Author:

Laura McKinney

Date Of Creation:

4 August 2021

Update Date:

1 July 2024

Content

Operating overheads are the costs you pay to run your business regardless of whether the company has lots of orders or is running in moderation. Good management of overall operating costs will help businesses get better output prices for their products / services, and will also show ways the business can save costs and rearrange models. business. However, these benefits only come from careful and diligent accountants. So read on to find out the best way to calculate your overall operating costs.

Steps

Method 1 of 3: Identifying General Operating Costs

Understand that overall operating costs are expenses that are not directly related to your product. The overheads are also known as indirect costs. Indirect costs such as rent, salaries for administrative staff, machine repair costs and marketing costs are very important to your business and must be recurring.

- In our example, indirect costs such as postage and insurance are essential to the business, but not the direct cost of creating the product.

- When calculating general operating costs, always consider what is considered a fixed or variable cost. Fixed costs are constant numbers, while variable costs are numbers that change with firm activity and level of production.

Please note that direct cost is the cost of creating the product or service. These costs will fluctuate based on the customer's demand for your product and the market price of your input materials. If you open a bakery, the direct costs will be wages and ingredients. If you open a clinic, the direct expenses are the doctor's salary, stethoscope, etc.- The most common direct costs, as described above, are wages and material costs.

- In simple terms, the direct costs are paid for the things on the production line while the indirect costs are paid to the "main" of the production line.

Create a list that lists each expense category for each month, quarter, or year. You can choose custom intervals and usually companies analyze costs by month.- Fix the time period you choose. If you calculate the monthly indirect costs, you will also have to calculate the monthly direct costs.

- Use programs like QuickBooks, Excel, or Freshbooks to help you manage your data more efficiently and easily.

- Worry about where your expenses will be. You should have an overall cost picture before you can calculate your overheads.

Now look for general operating costs (indirect costs). Companies have to pay costs such as taxes, rent, insurance, licensing fees, utility costs, accounting and legal costs, administrative staff salaries, maintenance costs. equipment, etc. Look for all indirect costs.- Review past expense and invoice reports to make sure you haven't overlooked any charges.

- Don't forget about recurring expenses, like the costs of applying for a new license or applying. While these costs are less common, they are still counted as general operating costs.

Use old expenses or estimate them if you don't know your exact cost. If you are a new or aspiring entrepreneur, you should do a full research on your supply, manpower and other potential overheads.

- If you have old accounting data, you can use it and apply it to next year's expense plan. The numbers in the plan are usually the same over the years unless you make major changes to your business plan.

- Averaging costs over 3 to 4 months to minimize the impact of costs that happen abnormally.

Divide the costs on the list into direct and indirect ones based on your business model. Different business lines will have different divisions and you need to decide on this division for yourself. Law costs, for example, are usually the division of production overheads, but they contribute directly to the business if you run a law firm.

- If you are still confused with division, think of the overheads as expenses that you will still pay even if you stop production immediately. So what are the general costs?

- Update this list every time you encounter a new expense.

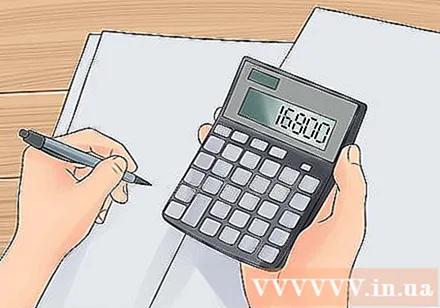

Add all of the indirect costs together to get the total operating costs. This is the cost you will have to pay to keep your business running. In the example above, the initial overhead is $ 16,800. This is an important number when you are planning a business. advertisement

Method 2 of 3: Deepening General Operating Costs

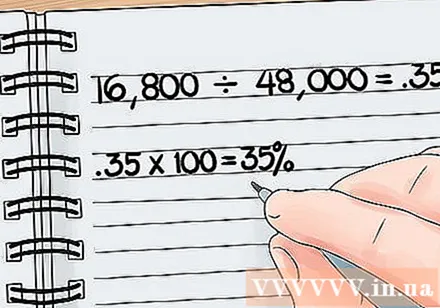

Calculate the percentage of your overheads to your total costs. That percentage shows how much your company is spending to maintain operations and how much it spends to make a product. So let's calculate the percentage:

- Next, divide the indirect costs by the direct costs. In the above example, the indirect cost ratio is 0.35 (16,800 / 48,000 = 0.35).

- Multiplying this number by 100 gives us the operating expenses percentage. Here we have the rate of 35%.

- That means your company spends 35% of its total costs on judicial fees, administrative staff, space rentals, etc. on every product it produces.

- The lower the overall operating cost, the greater the profit. Hence, a low overall operating cost ratio is a good thing.

Next, compare your company's overall operating costs with other companies. The assumption here is that companies that pay relatively similar direct costs, and companies with a lower ratio of overall operating costs, will make more money selling products. By reducing your overall operating costs, your company can sell products at a more competitive price or / and earn higher profits. advertisement

Method 3 of 3: Using General Operating Costs to Improve Business Performance

Divide the overheads by the labor costs to see how efficiently you're using resources. Multiply by 100 to get the overall operating expenses percentage per employee.

- If the ratio is low, it means your company is cost effective.

- If the rate is high, maybe your company employs too many employees.

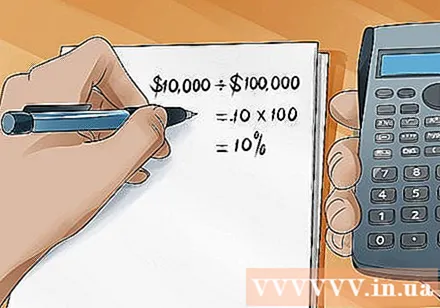

Calculate the percentage of your sales that must be spent on your overheads. Divide the overheads by the sales, then multiply by 100 to get a percentage. This is an easy way to see if you are selling enough goods / services to keep your business going.

- For example, if my company sells $ 100,000 a month in soap sales and I have to pay $ 10,000 to keep it running, then I'm paying 10% of the sales for general operating expenses.

- The higher this ratio, the lower the profit margin

Find ways to cut or manage more closely your overall operating costs if those rates are high. This is one of the main reasons why you don't make a lot of profit. You may be paying too much rent or may need to sell more products to cover your overall operating costs. Maybe, you are having too many employees and not the strict management for employees to work effectively. Use these numbers to further analyze your business model and make changes.

- All industries, companies have to pay operating expenses, but companies that strictly manage these costs will get higher profits.

- However, the high overheads do not necessarily yield negative results. If you pay for good equipment or for employee satisfaction, you can get higher labor productivity and higher profits.

Advice

- If you are calculating general operating costs for the past, then you can use the available numbers to do the calculation. If you want to estimate your overall operating costs for the coming years, you need to use averages to calculate. For example, to calculate future indirect costs, you need data for many accounting periods in the past and calculate the average indirect cost of each item that may arise in the company in the future. Likewise, to calculate future direct costs, you need to estimate your average costs based on past and present data.For example, direct labor costs can be calculated by multiplying the average hourly wage worked by the average number of hours worked over a given period. Results may not be accurate when applied in practice, but this will be an approximate estimate.

- Keep track of the overall operating cost ratio continuously - month by month, quarterly and yearly, to minimize the impact of variables generated by cycle, buying sentiment, and availability / cost of raw materials .

Warning

- The steps shown above are outlined to help you analyze quantitative data better. Each company is unique, so overall operating cost optimization is not an exact science.