Author:

Joan Hall

Date Of Creation:

3 July 2021

Update Date:

1 July 2024

Content

The annual interest rate on a credit card can be quite high. Despite the fact that most people prefer to quickly cut and pay off credit card debt, the latter remain close friends of family budgets. We will tell you how to calculate interest on a credit card in Excel, so that you can calculate the cost of using a loan and promptly reduce or pay off your card debt.

Steps

1 Gather information on all credit cards you have.

1 Gather information on all credit cards you have.- The most recent credit card statements should tell you the current card balance, minimum payments to pay off debt, and annual interest rates.

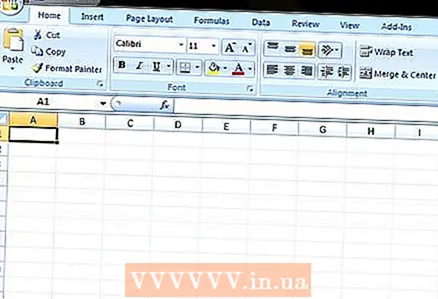

2 Start Microsoft Excel and create a new workbook.

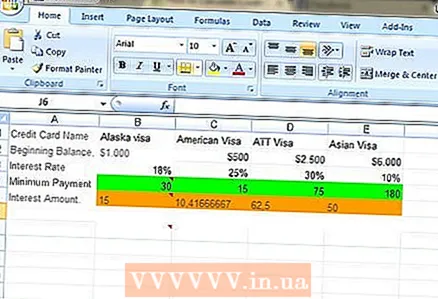

2 Start Microsoft Excel and create a new workbook. 3 Title cells A1 through A5 in the following order: credit card name, balance, interest rate, minimum payment and interest amount.

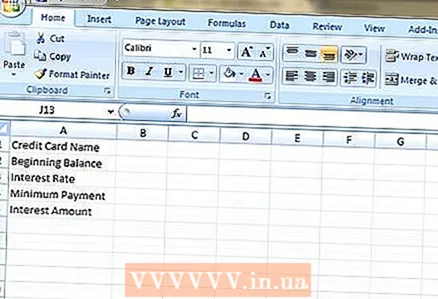

3 Title cells A1 through A5 in the following order: credit card name, balance, interest rate, minimum payment and interest amount.  4 Enter the appropriate information for the first credit card in cells B1-B4, in cells C1-C4 for the second, etc.etc.

4 Enter the appropriate information for the first credit card in cells B1-B4, in cells C1-C4 for the second, etc.etc. - Suppose that there is a debt of 1,000 rubles on a Visa card, the annual interest rate is 18%, and the minimum payment must be at least 3% of the amount owed.

- In this case, the minimum payment will be 30 rubles (the formula is "= 1000 * 0.03").

- If you cannot find out the data on the percentage of the minimum payment from the statement, divide the amount of the minimum payment by the amount owed and get the percentage.

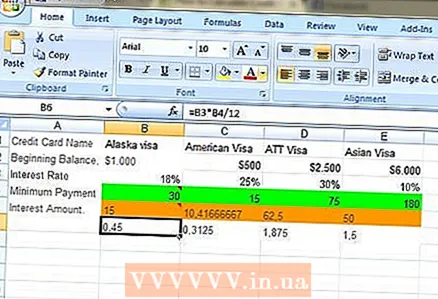

5 Calculate the amount of interest in each cell in the 6th row for all credit cards.

5 Calculate the amount of interest in each cell in the 6th row for all credit cards.- In the first cell labeled B6, enter a formula like "= B2 * B3 / 12" and press Enter.

- Copy and paste the formula in cell B6 and the rest of the 6th row for credit card accounts.

- The annual interest rate, when divided by 12, gives the monthly interest rate and allows you to determine the monthly interest payment. In our example, the formula returns the interest amount equal to 15 rubles.

6 Pay attention to the proportional relationship between interest repayment and principal in your debt payment.

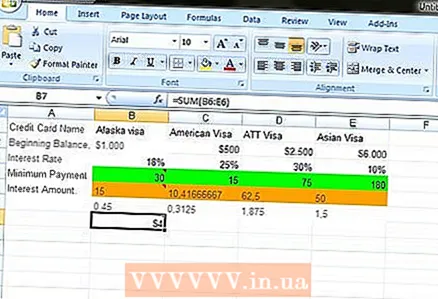

6 Pay attention to the proportional relationship between interest repayment and principal in your debt payment. 7 Calculate the total of all monthly interest payments.

7 Calculate the total of all monthly interest payments.- Use the "SUM" function. The formula will look like this: "= SUM (B6: E6)", where cell E6 will be the last cell in the row with numeric data.

Tips

- Many credit institutions can determine the amount of interest based on the average daily balances of the card debt for the month. If your credit card balance fluctuates a lot from month to month, and your lender uses this method, then it will be much more difficult for you to calculate the amount of monthly interest.

Warnings

- The interest rate declared by the credit institution may already be monthly, since the interest seems to be lower to the clients. Make sure to use the actual annual interest rate for the calculation.

What do you need

- Computer

- Excel program

- Credit card account information