Author:

Randy Alexander

Date Of Creation:

27 April 2021

Update Date:

1 July 2024

Content

To be rich is almost everyone's dream. After years of hard work and hard work, you want to show off a little. So how do you trade off current needs to invest in the future? Here is a guide for you.

Steps

Part 1 of 4: Becoming the Savior Master

Sit down and make a savings plan. Focus on the priorities and the most important. You cannot be rich without saving and you cannot save without knowing how much you have and how you are spending. The main principle is to build a budget reasonable so that you can follow and learn. This is a big step change (!) To achieve financial freedom.

Set aside a portion of the salary you earn. How much is up to you. Some people spend 10-15% of their total salary and others a little bit higher. The younger you save, the more time you will have to save and the smaller the amount you will save. So, start saving even if you're earning only 10% of your salary.- Another rule of thumb that many people use is the 8x rule. This rule of thumb recommends that you save 8 times the salary you have in retirement. With this metric, you will have 1x month of salary saved at age 35, 3x of monthly salary at 45, and 5x of monthly salary at age 55.

Take advantage of "free" money. Only a few things in life are free and often free. In fact, money is rarely free, so you have to take advantage of it when you get the chance. Here is an example where we make "free" money:- Many companies follow a 401 (k) retirement assistance scheme. This means that for every dollar you pay into your 401 (k) plan, your company will pay one dollar as well. Theoretically, if you contribute $ 2,500 to a 401 (k) plan, your company also pays $ 2,500 to the total $ 5,000. This is almost the "free" money you can get. Take advantage of this.

- The 401 (k) plan provides you with a retirement account for you to pay in and tax breaks. This means that you will not be taxed until a certain point or exempt.

Deposit into the Roth IRA - as soon as possible! Like the 401 (k) plan, a Roth IRA is a retirement fund that lets you deposit money into investments and not get taxed. However, the IRA limits how much you contribute annually to the fund (up to $ 5,000), but you can set a goal - in your 20s and 30s - to contribute up to that amount each year.- Below is an example of how a Roth IPA fund can help you get rich. If a 20 year old person contributes up to $ 5,000 to an IRA per year for 45 years at an interest rate of 8% per annum, magic happens. When they retire, they will have a net worth of more than $ 1.93 million. Amount 1.7 million Profit dollars are much higher than putting money in a regular savings account.

- How does the Roth IRA generate such wealth? That is compound interest. Here's how compound interest works. A bank or other financial institution pays you IRA interest, but instead of interest, you send it back. So the next time you enjoy interest, you will not only enjoy the principal but also the interest.

- The earlier you save, the better. If you make a lump sum of $ 5,000 at the age of 20 and leave it there for 45 years at 8% annual interest, you will have up to $ 160,000. However, if you make a one-time contribution of $ 5,000 at the age of 39, when you retire your $ 5,000 will be $ 40,000. So let's get started early.

Get rid of the habit of using credit or debit cards. While credit cards can be helpful in some situations, they will encourage bad consumer habits. Because they encourage cardholders to spend more money when they won't face pressure to pay until the day the balance hits the warning level.

- Not only that, scientists have discovered that the human brain thinks about credit cards and real money very different. One study found that cardholders typically spend more than 12% to 18% on average, while McDonald's found that people who pay with wall cards spend $ 2.5 more than customers who pay with cash at their shop. Why is this?

- We don't know for sure, but we think that holding cash makes money feel much more "money" than with a credit card and probably because the money doesn't actually appear when you swipe the card. In a nutshell, credit cards are like money in the billionaire - just virtual money - in our brains.

Save on your tax refunds, or at least spend smart. When the government announced its tax refund program earlier this year, many people flocked to shop. They will think, "Hey, this is a godsend. Why not spend some for fun?" While this is an acceptable thing to do with the occasional (and good reason) shopping, it won't help you. build richness. Instead of spending your tax refund, try to save, invest or pay off your debts. This may not feel as pleasant as buying a few chairs or rebuilding the kitchen, but it will help you achieve your future goals.

Change your view of savings. We all know that saving is hard. It's really hard. Thrifting is essentially a trade-off in the present fun for future results, and this is an encouraging action. By looking into your future and seeing it from another perspective, you can encourage yourself to be a saver. Here are a few tips:

- Whenever you buy something of great value, divide the price by your hourly wage. If you're looking to buy $ 300 shoes, but you only make $ 12 / hour, that means 25 hours of work or more than a half a week of work? Are the shoes really worth the labor you put in? Occasionally, it might be.

- Divide your savings goals into smaller ones. Instead of aiming to save $ 5,500 per year, divide it by month, week, or day. Think, "I'm trying to save $ 15 today and will do it." If you do it for 365 days, you will end up with $ 5,500.

Part 2 of 4: Actively Build Wealth

Talk to a personal financial advisor. Have you ever heard the phrase "Money makes money?" If you meet a good consultant, you will know it. A consultant will cost you money. But she will swordgiving you more than you paid. So, this is a good investment. It will help you get rich.

- A good financial advisor will do more than just manage your money. She teaches you about investment strategies, explains your short / long term goals, helps you build a solid path to wealth, and shows you when to spend your bloody money.

Decide if you want to start investing part of your portfolio. Portfolio building is important if you want to, not just maintain, but build your wealth. There are thousands of ways to invest and when investing in the stock market your advisor can point you in the right direction. Here are a few ways to think about investing:

- Think of investment as an indicator. If you invest in the S&P 500, or the Dow Jones, what you're doing is betting that the US economy will prosper. Many investors think that pouring money into an index is a relatively safe and smart way of betting.

- Learn to invest in a Mutual Fund. Mutual funds often invest in many types of stocks and bonds to disperse risks. While they may not be as profitable as when you put all your money into a stock or two, they are less risky.

Don't get caught up in the market. You think you can beat the market by buying low and selling high every day, but time will catch up to you to prove you wrong. Even if you consider stable industries, the fundamentals of the business, the situation of each industry or other investment principles when choosing stocks, what you are doing is betting. muscle instead of investing. And when speculating, the House usually wins.

- There are many studies that show that regular trading will not bring high profits. Not only will you lose transaction fees you will only see 25% and 50% increase in price is the same - if you're lucky. Hence it is difficult to choose the right time in the stock market. Many people who simply choose stocks and leave them there for a long time often make a lot more money than people who buy and sell all day.

Consider investing in foreign markets or emerging markets. For a long time, the US stock market was the most profitable place to invest in. But now emerging markets also have compelling opportunities in certain industries. Investing in foreign stocks and bonds will improve your portfolio and minimize the risks you may face.

Consider investing in real estate too - with a few caveats. Investing in the real estate market can be a lucrative way to make you rich, but not absolutely necessary. People who believe that real estate prices have only increased find themselves at the heart of the Great Depression Around 2008. People soon realize that their home prices are plummeting as credit is tightening. Since the market has stabilized, many people have been investing in real estate. Here are a few ways you can choose when investing in real estate:

- Consider buying a home that you can afford and building property instead of paying rent. A real estate loan is probably one of the greatest value purchases you will make in your life, but that will only convince you to buy a home you can afford if the market is favorable. Why pay hundreds or thousands of dollars in rent to landlords that you end up owning nothing? Instead accumulate to come on his own? If you are ready to own a home (they take a lot of money to maintain), this would be a wise move.

- Be careful with a quick sale. Think carefully about this trick. That is, you buy a house, upgrade it to spend as little money as possible, and sell it right away to make a profit. The house can be changed hands, and some people can make a profit, but it can also be sold forever without anyone buying, becoming a money pit or more expensive for people willing to buy.

Part 3 of 4: Becoming a Smarter Consumer

Live within your own income. This is one of the hardest personal finance lessons. Live below your current level of income to live on later. If you were living above what you are now, you will have to live it below Future. For many, move up the ranks on preferably relegated below.

Never buy expensive items when you're in a hurry. You want a brand new car after seeing your best friend drive the car down the street on sleek wheels, but that's just from your feelings, not your senses. Emotions tell you to buy and reason says no:

- Set a required waiting time. Wait at least a week or even the end of a month when you know your finances better. If you still want to buy the item after a week or so, this is probably not an impulse buy.

Don't go hungry when shopping and make a list of things to buy. Studies show that when we become hungry, we often buy more than we need and buy foods with more calories. So eat before you go shopping and make a list. At the grocery store, buy only the items on the list, and only one or two exceptions are allowed. This way, you will only buy things you really need, not things you think you might need. Studies show that 12% of what you will buy at the store goes unused. So don't pay extra just to buy things you don't need.

With online purchases, buy in bulk! Instead of buying a box of Kleenex that will run out in a month, buy enough for a year. Retailers often offer discounts on large purchases and pass the money on to you. And if you're looking for the best deal, check the prices before you buy. Selling prices online are usually cheaper because the retailer doesn't have to pay labor and space costs - they just bear the warehouse cost.

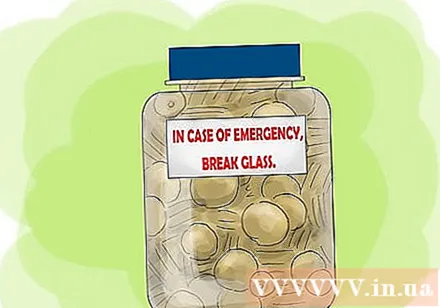

Please bring lunch often. If buying lunch costs $ 10 and cooking it yourself for just $ 5, you will save $ 1,300 for the whole year. The money is enough for you to save or open an emergency fund in case you incur extraordinary expenses or lose your job. Naturally, you want to balance your savings with maintaining a relationship, so spend some time and money hanging out with colleagues.

If you have a real estate loan, refinance your loan to save money. Loan refinancing can save you thousands of dollars in total monthly payments over the life of your loan. In particular, if you have an adjustable rate mortgage and your interest rate is getting higher, consider refinancing. advertisement

Part 4 of 4: Enriching with Skill Improvement

Learn how to make money. If you find that your skills are limiting your earning, think about going back to school. Trade schools and community colleges give you many opportunities to improve your income. If you are in the computer industry, many schools have computer certifications so you can study and take the exam.

- The total cost is generally cheaper and takes less time to study than the full-fledged program as you won't have to study basic subjects like English, math and history to get your degree! You can also study online for many subjects that are required for a 2-year training program.

- You should also not underestimate the value of an associate's degree. After all, many companies just want to know how you complete the program and are motivated to improve yourself, while others just want a "degree."

Continue to network with industry insiders. Don't be afraid of office tricks; Helping someone out in a "reciprocal" relationship can be a good thing.

Join community activities. Look for organizations like the Chamber of Commerce and the Small Business Association. Spend time volunteering there, talking with members, and giving back to the community. Like networking, you never know how you will impact their lives and vice versa. It is worth it for you to have many relationships.

Learn how use money. After you've learned how to save money, remember that making sacrifices now for a better future, always remind yourself that it's good to spend. After all, money is not a means to an end, and its value is in what you can afford, not how much you have at death. So let yourself enjoy both the simple and the not-so-simple things of life - a ticket to Verdi, a trip to China, or a pair of leather shoes. That is how you can enjoy it when living. advertisement

Advice

- Read, read, and read. Read everything to know what's going on in your industry (new trends, perspectives), learn to know what's going on in the world. This is the global economy, and whatever happens in the world will affect your industry.

- Learn to invest with profit.

- If your company supports the 401k plan, join it. Most companies support your participation by a certain percentage. This is FREE MONEY! - You don't have to do anything to get more money except give yourself money. Nothing is easier than that.

- Add knowledge ... like fertile or abandoned; study and accumulate more to apply in your areas of interest ...

- Think of money as the seed to "cultivate and thrive" for investments - areas you have never entered or have sufficient knowledge of (maintain profitable investments) ...

Warning

- Don't spend your savings on just what you want.

- Don't work for the minimum wage - they (the company) will pay you less if legal after all.

- Don't forget to plant "seeds" otherwise you won't have "crop / harvest" ...

- Investment advice: If all the seeds are eaten, there will be no crops to harvest; If all eggs are eaten, there will be no chicks nearby

- You will get old and then lose your income!

- If you're investing in a 401k or similar program - whatever you do - DON'T SHOULD MAKE THEM DRAWING THEM.