Author:

Janice Evans

Date Of Creation:

25 July 2021

Update Date:

1 July 2024

Content

Bank customers are always interested in how much they will receive in interest on a bank deposit. Yes, you can simply multiply the deposit amount by the interest rate, but it would be much more accurate to use a formula that takes into account the fact that interest can be complex. Again, don't throw extra contributions - and especially regular extra contributions - into account. This article will show you how to use the standard deposit interest calculation formula to calculate monthly capitalized interest, and how to use the accumulated savings formula to calculate the amount of interest earned on deposits at regular intervals.

Steps

Method 1 of 1: Calculating the interest on the deposit

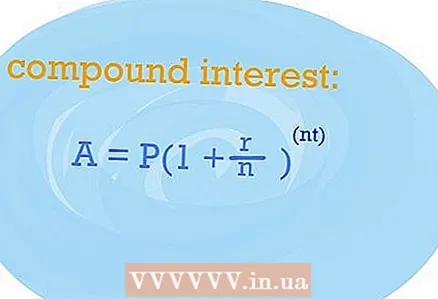

- 1 To calculate how much you will receive as interest on the deposit, use the formula for calculating compound interest. With its help, you can find out how much interest you will receive in a year if you have only one deposit. The compound interest formula is good because it gives more accurate results when the deposit is opened with interest capitalization.

- Let's take a look at the variables used in the standard formula. By the way, get your agreement for opening a deposit, you will need it. So, the formula consists of the following variables: down payment (P), interest rate (r), number of years (t), amount of interest accrued (n). Interest on the deposit (A) is the solution to the equation, and the value (n) should be 365 with daily capitalization of interest, 12 with monthly and 4 with quarterly capitalization, respectively.

- Then just use the standard formula, substituting your data in place of certain variables. Strictly speaking, the formula has the following form: A = P (1 + r / n) ^ (nt).

- You need to correctly identify the values of each of the variables. Use the agreement for opening a deposit in the bank, contact its representative. You need to find out the following values: down payment (P), interest rate (r), number of years (t), amount of interest accrued (n). Interest on the deposit (A) is the solution to the equation, and the value (n) should be 365 with daily capitalization of interest, 12 with monthly and 4 with quarterly capitalization, respectively.

- Let's take a look at the variables used in the standard formula. By the way, get your agreement for opening a deposit, you will need it. So, the formula consists of the following variables: down payment (P), interest rate (r), number of years (t), amount of interest accrued (n). Interest on the deposit (A) is the solution to the equation, and the value (n) should be 365 with daily capitalization of interest, 12 with monthly and 4 with quarterly capitalization, respectively.

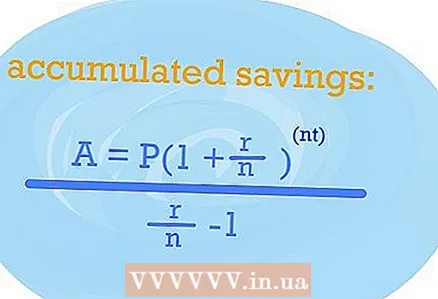

2 Use the accumulated savings formula to determine the EPR. EPS, it is also the effective interest rate, will show how much interest you will receive with regular replenishment of the deposit and one or another capitalization.

2 Use the accumulated savings formula to determine the EPR. EPS, it is also the effective interest rate, will show how much interest you will receive with regular replenishment of the deposit and one or another capitalization. - So, if you regularly replenish your deposit, then you need to use the following formula: A = P (1 + r / n) nt / (r / n) -1. The variables remain the same, so just plug the values you want into the corresponding parts of the equation. The result will be EPS.

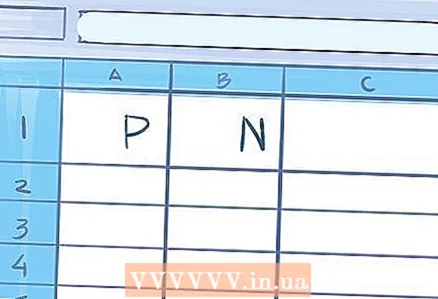

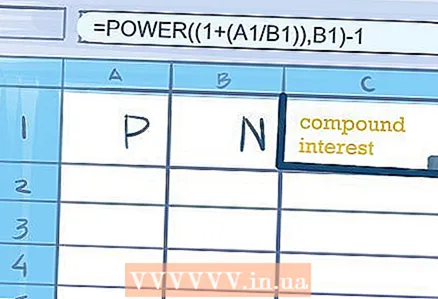

- 3 Use a spreadsheet to make calculations if the term of the deposit is more than a year. Perhaps it will be even easier there.

- In cell A1, enter the interest rate, and the capitalization value (365/12/4, and so on) - in cell B1.

- In cell C1 or any adjacent cell, enter the following formula to calculate compound interest "= POWER ((1+ (A1 / B1)), B1) -1." Quotation marks are not needed. In the cell where you entered the formula, the amount received by the interest on the deposit for the year will be displayed.

- In cell A1, enter the interest rate, and the capitalization value (365/12/4, and so on) - in cell B1.

Tips

- Use free online calculators to find out how much interest you will receive on a deposit under certain conditions. There is something similar on the banki.ru website.