Author:

Louise Ward

Date Of Creation:

8 February 2021

Update Date:

1 July 2024

Content

The cost of college education is quite large, but worth the investment. A college degree brings more job opportunities and higher income for you. Enterprises appreciate people with university degrees and prioritize their recruitment more than those who just graduated from high school. Many students still have to pay their tuition fees after graduation, but there are other ways for them to make money to cover this fee. In some cases you do not have to pay back, thus reducing your study costs.

Steps

Method 1 of 3: Apply for scholarships, grants and loans

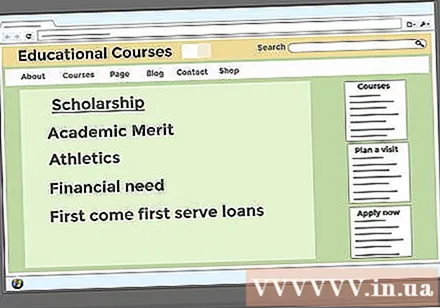

Ask the school for information about the scholarship program. Many universities offer scholarship programs for academic disciplines, sports and a number of other scholarships. Each year the organizations pay out more than one million scholarships to students.

- The basis for providing a scholarship is based on academic merit, sports, financial need or simply being quick.

- Depending on which school you plan to attend, you may need to apply for federal aid first.

Consider organizations that specialize in providing scholarships for the industry / profession you plan to pursue. The American Broadcasters Association, for example, often grants scholarships to radio apprenticeships.

Apply for benefits as soon as possible. There are many different types of benefits, such as state, institutional, and federal benefits. Benefits are usually offered on a first come, first served basis, so you must apply as soon as possible. Applying early also gives you a chance to get more money. You should apply for grants and scholarships from federal, state or private organizations.

- If you live in the US and make less than $ 40,000 a year you are eligible to apply for some kind of benefit.

Consider applying for state benefits if you live in the US. Most states have their own grant program, the basis for which funding is based on financial need, although some programs prioritize specific disciplines. Some states get information from the FAFSA, others require you to fill out their own application.

Take advantage of the opportunity to earn money subsidies from organizations. Many organizations award student grants when federal and state support is not enough to pay tuition fees, or to reduce tuition fees for students in need. This grant comes from the university you are applying to.

Consider applying for federal benefits. If you live in the US you can apply to the FAFSA for federal assistance. You have the opportunity to apply for the Pell grant, which is the most valuable benefit program available today.The lowest Pell grant is a few hundred dollars and can reach many thousands of dollars. You also have the opportunity to be considered for other federal grants, employment programs and student loans.

- You must complete the FAFSA online form by January 1 of each year.

Consider federal lending programs and private low-interest loans. Unlike grants and scholarships, you will have to repay the money back after the loan period. Loans usually have different interest rates and are due to repay after graduation.

- Federal FAFSA loans may or may not be subsidized. Sometimes they use your income to decide the loan amount and interest.

- Private loans typically have a higher federal interest rate, suitable for students who have used up their federal loan limits.

Negotiate for the financial aid package. Initially, some schools only offer low financial aid, if students ask for more aid they may add more. Also many schools give scholarships to students but then they decide not to enroll, and the money is redistributed to other students. advertisement

Method 2 of 3: Make money in another way

Find a job. You do not have to apply for a job that is related to your field of study. A simple job like selling, serving in a coffee shop or waiter is easy to find and has flexible working hours.

- Consider applying for multiple part-time or full-time jobs over the summer. Of course, if you work a lot, you will not have time to have fun and relax with your friends, but in exchange you have money to pay tuition fees.

- If you plan to work while studying, find a flexible part-time job. This will help you keep your focus on your studies, but at the same time make money.

- When you get a job you should ask your company if they have a fee subsidy program.

Self-baked cakes sold to the neighborhood. This may remind you of when you were in elementary school, but people will be happy to donate money for a good cause, while also having a bite of the cake.

Make use of your talents. Not everyone needs your talent, but somehow there are people who are willing to spend money to buy items you make by yourself or ask you to fix their computers. For example:

- If you are good at arts and crafts, make your own at a fair or online sale. People often spend a lot of money on handmade handbags, scarves, gloves, and pottery.

- Provide babysitting services or take pets if you love children and animals. Community centers, libraries and cafes are a good place to put your flyers on.

- If you have a talent for repairing items, such as electronics, you should post flyers at community centers, libraries, and cafes.

Ask for money instead of gifts. The $ 200 earrings look great, but the money comes in better when you buy books. When a friend or family member asks you what you would like to give a gift for a birthday, Christmas or other holiday, you should ask for money instead of expensive items, jewelry, clothing, and so on.

Find information about school competitions. Some tournaments have monetary rewards, but sometimes the reward is free lessons or textbooks. advertisement

Method 3 of 3: Save money

Don't pay attention to new models of phones, cars or computers because they are very expensive. While the latest version is always better, it's not necessary as long as your device is still working fine. Unless your phone, car or computer is completely damaged, you should try to save money in your account.

When buying a car, you should choose one that costs less gas instead of its stylish appearance. Gasoline also costs a lot of money if you go to school by car. If the car is nice and consumes a lot of gas, then your bank account will not look good after a few months. Conversely, you should buy a small car that consumes less gas, or buy a car that is known to save fuel and be safe to drive.

Before buying a textbook, you should check the price in a few places, because not all bookstores sell textbooks at affordable prices. Instead of buying new books, you should buy used books because they cost only about half of the new books. You can also buy a cheaper version over the internet.

- There are bookstores around some universities that sell textbooks, which are not under the control of the school nor a bookstore for students, but the book prices are much cheaper.

- Be cautious when buying textbooks. Some professors ask to use the latest version of a book, so old books may not match the required version.

- To make a little money, you should sell textbooks at the end of the term, but if a new version comes out at the same time, the old book price is very cheap.

- You can also rent textbooks. This is the least expensive option and you don't have to worry about falling old bookshelves by the end of the term.

Submit your earnings to a variety of accounts. When you have money you should divide into three types of accounts: regular account, tuition account and emergency account. After receiving the salary you transfer a small part to "tuition account" and a part to "emergency account". The rest goes into your regular account and is how much you can spend until your next paycheck.

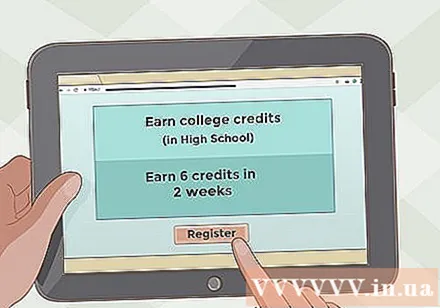

Consider taking college credit while you're still in high school. Some high schools offer study programs (such as AP and Cambridge) for you to earn college credit.

Enter a community college to take general subjects. You can enroll in general subjects at the community college where you live, and leave specialized subjects to study at the university. Tuition at a community college is usually much cheaper, in addition you can complete the training program at the university sooner.

Try to live in your own or a loved one's home. You often associate college age with freedom, but that doesn't mean you have to move out and live alone. The rent is quite expensive and the cost of living in an apartment or dorm room also accounts for a significant part. If you have parents or relatives who live near the school, you should live with them so you can save on other things like internet, fireplace, water, electricity and food.

Ask a parent or relative for financial support. Even though they cannot pay the tuition, they can sometimes offer a little help with the funding of necessities, like textbooks and school supplies. There are cases where they ask for money back but unlike an outside loan, you do not have to pay interest.

Save money on travel. Going to school by car is fast and convenient, but it also costs a lot of money, especially when schools require monthly parking fees. Consider walking, cycling or skateboarding to school instead.

- Take public transport near the school if available. Many schools sell bus passes at a discount to students. The benefit of riding the bus is that you can do your homework in the car.

- If you have to drive to school, you should ask a few friends to come along and share the parking fee, gas money.

Advice

- To make money from the state you should go online to find information about student aid packages or contact the higher education committee.

- Remember to submit your application on time. Every university, every state, and most private scholarships have clear application deadlines.

- Use excel or a similar application to list all deadlines for where you apply for financial aid.

- Loans must be repaid with interest, but grants and scholarships do not have to be repaid.

- To cut costs you should download e-textbooks, rent books from the national book rental center or buy used books.

Warning

- Be careful not to be scammed. The application process for grants and scholarships is always free, so if you have to pay to get a grant or scholarship, chances are it is a scam.