees. It is best to use one method for all proportionally paid workers.