Author:

Florence Bailey

Date Of Creation:

22 March 2021

Update Date:

1 July 2024

Content

Banks warn us to be careful when revealing the PIN of a new card.But did you know that there are many other ways you can use to protect your number and make sure no one is trying to use your account? Debit cards are very attractive to would-be robbers as they are a direct source of cash. Here are some additional easy steps to protect your PIN (Personal Identification Number).

Steps

1 Never give your PIN. It can be tempting to trust a friend or family member with your PIN, but this is not a good idea. Circumstances can change, and sometimes need prevails over maintaining trust or, even worse, someone you trust can be put in a compromising situation with a third party and forced to reveal their PIN under threat of harassment. Better never to tempt fate.

1 Never give your PIN. It can be tempting to trust a friend or family member with your PIN, but this is not a good idea. Circumstances can change, and sometimes need prevails over maintaining trust or, even worse, someone you trust can be put in a compromising situation with a third party and forced to reveal their PIN under threat of harassment. Better never to tempt fate.  2 Never give your PIN in response to an email or phone request. Phishing attacks - unsolicited emails asking for bank account details, passwords and PINs. Delete them without thinking and never react to them. Also, never give your PIN over the phone; there is no such need for this, so it will always be a fraudulent request.

2 Never give your PIN in response to an email or phone request. Phishing attacks - unsolicited emails asking for bank account details, passwords and PINs. Delete them without thinking and never react to them. Also, never give your PIN over the phone; there is no such need for this, so it will always be a fraudulent request.  3 Protect your PIN while using it. Use your hand, checkbook, piece of paper, etc. to shield the PIN as you type. Be especially vigilant in store lines where someone might be paying more attention than you. Also, beware of skimmers at ATMs; they pass the card slot through the scanner to extract information about it and watch the PIN data through the camera. If you close your PIN well, they are limited in their attempts.

3 Protect your PIN while using it. Use your hand, checkbook, piece of paper, etc. to shield the PIN as you type. Be especially vigilant in store lines where someone might be paying more attention than you. Also, beware of skimmers at ATMs; they pass the card slot through the scanner to extract information about it and watch the PIN data through the camera. If you close your PIN well, they are limited in their attempts.  4 Choose a PIN that is not obvious. Your date of birth, wedding anniversary, phone number, and home address are all obvious choices, so just don't use them. Instead, think about numbers unrelated to major events and addresses in your life to create your PIN.

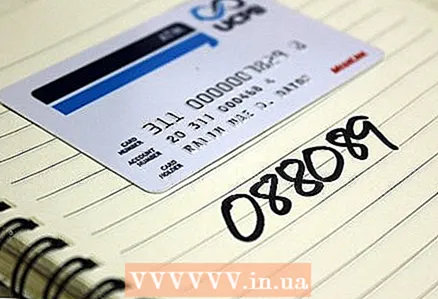

4 Choose a PIN that is not obvious. Your date of birth, wedding anniversary, phone number, and home address are all obvious choices, so just don't use them. Instead, think about numbers unrelated to major events and addresses in your life to create your PIN.  5 Never write your PIN on the card. Even in the diary. If you need to write it down, mask it in some way, or put it in a place that has nothing to do with the map, such as in the middle of Shakespeare's complete works.

5 Never write your PIN on the card. Even in the diary. If you need to write it down, mask it in some way, or put it in a place that has nothing to do with the map, such as in the middle of Shakespeare's complete works. - Use different PINs on different cards. Do not set the same PIN for all of your cards. Have a different PIN for each one, so if you accidentally lose your wallet, the PIN will be harder to crack.

- Use different PINs on different cards. Do not set the same PIN for all of your cards. Have a different PIN for each one, so if you accidentally lose your wallet, the PIN will be harder to crack.

6 Contact the bank immediately if your card is stolen or lost. Tell them right away if you think there is something that could jeopardize your PIN, such as a light PIN and other hints in your wallet that make it easier for a cracker or, horror of all horrors, the PIN is written somewhere- then in your wallet or card. Have the bank void the card immediately.

6 Contact the bank immediately if your card is stolen or lost. Tell them right away if you think there is something that could jeopardize your PIN, such as a light PIN and other hints in your wallet that make it easier for a cracker or, horror of all horrors, the PIN is written somewhere- then in your wallet or card. Have the bank void the card immediately.  7 Be proactive. If you suspect any fraudulent activity using the card in your possession, in addition to notifying the bank and the police, change your PIN immediately.

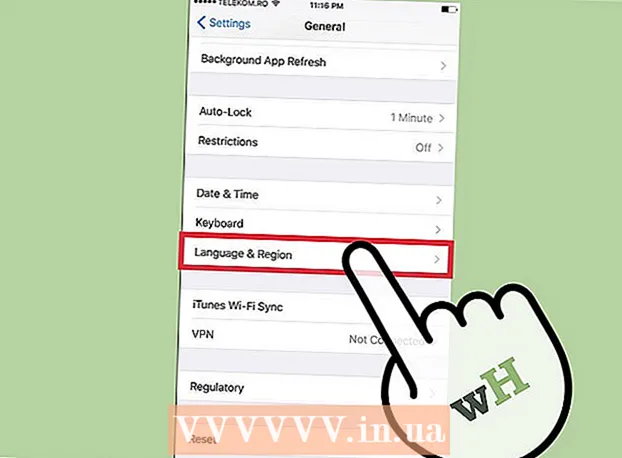

7 Be proactive. If you suspect any fraudulent activity using the card in your possession, in addition to notifying the bank and the police, change your PIN immediately.

Tips

- Respect the privacy of others when using ATMs; give them space and look at the keyboard.

- Be careful and regularly check your account statements to ensure there are no unauthorized transactions using your card.

- Method to write PIN on card with relative safety: 1) Come up with a unique combination of numbers that you will never forget. 2) add or subtract it from your real PIN 3) Write the result on the back of the card (this will confuse a potential thief) 4) use the same formula for your other PINs so you only have to remember the formula, not the actual combinations PINs.

- Use a 5 or 6 digit PIN if your bank offers this option.Please be aware that some ATMs abroad only accept 4-digit PINs.

- If you are a very forgetful person, try to memorize the PIN using memory training methods.

- Don't disguise your PIN as a phone number: attackers know this trick and one of the first places they look will be your address book.

- One method that works for PINs is to divide them into two groups of two digits, which are written as years, for example, 8367 becomes 1983 and 1967. Then find some event that corresponds to each year. Each event should be associated with something personal, known only to you, or something historical, but relatively unclear. From them, develop a funny and strange phrase connecting two events, from which events, and therefore dates, cannot be calculated easily. Write down that phrase, not the PIN itself.

- One way to create a PIN that is also easy to remember is to translate the word into numbers (like on a phone keypad). Example: The word "wiki" would be 9454. ATM machines often have letters under each number.

- You can use PIN masking applications. For example, SafePin for the iOS operating system allows you to hide the PIN code in the color segments of the matrix according to the principle of your choice. Just enter the numbers in the segments of the preferred color in the preferred location (for example, in the upper left corner). Do this when no one sees you. Your PIN is completely secure and you can safely access the app in public.

- Instead of signing the back of the card, write “photo ID required”. Almost all identity documents are signed by the owner. Most clerks are actually looking at your signature now so they can see your photo and verify your signature at the same time.

Warnings

- Contact your bank immediately if the ATM eats up your card. This may indicate the use of a skimmer at the ATM.

- Use the same ATM for more security and consider it, for example: a skimmer device will bounce at the height of the keyboard or create a difference around the monitor. If in doubt, contact the bank in charge of the ATM.

- Please be aware that if you do lend your card to someone and provide your PIN, the bank has the legal right to refuse to return your card if the card is compromised. This is considered a lack of due diligence on your part to protect the information.

- Don't worry about keeping your debit or credit cards close to magnets; the attraction of a magnet will not demagnetize cards or erase any information. However, direct contact with a very strong magnet will erase the tape or damage the data.

- Never write your PIN on a postcard or envelope.

- Ignore those who tell you never to sign the back of a card. When restoring your card, if your signature is not on the back, the seller is not obliged to return your money. Since the employee had no way to identify the ownership of the card to the actual holder, and any signature is considered valid.

What do you need

- Debit or credit card