Author:

Laura McKinney

Date Of Creation:

5 August 2021

Update Date:

1 July 2024

Content

Operating leverage is a measure of how much profit a company generates from fixed costs. The more profit a company generates from fixed costs, the higher its ratio of operating leverage. Operational leverage can be calculated according to many different formulas, but the most common formula is to calculate the rate of variation of the margin to the rate of variation of the profit from the business.

Steps

Part 1 of 3: Calculating operating leverage

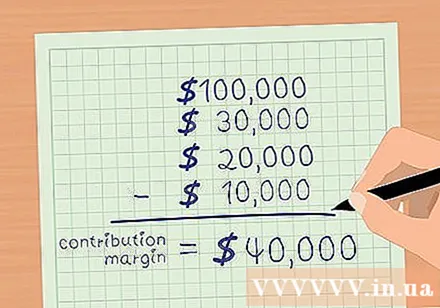

Contribution margin. The margin is the total revenue minus variable costs. Variable costs are those that increase with each volume of sales. Cost of goods, commission and delivery costs are some of the basic variable costs. Subtract your total sales from variable costs to calculate your margin.

- For example, suppose Company ABC has total sales of 100,000 USD in December 2015. Variable costs include: COGS - 30,000 USD; Commission - 20,000 USD; Delivery cost - 10,000 USD.

- The balance of the premium is.

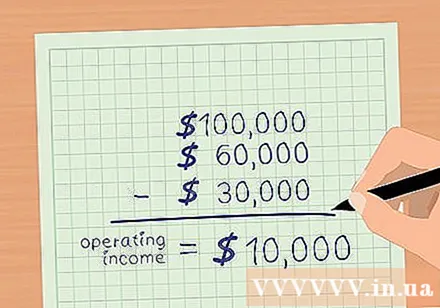

Calculate the profit from business. Operating profit is the total revenue minus all operating expenses except interest and taxes. If variable costs have been deducted, then subtract the fixed costs to calculate profit from the business. Fixed costs include advertising, insurance, rent, service charges (electricity, water, etc.), and wages.- Assume that Company ABC's fixed costs have: advertising - $ 2,000; Insurance - 5,000 USD; Rent - 3,000 USD; services - $ 2,000; Salary - $ 18,000.

- Total fixed costs are $ 30,000.

- Operating profit is total revenue minus variable and fixed costs.

- For Company ABC, the total revenue is 100,000 USD. Variable costs are $ 60,000 and fixed costs $ 30,000.

- Thus, profit from business of ABC =.

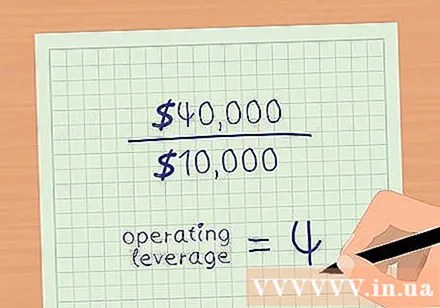

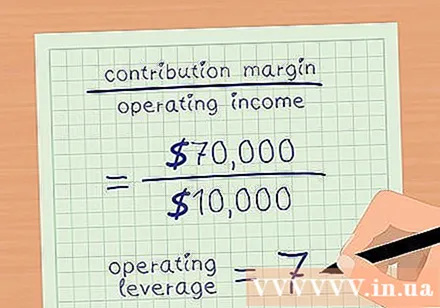

Operational leverage. Divide the guarantee balance by the profit from the business. Returning to the above example, Company ABC has a margin of 40,000 USD and a business profit of 10,000 USD.- Operating leverage = margin / operating profit.

- Company ABC's operating leverage is 4.

Part 2 of 3: Working Leverage Index Analysis

Evaluate returns with a measure of operating leverage. Operating leverage tells you how fast your net profit from business increases with sales.In the above example, Company ABC's operating leverage is 4. This means that net profit from operating grows 4 times as much as revenue. However, this number varies depending on the ratio of fixed and variable costs- The higher the fixed cost as a percentage of the total cost, the greater your operating leverage will be.

- A higher operating leverage means your net income grows at a faster rate.

Analyze the effects of higher fixed and lower variable costs. Company XYZ has the same revenue and margin as the guarantee balance with Company ABC (revenue = USD 100,000, profit from business = USD 10,000). However, company XYZ's variable costs are $ 30,000 and fixed costs are $ 60,000.

- The balance of the premium is.

- Net profit from business is.

- Operating leverage = margin / operating profit.

- .

- Thus, the net profit from business of company XYZ increases 7 times compared to sales.

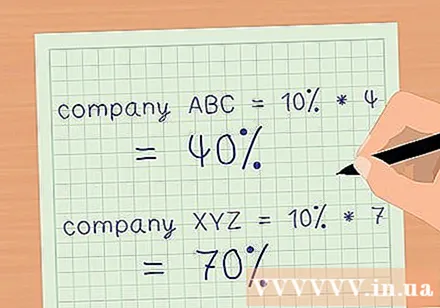

Determine the impact of revenue growth on profit margins. Use operating leverage to calculate how much profit margins will increase as sales increase. Multiply your operating leverage by the percentage of increased sales. This is the percentage at which you can estimate your margins will increase.

- Let's say the two companies in the above examples both have a 10% increase in sales.

- Company ABC with operating leverage of 4, net profit margin will increase 40% with sales increase 10%.

- Company XYZ with operating leverage of 7, net profit margin will increase 70% with sales increase 10%.

- As a result, you can use operating leverage to quickly calculate the impact of a change in revenue on your net profitability of your business without having to prepare detailed financial statements.

Part 3 of 3: Risk assessment with operating leverage

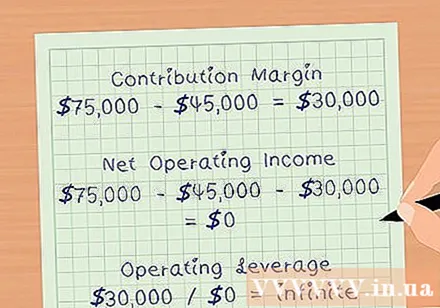

Determine your breakeven point. The breakeven point is the amount of revenue that is achieved just enough to cover operating costs, including all fixed and variable costs. At breakeven, your profit margin is 0 USD. Therefore, the operating leverage is limitless. Operating leverage increases as you get closer to your breakeven point.

- For example, suppose company ABC in the above example has sales of $ 75,000, variable costs $ 45,000, and fixed costs $ 30,000.

- The margin will be guaranteed.

- The net profit from business will be.

- The operating leverage will be.

Evaluate the company's risk profile. High operating leverage means the company can increase profits significantly as sales increase. However, high operating leverage also means that a company invests a lot of money in fixed costs, like machinery, real estate and wages. If the economy slows down and revenue falls, the company won't have much chance to reduce costs to maintain its profitability.

- This is the reason why investors should be cautious when investing in companies with high operating leverage.

Use your leverage to work carefully. Because operating leverage can sometimes misrepresent a company's ability to increase its margins. For example, a company with 7 operating leverage should be able to increase its profit margin seven times as much as its revenue. But in reality, to increase revenue, a company may need more labor or expand space. The cost of this activity will increase the fixed cost, and as such, the company's profit margin will not increase as expected from operating leverage. advertisement